ETH is also overbought here, but not as overbought as Bitcoin, which may mean that there may be a slightly more upside in ETH if BTC can hold up. Let's unpack the key levels and indicators to watch.

TLDR

- ETH rejected at the $1,823-$1,853 resistance zone.

- RSI is overbought but not as extended as BTC.

- A very positive funding rate indicates bias for longs.

- The uptrend support is intact, but expect consolidation if BTC retraces.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

ETH remains well above its main uptrend line (thick yellow line). It is now trying to build support above the $1,745 horizontal resistance. However, ETH rejected in the resistance zone between the horizontal levels of $1,823 and $1,853. So, it has not been able to clear above more significant levels - unlike BTC.In the short term, you’d want to see ETH hold above the $1,745 horizontal level and turn that into new support. We are just watching this for now and waiting for a breakout of the range. Local support is $1,745, with local resistance at $1,853.

RSI and funding rates

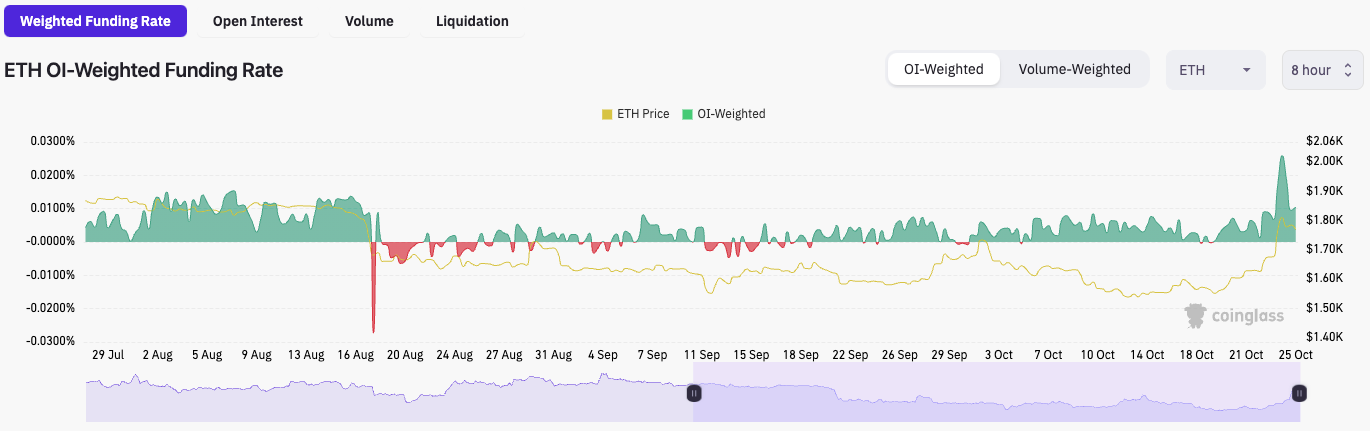

The RSI is in overbought territory. But, at 72, it is nowhere near as hyper-extended to the upside as BTC is. For now, there aren’t any major divergences to be aware of.In terms of funding rates, ETH has a very positive funding rate. Even though this has come back slightly, it's still very positive, indicating there is a strong bias to long rather than short.

ETH Weighted Funding Rate

Cryptonary’s take

“Like the rest of the market, ETH is overbought here, and fresh longs shouldn’t be encouraged. ETH is undervalued today compared to where it’ll likely be in the bull run. However, if BTC can see a slight pullback, we should expect ETH to do the same”.This was yesterday’s conclusion, and it remains very relevant today. If BTC can hold up, ETH can retest $1,823 to $1,853, but if BTC pulls back, we expect that this will drag ETH back also.

Action

- ETH has rejected in the resistance area of $1,823 to $1,853.

- Longs shouldn’t be encouraged here just because of how overbought the market is in general.