Market Direction

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

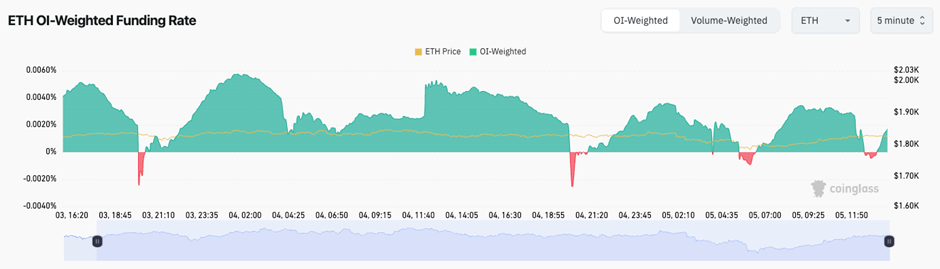

- ETH's Funding Rate has fluctuated, but it has mostly remained positive, whilst its Open Interest (by number of coins) remains very high. This suggests that there's a big demand for the 'cash-and-carry' trade. This distorts the data, meaning OI and Funding become less of a signal for ETH.

Technical analysis

- ETH has broken out of its main downtrend line, and it's holding above its horizontal level of $1,745. If price loses this level, then we'd expect a move back to $1,600.

- To the upside, the key horizontal resistances are at $2,000 and $2,160.

- The RSI is in middle territory, and it's now sitting on top of its moving average; this is a support level for ETH.

- Price has remained in a tight range between $1,745 and $1,850. We are expecting a breakout, and likely to the upside, assuming the general market doesn't dramatically sell off.

- Next Support: $1,745

- Next Resistance: $2,000

- Direction: Neutral/Bullish

- Upside Target: $2,160

- Downside Target: $1,530

Cryptonary's take

Overall, we're relatively sceptical on the market now as we are expecting a pullback over the coming days/weeks. However, ETH is the setup that looks best for a move higher, if that's directionally how you want to bet. If the market can hold up, then ETH can break out and move higher, potentially to $2,000. However, due to our bearish stance on the market currently, we're not looking to play ETH here.If ETH were to pull back to $1,530 to $1,600, it may be worth beginning to accumulate a very small bag for the long run, even if we do believe more in SOL and HYPE as outperformers over the coming 6-12 months.