Our message remains unchanged this week: "Pullbacks are for buying."

For Bitcoin, while the short-term direction is uncertain, any substantial dip below $47,000 could present attractive buying opportunities for long-term holders.

Ethereum's swift ascent has taken it to the $3,140 horizontal resistance, and a short-term consolidation or pullback is possible. Solana has already experienced rejection from its $117 resistance, falling below its main uptrend and local uptrend lines.

Smaller altcoins like SHDW and NOSANA offer their unique opportunities.

You can jump to the analysis of assets you are most interested in by clicking the directional links below.

We're still super early in this cycle. Pullbacks are for buying. Keep calm and set buy orders to clip the bottom of the ranges. ETH and SHDW have both recently been great examples of this approach, particularly ETH.Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Market mechanics

As usual, we will kick this off by assessing the mechanics.Firstly, Funding Rates, which we can see have moved higher since our last update four days ago. High Funding Rates mean there is a bias amongst traders to be Long.

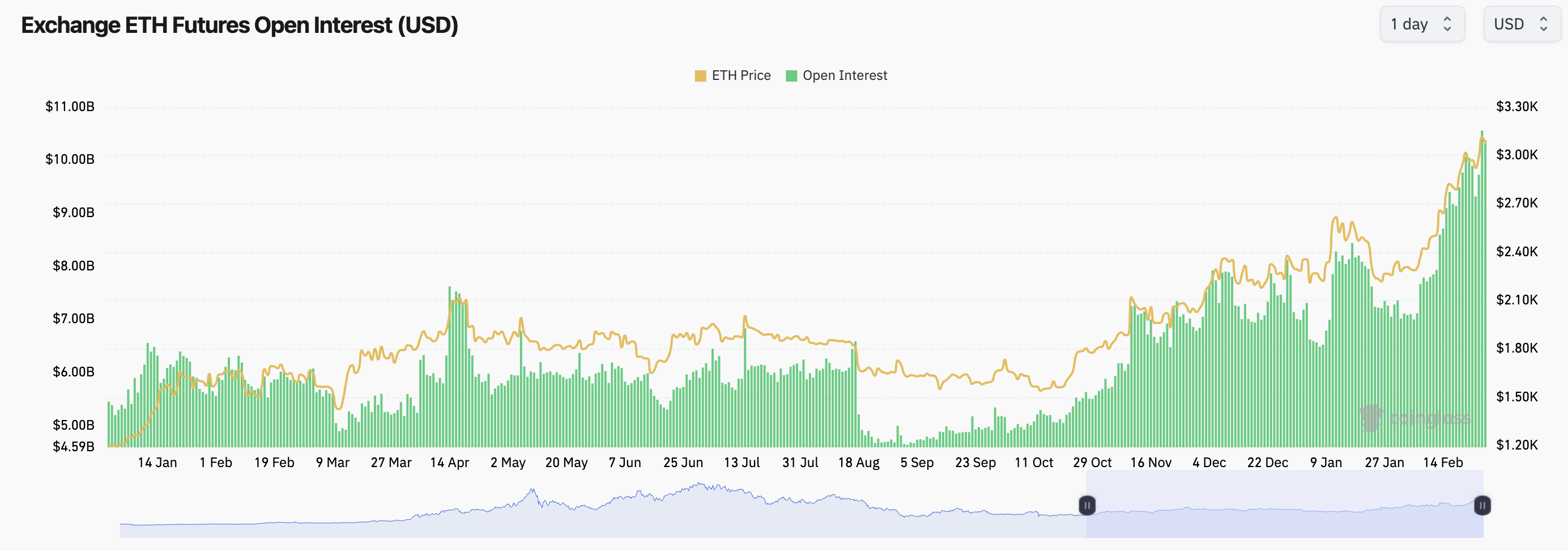

The higher the rate goes, the more overcrowded the position/trade. Over the last four days, we have increased funding across the board. This suggests that a flush-out is increasingly likely, particularly if this is paired with high Open Interest (a high amount of leverage).

If we now look at the Open Interest, we can see that all BTC, ETH and SOL have a high Open Interest, indicating that there has been a large leverage build-up. Again, we are increasingly likely to see a flush out of positioning. Lots of leverage and mostly positioned in one direction - Long.

BTC

- Price continues to find resistance at the $52,800 horizontal level, which also currently converges with the top of the Kelten channel.

- A convincing break above $52,800 would open BTC up for a move to $57,400.

- There may be a local support at $50,000 for BTC, but the most major support is at $47,000.

- Below $47,000, $44,000 is a major support and support we expect to hold if price does decline that far.

Cryptonary's take

The situation remains similar to last week, and price has been somewhat volatile between this tight range between $50,700 and $52,700. We're still holding Spot positions and not looking to sell, but we're open to the idea that there may be a pullback for price in the near term if $53k cannot be breached.We would be a buyer of any major pullbacks - sub $47k.

We're not looking to take any trading opportunities as the next move will likely be volatile, particularly with how the mechanics are set up currently. It's a difficult call to call BTC's next major move. If we had to call it, we'd say lower, although in the long-term, we remain very bullish.

ETH

- ETH has moved swiftly higher to the horizontal resistance of $3,140 and has initially found some resistance at that level.

- ETH is also at the top of its Kelten channel and may find it tricky to breach the $3,140 in the short term. We may see some short-term consolidation or even a slight pullback due to the above.

- If ETH can breach above $3,140, then $3,500 is the next natural target.

- However, if there is a pullback in price, which we believe is certainly possible considering the run-up over the last four weeks, then $2,600 to $2,700 should be a relatively strong support for ETH.

- One thing to watch out for on ETH is that the RSI is overbought on the larger timeframes and has put in a bearish divergence in overbought territory on the Daily timeframe, having moved into the horizontal resistance of $3,140 that we have been calling for a move up to for price for the past month or so.

Cryptonary's take

Keeping this super simple. We continue to hold Spot bags but recognise we could be at a resistance here in the short-term, and price may even pull back from here. Regardless, we're not looking to sell Spot bags that we comfortably added to in the mid $1,900s many months ago when ETH was in the accumulation range.But, we also note that ETH's Funding Rate is high, along with its Open Interest having moved to new cycle highs, so we're wary of this setup, as the more common outcome is a flushing out. We're, therefore, wary of this and not looking to take on any new leverage positions.

SOL

- A slightly different setup here in that SOL has rejected from its horizontal resistance of $117 and has now fallen out of its main uptrend (thick Yellow line) and its local uptrend (dotted Yellow line).

- SOL also rejected at the top of its Kelten channel (blue channel).

- Price has now fallen below the mid-level of the channel and is finding that mid-point as new local resistance. This will likely see price move to the bottom of the channel, which converges with the Local Yellow box between $94.00 and $96.60.

Cryptonary's take

We do see SOL moving lower in the coming weeks.If it does, and you're currently under-exposed, we see the Local Yellow box of $94.00 to $96.60 as a good long-term entry point.

We would expect this area to provide some support for SOL in the short term. We will then reassess again from there. But, in short, if SOL were to fall below $94 and move into the $80s, we would become more aggressive with our DCA buys with a view to holding them for the long term.

We see this period of the cycle, particularly now for SOL, as playing the range, potentially between $80 and $117.

In the bottom half of that range, sub $100, you pick off orders and continue adding to your bags at attractive prices. We did this similar approach with ETH between $1,900 and $2,100. We continued to add size every time $1,900 to $1,950 was tested. A month or two later, that has now paid dividends.

SHDW

- It's a strange overall play in that it's not set up for a box formation yet, really, unless the price moves beneath $0.92, which we're not fully confident that it will. Therefore, we play the ranges.

- For SHDW, the ranges are between $0.92 and $1.05. If price moves into this range, we will continue to leave DCA buy orders to continue adding to our Spot positions.

- The RSI is not a problem on SHDW; it's in a healthy middle territory, so this is all good for our theory of a continuation of accumulating between the $0.92 and $1.05 level.

Cryptonary's take

As stated above, SHDW chart-wise is a slightly more unique play where we focus on that key range and are just looking to add between $0.92 and $1.05 to our spot bags. Besides that, we don't focus on too much else; we keep it simple. We're still early in this cycle, so we leave our orders at those lower prices (between $0.92 and $1.05) and trust that they will get filled. If not, we will reassess when the time is right. But, so far, this strategy has and is working well for us.Nosana

- Up over 265% in just three weeks, NOSANA is flying. A SOL eco-system, AI play, the setup is there for this to be an even bigger performer in the coming 12-18 months.

- NOS is up a lot, so our aim now is to identify attractive levels that we’ll be interested in buying (or buying more) NOS if the market pulls back.

- NOS is at the top of its Kelten Channel, so it may begin to find resistance in the short term, particularly with the RSI being so overbought on many major timeframes. Note: it is possible this just keeps going, but the below is to prepare us for buying if a pullback does come.

- If NOS breaks down and loses the mid-point of its channel along with the uptrend line (quite a way away from happening currently), then the Yellow boxes could be tested.

Cryptonary's take

There are two key buying boxes (Yellow boxes), so we will make this into an entire range between $2.10 and $2.90.If price pulls back to these levels, we will look to add exposure to NOS, using a layered order strategy, i.e., a buy at every $0.05 or $0.010 down from $2.90 to $2.10.

With the RSI so overbought and considering how NOS has moved over the past few weeks, we may get a more substantial pullback. If we do get this, we want to be prepared for it and look to buy it at what we'd consider attractive price points for the long term (next 12-18 months).