Crypto boosted by rate cut odds for December increasing

Macro uncertainties like inflation and rate cuts are shaping crypto markets. BTC, DOGE, and WIF are navigating these shifts with resilience. Here’s a closer look at what’s moving the markets and what lies ahead.

In this report:

- Key Data and Rate Cuts

- Positive End of Year and Q1, What's The Risk?

- Funding Reset on Alts/Memes

- Cryptonary's Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Key data and rate cuts

This week's key data is the inflation data which comes out on Wednesday. But before we dive into that, let's recap last Friday's jobs data.Last Friday, the jobs data showed a rebound from the following month, with non-farms coming in at 227k (194k forecasted) and the unemployment rate coming in at 4.2%, a slight increase from the prior month.

However, risk assets were looking for the data to come in around the consensus figures, i.e., a nice rebound in the numbers that show that the labour market isn't materially weakening but also not for Non-Farms to be too high, indicating that the jobs market might be too hot, otherwise this might make the FED more cautious in their rate cutting.

With Non-Farms coming in at 227k and the Unemployment Rate at 4.2%, this was a 'Goldilocks' figure, and hence risk assets were bid.

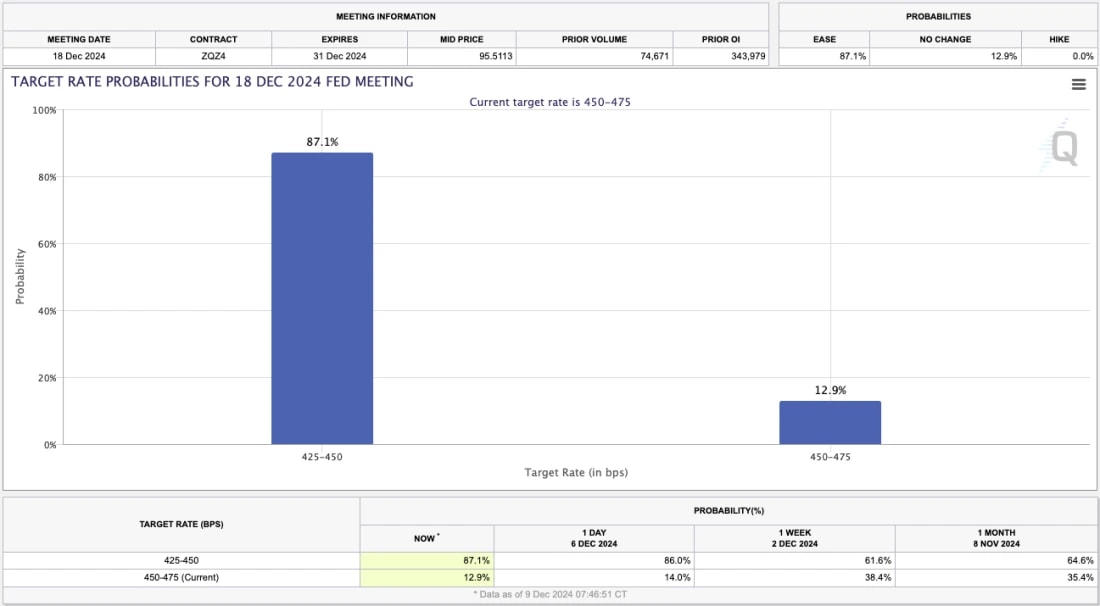

Following the release of the data, the market began pricing in an 87.1% chance of a FED Interest Rate cut at the December 18th Meeting, up from 66.0% before the data release.

December's Interest Rate cut is now all but nailed on; however, the path beyond this is more 'up-in-the-air'. We'll explore this in more detail later in this report.

Target rate probabilities for the 18th Dec Fed meeting:

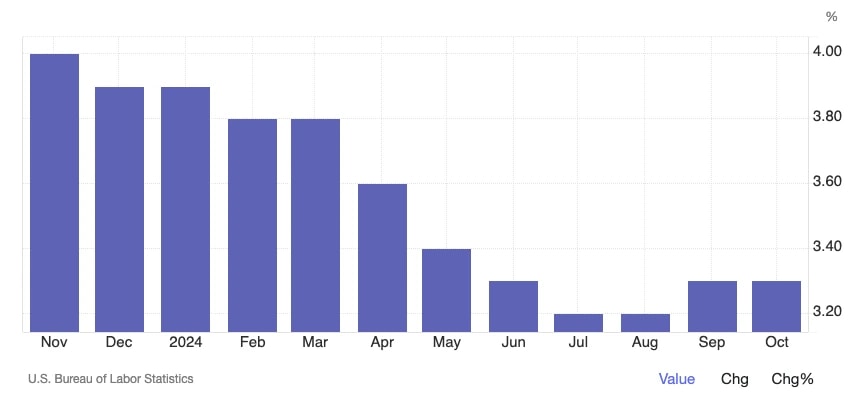

This week's key data is the inflation data that comes out on Wednesday (11th). The expectation is for the Core YoY number to come in at 3.3% again and for there to be a slight increase in the Headline number YoY, from 2.6% to 2.7%.

Analysts now estimate that the YoY inflation figures might remain sticky over the next few months. We can already see below that Core Inflation YoY and Headline Inflation YoY looked to have bottomed or just locally bottomed. That's the question.

Core inflation YoY:

Headline inflation YoY:

Positive end of the year for crypto, But what's the risk?

Our expectation is still that we're in for a mega next few months on the Crypto front. However, what we are watching out for is inflation and whether it maintains at this higher level than the FED's desired level.This shouldn't impact us in December or even January, but if we see a slightly hotter print in December and January, then this might alter the FED's interest rate-cutting path. This might then affect Crypto and risk assets further.

The current market expectation is for 3 Interest Rate cuts in 2025, approximately 1 x Q1, 1 x Q2 and 1 x Q3. The FED is expected to cut rates in December, skip January, and then go again in March. However, if the inflation prints come out hotter than expected in December and January, this might lead the FED to begin forward guiding, which they may also skip in March. Or they might forward a guide for a rate cut in March, but that would be the last cut.

Ultimately, this is looking quite far out and potentially even slightly too far out. However, the data for this theory/potential narrative will begin coming out this Wednesday.

So, this is worth being wary of, as currently, this is the main thing that could see an end to the bull run. As we've said already, we're really expecting the upcoming months to be super positive for Crypto; we're just trying to see what macro risks there might be and then begin becoming prepared for them.

Funding reset on Alts/Memes

Last week, on Thursday 5th, we saw BTC experience a leverage flush out when the price went from $104k down to $88,500 in just a few hours before swiftly rebounding to $98k. This was simply due to late Longs piling in when the rice broke above $100k.Open Interest soared as did the Funding rate, i.e., late, excessive leverage. As the price pulled back slightly, highly levered late Longs either closed out or were liquidated, which caused a cascading effect, and the price "plummeted" to $88,500 before quickly recovering.

However, Alts/Memes held up relatively well on the day, and we didn't see any meaningful flushouts from them in the majority. It was mostly isolated to just BTC.

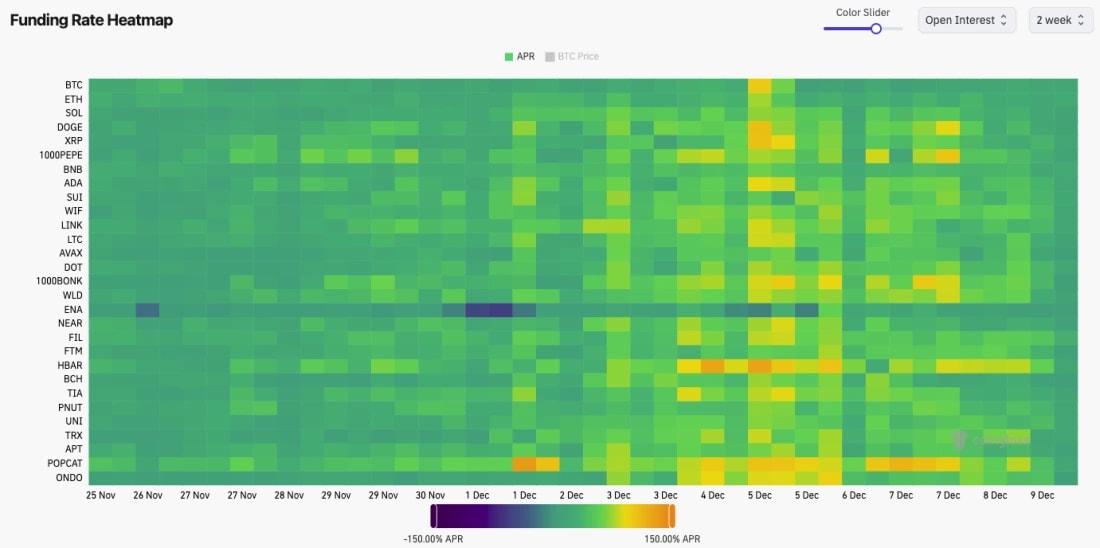

Today, however, we can see that Alts/Memes have gone through more of a flush-out. The heat map below shows that a few days ago, Funding was getting too elevated (orange/yellow). But, after this price moved down, funding returned to more normalised levels (green).

Funding rate heatmap:

If we then look at WIF as a specific example, we can see that on the 5th of December, Open Interest came down significantly, but Funding didn't really, indicating that there were still more Longs that needed to be flushed out.

Today, however, we can see that Funding has reset more meaningfully from 0.060% to 0.017%.

WIF price, funding rate and open interest:

As we explained last week, these leverage flush-outs are important and necessary for a bull market to continue on higher.

Cryptonary's take

We still remain of the opinion that the market looks good going forward:- There is positivity on the regulatory front following a Trump win.

- The market is talking about the potential for a Strategic Reserve for Bitcoin.

- Interest rate cuts are continuing whilst growth and the labour market remain positive.

- Funding and open interest have recently reset substantially, which is good in the short term.

In the last week, we have seen Meme begin to perform again, with DOGE performing well and now WIF slowly grinding higher towards $4.00. If further shakeouts do happen, we will see these as dips for buying, and we'll likely maintain this position going into January at the minimum.