Markets crashed — but BTC held up. Here’s what we’re watching next

Tariffs and inflation concerns are shaking up the markets, with Bitcoin ($BTC) and equities showing mixed reactions. Will trade deals bring relief or further volatility? Here’s an update on how to navigate this uncertain landscape.

In this report:

- Data Last Week and This Week.

- Implementation of Tariffs.

- Current Market.

- Cryptonary's Take & How We're Playing It.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data last week and this week

Last week, we had the labour market data out on Friday, which showed the Unemployment Rate ticking up very slightly to 4.2%, but with the US still adding a very strong 228k jobs.Bond Yields (and our focus was on the US10Y Yield) backed up on this (went higher) as the market cooled on its possible growth fears. We'll continue to track this, as we expect the labour market might weaken over the coming months, and the FED will have a close eye on this as a deteriorating labour market is what's likely to bring the FED to the interest rate cutting table quicker than anything else.

In terms of the data this week, the standout is the inflation data on Thursday (10th). The expectation is that the data comes in lighter, lower inflation, which the markets will likely react positively to.

What's next?

Markets just made a $2.5 trillion move in under an hour—what triggered it, and are we about to see even bigger swings?

Implementation of tariffs

The implementation of the reciprocal tariffs is tomorrow (9th). The most major ones are below:- EU = 20%

- Japan = 24%

- China = 34%

However, there are some positives. The EU made concessions by offering 'zero-for-zero' tariffs, which were rejected by the Trump administration. However, it shows that the EU is willing to negotiate, and they and the US will likely come to a deal.

Alongside this, Treasury Secretary Scott Bessent has been instructed to go to Japan and negotiate a trade deal, and he's one of the smartest people to have to go and do this. This should be seen as hugely positive, as it shows that trade deals are being set up, and potentially done and concluded.

Check out the tweet below from Bessent himself where he states that he and the Trump administration will be looking to get trade deals done over the coming weeks and months.

Tweet:

But the outlier is likely to be China. Trump has said he doesn't want the Chinese running a huge trade surplus and then spending that surplus on their military, and then them posing a greater threat down the line.

So this is trickier to work out exactly what Trump wants here, but we're likely to see a deal eventually, it might just take a few months, with a lot of uncertainty and volatility leading up to a deal.

So, we're seeing tariffs and trade deals as two-sided currently. The risk is that the tariffs and the trade war against China escalate, however, the market is already very fearful of this and is almost priced for this.

The positive side, and perhaps the market is under-priced to this, and therefore the risk is to the upside (for equities/risk assets), is on trade deals being done with Canada, Mexico, the EU, Japan, and others. Therefore, we see the market as now having priced a trade war between the US and China, but it's underpriced for upside, should trade deals with other trading partners (the EU, Japan, etc) be done.

We saw this yesterday, we had a positive headline come out, which was that the Trump administration was considering a 90-day postponement of the tariffs to allow for negotiations, which the White House then rejected as 'fake news'.

This resulted in a $2.5 trillion move in just 45 minutes yesterday, with the S&P500 moving up approximately 8% in 30 mins, before retracing 4.5% in the following 15 mins. These are huge moves, and they show that the risk is now maybe to the upside i.e., a few positive/strong headlines, and the market has the ability to rally.

Yesterday's S&P500 whip-sawing price action - 15min timeframe:

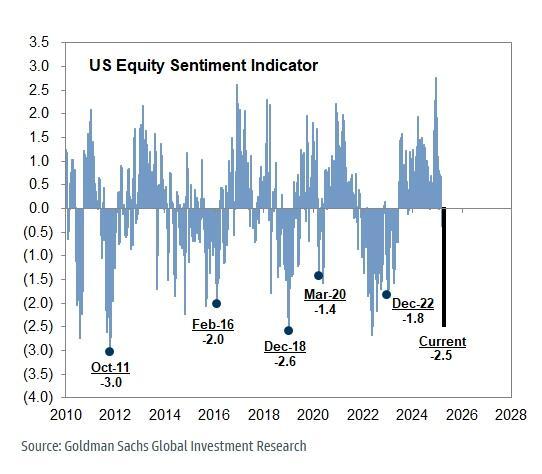

This makes sense, especially when we look at some of the sentiment indicators. We can see in the below that the US Equity Sentiment Indicator is extremely low; worse than 2022.

Therefore, this does leave the door open for violent moves upwards should we see a number of positive headlines roll in and we see some undoing of what has essentially taken the market lower ie, aggressive tariffs, and an unwind of these.

US equity sentiment indicator:

Current market

So, let's look at this top-down. We've seen a VIX spike into 60, whilst the S&P reached a low of 21.2% from its highs, and the Nasdaq reached a low of 26.5%. Both are also phenomenally oversold, the most oversold since the start of 2022.S&P 1D timeframe:

NDX 1D timeframe:

These are steep drawdowns, and yes it's possible that we see them both go lower in the coming weeks/months, especially as there's still a lot of uncertainty. However, in the short-term, we see the market as having become too fearful, and we foresaw tariffs as being something that could bring the market down, and now it has.

But, we're now beginning to move to being on the other side of it. We've seen the talk of tariffs, tariffs then be implemented, more aggressive tariffs go on, retaliation from other countries, and now we're beginning to see talk within the administration of a plan to do deals in the upcoming weeks and months.

So, it's possible peak bearishness is behind us, or in and around here.

Therefore, we think we're at a local bottom here, where positive headlines (trade deals, etc) can help fuel a relief rally. And we think it might just be that, a relief rally.

With uncertainty around a trade war with China, and without any real stimulus from the monetary of fiscal side, we see the lows being revisited in the coming weeks/months. We do expect there to be rate cuts this year, with the market now pricing for 4.5 cuts, however, we expect them to begin in June, but more likely in July.

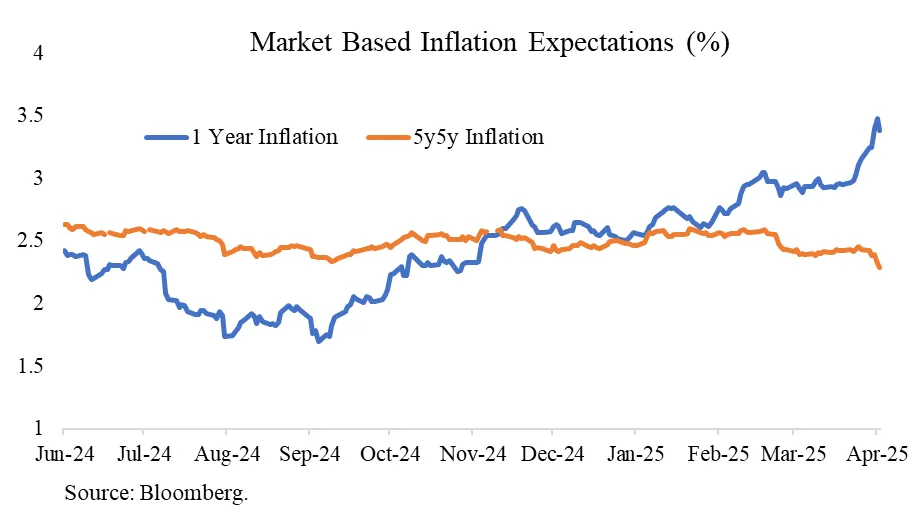

The reason is that 1Y inflation expectations have risen, but they 5y inflation expectations are falling. This suggests that the market is expecting the tariffs to cause a one-time rise in the price level but for it not to be inflationary going forward.

This likely means Powell and the FED continue to wait and be on pause, and they'll move later on, or when/if the data starts to meaningfully deteriorate.

1Y Vs 5Y inflation expectations:

Cryptonary's take & how we're playing this

Really, this depends on you as the individual. We're expecting a tactical bounce in the coming week or two, so if you're a trader, this'll provide you with a tradable bounce.However, for longer-term investors, we do expect the lows to be retested, and maybe even broken to the downside in the coming weeks/months, and it's those lows that we'd look to begin picking up long-term Spot bags.

At that point, we should be more weeks/months down the line, with more of the uncertainty removed, and with Powell and the FED being closer to cutting interest rates.

Therefore, that would be the opportunity to then put in a more sustainable market rally due to the removal of uncertainty, and it also being fuelled by interest rate cuts.

For Bitcoin, we're looking to accumulate long-term Spot bags in the Green Box - between $63,400 and $75,500. But we'll build a position over the coming weeks/months. So, we're not just playing against price, but we're playing against the timeline. This week, we'll also begin identifying levels for other coins: SOL, HYPE, etc.

BTC and the green buy box: