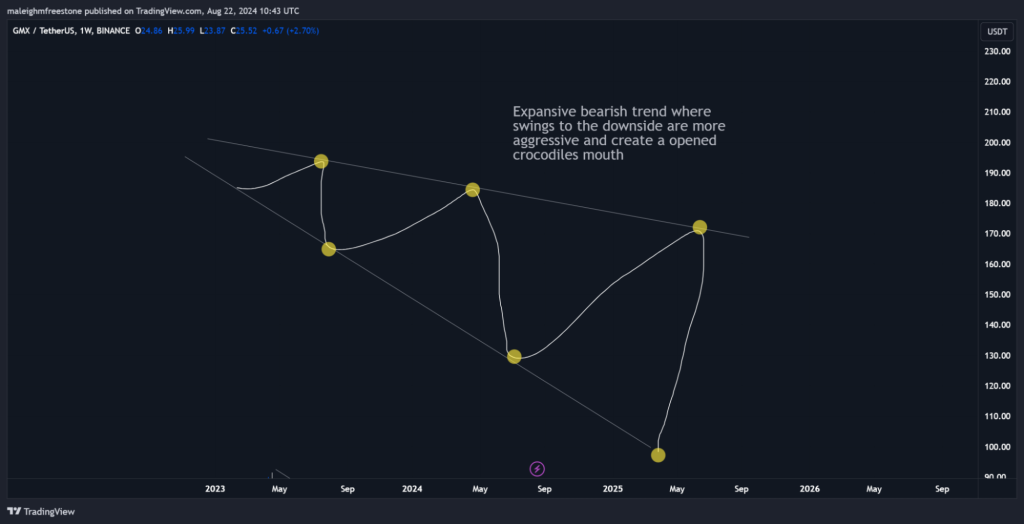

Picture this: descending triangles closing like a crocodile's mouth, liquidation heatmaps revealing hidden market forces, and price levels acting like magnets.

Sounds exciting? That's just the tip of the iceberg.

Today, we'll uncover potential 360% returns, dissect market mechanics, and reveal key accumulation zones that could set you up for long-term gains on two trades.

Let's dive in and explore the trading opportunities in GMX.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

So, we've got a buy box on GMX between $20 and $24.

This is a price range where we've noticed that momentum to the downside has started to slow down.

If we look at some of the swings GMX has made to the downside, they've actually been decreasing over time, which is a good sign. April 17th, 2023:

We set a swing high around $90. September 4th, 2023: We then dropped to $30, a 67% retracement. Next Swing: We went from $30 to $60, a solid 100% increase. From here, we then dropped from $60 down to $25, a 60% decrease.

Recent moves:

The following swing from $46 dropped about 50%. The key thing here is that the downside swings are actually getting smaller. They're not expanding to the downside as aggressively.

Educational insight: The Crocodile's Mouth

Here's a bit of an educational nugget for you.If a trend is continuing with strong momentum to the upside, the channel or diagonal levels of support and resistance will be wide open, like a crocodile's mouth when it's wide open.

But if the trend is slowing down, it starts forming a triangle, like the crocodile's mouth closing. This descending triangle pattern we're seeing here suggests that momentum to the downside is slowing, and demand is holding up at higher prices as we move down.

Now, we've actually flattened out a bit and found support around the $25 and $20 price points, which is why we've placed our buy box there.

Playbook

HypothesisThe retracement to $20-$24 offers a prime accumulation opportunity with a potential 360% return if GMX revisits all-time highs. The downside momentum is slowing, and support is strong in this range.

Risk management

This is a spot buy strategy—no leverage. Allocate only what you're comfortable holding long-term, as this is a position play, not a quick trade.

The play

Accumulate GMX in the $20-$24 buy box. Focus on building a spot position with an eye on the long-term upside.