Government Reopening, QT Ending - But Flows Remain Bearish

Markets are moving fast, with fresh headlines and sharp pivots shaping sentiment across both crypto and traditional markets. From Washington’s progress on reopening the US government to renewed liquidity debates and Trump’s proposed $2,000 “stimmy” talk, this week’s developments have kept investors on their toes. Here’s what matters and how it impacts BTC in the days ahead

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- US Gov Reopening: Senate passes GOP bill to reopen government until Jan 2026; full passage expected mid-November.

- Liquidity Outlook: QT ending doesn’t mean QE begins; TGA drawdown stabilises repo markets but won’t boost risk assets.

- Trump’s $2K Checks: Talk of stimulus cheques unlikely - may come as tax relief instead, modestly helping consumers.

- BTC Flows: BTC up from $98k lows on short-covering; ETFs still seeing outflows and long-term holders selling.

- Cryptonary’s View: Rally likely a relief bounce; expect rejection near $108k-$110k and possible move below $100k short-term.

Topics covered:

- US Government Set To Reopen.

- Is Liquidity Coming?

- Trump's $2,000 Stimmy Cheques.

- BTC's Flows.

- Cryptonary's Take.

US Government Set To Reopen:

Yesterday, a GOP bill vote was passed in the Senate (60-40 votes) that allows the US government to reopen again, should this bill then pass two more votes before it heads to the President's desk to be signed and passed.The details of the bill are:

- a continuing resolution to reopen the government until Jan 30th 2026.

- furloughed government workers will be reinstated and given back pay.

- the 'minibus' will be attached (this would fund the military, agriculture, the FDA and the legislative branch).

Prediction markets (Kalshi and Polymarket) are pricing (highest probabilities) for the US government to reopen between November 11th-15th.

Is Liquidity Coming?

This is something we're seeing all over 'Crypto Twitter', and quite frankly, there are a lot of poor takes. They vary from 'QT is ending, so QE will begin', to 'the TGA has built up during the government shutdown, that liquidity will now flow into risk assets'.Let's dive into them:

Just because quantitative tightening (QT) is ending, doesn't mean quantitative easing (QE) will begin. The Fed is ending QT (the run-off of assets from their balance sheet) to ease pressure on banking reserves so that repo markets can operate without hiccups (repo rates spiking, which we have seen recently). This does not mean QE follows the ending of QT.

If the Fed does begin to add assets to their balance sheet, and some Fed members have hinted that they may need to do this in the near future, then the Fed will be buying Bills. Again, this isn't QE. QE is the Fed buying long-end Bonds - taking duration out of the market. This wouldn't be that.

In terms of the TGA (Treasury General Account) that has now built up to just north of $900b due to the US government shutdown, we've seen a lot of takes that when the US government reopens, the build up in the TGA will be drawn down and this'll go into risk assets. This isn't correct. The TGA drawdown will result in banking reserves increasing, which should help repo rates to stabilise rather than spike, which we have seen recently. The Fed does not want stresses in repo markets.

Ultimately, and without going into phenomenal detail of how the plumbing of this all works, a TGA drawdown doesn't affect (positively affect) risk assets. And, just because QT is ending, doesn't mean QE is restarting. In the short-term, liquidity conditions are likely to remain choppy, and therefore unlikely to be a significant driver/aid to risk assets.

Trump's $2,000 Stimmy Cheques:

Over the weekend, President Trump put out a social media post where he mentioned giving US citizens a $2,000 cheque, funded from tariff revenues. This comes as Trump's political polling has dropped in recent weeks, dropping from -7.5 in mid-October to -13.0 by November 9th. This is the lowest polling point of his second term.However, Treasury Secretary Scott Bessent, somewhat walked back President Trump's statement, saying that the dividend "could come in lots of other forms, like 'no tax on tips', and 'no tax on overtime'", rather than an outright stimulus cheque.

Should $2,000 stimulus cheques be given out, this would be bullish for markets as it would ignite 'animal spirits'. However, it's more likely to come in the other forms that Bessent mentioned, meaning it would more likely help 'main street' rather than 'Wall Street'.

BTC's Flows:

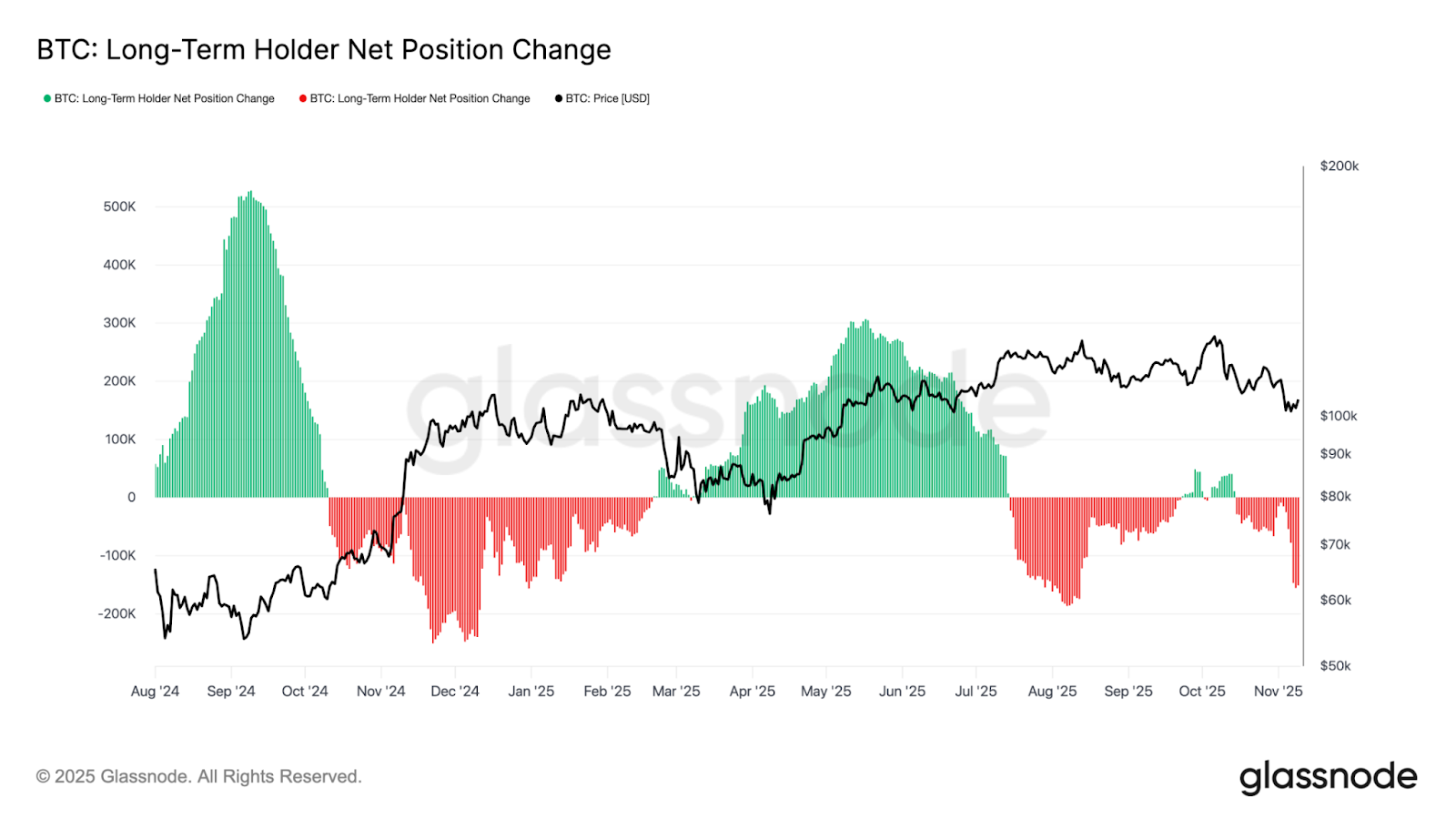

BTC has rallied over the last few days as Funding Rates have trended lower, and Open Interest higher. This suggests that this move has been driven by a gradual Short squeeze, although it has been backed by a light Spot bid.Meanwhile, the bearish flows trends we’ve been tracking continue: 1. Long-Term Holders: Still selling, and at a significant rate.

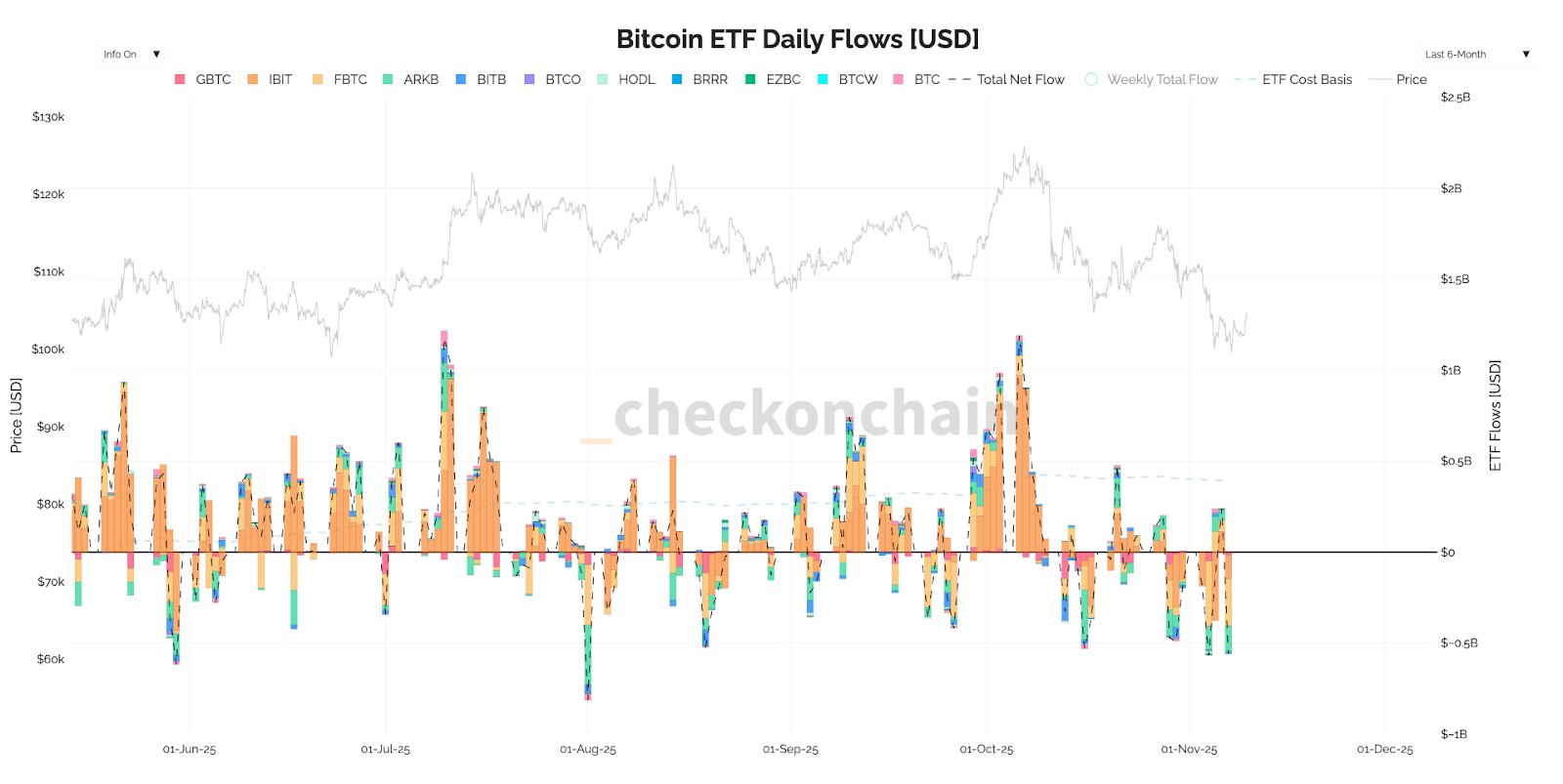

2. BTC ETF’s: Still seeing net outflows.

Long-Term Holder Net Position Change:

We continue to see the ETF's act as a net seller rather than buyer.

BTC ETF Flows:

The market dynamics that led us to a more cautious view when BTC was at $111k, still remain. And until we see these metrics turn, it's unlikely that we see meaningful, and sustained upside.

However, BTC has moved higher off the $98k lows, coming out of oversold territory and fearful levels on the 'Fear and Greed Index'.

Fear & Greed Index:

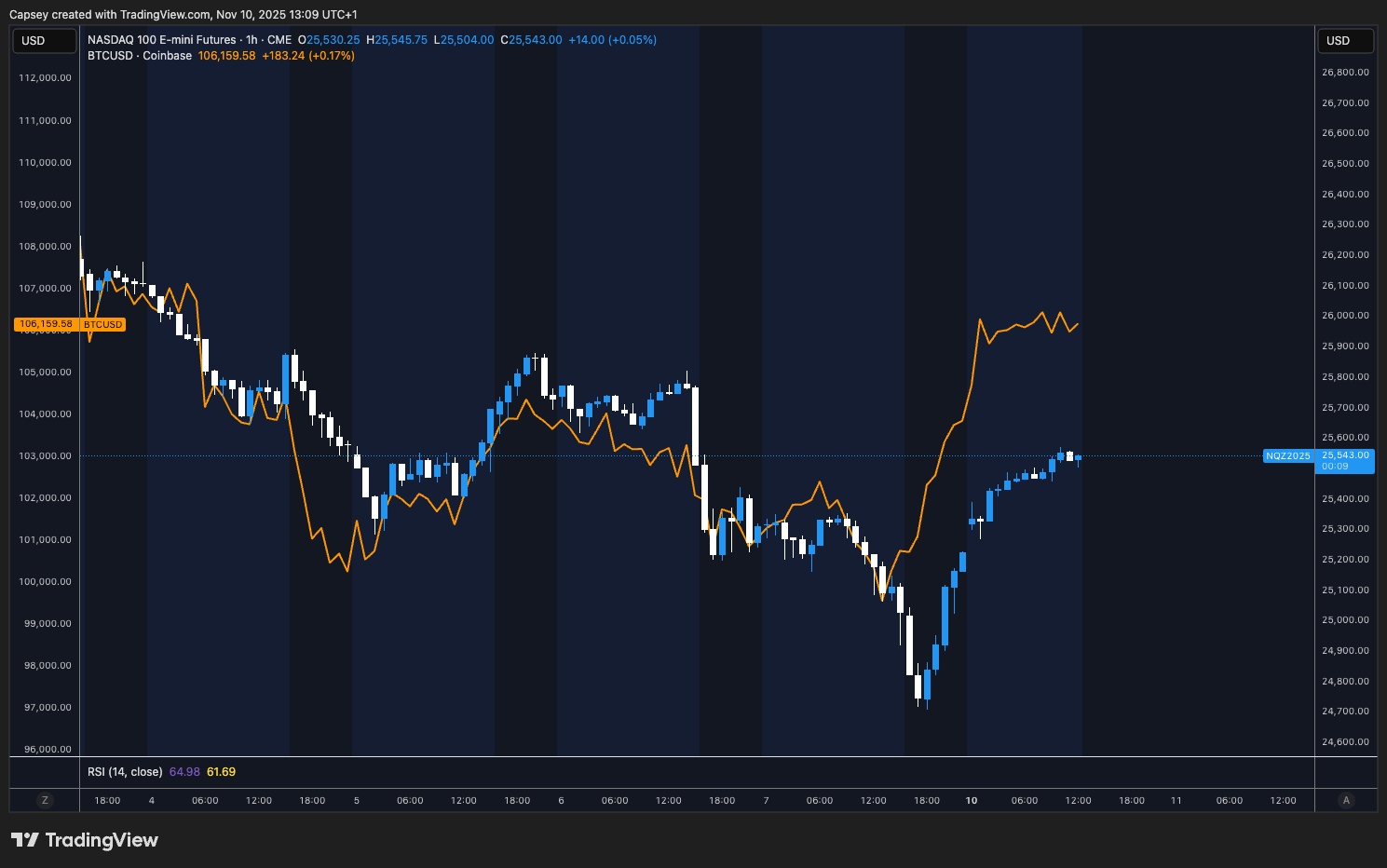

This was also supported by Equities bouncing going into Friday's session close. However, we did note that on the open of Friday's session, Equities made new lows, whereas BTC held up - front-running the bottoming process before heading higher.

We can see this in the below chart. BTC (orange line) held its lows, whilst the Nasdaq moved down to new lows in Friday's session.

What this means:

- Short-Term: BTC showing relative strength (positive).

- Medium-Term: Doesn’t change the flows picture (negative).

- Likely outcome: Both can rally together into resistances, before potentially rolling over.

Cryptonary's Take:

BTC has bounced off oversold levels with the Fear & Greed Index also at low levels, with the move higher mostly being driven by Shorts closing out, rather than a strong underlying Spot bid. Price is now moving into a few key resistance zones at $106k, $108k and then the $110k-$112k zone.The fundamentals we've tracked in recent week's; ETF flows and LTH selling, have yet to turn bullish, and in fact they both show continued selling. This leads us to be of the view that not much has actually changed and that this is likely a relief rally off of oversold levels, that is likely to reject into $108k-$110k, if price even gets there.

If we then pair this with the more hawkish Fed speak that we got last week, and the calls for further upside on the Twitter timeline due to "liquidity is coming" calls, this gives us increased confidence that there is more downside to come.

Ultimately, for those that de-risked when we exercised caution (at $111k in the last days of October), you can buy back here and still get more BTC for your money. However, at $106k, we see this as middle of the range between $99k and $112k, and with the data we've provided above, we expect the more likely scenario to be for a sub-$100k BTC in the short-term.

Going back to last Wednesday's screen recording update, we noted that there should be some 'light nibble' (buys) at $101k. We'd now be looking to offload those buys, and wait for lower to re-buy.

BTC 1D Timeframe:

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms