Market Direction

The key $0.62 horizontal level combines forces with a descending downtrend line to form a formidable barrier keeping XRP contained below.

However, underneath the lid, market mechanics have transformed to favour the bulls.

TLDR

- XRP is battling the downtrend line and horizontal resistance at $0.62.

- Market mechanics much improved - lower open interest and neutral funding.

- But funding rates are now picking up as longer-term players go long.

- A technical break above $0.62 could open the door for a rally to $0.67.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

XRP 12hr

Technical analysis

If XRP can reclaim some key levels, this would potentially open the door for considerable upside.- XRP finds itself beneath the main uptrend line while battling at the downtrend line.

- The $0.62 level is a major horizontal resistance.

- The RSI on all major timeframes has reset substantially, so there is room for the price to move higher.

Market mechanics

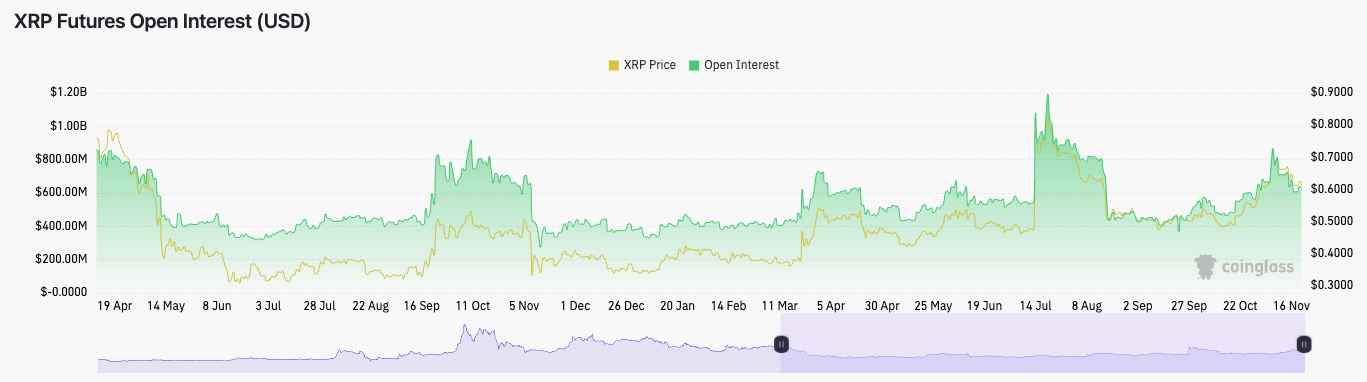

In terms of mechanics, it’s an interesting and different setup from what we usually see.- The open interest dropped from $868M a few weeks ago to $628M today. This is now back to healthier levels. XRP needed a flushing of its open interest, and despite it being a slow bleed, we’ve got the movement lower.

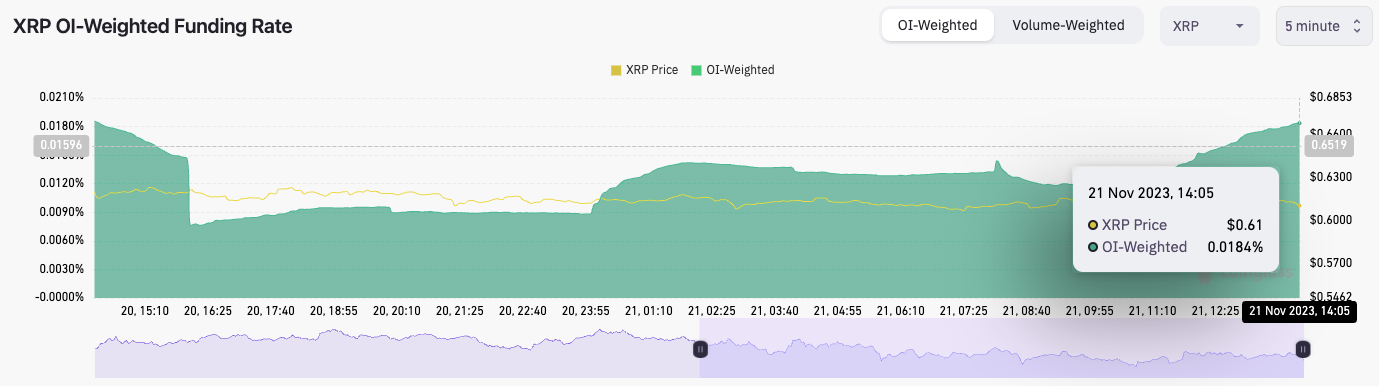

- The OI-weighted funding rate had reset to neutral levels around the 0.01% mark. However, we’ve seen it pick up quite significantly in the past few hours.

- The long/short Ratio is at 0.9354, indicating a bias among participants over the past 24 hours to go short rather than long. However, with the funding rate moving increasingly positive, we’re likely seeing bigger players long here while retail is short.

Cryptonary’s take

If the general market can hold up here, then XRP is one of the coins that could have a more meaningful upside. However, it would need to break above the downtrend line and the horizontal resistance of $0.62 to get a more meaningful move higher.If XRP breaks down to $0.54, we would consider long-term DCA orders for XRP there. However, XRP is not one of our portfolio coins currently.