How high can Bitcoin go? | April 13th

After weeks of constant ranging, the market is finally moving - and fast. What’s happening now might be deceiving. The market finally got exciting but is also reaching what we call a “topping region”, and downside can be expected. However - like all outcomes, this one can be invalidated. In this week’s report, we take a hard look at the market to understand where crypto prices go next. Friends, let’s dive in!

TLDR

- This week continues to be volatile, so trading isn’t recommended for the inexperienced.

- The Total Market Cap needs to close this week above $1.18T for more upside.

- Bitcoin is trading in a major resistance area. We believe it can top between $28,750 - $32,000 in the short-term.

- Ether is now trading at $2,000. For it to go higher (to $2500), Bitcoin will have to break above $32,000.

- SOL marked a new weekly high this week. It is now on track for $30.

- BNB remains stuck inside the $260 - $335 range. It will have to break one of these levels for a significant move to occur.

- DOGE is now at support $0.08250, but we don’t recommend buying.

- MATIC is heading to $1.30. That’s 16% away from its current price.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Total Market Cap (Weekly)

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap finally broke resistance at $1.18T on the lower timeframes, marking a 10-month high this week.

The Total Market Cap finally broke resistance at $1.18T on the lower timeframes, marking a 10-month high this week.

Despite marking a new high, we have no confirmation that upside will continue from here. A weekly closure above the $1.18T resistance level is required for the market to reach higher targets, such as $1.35T.

Given that this week is and will continue to be very volatile (lots of macro-related events unfolding), it would be best to wait for this week’s closure before deciding to trade/invest.

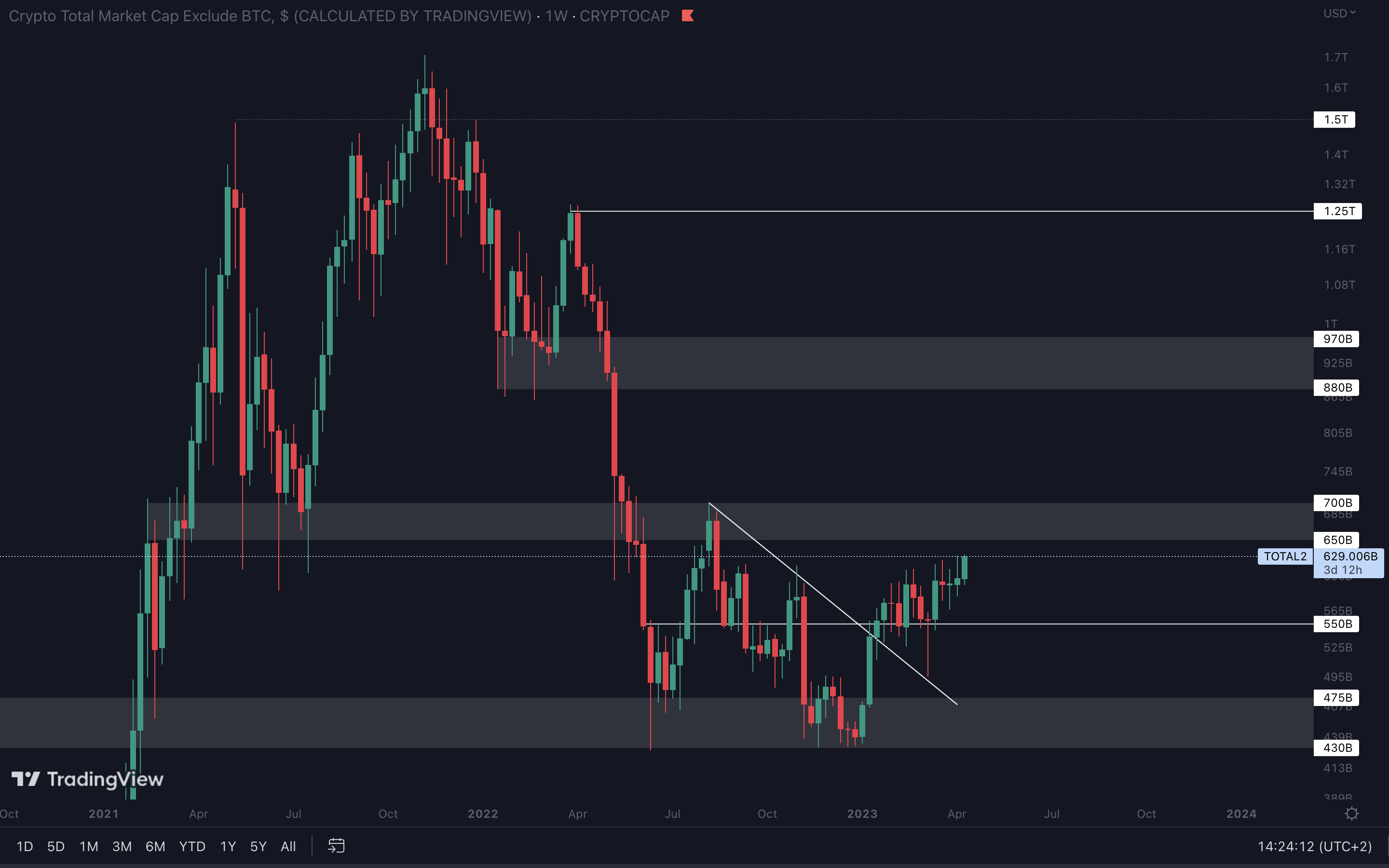

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The Altcoins Market Cap will not be able to reach its $650B - $700B resistance area unless the Total Market Cap closes a weekly candle above $1.18T. For the time being, that’s our priority.

The Altcoins Market Cap will not be able to reach its $650B - $700B resistance area unless the Total Market Cap closes a weekly candle above $1.18T. For the time being, that’s our priority.

Reaching this region means that altcoins will give good returns in the short-term, so that’s where you’d want to be if the Total Market Cap breaks $1.18T.

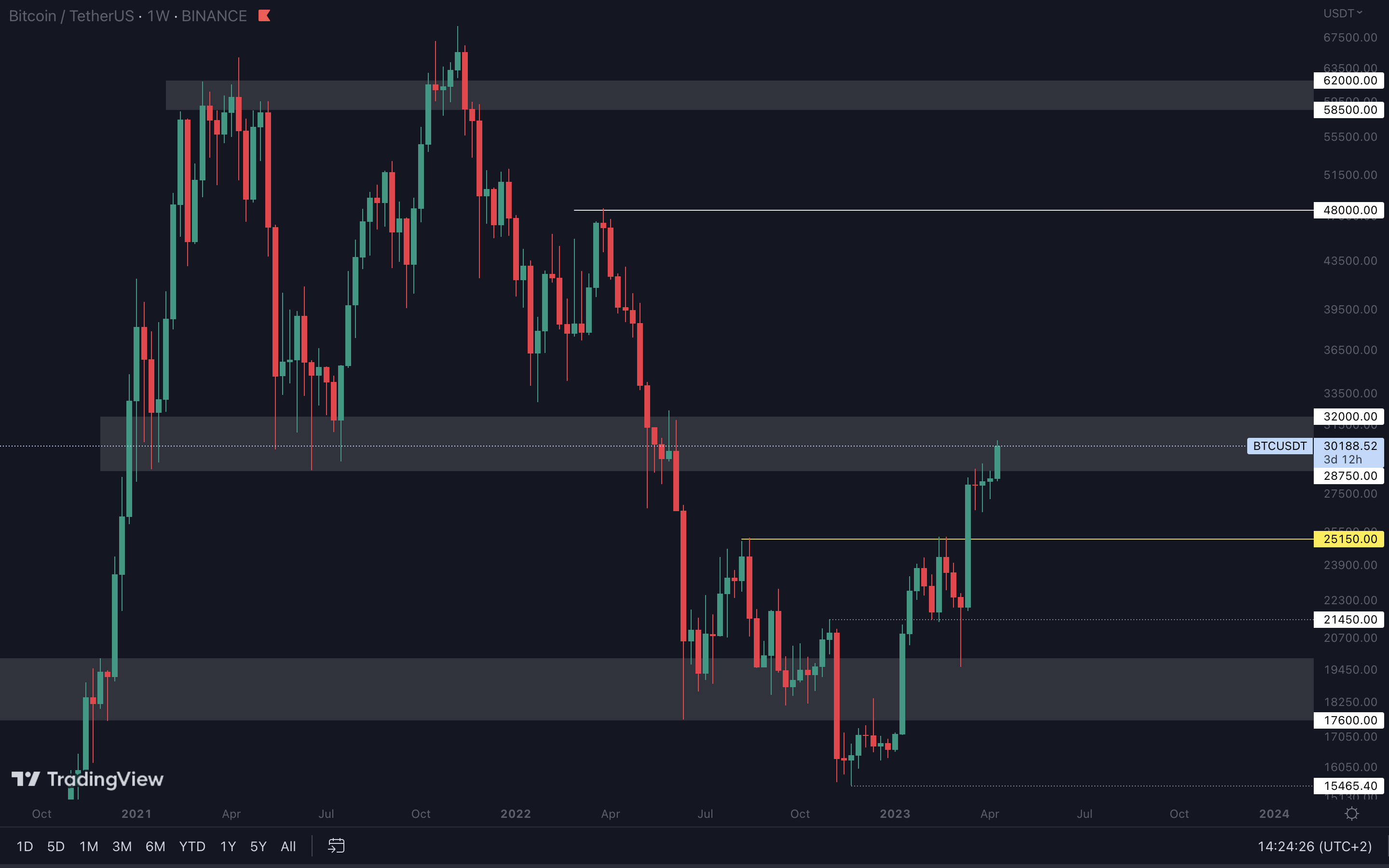

BTC | Bitcoin (Weekly)

After three weeks of constant boredom, Bitcoin broke to the upside and reached $30,000. As exciting as it is, we do believe that this is where Bitcoin will top in the short-term. The $28,750 - $32,000 resistance area was the previous bull-run’s support during 2021 and 2022. We saw major demand in this region, enough to keep the bull-run going and reach new all-time highs. Today, this area acts as resistance, so the odds of Bitcoin topping here have significantly increased. For further confluence, we looked at the Volume indicator. The obvious thing you’re seeing here is that volumes have decreased exponentially in the past weeks, despite the market rising. This is a clear sign that Bitcoin cannot sustain any moves higher naturally, unless its volume increases. An invalidation for this scenario occurs if Bitcoin flips $32,000 into support. This will open the road for $48,000.

BTC | Bitcoin (Relative Strength Index)

The second indicator we looked at was the Relative Strength Index (RSI). This indicator tells us whether an asset is overbought (value over 70) or oversold (value under 30). What we can see is that the RSI is approaching the overbought region (marked with red) at the same time with Bitcoin reaching resistance. In the past, we’ve seen the RSI go a lot higher inside the overbought region, which is why we can’t rule out that Bitcoin will not go higher, despite being at resistance. However, we now have three major confluences pointing to a single outcome - Bitcoin topping in the short-term. If this plays out, then we should expect it to retest $25,150 as support in the coming weeks.

ETH | Ethereum (Weekly)

ETH reached $2000 for the first time since August 2022. For it to reach its next resistance level of $2500, Bitcoin will have to break $32,000, which isn’t in line with our expectations for the short-term.

ETH reached $2000 for the first time since August 2022. For it to reach its next resistance level of $2500, Bitcoin will have to break $32,000, which isn’t in line with our expectations for the short-term.

However, taking hype and volatility into consideration, Bitcoin could break that level and put ETH on track for $2500. If we were to give an estimation, we’d say that ETH has a 60% chance of flipping $2000 into support and heading to $2500.

BNB | Binance (Weekly)

After taking the $300 - $310 (grey box) region as support, BNB saw a buying impulse that pushed it to the $335 resistance level.

After taking the $300 - $310 (grey box) region as support, BNB saw a buying impulse that pushed it to the $335 resistance level.

Unfortunately, BNB remains stuck inside the $260 - $335 range, and only a break of one of these levels will confirm a significant move in either direction. For the time being, the asset will follow Bitcoin’s price action, so we might see it testing $335 again.

XRP | XRP (Weekly)

Given that this is a big resistance region on the higher timeframes, it’s hard for anyone to catch a decent entry, let alone invest for the long-term. After all, we don’t buy at resistance, we buy at support.

For that reason, we recommend staying away from XRP for a while, until something of importance comes up such as a local top/bottom forming, or a break above $0.60.

Given that this is a big resistance region on the higher timeframes, it’s hard for anyone to catch a decent entry, let alone invest for the long-term. After all, we don’t buy at resistance, we buy at support.

For that reason, we recommend staying away from XRP for a while, until something of importance comes up such as a local top/bottom forming, or a break above $0.60.

ADA | Cardano (Weekly)

In confluence with the market, we might see ADA reaching the top side of its current resistance area, sitting at $0.45.

In confluence with the market, we might see ADA reaching the top side of its current resistance area, sitting at $0.45.

For significant upside to be confirmed, we’ll need to see a weekly closure above $0.45. Until that happens, the odds of ADA forming a local top here are high.

DOGE | Dogecoin (Daily)

It didn’t take long for DOGE to come back down at support - this alone shows how dangerous of an asset it actually is, especially for the inexperienced.

It didn’t take long for DOGE to come back down at support - this alone shows how dangerous of an asset it actually is, especially for the inexperienced.

Despite DOGE being at support, we recommend avoiding buying right now. The market’s current volatility, paired with DOGE’s volatility makes it an asset to run from, not towards.

MATIC | Polygon (Weekly)

When paired with Bitcoin potentially rising to $32,000, we could see MATIC going higher as well, specifically to $1.30. This is the probable outcome.

When paired with Bitcoin potentially rising to $32,000, we could see MATIC going higher as well, specifically to $1.30. This is the probable outcome.

As for the bearish scenario, the only way MATIC could reach the bottom side of this range would be if Bitcoin were to drop back to $25,150. There are neither technical nor fundamental reasons for MATIC to reach $0.75 at this time, so we remain bullish.

SOL | Solana (Weekly)

After weeks of utter boredom, SOL is finally moving. The asset is bouncing from its $19 - $22 support area, which now puts it on track for $30.

After weeks of utter boredom, SOL is finally moving. The asset is bouncing from its $19 - $22 support area, which now puts it on track for $30.

Expect this level to be reached in the coming weeks. Bitcoin rising to $32,000 will reinforce this possibility.

DOT | Polkadot (Weekly)

Like MATIC and BNB, DOT is stuck inside a range ($6 - $7) and only a break of either one of these levels will confirm a significant move. On another note, DOT is bouncing from the bottom of this range ($6), so we’ll likely see it reaching $7 in the coming weeks if Bitcoin continues to rise.

- A weekly closure above $7 will put DOT on track for $8, $9.65, and $10.45 respectively.

- A weekly closure under $6 will put DOT on track for $5 and $4.25.

LTC | Litecoin (Weekly)

For the time being, LTC is still heading toward $81.77 to retest this level as support. However, Bitcoin’s price action could reverse this and instead, LTC will be heading to $110.

For the time being, LTC is still heading toward $81.77 to retest this level as support. However, Bitcoin’s price action could reverse this and instead, LTC will be heading to $110.

Given that the asset is in the mid-range mark between $110 and $81.77, it’s hard to predict where it will be heading next. The only thing we can do is wait for events to unfold first, and act after.

Cryptonary's take

The market can rise higher in the short-term, but we believe it will top in the coming weeks, and we have multiple confluences to prove it. Of course, this scenario would be invalidated if Bitcoin flips $32,000 into support on the weekly timeframe, because this will put $48,000 on the cards.

Action points:

- This is not the time to go all-in on crypto, so avoid doing that.

- Waiting for this week’s closures is crucial. The market will tell us whether it can go higher or not.

- Avoid opening longs on assets that are at resistance. The risk outweighs the reward.