Important Market Update: Is Bull Cycle Over?

The crypto market hasn’t felt this tense in years. Confidence has cracked, liquidity is draining, and the stories driving this cycle are suddenly being questioned. ETF outflows are accelerating, sentiment has collapsed, and the macro picture is shifting by the day. The question echoing across the industry now is simple, but heavy: is the bull cycle ending right in front of us?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- September jobs data was mixed: strong payrolls but higher unemployment.

- Conflicting Fed comments: are whipsawing December/January rate-cut odds.

- TradFi showing stress: with AI equities reversing and risk-off flows rising.

- Crypto weakness: may stem from a large market maker unwinding after October losses.

- BTC is heavily oversold: with capitulation sentiment, though selling pressure persists.

- Low-mid $80k looks like long-term value; dips to $75k–$80k remain possible before a bottom forms.

Topics covered:

- Yesterday's Jobs Data.

- Rate Cut Odds Into The New Year.

- TradFi Issues?

- October 10th: Potential Contagion.

- Cryptonary's Take.

Yesterday's Jobs Data:

Yesterday, we received September's Jobs data, which showed a positive Payrolls number of 119k, but with the Unemployment rate moving up to 4.44%. Note that this data is September's data, so it's relatively dated now, particularly as we've had private data (ADP and Challenger) since, which have shown an increased weakening in the labour market. October's Jobs data is likely to never be released, whilst we won't receive November's data until December 16th.Despite the strong Payrolls number, an increase in the Unemployment rate to 4.44% (previously 4.3%) suggests that more people came into the labour force (potentially they're struggling financially and looking for work) and weren't able to find a job. Hence, a strong Payrolls number, but Unemployment is up.

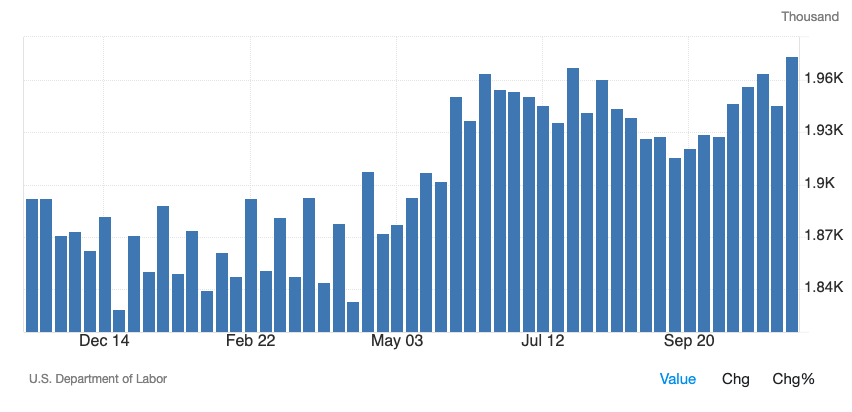

In this report, there was something for everyone. Doves (dovish Fed members) will point out a 4.44% Unemployment rate, whilst Continuing Claims rose to their highest level since late 2021. Doves will point out these data points and suggest that the Fed should continue cutting interest rates to support a weakening labour market.

Chart Title: Continuing Claims

Whereas hawks (hawkish Fed members) will point to the strong Payrolls number and suggest that the Fed should hold rates at their December Meeting, and wait for further data, which they won't get until 16th December, 6 days after their December Meeting.

Rate Cut Odds Into The New Year:

This week, we've had three events that have moved the odds of future rate cuts:- stronger Payrolls data yesterday (September's data).

- delayed Payrolls numbers (October and November's data).

- hawkish Fed speak.

Alongside this, we've had a plethora of hawkish Fed speak post yesterday's employment data. For example, Goolsbee was "uneasy about front-loading rate cuts", Barr said that the "Fed should move carefully with inflation still at 3.0%", and Hammack said that "rate cuts would prolong inflation".

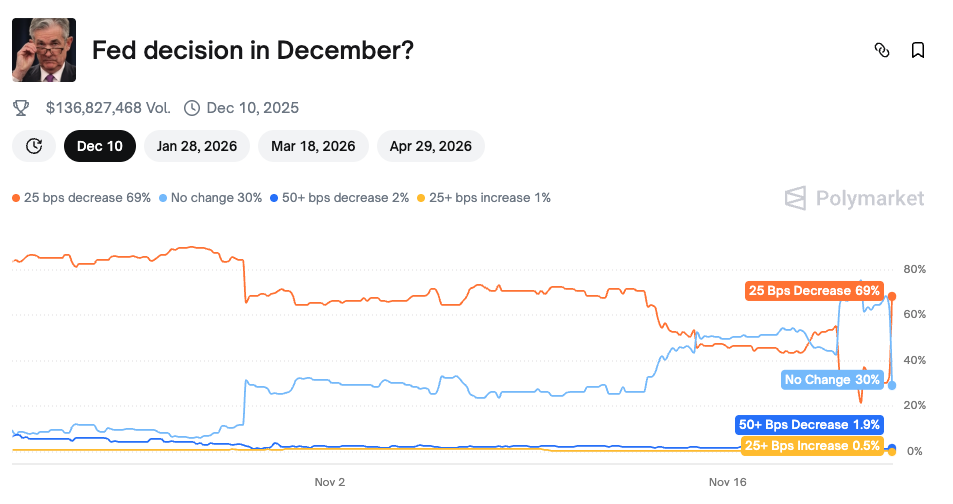

The above has ultimately resulted in an increase in the odds of 'no cut' at the Fed's December Meeting (from 50% a few days ago to now 66%), but interestingly, the odds of a rate cut at January's Meeting have increased. This suggests that market participants are expecting a hold in December but for the Fed to continue cutting rates at the late-January Meeting.

UPDATE:

However, as we're writing this update, New York Fed President John Williams gave a speech where he said that the "Fed can still cut rates in the near-term". This saw the odds of a December rate cut swing wildly again from 35% to 65%. The reason being, is that the market expects Williams to be in line with Chair Powell, as Williams is considered one of Powell's 'lieutenants' - so, if Williams is dovish, then perhaps Powell is also?This has once again really muddied the picture as to whether the Fed will cut in December or not, but the market is now pricing a near 70% chance that the Fed cuts in December.

Risk assets have bounced off the back of Fed President Williams' comments.

Chart Title: Fed Decision in December

TradFi Issues?

The initial pairing back of rate cut odds for December's Meeting has caused issues in the TradFi markets as well; the weakness hasn't been isolated to Crypto. Alongside this, there have been fears as to whether the AI "bubble" was/is getting over-extended. We saw this when Nvidia reported positive Earnings, beating Earnings estimates and also guiding to increased growth in 2026. The stock price surged on this news, only to completely reverse by the end of yesterday's trading. Usually, really good news not being rewarded and sold into isn't a good sign.Chart Title: Nvidia 1D Chart

This has been a perfect storm for bears. We've had an increase in the Dollar Index on a December rate cut being priced out, even though the US2Y Bond has been bid (Yield down) - flight to safety, suggesting risk-off in risk assets. And with the Dollar Index also looking as if it's about to break out of a key horizontal resistance of 101.30-101.50, this might be a further headwind for risk assets in the immediate term.

But, following William's comments, it's possible that risk assets can be supported here on the hopes of a December rate cut. We'll need to see if this materialises in the coming days/week.

Chart Title: DXY 1D Chart

October 10th: Potential Contagion

The October 10th liquidation event has been hanging over the crypto market for the past month. It was widely commented that a large firm might have taken considerable losses due to ADLs taking out hedges. However, in the days and weeks that followed, there was no news of a large firm (market maker, fund, etc.) that was negatively impacted by the October 10th liquidations.In an interview yesterday, Tom Lee suggested that a market maker took heavy losses and attributed crypto's recent weakness to this entity liquidating positions. This would be consistent with the price action we've observed.

To put this in perspective, we can look at how oversold the market is, with Bitcoin being the most oversold it's been on the Daily timeframe since August 2023.

Chart Title: BTC 1D Timeframe - Oversold RSI

And on the 3D timeframe, BTC is the most oversold it's been since June 2022.

Chart Title: BTC 3D Timeframe - Oversold RSI

What's also interesting to note is that both charts have hidden bullish divergences forming - this is a higher low in price, and a lower low on the oscillator.

It's possible that a large market maker took losses in early October and is now liquidating positions to cover these losses. This would be consistent with the price action we've seen recently - consistent selling pressure with bounces being sold into.

From a technical perspective, with BTC down 34% from its all-time high, we would view the current price (around $83k) as a long-term value area to add to spot positions.

Alongside this, we're seeing sentiment at extreme lows, as seen in the Fear & Greed index.

Chart Title: Fear & Greed Index

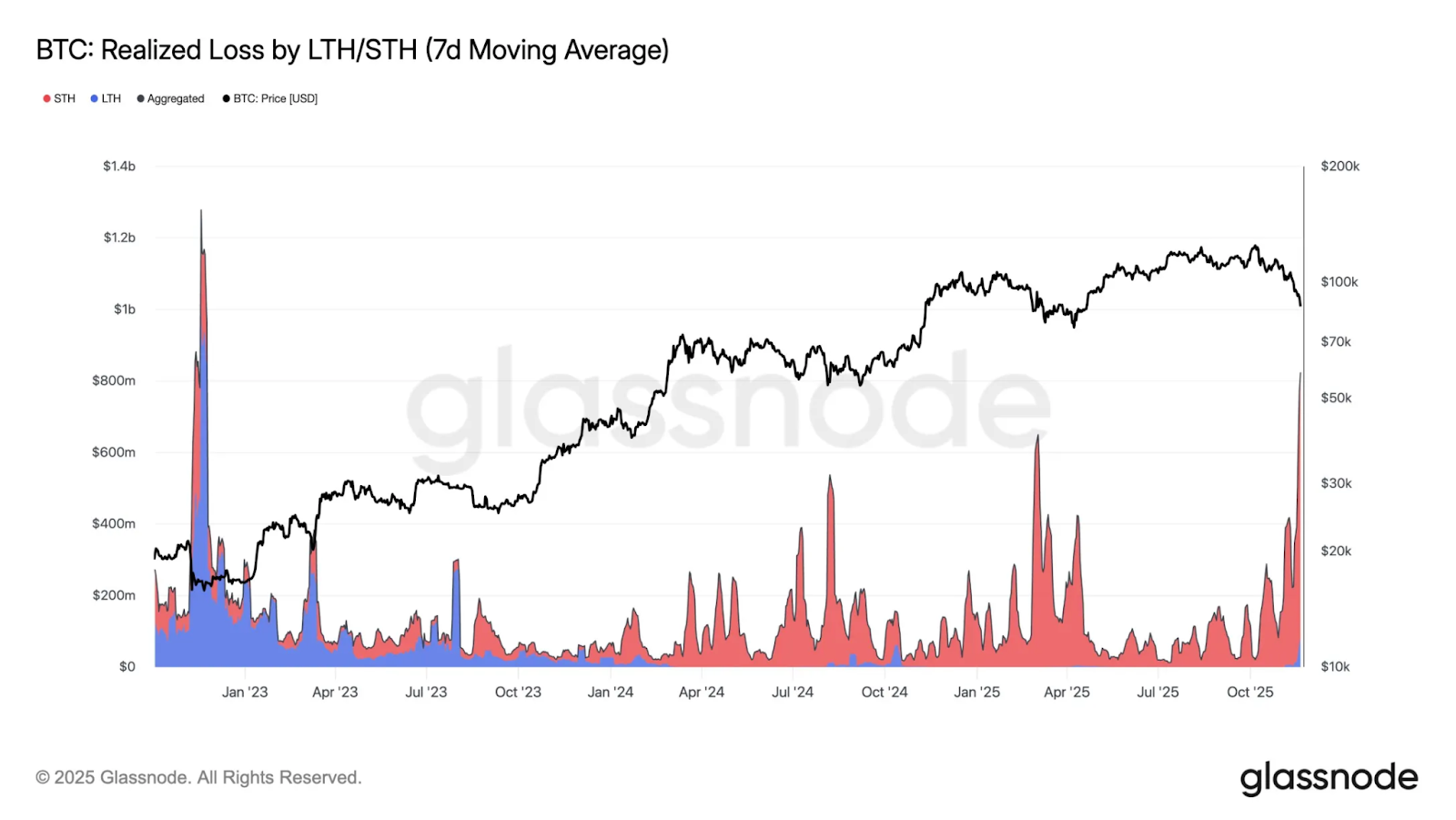

And in recent days, the market has experienced some capitulatory behaviour. The below chart shows that the magnitude of Realised Losses in the last few days has surged to levels not seen since the FTX collapse. These losses have been driven by Short-Term Holders.

Chart Title: Realised Loss by LTH/STH

However, what we can also see from this metric is that just because Realised Losses surge, that doesn't tend to mark a low, and historically, a new low has come within several weeks of this metric spiking.

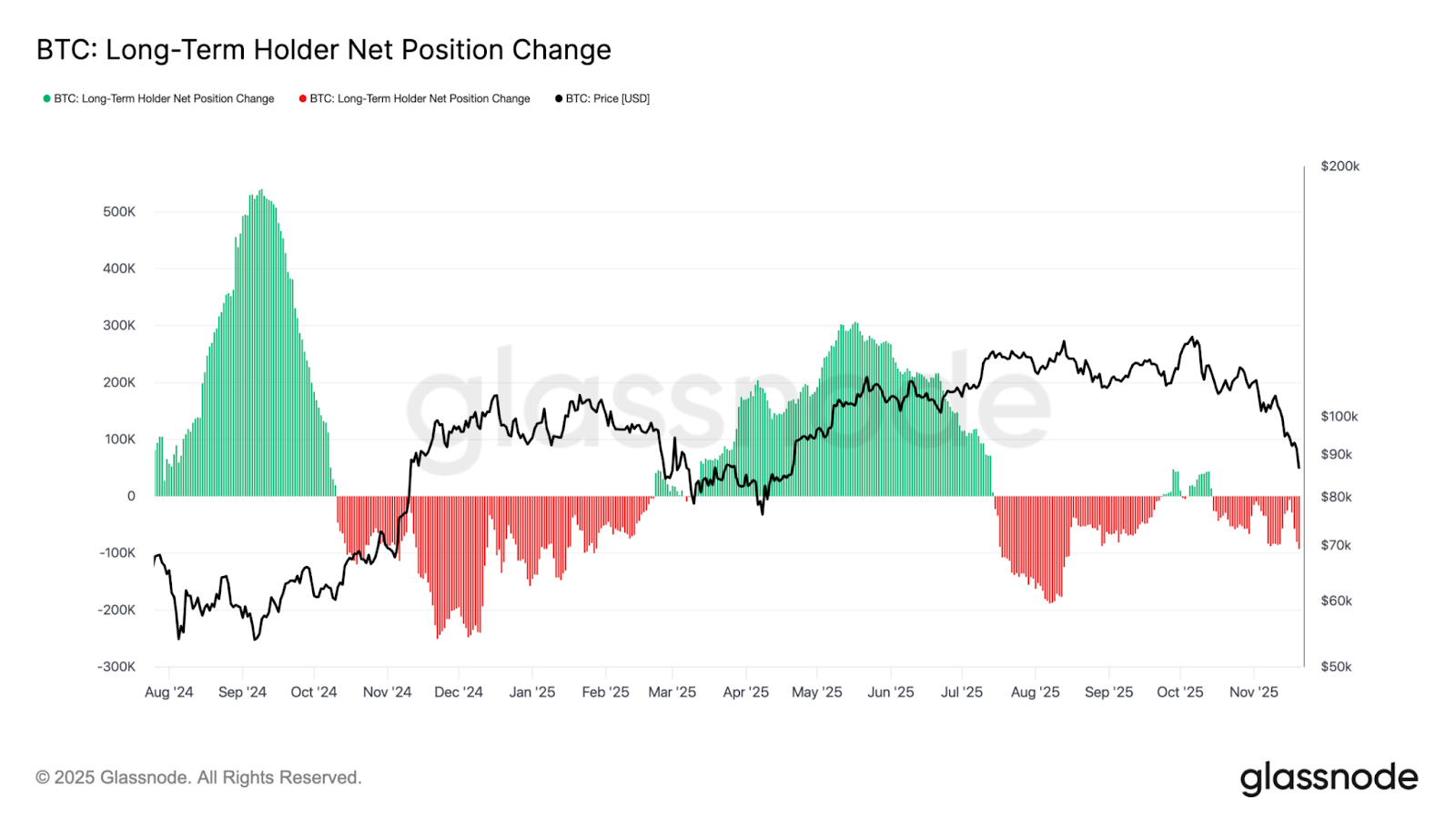

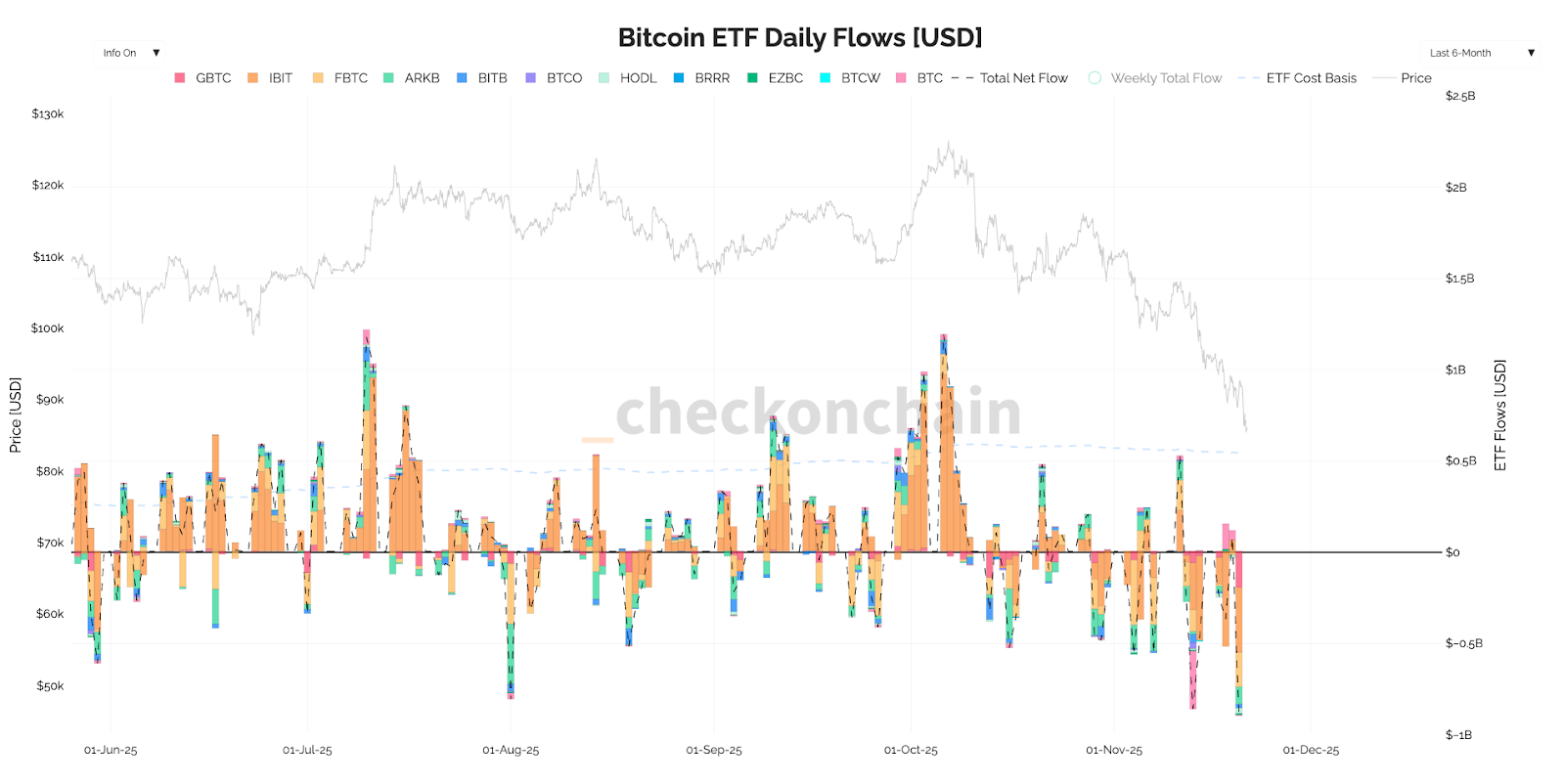

Alongside this, Long-Term Holders continue to sell down their supply, whilst the ETFs are also contributing to a large amount of the sell pressure, with yesterday (20th November) being the second biggest outflow day on record.

Chart Title: Long-Term Holder Net Supply Change

Chart Title: ETF Flows

Until these dynamics improve, it'll be difficult for price to bottom out and then see a sustained rally. We'll likely have to see these metrics ease off (less selling, preferably neutral flows) before price bottoms. We'll wait to see this in the data.

Cryptonary's Take:

Generally speaking, risk assets have traded heavily on the market's pricing out a December rate cut, paired with scepticism over the AI narrative.However, following New York Fed President John William's comments, the market has started pricing in improved odds of an interest rate cut at the Fed's December Meeting. This may help provide some support and therefore relief for risk assets as it now looks more likely that a December rate cut can happen. But ultimately, we still expect more interest rate cuts next year. With the rate at 4.00%, there's still plenty of room for the Fed to cut rates down to 3.0% - hence we see 2026 as being positive for Crypto and risk assets.

But, we still have heavy sellers from long-term and short-term holders, and the ETFs. Until this eases, we're unlikely to see a sustained upside rally that is Short-squeeze driven. Despite this, sentiment metrics suggest that BTC is oversold here with the low-to-mid $80k's reflecting a good long-term value zone. A move from $80k to $120k is a 50% gain - traders will likely be looking at this as an attractive opportunity now that price has pulled back nearly 36% from it's all-time highs.

We also have the macro timeline to consider - between now and the Fed Meeting on December 10th, it's possible that this large market maker hasn't finished liquidating positions. Therefore, with this in mind, we're reluctant to be buying "all-in" here. We see the low-to-mid $80k's as a good long-term value zone. But, we appreciate that there are other dynamics at play that can send price lower. So, we'd look to split our buying strategy into two:

- buying now in the low-to-mid $80k's due to extreme negative sentiment and oversold conditions.

- and dip buying into the $75k-$80k zone if we get more capitulation (our feeling is that we've already seen quite a bit of capitulation).

We don't expect the price to trade below $75k. We believe price is close to a bottom/putting in a bottoming process close to the current price ($83k), but that it may take more weeks for this "bottom" to form.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms