Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview

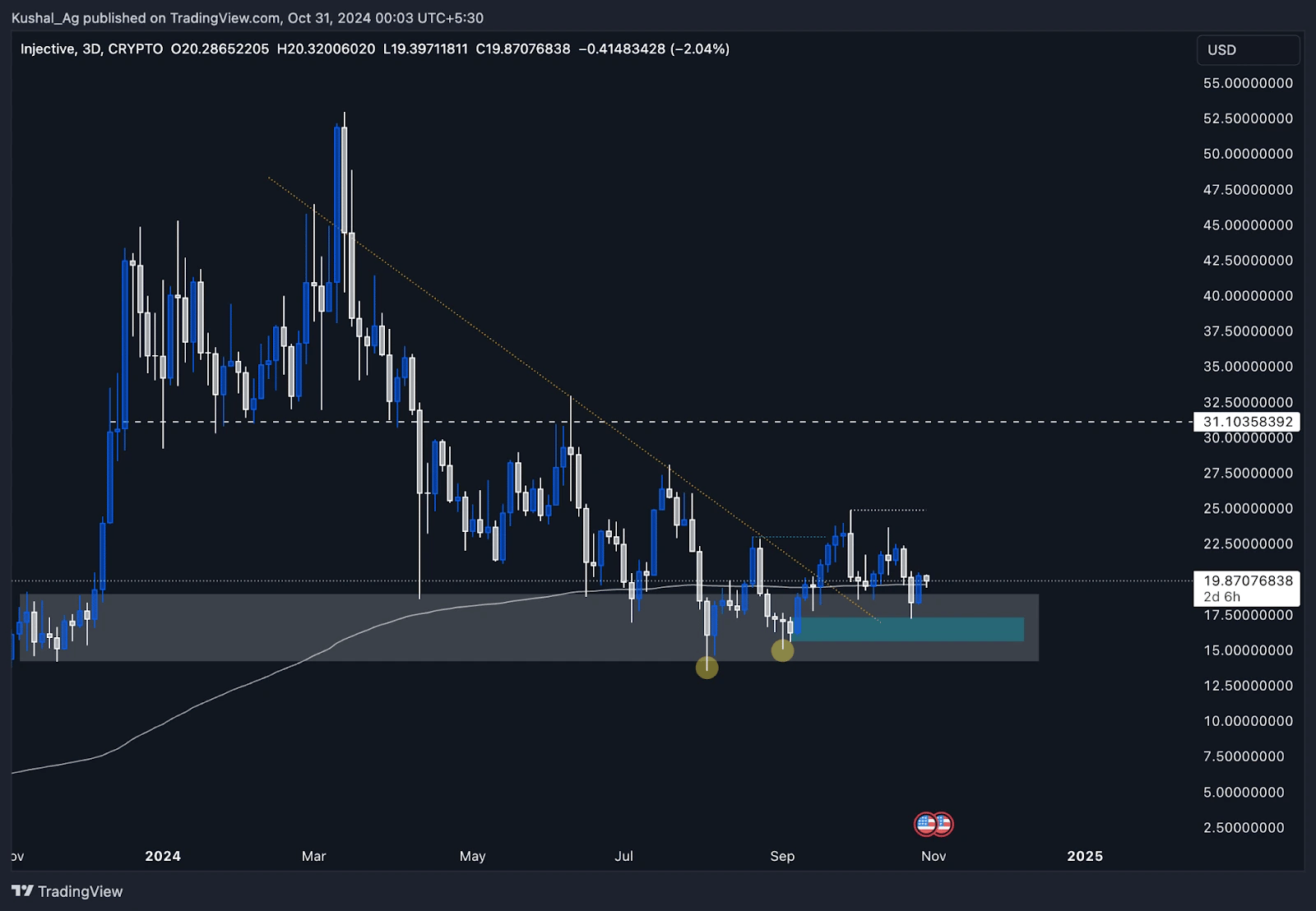

Injective (INJ) currently shows a strong technical setup in the three-day time frame, with a promising bullish outlook. INJ is holding steady above its 200 Exponential Moving Average (EMA), a significant support level, and has formed a double bottom structure, highlighted by two yellow dots. These indicators suggest a potential trend reversal and provide a solid base for upward movement.Three-day time frame analysis

- Support at 200 EMA: INJ has established a solid base on the 200 EMA at $19.59, currently serving as robust support. INJ is trading just above this level at $19.87, bouncing off the 200 EMA-a positive signal on a larger time frame like the three-day chart.

- Double bottom formation: The double bottom pattern, marked by two yellow dots, is a promising indication of potential price reversal from previous lows. This setup typically signals strong buying interest, adding to the asset's bullish sentiment.

- Break of structure: INJ has recently broken its intermediary structure to the upside, marked by a blue line at $23. This break signals a positive trend shift, with the blue demand zone ranging from $17.32 to $15.6 providing a strong foundation. INJ tested this demand zone on October 24 at $17.31, followed by a substantial bounce, rising over 15% since.

- Resistance levels: The next resistance on the upside for Injective is $24.8. A break above this level would indicate a new higher high, opening up a potential path to $31.1 in the medium term if bullish momentum holds.

- Support levels: On the downside, the three-day demand zone from $17.32 to $15.6 offers strong support. This zone serves as a solid foundation, reinforcing Injective's price action in case of any pullback.

Cryptonary's take

With Injective's solid structure in the three-day time frame and a clear upside structure break, the asset seems poised for a potential rally. The strong support at the 200 EMA and the double bottom formation further reinforce this outlook.However, a sustained move above $24.8 is essential to confirm ongoing bullish momentum. As always, traders should monitor support zones closely for any retracement potential.