Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview:

Injective Protocol (INJ) has been a standout performer in the altcoin market since its launch in October 2021. INJ has maintained a strong bullish structure across both weekly and daily timeframes, consistently showing strength through its higher highs and higher lows pattern.Currently trading at $19.50, INJ has been steady despite broader market fluctuations. With recent price movements breaking key resistance levels and maintaining critical support, INJ is positioned for a potential continuation of its bullish run as the wider cryptocurrency market trends upward.

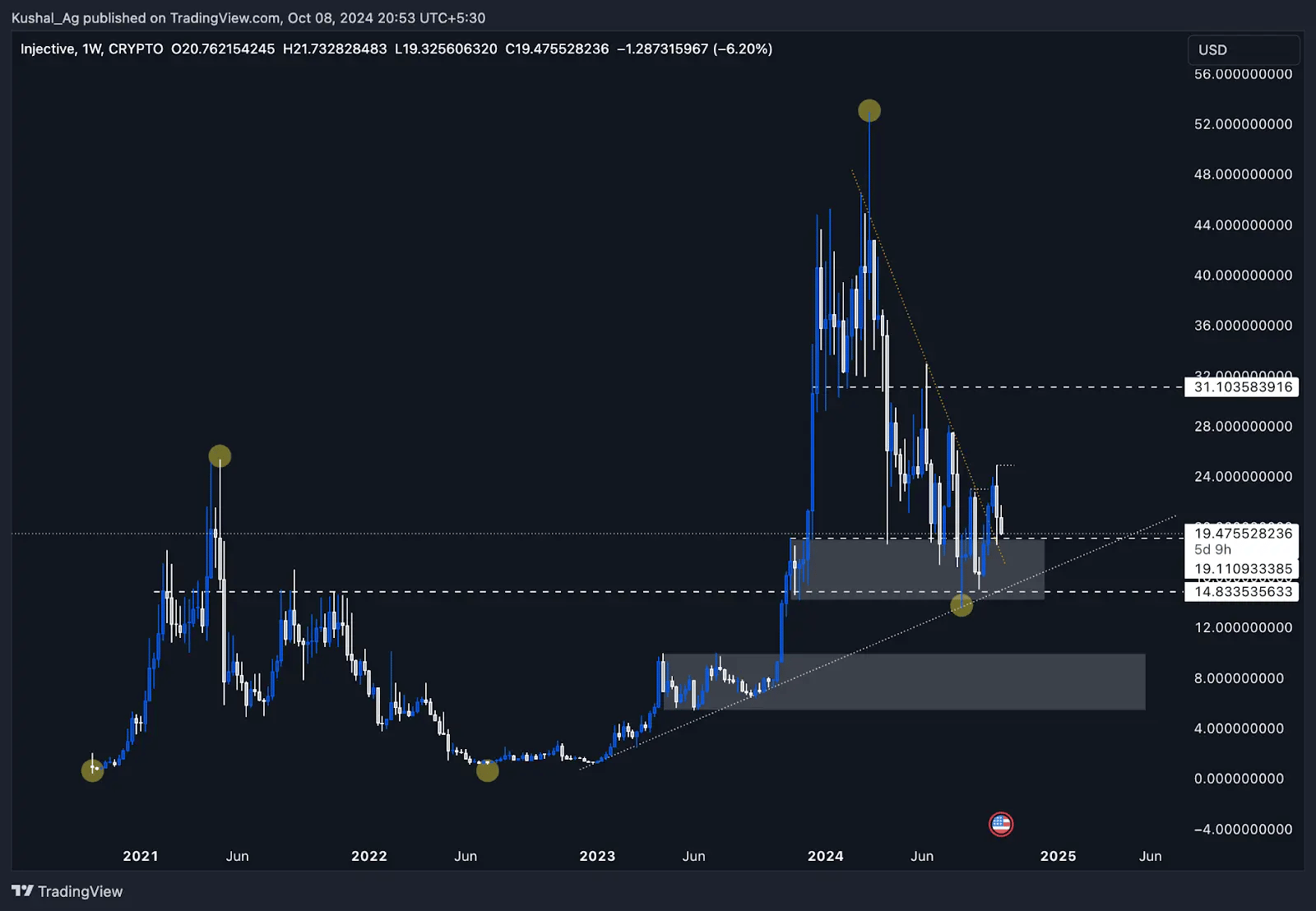

Weekly time frame analysis

Since its inception, INJ has demonstrated significant strength, maintaining a bullish structure despite corrections. After reaching an all-time high of $52.9 in March 2024, it retraced to the $19.50 range, where it is now trading within the weekly demand zone between $14.2 and $19.1.Price recently tested the $14.8 support zone, a historically important level that now acts as support after serving as resistance in 2021.

Key observations:

- Higher highs & lows: The yellow dots on the chart represent INJ's pattern of higher highs and higher lows, continuing the bullish structure on the weekly time frame.

- Strong demand zone: The price is holding above the $14.2 - $19.1 demand zone, which has consistently attracted buying pressure.

- White dotted trendline: The uptrend maintained by the white dotted line continues to support price action. As long as this trendline remains unbroken, INJ's bullish structure in the weekly time frame will be preserved.

- Next support levels: If the demand zone fails, the next support zones are between $9.94 and $5.41, though this seems unlikely given the current bullish market momentum.

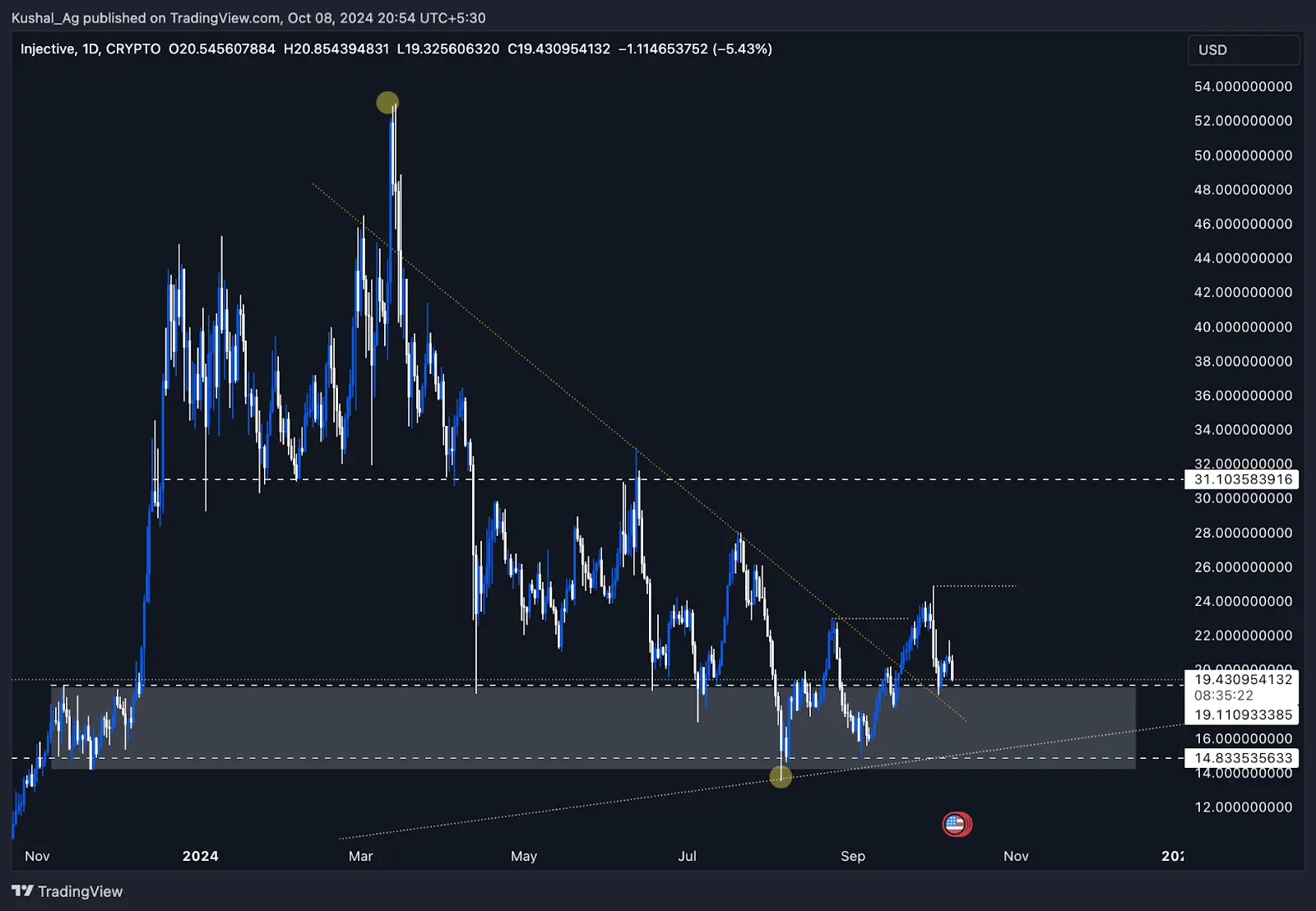

Daily time frame analysis

On the daily chart, INJ recently broke out from a downtrend trendline in late September 2024, marked by the orange dotted line. This breakout has led to a significant bullish swing as INJ also broke an intermediate structure on the upside, further adding confluence to the breakout.Current market outlook

- Breakout Retest: After breaking out from the downtrend, INJ has returned to the breakout range for a retest, which is a healthy sign of consolidation before another move-up. The price should hold above the weekly demand zone at around $19.1 for the bullish trend to continue.

- Resistance Levels: On the upside, $24.8 is the immediate resistance, followed by $31 as the next major level to break.

- Support Levels: On the downside, $14.8 remains a key support level, which has held firm in recent pullbacks.

- The $19.1 area and weekly demand zone offer good opportunities for accumulation for long-term investors. If the price holds above this zone, INJ is well-positioned to rally toward $24.8 and eventually aim for the $31 resistance.

- In the event of a bearish retracement, bids can be placed around the $14.8 level, which has proven to be a strong historical support zone.

Cryptonary's take

Injective Protocol (INJ) continues to show some strength on both the weekly and daily timeframes, with a solid market structure and bullish indicators across multiple key levels. The breakout from the downtrend on the daily chart, combined with price holding above the weekly demand zone, points toward a potential rally in the near term.However, it's essential to remain cautious of any downside risk. The $14.8 support level will be critical in determining whether the bullish trend continues or a deeper retracement occurs. With the wider market turning bullish and Bitcoin breaking through significant resistance zones, INJ is in a favourable position to capitalize on this momentum, targeting $24.8, $31, and potentially higher levels in the coming weeks.