Hypothesis

Today's trading opportunity centres around seizing an opportunity after a recent break-even trade retraced back to a crucial demand zone. This area has historically proven pivotal, showing strong support levels.We believe this coin's oversold condition presents an excellent entry point for long positions, aligning with our strategy to capitalise on a bullish reversal. We aim to maximise potential gains from this strategic repositioning by leveraging historical price patterns and technical analysis.

Let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. We also advise setting a risk tolerance level in terms of capital allocation while trading. The industry standard is no more than 2% of your portfolio at any given time. This means if you are in an open position already, it's advised not to take on more trades, which will lead you to be overexposed. Allow current trades to be settled; there will be more opportunities around the corner.

Technical analysis

As you already know, based on the latest altcoin opportunity, the area of demand found here aligns nicely with a Fibonacci retracement level. This is also the price area that has served as support twice now despite significant bearish price action across the market.

The fact that this price point is holding up well provides us with a solid, well-justified entry point and a clear area to place stops to ensure we abide by our risk management protocols.

This isn't just a good return at 60% for spot holders; with the application of some leverage, it's a generous and well-justified opportunity with a clear technical conviction.

Market mechanics

Injective's funding is 0.067%, indicating a relatively even balance between long and shorts. We would be cautious about entering long positions if an asset's funding rate was heavily positive, as seen for Injective in April.

Injective's funding is 0.067%, indicating a relatively even balance between long and shorts. We would be cautious about entering long positions if an asset's funding rate was heavily positive, as seen for Injective in April.

However, the current balanced reading gives us the green light.

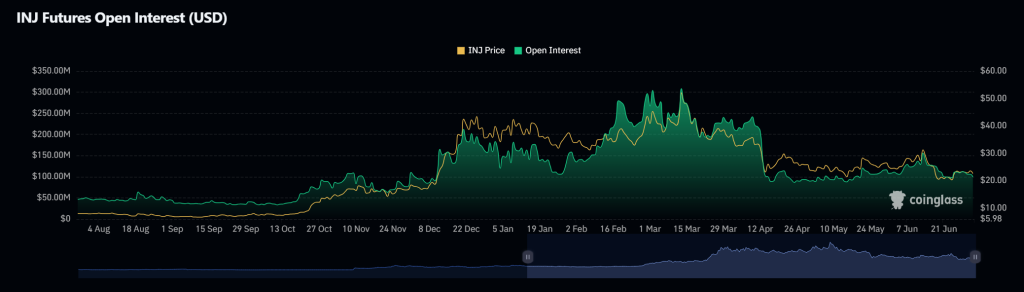

Open interest (the number of open leverage positions) has also decreased significantly compared to April, from 240.91 million to 72.38 million.

When open interest has significantly ramped up and is high compared to previous readings, and the funding rate is heavily positive, we would proceed with caution when building a long position. But neither of these conditions suggests a need for caution right now, giving us the green light from a market mechanics point of view.

Play for traders

Consider entering at market price in the buy box, price range between $20.75 and $18.80Risk and reward

We only suggest always having a small percentage of your portfolio allocated to trades. This may be different if you want to accumulate and build a spot position in this asset. However, if this is a trade, you should place a stop below; this stop loss will provide us with an R:R of 3:1.- Stop loss - $15.91

- TP 1: $34.20