However, early signs suggest this conflict may be contained in the short term, allowing crypto markets to recover cautiously. The attack triggered a pullback in crypto prices. However, this has reset key metrics like leverage and funding rates, potentially setting the stage for a healthier and more sustainable bull market over the next 6-12 months.

Overall, the short-term outlook appears more positive, provided the Israel-Iran conflict does not significantly escalate further.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Iran striking Israel and its effects

As many of you will be aware by now, the big news over the weekend was Iran's direct attack on Israel. The Iranian missiles targeted military bases in Israel, but many of the missiles didn't pass the 'Iron Dome'; this meant that the Israelis were able to shoot the missiles out of the sky.Upon the attack, which occurred on Saturday evening UK time, crypto assets plummeted and have recovered somewhat now, with Bitcoin easily the best performer.

The big question now is: Will this escalate, and how could it impact oil, which in turn could impact risk assets?

From everything I'm (Tom) reading, in the short term, it looks like this may be contained. Both Israel and Iran have a win here, and both are able to save face.

The Israelis have attacked the Iranian embassy in Damascus while the Iranians have directly struck Israeli military bases inside Israel, something that hasn't happened before - a direct revenge strike.

Both countries do not want an escalation from here, and Biden and the US are likely to put huge pressure on Netanyahu not to escalate this.

But Netanyahu has been able to bring the US more into the war, meaning they are stronger from a defensive point of view (Israel and Netanyahu have what they want here). But Biden is likely threatening to withdraw support from Israel if they escalate this. The Israelis absolutely cannot afford to lose US support, so this, to me, seems like it's come to a natural stalemate/draw in the short term.

Again, I'll emphasise the short-term aspect of this. But this is potentially why we've seen a relatively decent bounce for crypto since it fell dramatically on Saturday evening, as the market sniffs out a natural draw/stalemate here for now.

Some caution will be exercised in the very short term, but we think the more likely result is a cautious recovery for crypto.

Metrics resetting

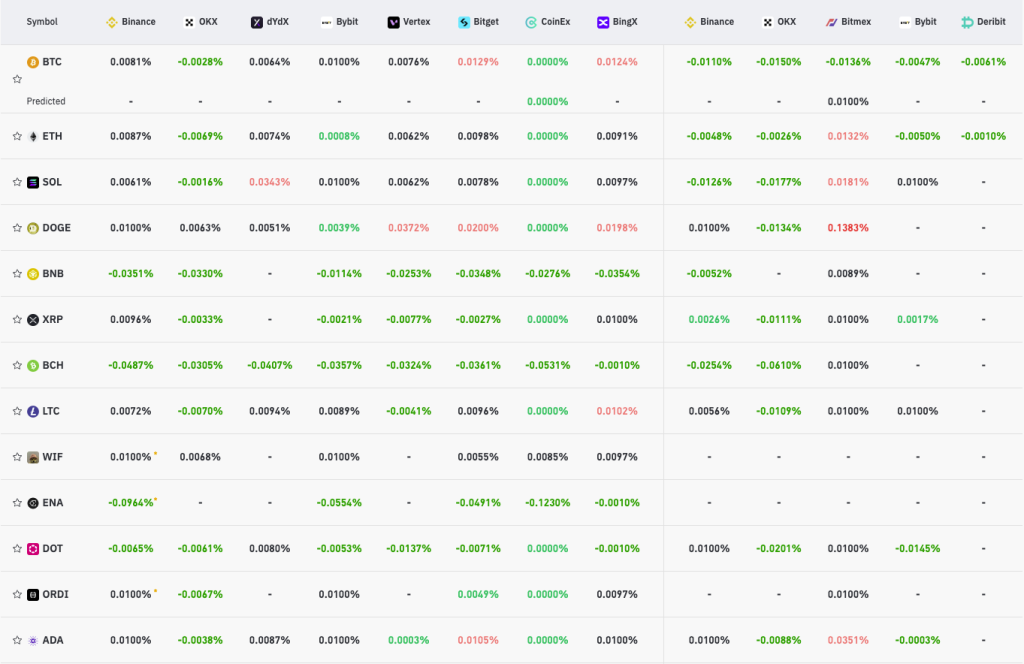

Bitcoin has been the strongest performer, only down 5% from Thursday's trading session. Altcoins, of course, have taken more of a battering, with some beginning to put in decent recoveries and some still at meaningful lows, most likely still due to confidence being relatively low.When we look at the Market mechanics, Open Interest has pulled back substantially, down 20% from its most recent highs. Alongside this, Funding Rates are, in the majority, negative or well below the 0.01% positive and healthy level.

Funding rates

This is a full resetting in the leverage market and something we've needed. This resetting allows for a new base to be created, and if confidence remains low, I'd feel even more encouraged that we don't see large amounts of leverage immediately pile back on.

Alongside this, the trading indicators such as the RSI has pulled back substantially from overbought levels on the larger timeframes. Many are now also printing lower lows while prices print higher lows, meaning hidden bullish divergences are appearing - this is a bullish signal.

Overall, the resetting in the leverage market should absolutely be seen as a positive thing, and this resetting, and the potential lack of confidence for leverage to pile back on, may mean we see a healthier next move higher.

Cryptonary's take

I (Tom) did a relatively late-night update on Saturday night; this was not to sell any positions. The only action I took was to add positions.I always keep USDT on the sides, but I put all of it to work into new positions (mostly SOL ecosystem plays) on Saturday evening. It just looked like a great opportunity to buy from a price-attractiveness price point of view.

My general feeling here is that as long as the war doesn't escalate further, this week's Iran/Israel situation has been positive for crypto and somewhat needed.

The major pullbacks in prices have reset many of the metrics, which gives me confidence that this can prolong the bull market, and we get potentially greater upside in prices over the coming 6 to 12 months.