Is $30,000 the finish line? | March 23rd

After an intense week, it seems the crypto market is finally cooling off. The higher you climb, the harder you fall. We believe this saying applies to the market right now, and we’re expecting it to head lower. However, we’re confident that the pullback will be short-lived, and higher prices ($32,000 and above) will follow! Friends, let’s dive in!

TLDR

- The Total Market Cap is at resistance. A weekly closure above $1.18T is needed for upside to continue. Otherwise, the market will likely head lower.

- Bitcoin is at resistance. A weekly closure above $28,750 is needed for upside to continue.

- We believe Bitcoin will retrace to $25,150 first, before heading to higher prices.

- Ether needs to hold $1740 on the weekly timeframe for $2000 to remain on the cards.

- BNB is struggling to stay above $335. A weekly closure under this level would invalidate further upside.

- XRP broke out from its symmetrical triangle, so the opportunity is gone. The risk outweighs the reward, so there’s no point in entering now.

- LTC closed last week’s candle above resistance ($81.77). If it can hold this level as support, a move to $113 is on the cards.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

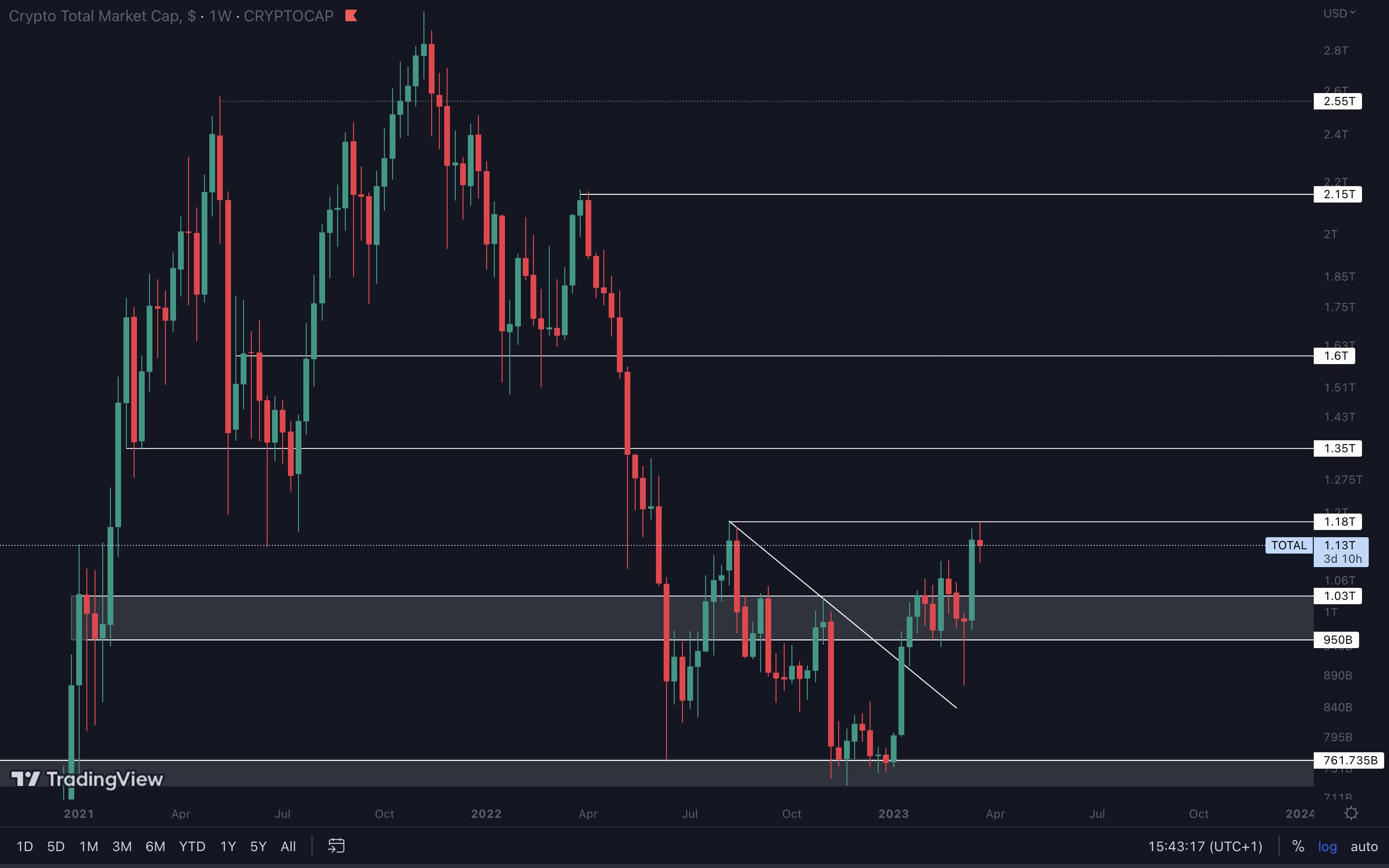

Total Market Cap (Weekly)

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap tested $1.18T as resistance this week, a level we’ve been expecting for some time now. We believe that the market is now in an “exhaustion state.” So, last week’s move needs to be balanced with a pullback.

The Total Market Cap tested $1.18T as resistance this week, a level we’ve been expecting for some time now. We believe that the market is now in an “exhaustion state.” So, last week’s move needs to be balanced with a pullback.

This keeps the trend healthy and intact, while leaving room for more upside. An “UP only” mode isn’t sustainable in the long run. We could see the market experience a pullback, before heading back to $1.18T and $1.35T, respectively.

The closest support level for the Total Market Cap is $1.03T. The market will likely test this level as support in the coming weeks, unless we see a weekly closure above $1.18T.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

Besides the Altcoins Market Cap marking another high this week, not much has changed here.

Besides the Altcoins Market Cap marking another high this week, not much has changed here.

The index remains on track for $650B and is currently in mid-range between $650B and $550B. When paired with our expectations for the market as a whole (potential pullback), the Altcoins Market Cap might revisit $550B in the coming weeks.

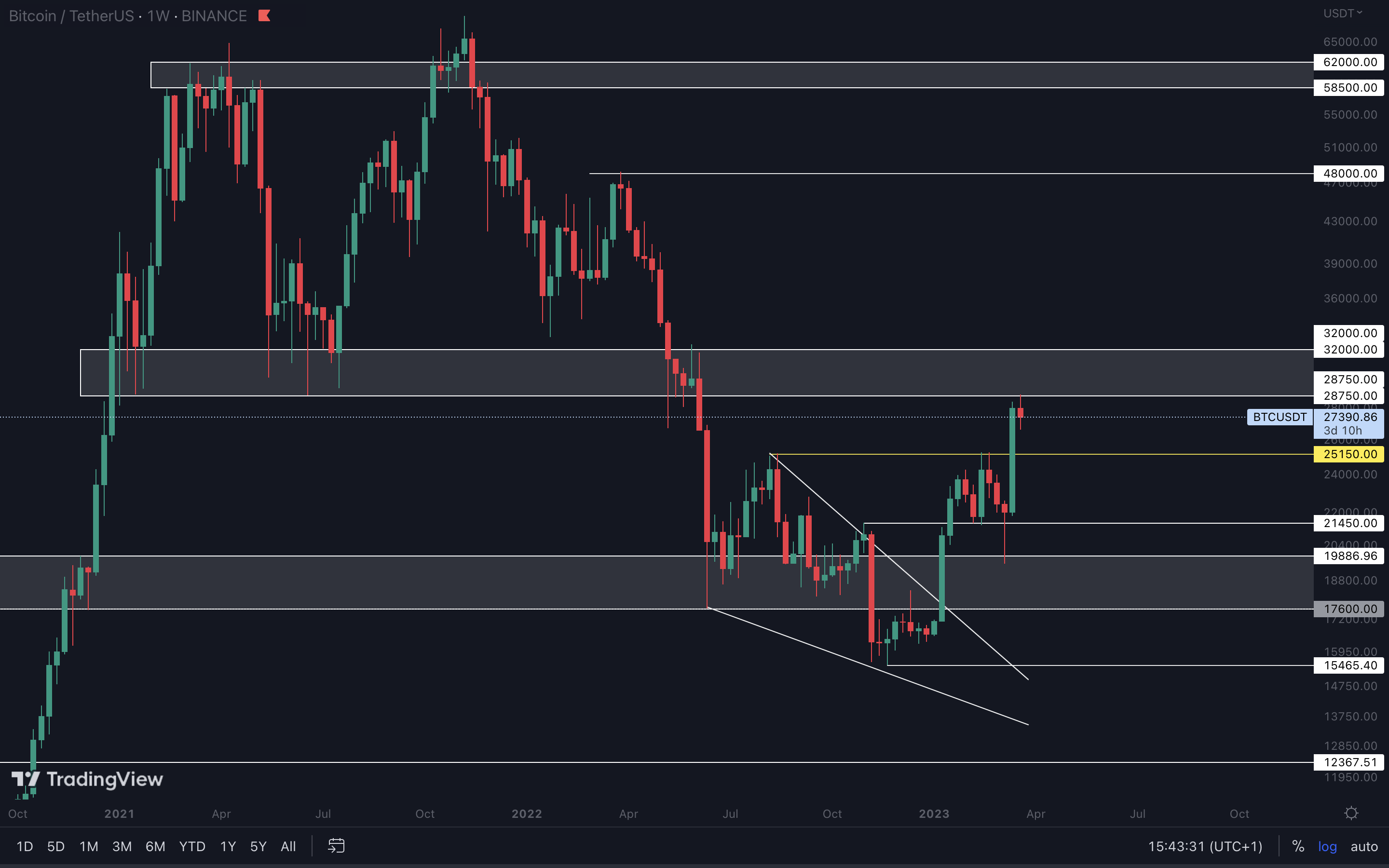

BTC | Bitcoin (Weekly)

Our take on what’s happening here is simple - due to potential exhaustion (over 40% in a single week is enough to reach the exhaustion stage), Bitcoin will be unable to break resistance and head back to $25,150.

Holding $25,150 on the weekly timeframe will keep the market structure intact, and make more room for upside.

Of course, the opposite can also happen. If closes a weekly candle above $28,750, it would invalidate this scenario and we’d will likely see $30,000 - $32,000 first.

Our take on what’s happening here is simple - due to potential exhaustion (over 40% in a single week is enough to reach the exhaustion stage), Bitcoin will be unable to break resistance and head back to $25,150.

Holding $25,150 on the weekly timeframe will keep the market structure intact, and make more room for upside.

Of course, the opposite can also happen. If closes a weekly candle above $28,750, it would invalidate this scenario and we’d will likely see $30,000 - $32,000 first.

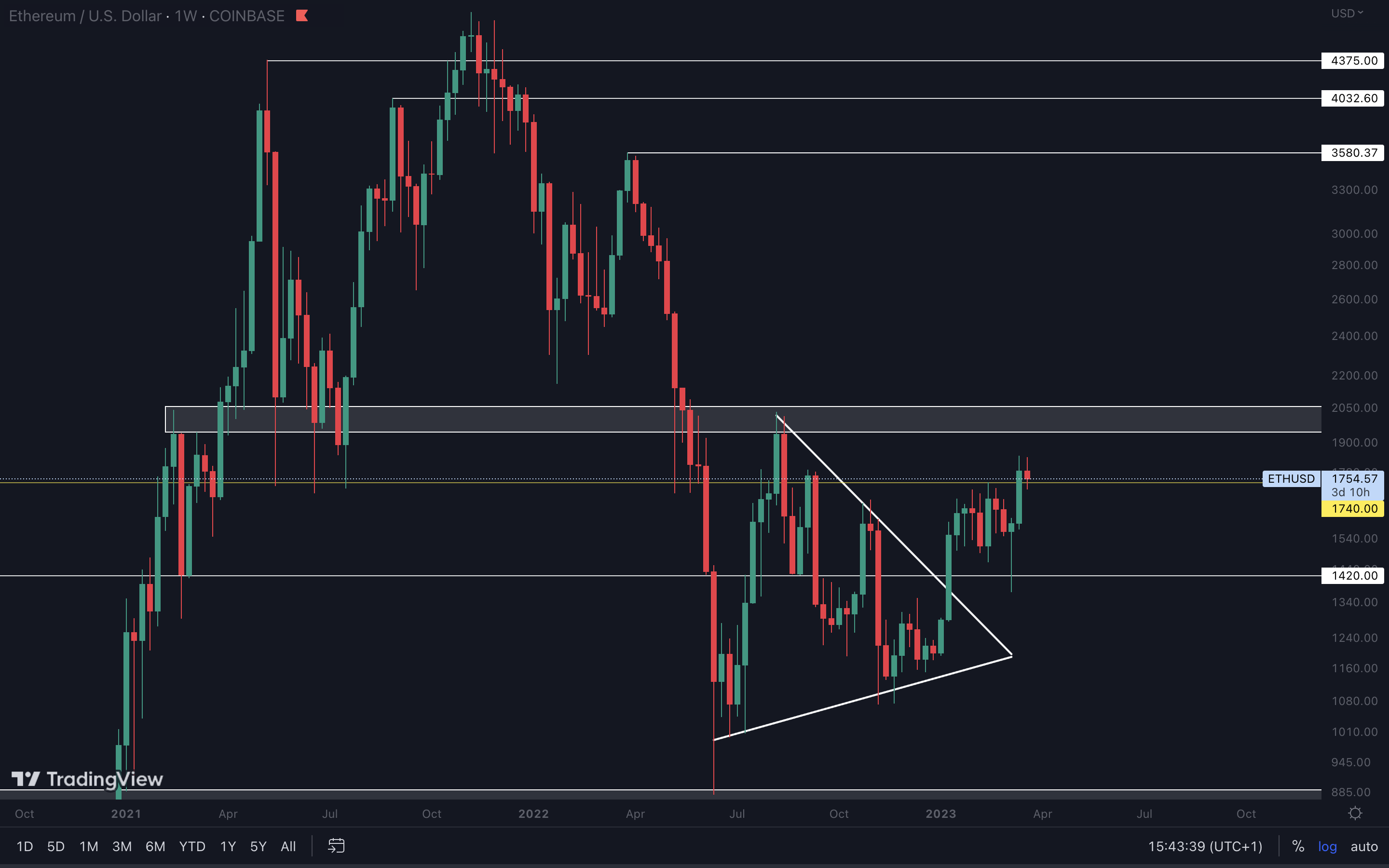

ETH | Ethereum (Weekly)

Ether seems to be holding up well for now. Our priority here is holding $1740 as support because this keeps $2000 on the cards.

Ether seems to be holding up well for now. Our priority here is holding $1740 as support because this keeps $2000 on the cards.

If Bitcoin does take the pullback route, Ether will lose $1740 and head lower.

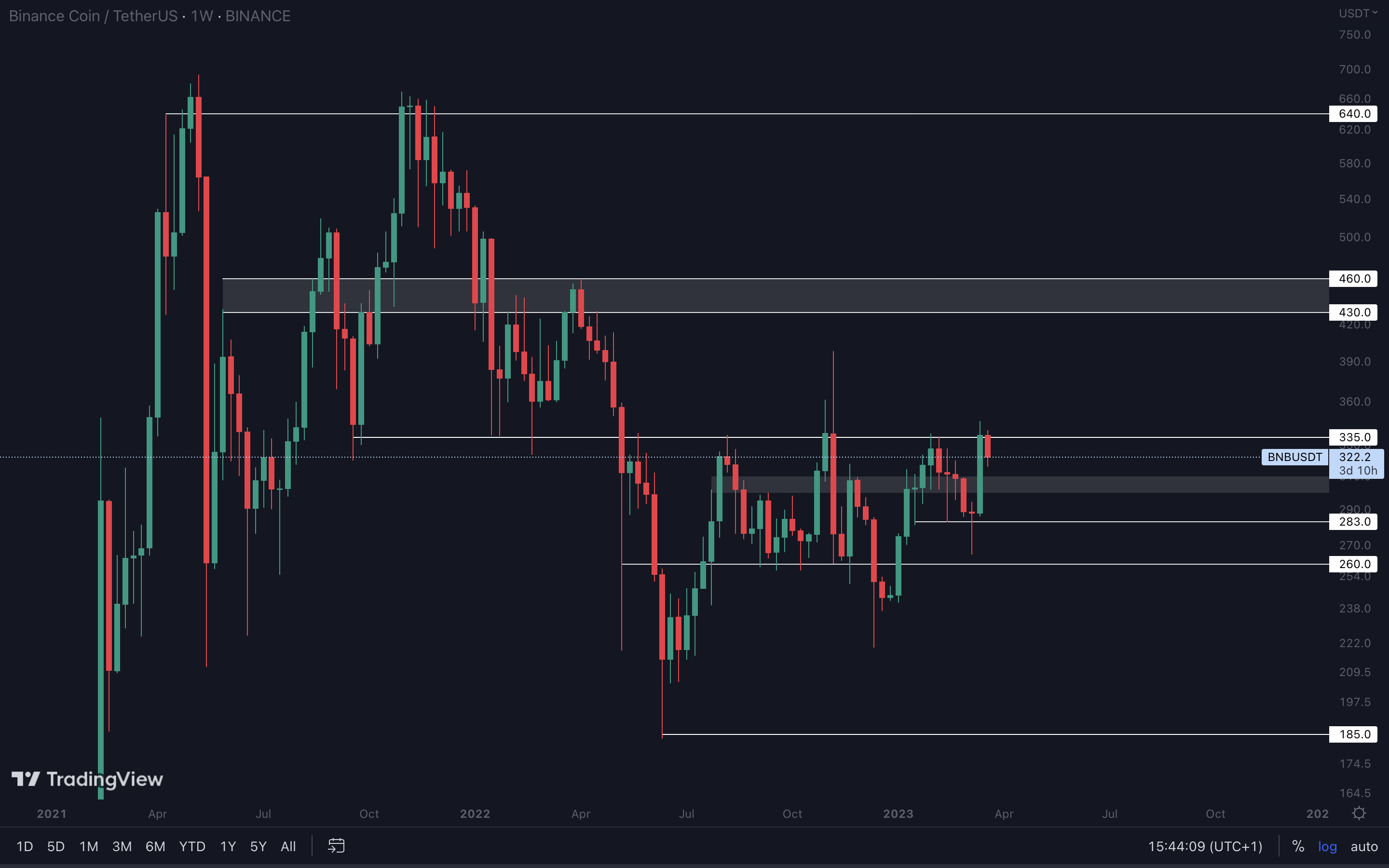

BNB | Binance (Weekly)

Despite closing above $335 last week, BNB is struggling to stay above it. A weekly closure under this level would result in a rejection and open the road back to $300.

Despite closing above $335 last week, BNB is struggling to stay above it. A weekly closure under this level would result in a rejection and open the road back to $300.

This is in confluence with our expectation for the market in the short-term. An invalidation of this scenario would occur if BNB closes above $335 on the weekly timeframe.

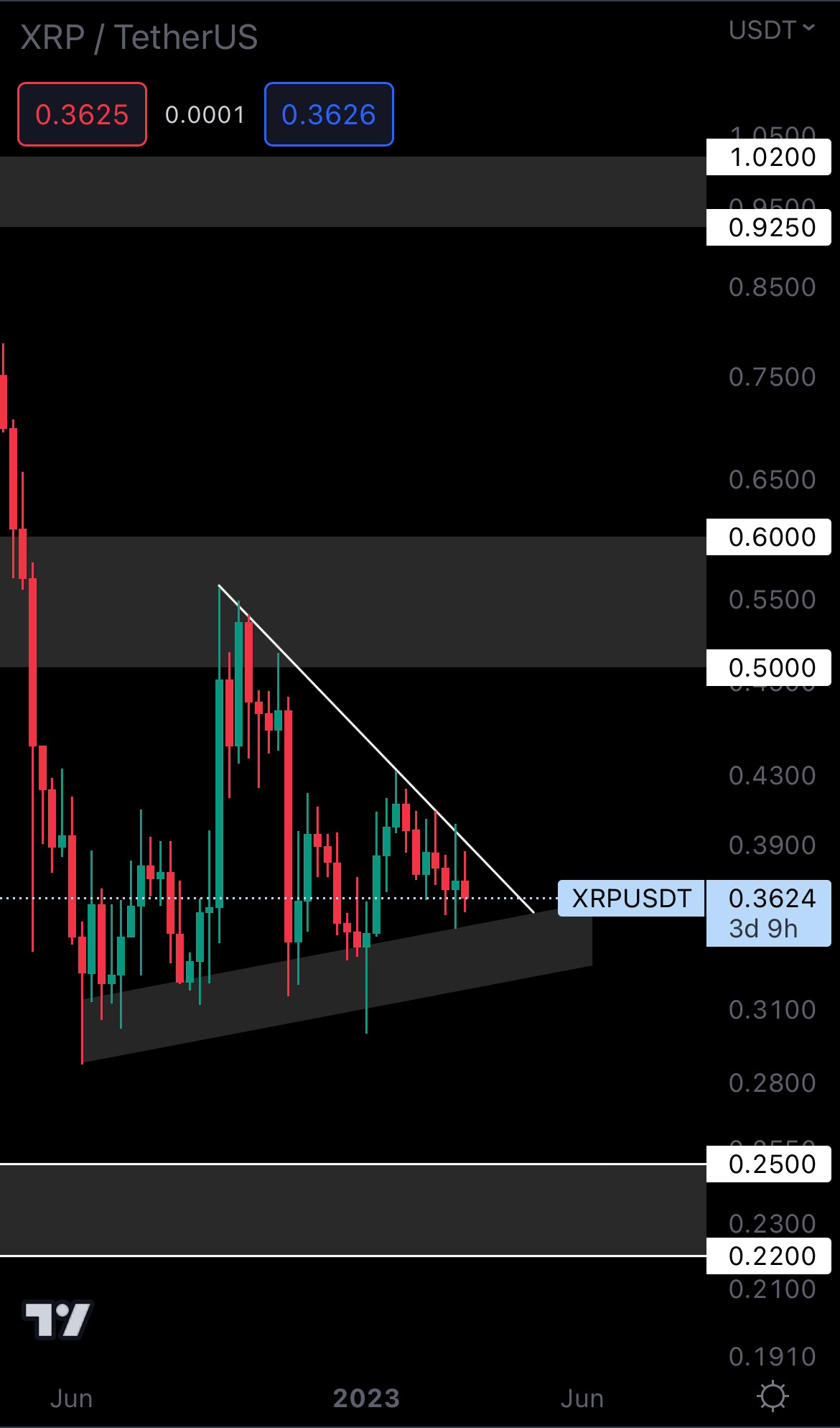

XRP | XRP (Weekly)

As expected, XRP broke out from its symmetrical triangle and exploded toward $0.50. We don’t think entering now is wise, the opportunity is already gone. Eentering now comes with a higher risk and lower reward.

So, staying on the sidelines, and watching what XRP will do next is the best play.

As expected, XRP broke out from its symmetrical triangle and exploded toward $0.50. We don’t think entering now is wise, the opportunity is already gone. Eentering now comes with a higher risk and lower reward.

So, staying on the sidelines, and watching what XRP will do next is the best play.

ADA | Cardano (Weekly)

ADA seems to be holding itself pretty well. The asset remains on track for $0.40, a target that may or may not be reached depending on how long it takes Bitcoin to choose its direction.

ADA seems to be holding itself pretty well. The asset remains on track for $0.40, a target that may or may not be reached depending on how long it takes Bitcoin to choose its direction.

Bitcoin heading lower would invalidate ADA’s move to $0.40, pushing it back to the $0.30 support level. It’s best not to enter until a direction is clearer. At this time, ADA is in mid-range, so the probabilities are 50/50.

DOGE | Dogecoin (Daily)

DOGE is experiencing choppiness after breaking above the top trend line. This is caused by the fluctuations in Bitcoin’s price, and the fact that small movements (percentage wise) typically affect altcoins more, increasing volatility.

DOGE is experiencing choppiness after breaking above the top trend line. This is caused by the fluctuations in Bitcoin’s price, and the fact that small movements (percentage wise) typically affect altcoins more, increasing volatility.

We have yet to see an increase in buying volume. This is an important factor in pattern breakouts and one that DOGE is currently lacking.

For now, the asset will follow Bitcoin’s price action, and if our expectations come true, DOGE will invalidate the breakout and head lower.

MATIC | Polygon (Weekly)

We can see that the last two weekly candles have short bodies and medium-long wicks. This is an obvious sign of indecision. We don’t know who is in control at the moment, and that makes predicting MATIC’s next move difficult.

We can see that the last two weekly candles have short bodies and medium-long wicks. This is an obvious sign of indecision. We don’t know who is in control at the moment, and that makes predicting MATIC’s next move difficult.

The only thing we can do is expect it to follow Bitcoin’s price action. MATIC will likely head lower unless Bitcoin can break $28,750.

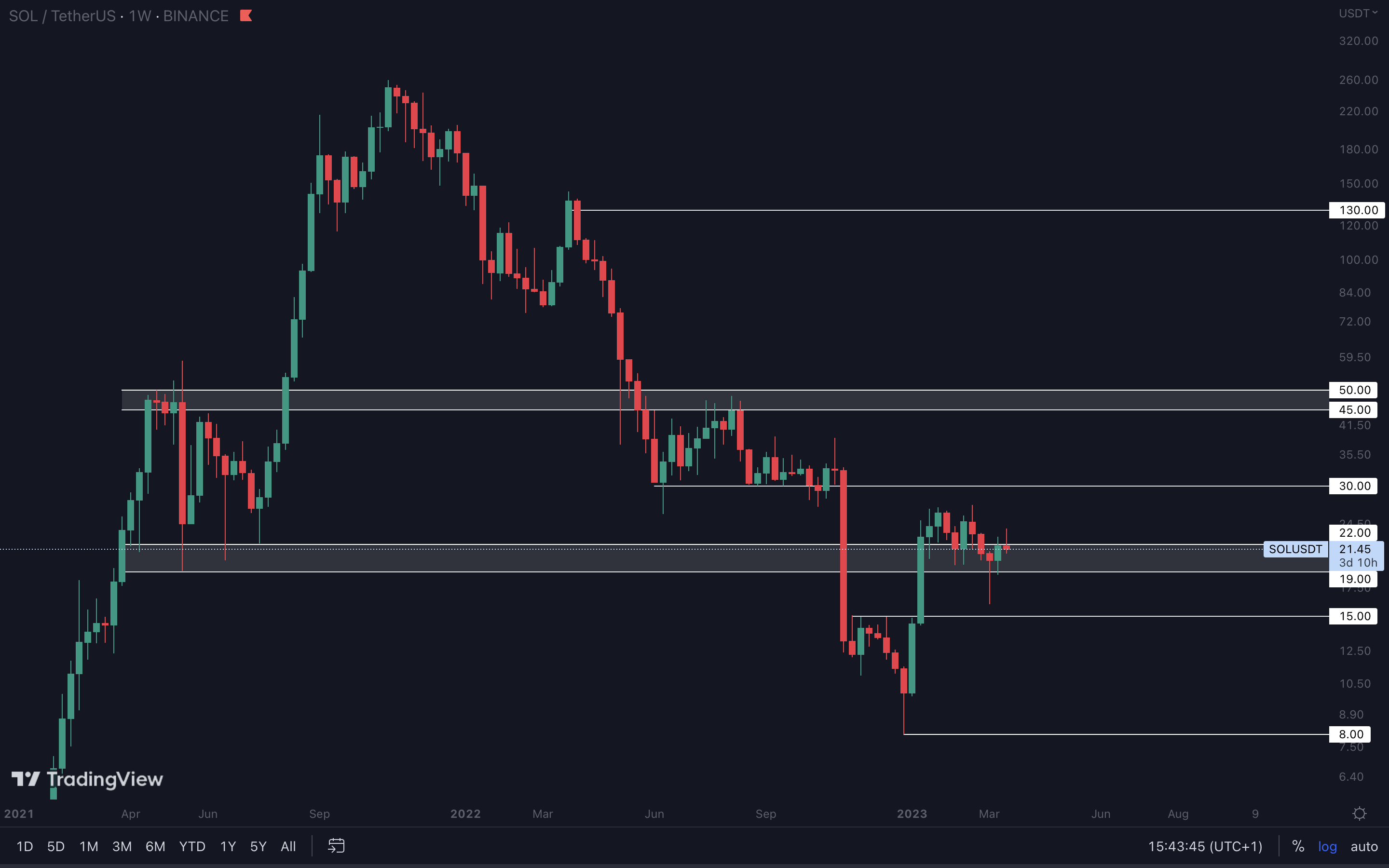

SOL | Solana (Weekly)

SOL has been ranging above $19 for the past 70 days. This level is and will continue to be our main priority, because only a weekly closure under $19 would invalidate further upside.

SOL has been ranging above $19 for the past 70 days. This level is and will continue to be our main priority, because only a weekly closure under $19 would invalidate further upside.

When paired with our expectations for BTC, SOL may be heading back to $19.

DOT | Polkadot (Weekly)

DOT closed last week’s candle above $6, and has now retested this level as support. Staying above this level would the road open for $7, but a loss of $6 would result in DOT heading to $5.50 and below.

DOT closed last week’s candle above $6, and has now retested this level as support. Staying above this level would the road open for $7, but a loss of $6 would result in DOT heading to $5.50 and below.

LTC | Litecoin (Weekly)

LTC made it back into the Digest this week.

LTC made it back into the Digest this week.

Last week, the asset closed above $81.77, a local level that acted as resistance on lower timeframes back in November. This led to the formation of a weekly higher low, keeping LTC’s market structure intact (this is bullish).

Despite selling pressure earlier this week, LTC invalidated it entirely by flipping the weekly candle green.

Our only concern here would be Bitcoin’s potential pullback, but if that doesn’thappen, LTC will head to $113 to test this level as resistance.

Cryptonary's take

Although the market is looking ready to bless our eyes even more, we can’t ignore that a potential pullback is on the cards. It’s best to keep your eyes on this week’s closure, because Bitcoin closing under $28,750 will increase the odds of a pullback. Keep in mind that a pullback isn’t negative at all - it will reduce exhaustion and make room for even more upside!

Here are a few action steps for you:

- Trading assets that are in mid-range is risky at this time, and it’s best to avoid them. We need to wait for a clear indication as to where the market is going for those risks to be reduced.

- Watch this week’s closure! A bearish closure will increase the chances of a pullback.