In this update:

- Powell's Speech.

- Weaker Data.

- Rising Inflation Over the Coming Months Could Lead to A Hard Trump Pivot.

- On-Chain Data Suggests There's Room for Lower Price.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Powell's speech

On Wednesday, FED Chair J Powell spoke at the Economic Club of Chicago. Powell struck a more hawkish stance than markets were perhaps expecting. The markets seemed to be looking for Powell to say that there was a 'FED Put' if something in the markets began to break. However, Powell suggested that there wasn't, and that markets are seemingly acting in a functional way despite the overall level of uncertainty.Powell also said that "for the time being, we (the FED) are well positioned to wait for greater clarity before considering any adjustments to our policy stance". The markets sold off on this as it suggested there isn't a chance of FED rate cuts anytime soon, at the May or June FED Meetings.

This is since the tariffs and their overall level of uncertainty will likely result in an economic slowdown (which we're already starting to see - see the next section), which will likely see both Unemployment and inflation rise.

Powell even mentioned this, saying, "I do think we'll be moving away from these goals" - that's the FED's dual mandate of stable inflation and maximum employment.

To add to this, other FED members have struck a similar tone to Powell, which is that the FED should remain on pause until there is more clarity around tariffs.

What's next?

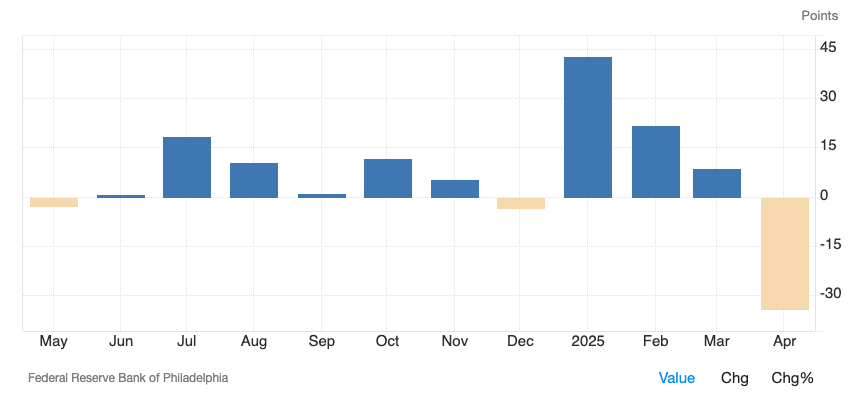

With inflation expectations climbing to over 4% in the coming months and Philly Fed new orders plummeting by 30%, how soon will the FED act, and what could this mean for market volatility in the weeks ahead?Weaker data

Recently, we've been watching the 'soft' data (which is a lot of the survey data) to see if the weakness we've seen in that begins showing up in the harder data. And yesterday, we began to see that.Philly Fed New Orders fell off a cliff yesterday, showing that manufacturers have cut down on their number of orders and slowed down.

Philly Fed new orders:

Alongside this, we also had the Fed Manufacturing Index pull down sharply.

Philly Fed manufacturing index:

And to add to this, Prices Paid continued to increase.

Philly Fed prices paid:

So, this is just not what the FED would want to see. We're beginning to see a real slowdown in the economic data, which the FED could cut interest rates to potentially halt, and then reverse the slowdown. But, due to the rising prices (inflation), and the substantially rising Inflation Expectations (which we have covered in recent Market Update Reports), the FED have to remain on pause for the time being, i.e., no interest rate cuts at either the May and probably the June Meetings.

Rising inflation over the coming months could lead to a hard Trump pivot

It is expected that the impact of tariffs will see inflation (CPI) spike higher over the coming months. April and May are likely to see inflation increase to just north of 4%, whilst June's figure could come in around 6% - this is based on annualising out month-on-month changes.The result of this could see Trump have to pivot, and potentially why we've seen him come in with a softer stance over the last week. He now needs a deal to be done quickly so that he can get it done before these potentially hotter inflation prints come out in the coming months, and that could result in the public turning on him, him having to pivot, and that resulting in him getting a poor trade deal with China.

This is something to be closely watching, and it could mean we see progress on a China trade deal happen much sooner than expected. This would likely result in upside for markets, especially if there is a significant removal of some of the uncertainty.

On-chain data suggests there's room for lower prices

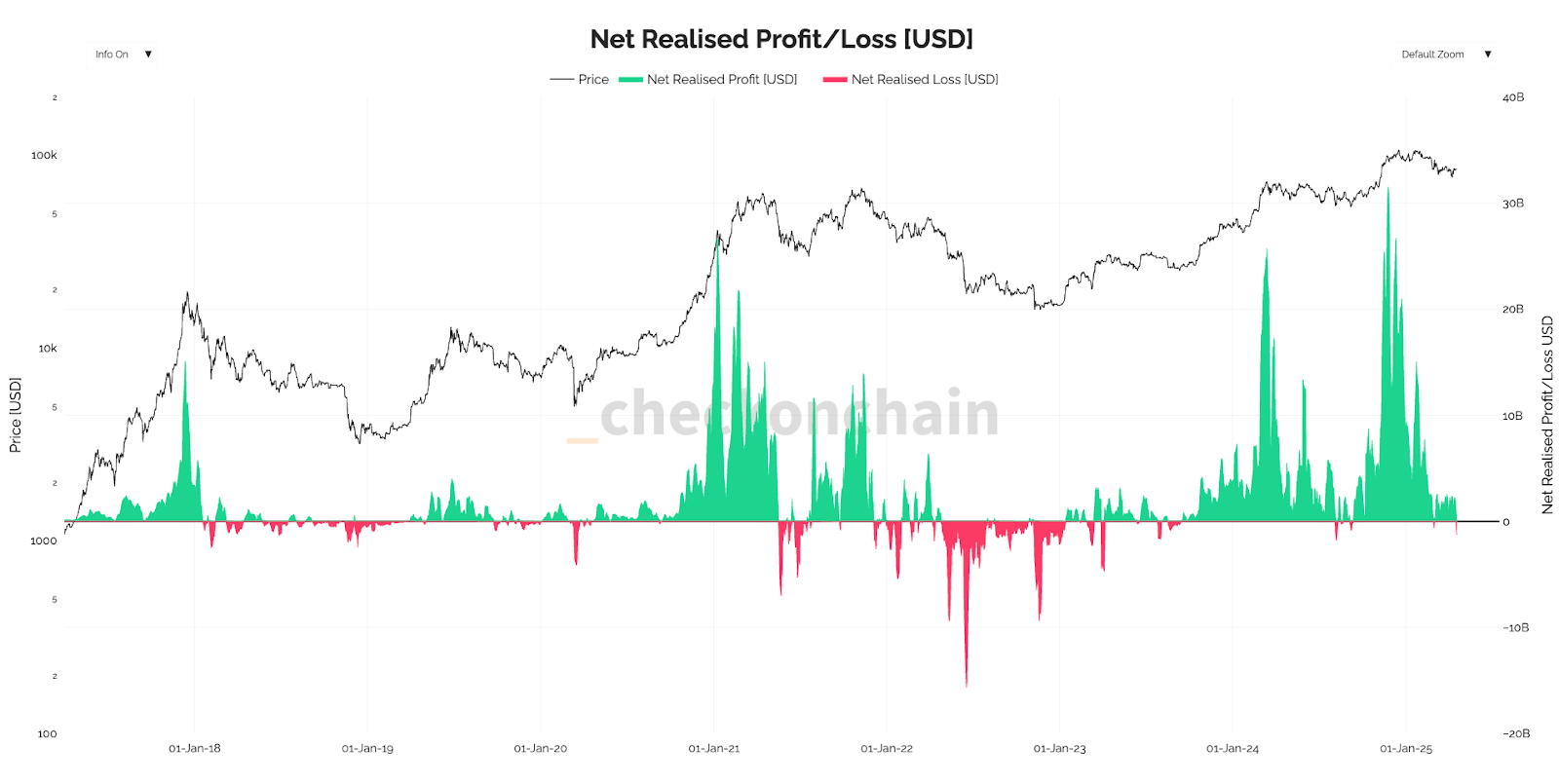

Looking at the on-chain data, we can see that the Net Realised Profit/Loss chart and the number of realised losses are low. It's similar to the "chop" period of 2024.There weren't huge amounts of Realised Losses whilst BTC just remained range-bound, which suggests that this current percentage movement down in price (for BTC) hasn't been enough to really shake the conviction of holders, and perhaps this period is yet to come. Where that price level might be is hard to say. But we can assess potential levels by looking at another chart.

Net realised profit/loss:

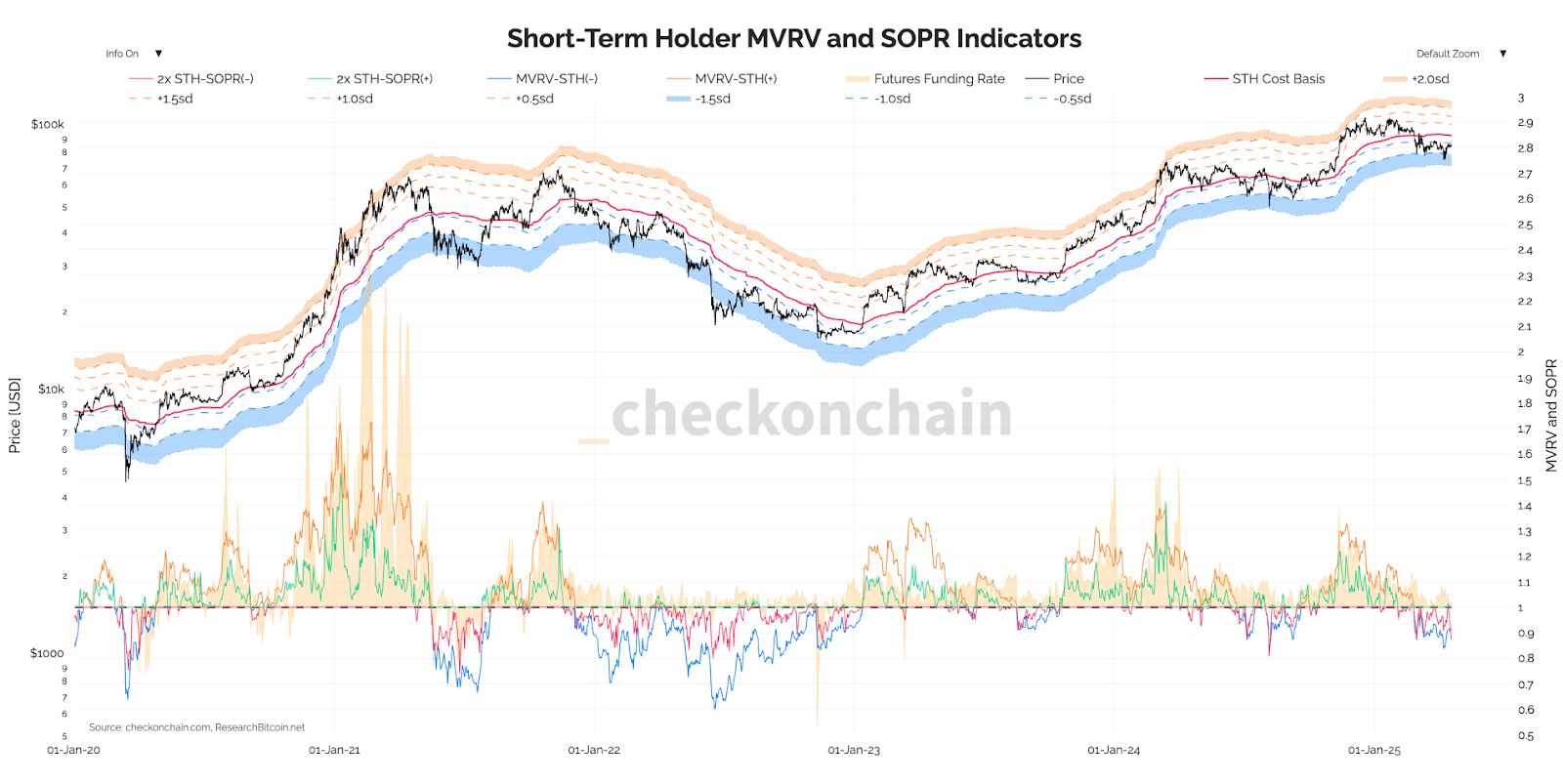

If we now look at the Short-Term Holder MVRV and SOPR Indicators, we can see that the -1.0 to -1.5 standard deviation move of the MVRV-Short-Term Holders is between $70,800 and $78,500 (the light shaded blue zone). This has acted as support in recent moves lower, but the more that's retested (assuming there are more retests), the less likely it is to hold, or the higher chance it'll be filled completely.

Another key level is the True Market Mean, which currently sits at $65,000. We can therefore conclude that from an on-chain perspective, the key downside levels are probably the lower bound of the shaded blue area that hasn't been filled by price yet. So, that would be between $70,800 and $74,000. But below that, we have the True Market Mean at $65,000.

For us, we would look at $65,000 to $74,000 (that zone) as a key area for price, and we would expect it to be meaningful support. Therefore, that is the zone we will look to more aggressively accumulate Bitcoin, outright buying BTC.

Short-term holder MVRV and SOPR indicators:

Cryptonary's take

Simply put, it is more of the same. We remain patient, and despite it being boring, it is ultimately the right play. We were out of BTC in and around the $105k levels, and with the price now sitting at $84k, we do expect further downside, to which we'll re-add to our bags. In markets, there are times when the best play is to do nothing and just sit on your hands.Now, fortunately, we're on the right side of it, having sold our bags at much higher prices than current prices, and even though sitting still might feel boring now, it is the right move.

We remain confident that we're on the right side with our analysis and assessments currently, and so it's normal that it can take more time for prices to come lower. For that reason, we remain on the sidelines for now. In the meantime, we'll continue looking for and putting out trading opportunities which can be attractive whilst we're in this choppy/down-trending market.

The time will come, but not yet. We delivered 100x calls last year, and we got out in early January this year (close to the top). We're confident we'll continue to perform, but for now, patience is the key.