Is DOGE set for a strong rally?

DOGE's higher timeframe price action, specifically on the weekly chart, indicates that it has taken key support from the 200 EMA. Furthermore, DOGE's daily chart shows that it has been respecting its demand zones and breaking out of critical downtrend trendlines. This combination of bullish developments places DOGE in a favourable position as we analyse its potential move higher, especially given that Bitcoin (BTC) has been breaking through its own key resistances.

Overview

DOGE has proven its staying power by becoming a favourite for many investors and traders. As of today, DOGE is showing clear signs of bullish momentum. After a period of consolidation and a brief retracement, it's now on the move, trading at approximately $0.127 with an 8% gain just today.With this backdrop, let's dive into DOGE's weekly and daily charts and analyse its performance against Bitcoin (DOGE/BTC pair).

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

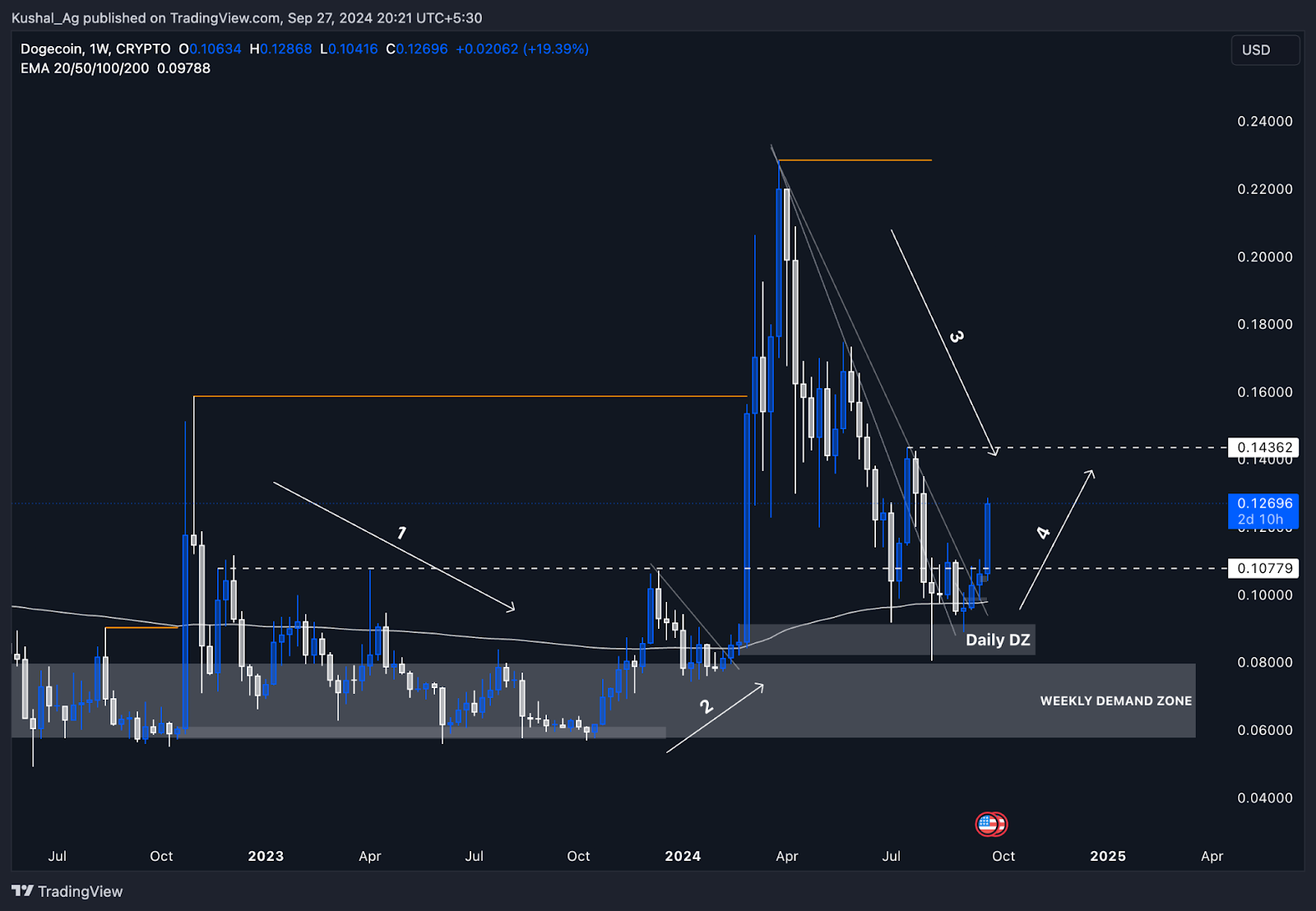

Weekly timeframe analysis (DOGE/USD)

DOGE has held up well on the weekly timeframe, using the 200 EMA as a crucial support level. After multiple tests, the price dipped below momentarily, leading to long liquidations, but this ultimately proved to be a liquidity grab before a reset and bounce back to higher levels.- 200 EMA support: DOGE's ability to consistently hold the 200 EMA suggests that this is a strong level of support, signalling the long-term health of the asset. Buyers have continued to step in at this level, pushing prices back up.

- Bullish trendline break: DOGE has been consolidating for several weeks and has now broken out of a downtrend trendline, marked by the orange line on the chart. This breakout indicates that momentum is beginning to shift in DOGE's favour.

- Key resistance levels: The first major resistance is at $0.1436, and breaking this would potentially trigger a much stronger rally. The next resistance is at $0.23, followed by the ATH zone. If these levels are flipped into support, DOGE could see a more significant move upward in the coming weeks and months.

Daily timeframe analysis (DOGE/USD)

On the daily timeframe, DOGE continues to show a strong bullish trend. The coin has respected the $0.10078 level as a significant support zone, which led to a major breakout after several days of consolidation. DOGE also took support from the daily demand zone, marked by the grey box on the chart, which is key to its recent price action.- Breakout from downtrend: DOGE has broken out of a downtrend trendline, resulting in a strong rally of 25%, moving from $0.10078 to $0.125.

- Potential accumulation zone: The $0.10078 level, now flipped into support, offers a potential accumulation zone for investors looking for solid entries. Layering orders in this region provides a good risk-to-reward ratio, given DOGE's bullish momentum. Additionally, the $0.1436 resistance could act as a new support if flipped, offering another area for accumulation.

- Next resistance levels: As DOGE pushes higher, the next key resistance zones to watch are $0.1436, followed by $0.23. Once $0.1436 is flipped, DOGE could move swiftly toward higher levels, including the ATH target.

DOGE/BTC pair analysis

The DOGE/BTC pair is crucial in analyzing DOGE's relative strength against Bitcoin (BTC). After a long downtrend, DOGE/BTC has recently broken out of a daily downtrend trendline. This breakout signals that DOGE is poised to outperform BTC, especially if Bitcoin continues its bullish run.- Higher highs and higher lows: The structure on the DOGE/BTC pair shows that DOGE has been forming consistent higher highs and higher lows, marked by the red dots on the chart. This indicates strength in DOGE's price action relative to BTC.

- Demand zone bounce: DOGE/BTC found strong support in a daily demand zone, represented by the grey box on the chart. This zone acted as a springboard for the price to break out of its downtrend and move higher.

- Potential outperformance: With both DOGE/USD and DOGE/BTC breaking key resistances, DOGE seems poised for outperformance against BTC. This is especially relevant as Bitcoin continues breaking key levels, further fueling DOGE's momentum.

Cryptonary's take

DOGE appears to be gearing up for a notable bullish move, supported by strong technical signals on both the weekly and daily timeframes. The breakout from key downtrend lines, combined with the strength shown in the DOGE/BTC pair, underscores the potential for significant outperformance in the near future. If DOGE can flip the critical $0.1436 resistance into support, it could rally toward $0.23 and beyond, aligning with the broader market's bullish momentum.That said, meme coins like DOGE come with inherent volatility and heightened risk. While technical indicators are signalling a potential breakout, it's essential to be cautious as DOGE remains susceptible to sharp corrections. Investors should closely monitor Bitcoin's performance, as its movement will heavily influence DOGE's trajectory. For those looking to accumulate, the current setup presents opportunities, but strategic risk management remains crucial in this high-risk asset class.