Market Direction

- ETH's Open Interest has remained relatively flat, suggesting that traders aren't looking to aggressively trade ETH here.

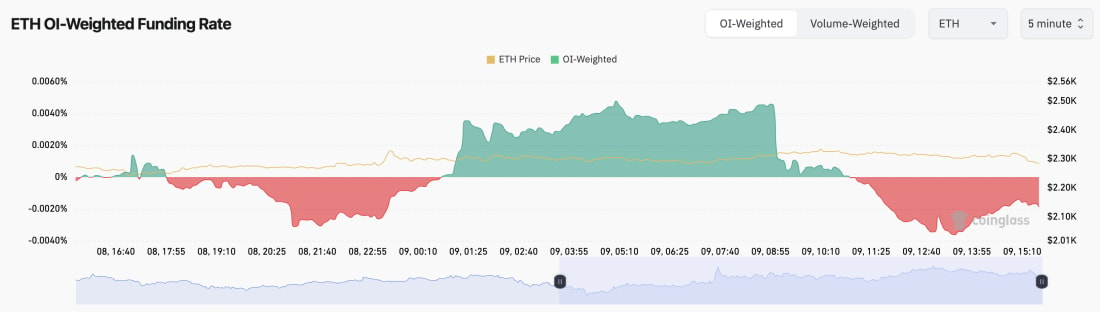

- ETH's Funding Rate flip-flops between slightly positive and slightly negative, indicating indecision amongst traders.

- Overall, this is a healthier setup. ETH's Funding Rate is less negative than BTC's, and Open Interest hasn't ramped up. From a mechanics perspective, ETH is arguably an attractive Long at these prices, while the leverage market has seen a major flushing out.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

ETH's funding rate:

Technical analysis

- ETH has also fallen below its grey support box (between $2,330 and $2,470).

- ETH did find support at our major horizontal support line of $2,150, though.

- ETH has also put in a bullish divergence (lower low in price and higher low on the oscillator), with the higher low being put in just above oversold territory.

- If ETH can break out from its local downtrend line, it's possible ETH could retest the $2,550 local horizontal resistance.

- Beyond $2,550, the major horizontal resistance is at $2,875.

Cryptonary's take

Despite the fact we're still relatively wary of the market over the coming weeks, ETH looks as if it's either at or close to a bottom here. ETH has been down just shy of 50% from it's highs this cycle, whilst we've also seen a major resetting in the leverage market. Price is currently sitting on top of a major support zone between $1,900 and $2,150. If ETH does revisit this area, this is likely a good price to bid with a 12 month view.