There are obstacles in our path which might make you question whether this is the time to buy or sell. If that’s you, then you’ve come to the right place.

Let’s dive into prices.

TLDR 📃

- Bitcoin is still battling resistance. However, the chances of breaking past are real, so buckle up!

- There's always been a smarter alternative to trading, and we’re sharing it with you.

- ETH is slowly approaching $2,000, which is a major resistance level - sellers will be waiting.

- The Total Market Cap slightly broke above resistance at $1.18T for us to get a more decisive confirmation that an upside will follow.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total market cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand the overall market and predict where it will go next.

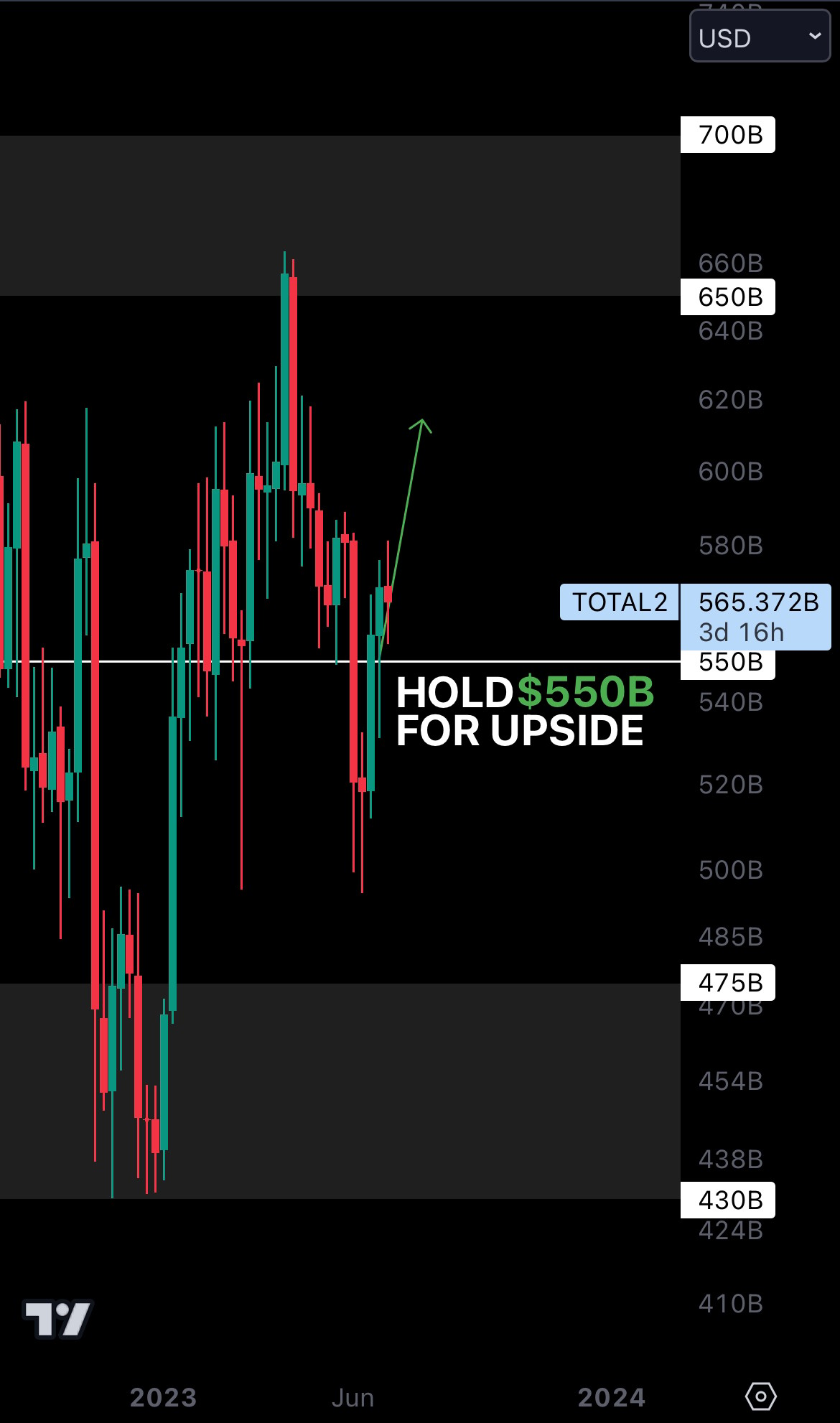

Altcoins market cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Ethereum | ETH

Binance | BNB

Ripple | XRP

Cardano | ADA

Dogecoin | DOGE

TRON | TRX

Solana | SOL

Litecoin | LTC

Polkadot | DOT

Bitcoin | BTC

Can Bitcoin break resistance and go higher?

We still have our eyes glued to $32,000. This price point is a crucial level, which will determine whether BTC can reach higher prices, such as $35,000 or even $40,000. This upswing is only validated if BTC closes a weekly candle above $32,000, so let’s wait patiently for that to happen.

But hey, let's take a moment to ponder something: Is short-term trading really the best choice for you?

Here's where we step in and let you in on a little secret: there's always been a smarter alternative - dollar-cost averaging, or DCA for short. With DCA, you buy a token regularly, whether daily, weekly, or monthly.

The best part about dollar-cost averaging is that it saves you from the rollercoaster of stress caused by short-term price fluctuations. Plus, statistically speaking, it might even increase your chances of turning a profit in the long run.

To us, it's like having a cheat code in the world of crypto investing, and we highly recommend it to anyone eager to jump into investing right away.

Cryptonary’s take 🧠

Despite the overall bullish sentiment we share with the rest of the market, we must acknowledge that Bitcoin is still facing resistance. There’s a good chance of it breaking to the upside, but we can’t ignore the possibility that BTC might find a top inside this region.

That’s probably a good sign for you not to turn into James Bond from Casino Royale and go all-in just to put on a good show for yourself. Let’s be patient, do our usual DCA (dollar-cost average), and wait for the market to be in a better position for risking-on.

Action points 📝

- Bitcoin will likely continue to be in the spotlight, with its dominance still on the rise.

- Altcoins won't outperform in the coming weeks, but there will be some exceptions. You can find out all about those by subscribing to Cryptonary Pro. 😎

- Experienced or not, a DCA approach is your best move.

- Got questions? Hit us up on Discord in the “🌎 general” channel. We’re happy to help.

As always, thanks for reading.🙏

Cryptonary, out!