Market Direction

This harsh rejection after RUNE's parabolic rally has printed an ugly inverse hammer candle, serving as a warning sign that the party may be over.

RUNE now looks poised for a pullback after gaining over 250% in the past month, with the $5.20 area a potential target to the downside. The metrics suggest leverage remains elevated, but the tide may be turning with traders less extremely biased to the long side after yesterday's rejection at a critical barrier.

TLDR

- RUNE faced harsh rejection at a major resistance of $6.53.

- The price printed an ugly inverse hammer candle; it is now at risk of a retreat to the $5.20 support.

- Leverage remains high, but other metrics are healthier than in recent days.

- A pullback is likely needed after the +250% gain in the past month.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

RUNE 1D

Technical analysis

We outlined yesterday that RUNE was butting into a major horizontal resistance at $6.53, and having gone straight up before this, it was likely that $6.53 would prove a sticking point.- Having rejected into the horizontal resistance of $6.53, RUNE printed an ugly inverse hammer.

- The support is at $4.58 with local support at $5.20 - it’s possible price will pull back to this $5.20 local support.

- The RSI on the daily timeframes remains heavily overbought. At the same time, the new higher high in price and the lower high on the oscillator have created a bearish divergence in overbought territory on the daily timeframe.

- The 3D and weekly timeframes also remain phenomenally overbought, and a pullback may be needed.

Market mechanics

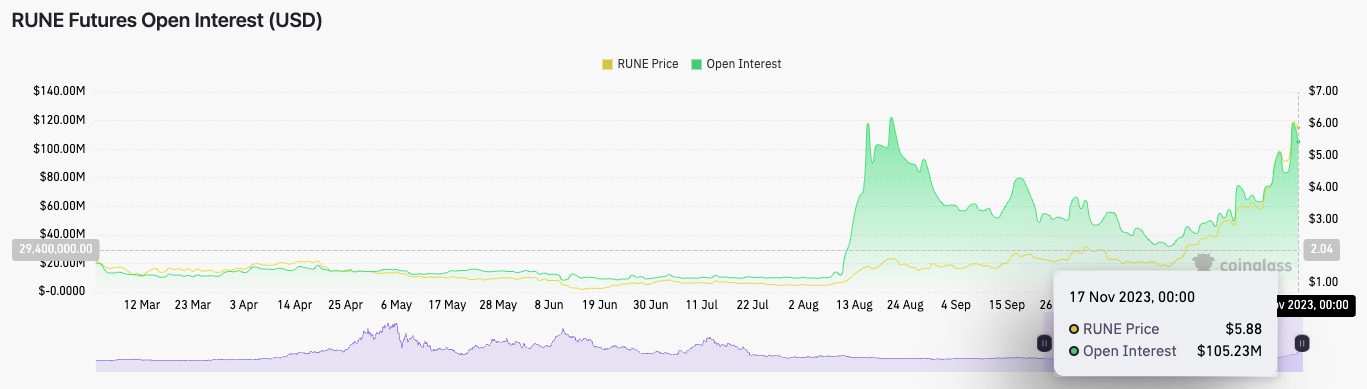

The mechanics for RUNE are far healthier than they were yesterday. Let’s take a look:- Open interest remains high and well above RUNE’s historical average in terms of open interest.

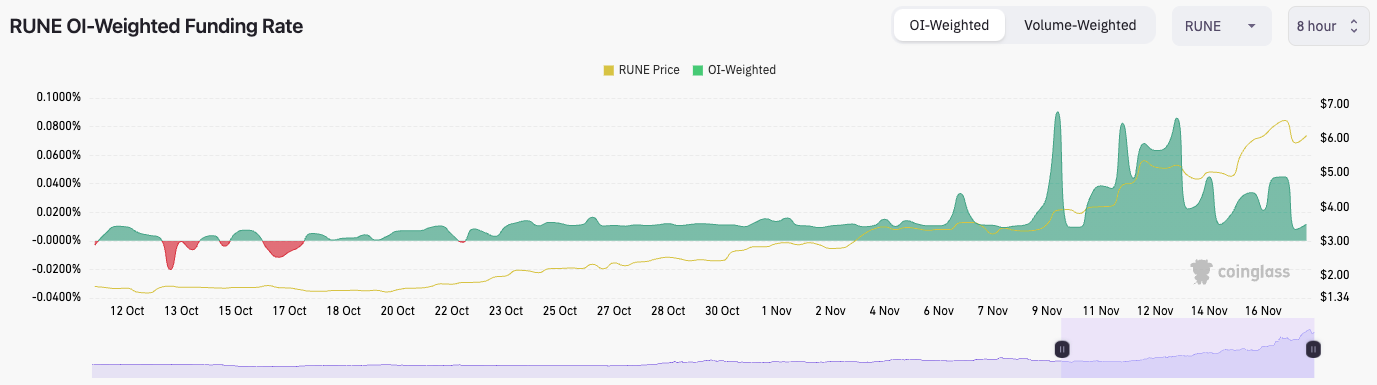

- The OI-Weighted funding rate is at 0.0132%, far better than it has been in the past few days. This rate is at 0.050%, indicating a massive long bias with longs then vulnerable to being squeezed. Funding is now at a healthier level where neither longs nor shorts are too overcrowded or vulnerable to a squeeze.

- The long/short ratio over the past 24 hours is at 0.981, so there is a slight bias amongst the number of participants yesterday to be short.

Cryptonary’s take

Our analysis for RUNE remains similar to yesterday in that RUNE has moved up massively over the past month - well up over 250%. Therefore, a number of the metrics and indicators suggest a pullback may be on the cards.If price revisits $6.50, it may be worth reducing some of your size. However, we may not get another revisit before we see a further pullback. Regarding a price to pull back to, we’re eyeing the low $5.00s.