Market Direction

Is SOL due for a meaningful pullback?

The mechanics, however, are getting overheated again, with Longs becoming overweight. We may see a move lower for price in the very short term to flush out the excess Longs that are currently building up. What we then need to see is $61 hold as support.

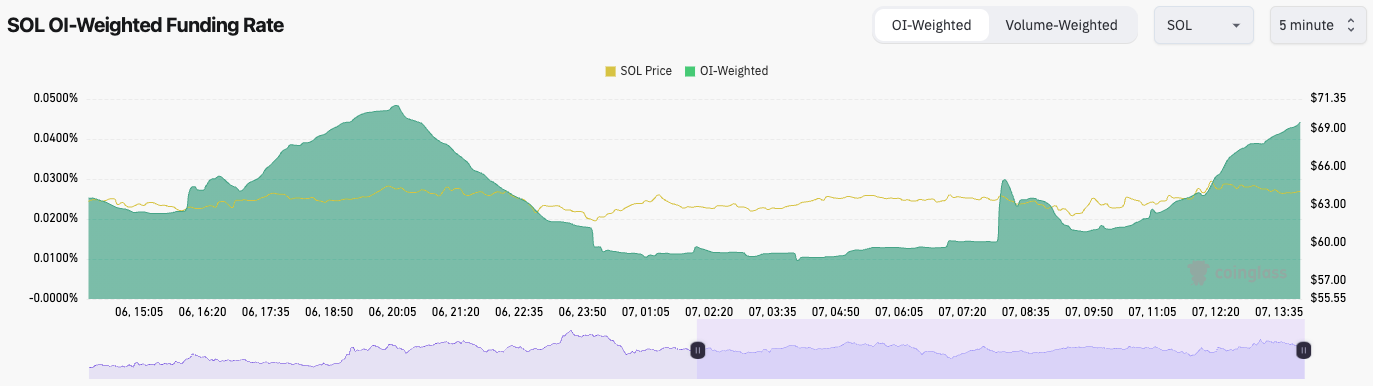

SOL's OI is at new highs while funding is ramping up aggressively. Longs are piling in and now becoming offside.

On TA, SOL looks strong, recovering $61 and pushing into the local resistance of $65.

We'd emphasise caution here.

TLDR

- Solana bounced back up after holding the key $61 support.

- Price is targeting the next resistance at $65; breaking higher opens the path to $69.

- Open interest at new highs and funding spiking as leverage builds.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

SOL 12hr

Technical analysis

- SOL found support at $61 and has now been able to bounce off that level. This is very positive for price, and has invalidated what was a bearish structure.

- If SOL can claim above $65, then $69 can be retested again.

- $59 to $61 is a large support now for SOL; if this level is broken, we could see a more meaningful decline.

- The RSI is very overbought on the 3D and the Weekly but remains positive and healthy on all other timeframes.

- We’re not looking for short-term trades on SOL, but we will be looking to DCA into SOL if there’s a move to $52, sub $48, we’ll DCA more aggressively.

Market mechanics

- Open Interest is now back to new highs.

- The OI-Weighted Funding Rate did reset yesterday, but as price has moved higher today, Funding has aggressively ramped up. Longs are beginning to look overweight here, and increasingly so if this continues.

Cryptonary’s take

SOL has had really positive price action in the past few days, having been able to reclaim $61, which is a really key level and invalidates the bearish setup.We’re not looking for any short-term trades unless Funding continues to increase and the price moves to $66. Then, we may look to take the other side and go Short.

Regarding DCA’ing, we will look to DCA on a pullback to $52.