Is the market going UP? | Jan 6th

Before diving in, we first want to make it known that this year will likely be for accumulating. We are going to see assets range for multiple months. Most market participants have opened the door and ran because of fear, false hope, or indecisiveness overall.

We're here to tell you that NOW is the time to jump into the market. When everyone goes in the same direction, you need to be the one to go in the opposite direction. This has been proven to work in the financial markets.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The year of accumulation. We believe the market will remain relativity quiet throughout 2023.

- The foundations are set for ETH to outperform in the next few weeks.

- Q1 of 2023 is ready to go crazy.

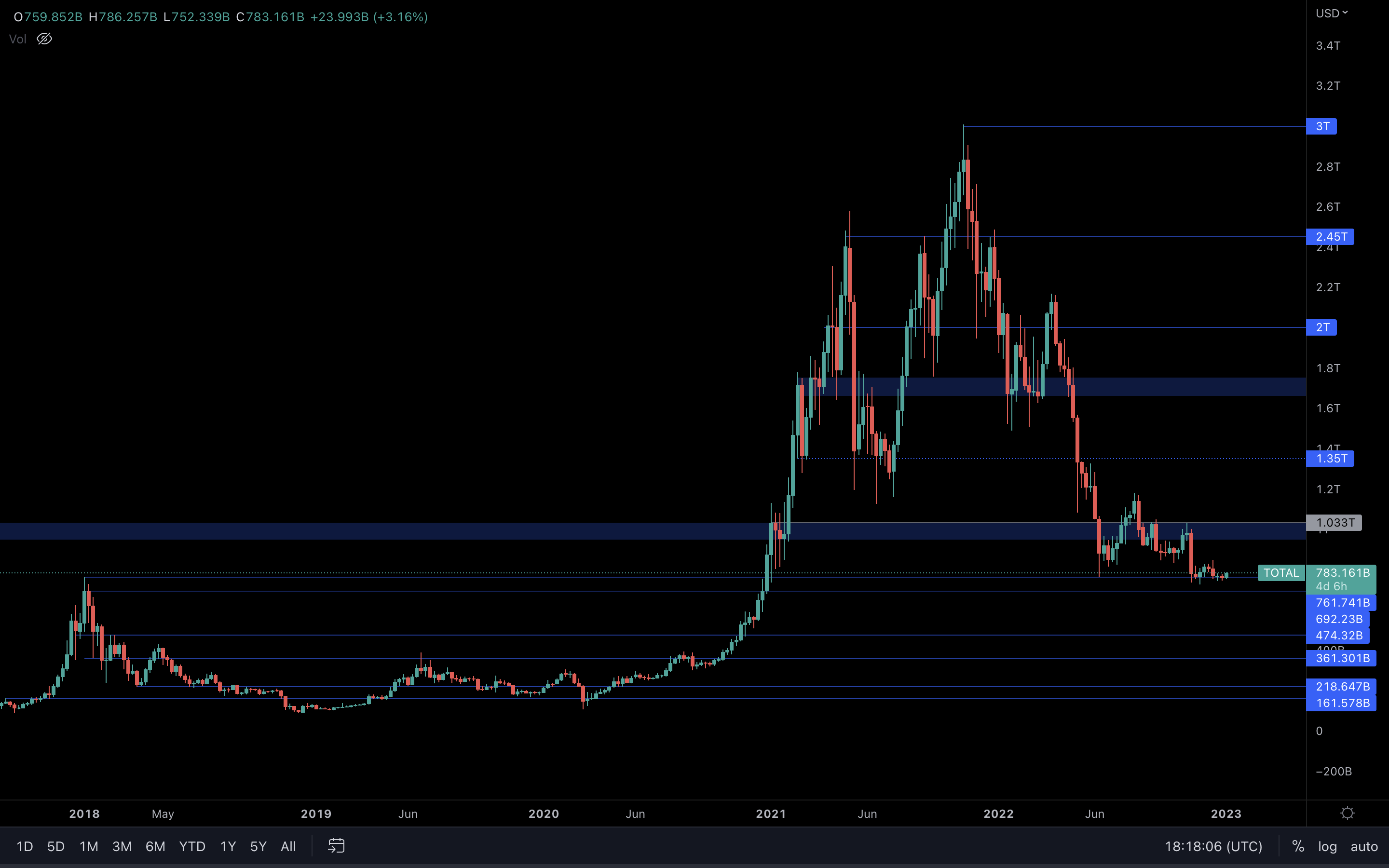

Total Market Cap

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and where it will be going.

There’s only one thing you need to know about this chart - we are sitting at 2018 all-time high levels, and it has bottoming potential.

As long as we see the Total Market Cap index hold its 2018 all-time high, then we could see a rally in Q1-Q2 of 2023.

Altcoins Market Cap

The Altcoins Market Cap index represents the entire evaluation of the altcoins market. Imagine all altcoins in the same basket but Bitcoin in a different one. There is one huge difference between this index and the Total Market Cap - here, we’ve seen a loss of the 2018 all-time high.

There is one huge difference between this index and the Total Market Cap - here, we’ve seen a loss of the 2018 all-time high.

Unless a reclaim (weekly closure above the previous ATH) occurs, we could see the Altcoins Market Cap index drop another ~30%.

BTC | Bitcoin

We strongly believe 2023 will be big on accumulation, and Bitcoin is in that same boat. However, let’s think a little smaller - what will likely happen in the first three months of 2023?

Bitcoin has been ranging between $18,600 and $15,770 for two months now - a break of this range should be expected sometime in Q1 of 2023.

Bitcoin has been ranging between $18,600 and $15,770 for two months now - a break of this range should be expected sometime in Q1 of 2023.

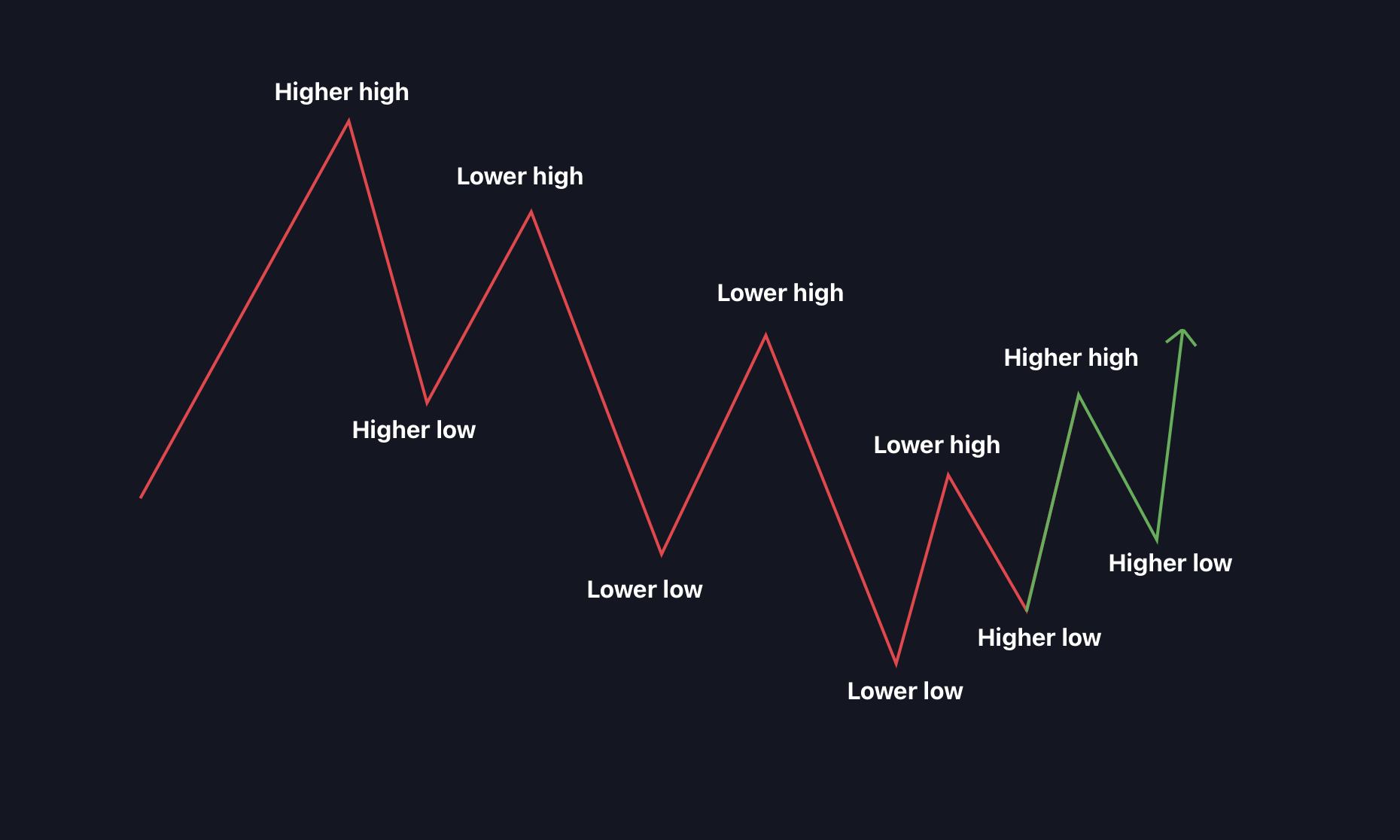

For now, a market structure change is required for us to expect higher prices. We should wait for a higher low and a higher high for Bitcoin to flip its market structure from bearish to bullish.

As an example, here’s how Bitcoin’s current price action should look to flip its market structure:

ETH | Ethereum

One of the most, if not the most interesting chart out there - and for a good reason.

We’ve identified a symmetrical triangle on the weekly ETH chart. If you’re unfamiliar with this pattern, let me simplify it for you:

An asset making higher lows and lower highs simultaneously is trading in a symmetrical triangle. This pattern differs from a descending or ascending triangle because there are no equal highs or lows. Low volume is known to be present during the pattern formation, which we have because of the current market conditions.

In financial markets, a symmetrical triangle is known as a continuation pattern. To understand what this means, look at the previous trend before the pattern started forming - it’s bearish, correct. In that case, the odds of continuing to the downside are higher than continuing to the upside. This is based on statistics, so nothing is set in stone.

As to where ETH is headed in the next three months, I can show you exactly where we believe it will be going with just one chart:

ETH/BTC

This is the ETH/BTC pair - we monitor this chart to understand who is outperforming - Ether or Bitcoin. As you can see, we also have a symmetrical triangle on this chart which has broken out and is heading to the upside.What does that mean, you might ask? In simple terms, a rising ETH/BTC - ETH outperforms.

We should expect Ethereum (and most altcoins) to perform well in the coming weeks. Invalidation of this scenario occurs when we see a drop below the first gray trend line (0.072500).

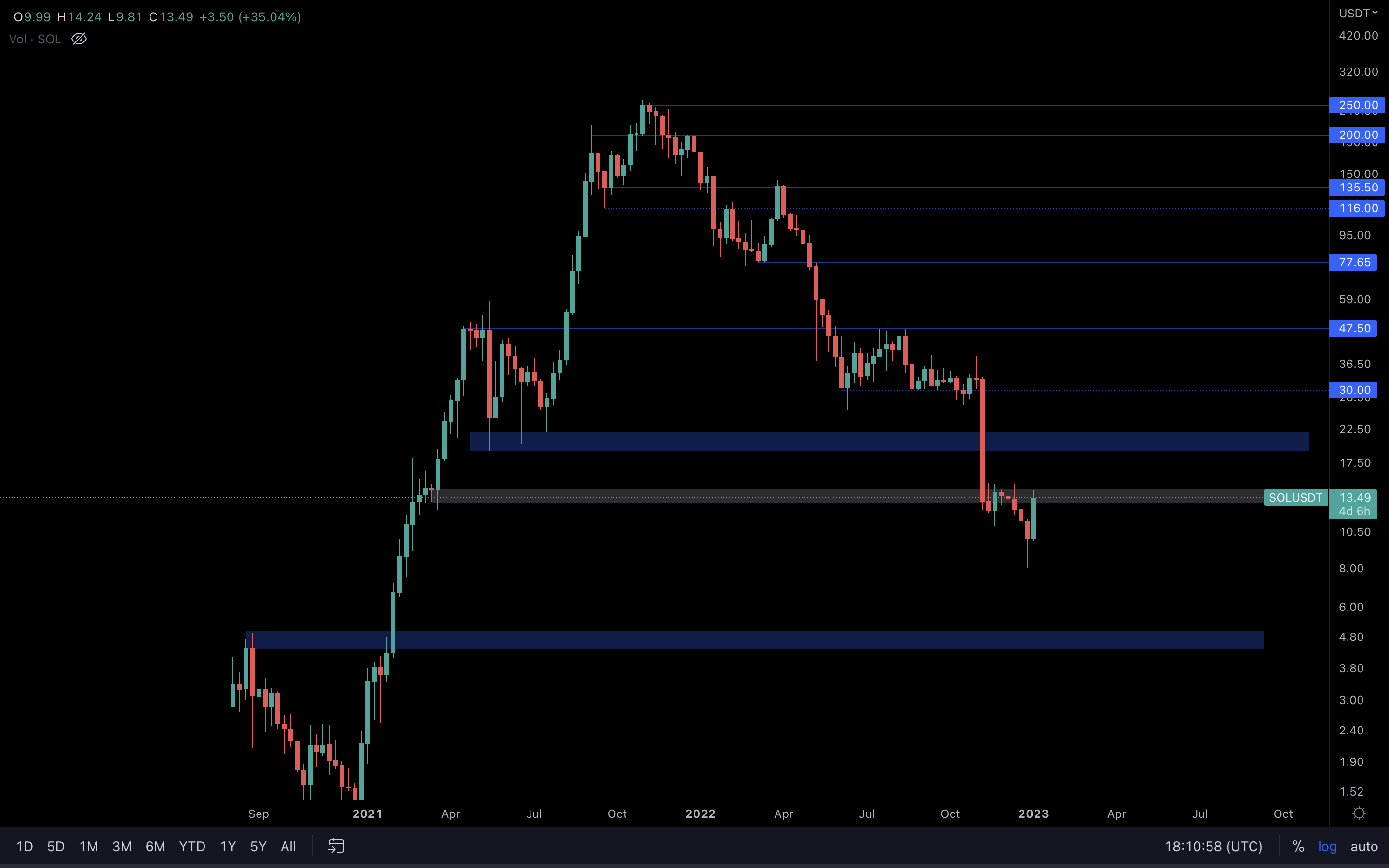

SOL | Solana

This is a logarithmic chart for SOL, and there’s no surprise in me telling you this, but the chart looks really bad. We’ve seen SOL rise from $7.80 to $14 in the last few days alone, and it is now at resistance. However, this does not change anything from a technical standpoint, and we believe SOL will test $4.75 (the bottom blue box) sometime this year.

We’ve seen SOL rise from $7.80 to $14 in the last few days alone, and it is now at resistance. However, this does not change anything from a technical standpoint, and we believe SOL will test $4.75 (the bottom blue box) sometime this year.

BNB | Binance

What you see here likely has bottoming potential - at least in the short term (next few weeks).

BNB has taken the diagonal trend line as support and is now experiencing some buying pressure that will likely continue over the course of the following weeks. Include a good-performing BTC & ETH, and we see an evident rise here.

UNI | Uniswap

It would be best if you were on the lookout for when UNI breaks that diagonal resistance trend line.

Since altcoins are easily moved by the majors, especially in this market, it’s safe to assume UNI won’t be any different. With BTC & ETH showing sides of upside, we could see UNI test $7.77 in the coming weeks.

Summary

2023 will be a year of accumulation. Most of the market participants have left in hope that they could time the bottom, get in lower or just save their capital. Does the reason really matter? Absolutely not.

It won’t be a surprise to us when we see the markets consolidate for multiple months, just know that this is the time to get in - not out.