Is the market set to explode? | February 23th

Friends, the market is indecisive right now… Sure, we closed bullish last week, and most altcoins have pumped to new daily highs. Everything points to more upside from here, but that’s not the case… yet. If you’ve read our previous reports, you know Bitcoin needs to break above $25,150 for this indecision to disappear. In the meantime, price action might become choppy and boring, constantly playing with our emotions. This is exactly why we recommend waiting for confirmation first, before taking any action.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The Total Market Cap is retesting $1.03T as support. Holding this level is necessary for upside to remain on the cards.

- Bitcoin has been rejected at $25,150. For significant upside to be confirmed, a reclaim of this level is necessary.

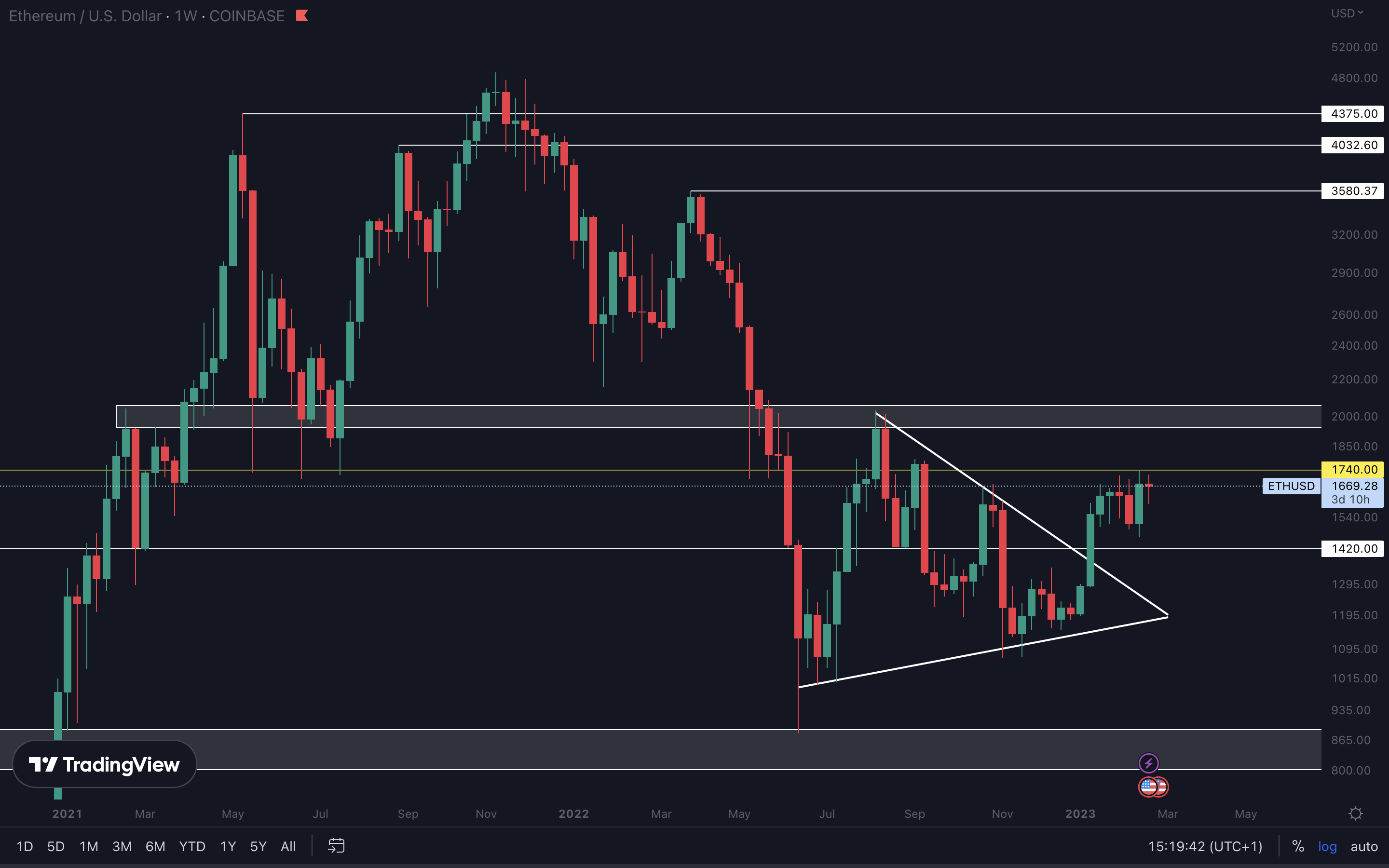

- Ether needs to break above $1740 for $2000 to be confirmed.

- BNB is at support. A loss of $300 would invalidate a potential move to $335.

- Unless UNI’s bullish daily market structure changes, a move to $7.80 is still possible.

Total Market Cap

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap index is retesting $1.03T as support. We’ve seen it struggle to break above this level before, so it’s absolutely necessary it holds it as support now.

The Total Market Cap index is retesting $1.03T as support. We’ve seen it struggle to break above this level before, so it’s absolutely necessary it holds it as support now.

Let’s assume a mild scenario, in which the Total Market Cap drops back to $950B. From a technical standpoint, this doesn’t invalidate the possibility of further upside, because the previous weekly low wouldn’t be broken.

Our only “pack your bags, it’s time to go” card is a weekly closure under $950B. The index’s weekly market structure is bullish right now, but a loss of $950B would break this structure and invalidate any upside in the short term.

The Total Market Cap could also hold $1.03T as support and bounce from here, and that’s exactly what we’re looking for.

Altcoins Market Cap

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The Altcoins Market Cap index is looking pretty healthy. Last week, a bullish engulfing formed right from support, confirming a move to the $650B - $700B resistance level.

The Altcoins Market Cap index is looking pretty healthy. Last week, a bullish engulfing formed right from support, confirming a move to the $650B - $700B resistance level.

An invalidation of this would occur if we see a weekly closure under $550B.

BTC | Bitcoin

This is where things get tricky. Last week, Bitcoin closed as a bullish engulfing candle right into resistance and is now getting rejected from that level. This is a prime example of why bullish engulfings should not form into resistance, and the same thing goes for bearish engulfings and forming into support. This creates indecision.

Sellers are rejecting Bitcoin’s price at the $25,150 resistance level. The weekly market structure is now bullish, so even if we close red this week and some downside occurs, only a break in structure would invalidate further upside.

With that said, a weekly loss of $21,450 is required for Bitcoin to break its bullish market structure. As long as it holds that level, we believe higher prices may follow. A weekly closure above $25,150 would confirm $28,750 - $32,000 as our next target for Bitcoin in the short-term, but until this level is reclaimed that target isn’t confirmed.

This is where things get tricky. Last week, Bitcoin closed as a bullish engulfing candle right into resistance and is now getting rejected from that level. This is a prime example of why bullish engulfings should not form into resistance, and the same thing goes for bearish engulfings and forming into support. This creates indecision.

Sellers are rejecting Bitcoin’s price at the $25,150 resistance level. The weekly market structure is now bullish, so even if we close red this week and some downside occurs, only a break in structure would invalidate further upside.

With that said, a weekly loss of $21,450 is required for Bitcoin to break its bullish market structure. As long as it holds that level, we believe higher prices may follow. A weekly closure above $25,150 would confirm $28,750 - $32,000 as our next target for Bitcoin in the short-term, but until this level is reclaimed that target isn’t confirmed.

ETH | Ethereum

Ether’s in the same boat as Bitcoin. The asset is being rejected after forming a bullish engulfing candle into resistance. For us to confirm a move higher, specifically to $2000, Ether requires a weekly closure above $1740.

Ether’s in the same boat as Bitcoin. The asset is being rejected after forming a bullish engulfing candle into resistance. For us to confirm a move higher, specifically to $2000, Ether requires a weekly closure above $1740.

A break of $1740 would provide us with the perfect opportunity to switch teams and get into altcoins, especially the ones that outperform.

SOL | Solana

SOL may or may not retest $22 as support in the short term. It depends on how Bitcoin performs. It shouldn’t be of any worry to us anyway given how it’s such a small move (-8%).

SOL may or may not retest $22 as support in the short term. It depends on how Bitcoin performs. It shouldn’t be of any worry to us anyway given how it’s such a small move (-8%).

We remain confident that SOL will reach $30 some time during Q1 or Q2. However, an invalidation of this would occur if a weekly candle closes under $19. This would confirm $15 as our next target.

BNB | Binance

As long as BNB holds this gray box ($300 - $310) as support, a move to $335 is still on the cards. We see no reason for BNB to drop under $300 unless Bitcoin forces it to do so.

In the case that $300 is lost, $260 is next on the cards. As for the bullish scenario, a weekly closure above $335 would confirm $430 - $460 as our next target for BNB. These are the only levels you should watch as we head into next few weeks.

As long as BNB holds this gray box ($300 - $310) as support, a move to $335 is still on the cards. We see no reason for BNB to drop under $300 unless Bitcoin forces it to do so.

In the case that $300 is lost, $260 is next on the cards. As for the bullish scenario, a weekly closure above $335 would confirm $430 - $460 as our next target for BNB. These are the only levels you should watch as we head into next few weeks.

UNI | Uniswap

UNI’s weekly market structure is now bullish after the asset marked a higher high last week. A test of $7.80 is on the cards unless we see a break in structure. For this to happen, UNI would need to drop under its previous weekly low of $6.09.

UNI’s weekly market structure is now bullish after the asset marked a higher high last week. A test of $7.80 is on the cards unless we see a break in structure. For this to happen, UNI would need to drop under its previous weekly low of $6.09.

If UNI manages to close a weekly candle above $7.80, $9.65 would be confirmed as our next target. Keep in mind that Bitcoin is still the leader here, so UNI’s potential upside won’t become reality unless Bitcoin performs well.

Cryptonary's take

If you’re eager to add more capital into the market, waiting for Bitcoin to break above $25,150 is a necessary precaution. If you jump in now in hopes that the market will continue its rally, you’ll become what’s known as a degen, and let me tell you: no one wants to be a degen. There’s not a single person alive who consistently made money in the markets without being patient and calculated. Waiting for confirmation is, in our opinion, a trader’s best play. If you’re investing for the long-term, current price action isn’t your concern and you should be able to sleep like a baby. 👶

Action Steps

- Wait for Bitcoin to close a weekly candle above $25,150 before taking on short-term opportunities. This reduces your chances of losing.

- Once/If Ether breaks $1740, moving your attention to altcoins is recommended. This would provide you with better opportunities to take advantage of.