Is the pullback over? | February 13th

Is the pullback over? Short answer - it depends. The Total Market Cap is at support, but we could easily go lower, and the rally would still look promising for the rest of Q1 and Q2. It’s more of a waiting game than anything. We need to see the next direction before jumping on any opportunities, and we believe the market requires a bit more time so that we can make a proper decision.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

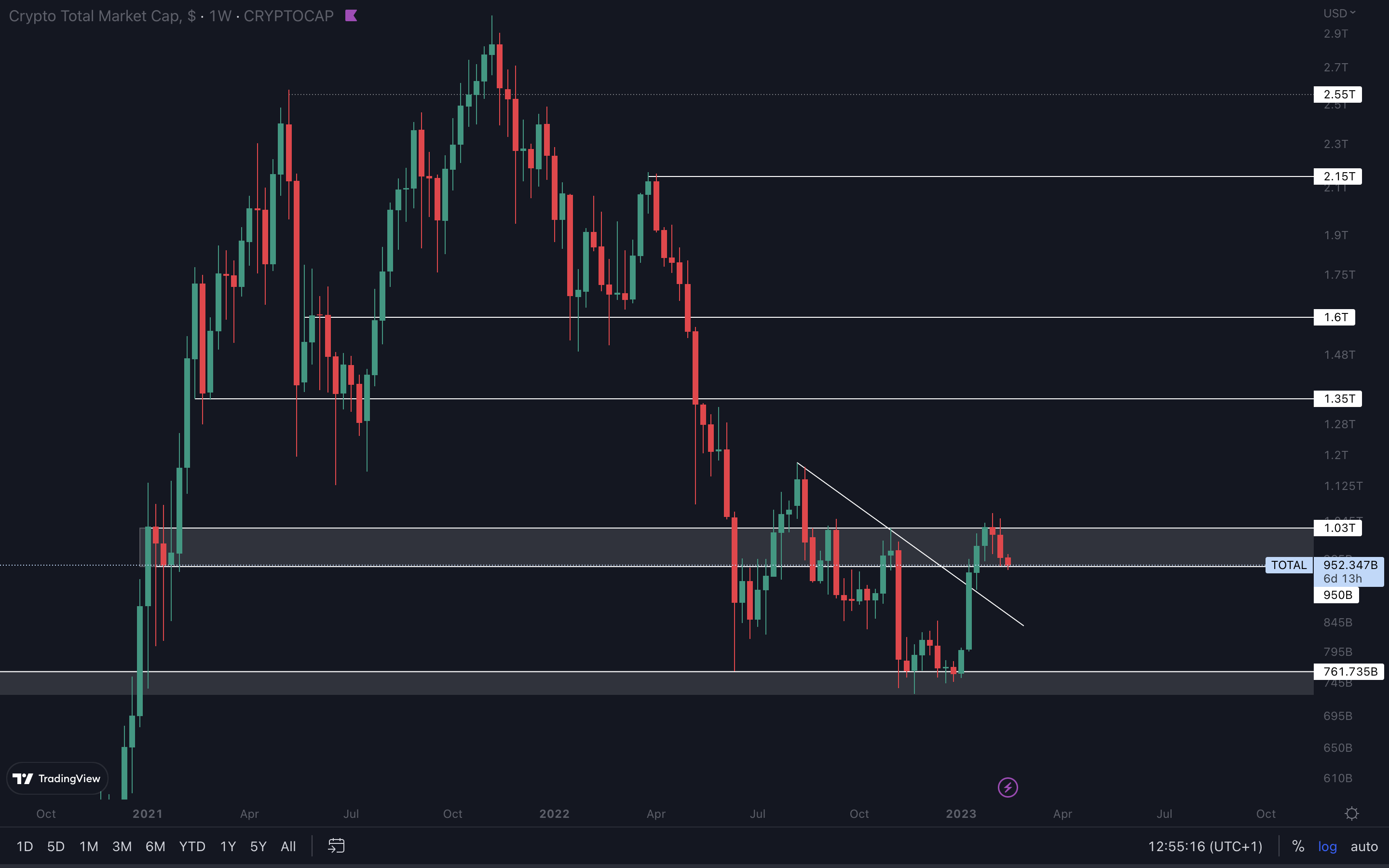

- The Total Market Cap is at support. A weekly loss of $950B would confirm further downside.

- Tomorrow, new CPI figures will be announced. We should expect the markets to be volatile, so staying on the sidelines is recommended.

- Bitcoin is at support, and a loss of support would result in a more significant pullback. Keep reading to find out what our targets are for all assets.

- DYDX needs to close this week above $2.50. Otherwise, our targets will be invalidated for the time being.

- HEGIC and ASTR are extremely volatile. If you’re inexperienced, trading these assets isn’t recommended.

Total Market Cap

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and to predict where it will likely go next.

The Total Market Cap is currently testing $950B as support. At this time, it’s unclear whether the crypto market will lose this support and head lower, or we’ll see a bounce from here. A weekly closure under $950B will confirm further downside and result in Bitcoin heading toward its 2017 all-time high (~$19,886). You’ll find more on that in the BTC section below.

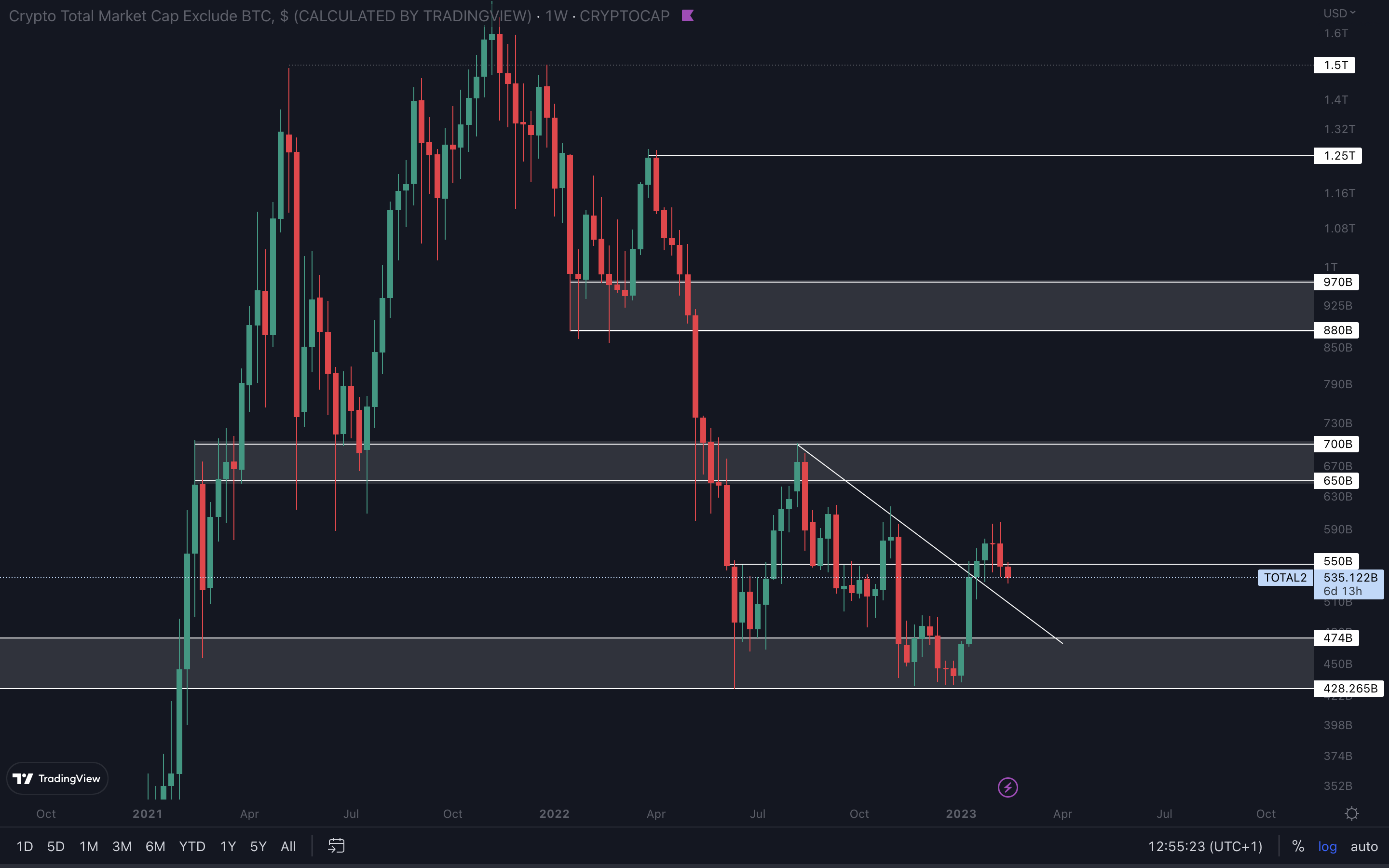

Altcoins Market Cap

The Altcoins Market Cap index represents the entire evaluation of the altcoins market (all coins other than BTC).

The Altcoins Market Cap lost $550B as support after closing last week’s candle under this level. A reclaim of $550B is now necessary to invalidate further downside. This index will not descend on its own and given that the Total Market Cap is at support, the Altcoins index is “saved” for the time being. A loss of support on the Total Market Cap would result in the altcoins market dropping even more aggressively.

BTC | Bitcoin

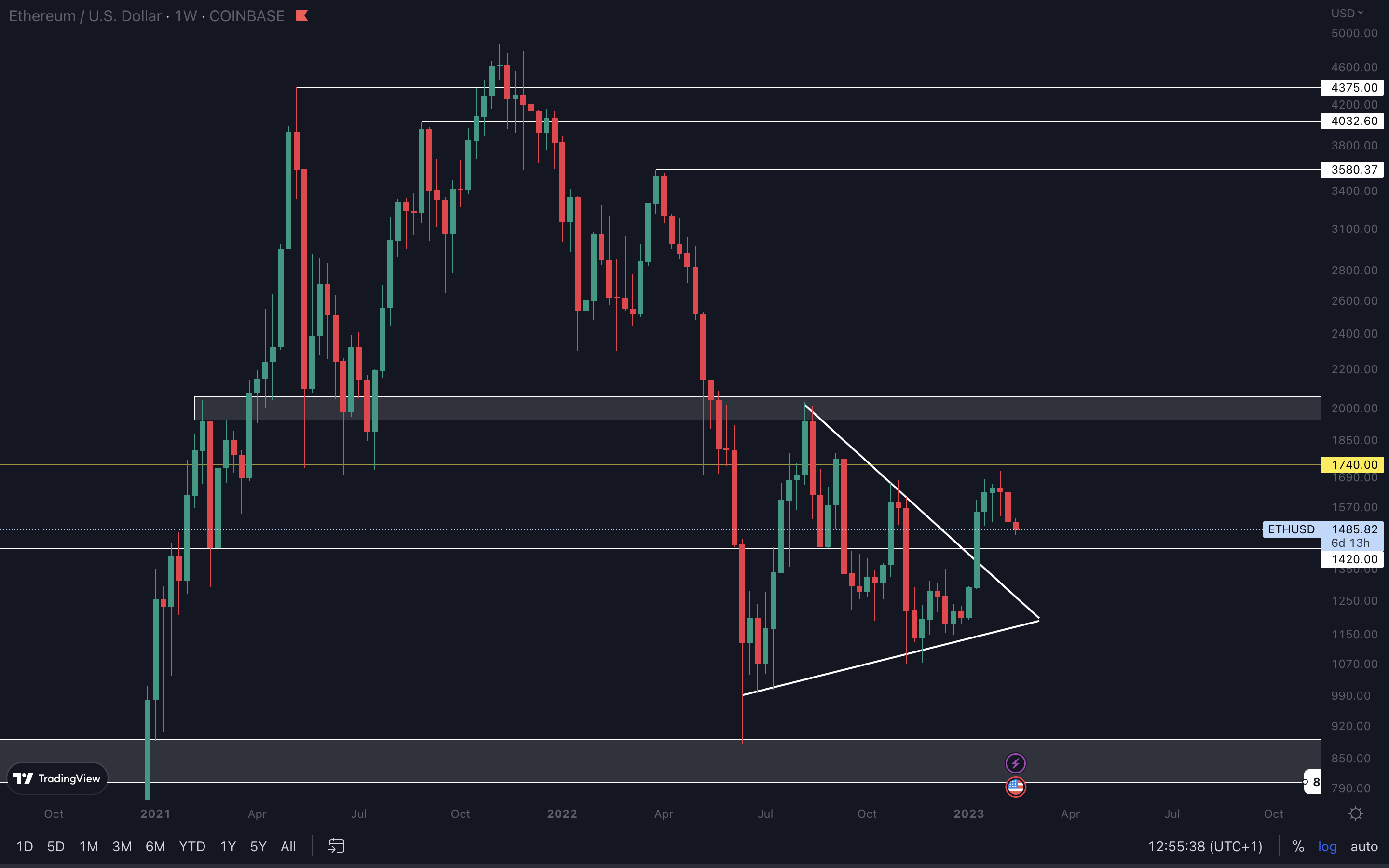

ETH | Ethereum

Given that Bitcoin is at support, we’ll have to see it lose $21,450 and head lower for Ether to reach $1420. Tomorrow, new CPI figures will be announced. A negative outcome would most likely affect the market and cause Ether to drop to $1420. Keep in mind that although $1420 is Ether’s 2017 ATH, Bitcoin has around -7% to go to reach its 2017 ATH. A -7% drop in BTC would likely result in Ether losing $1420 as support. We’ll need to wait and see how tomorrow plays out to determine what we should expect next. As always, daily updates will be given in our Discord.

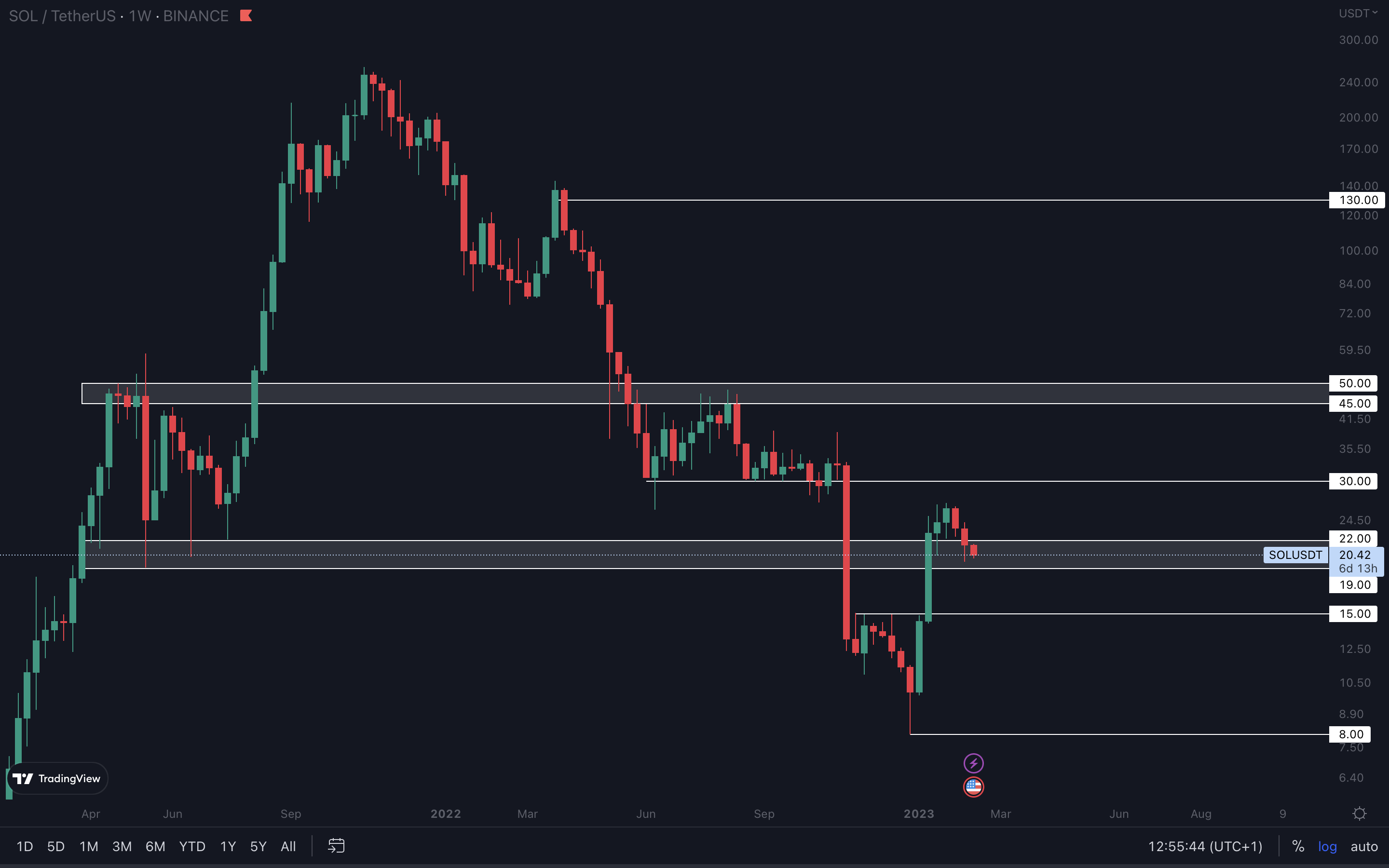

SOL | Solana

SOL is on its way to $19, the bottom of this current support area (gray box). Holding either $19 or $15 would keep the road to $30 open for the near future (Q1/Q2). So, we’re not really concerned about SOL losing $19 as support.

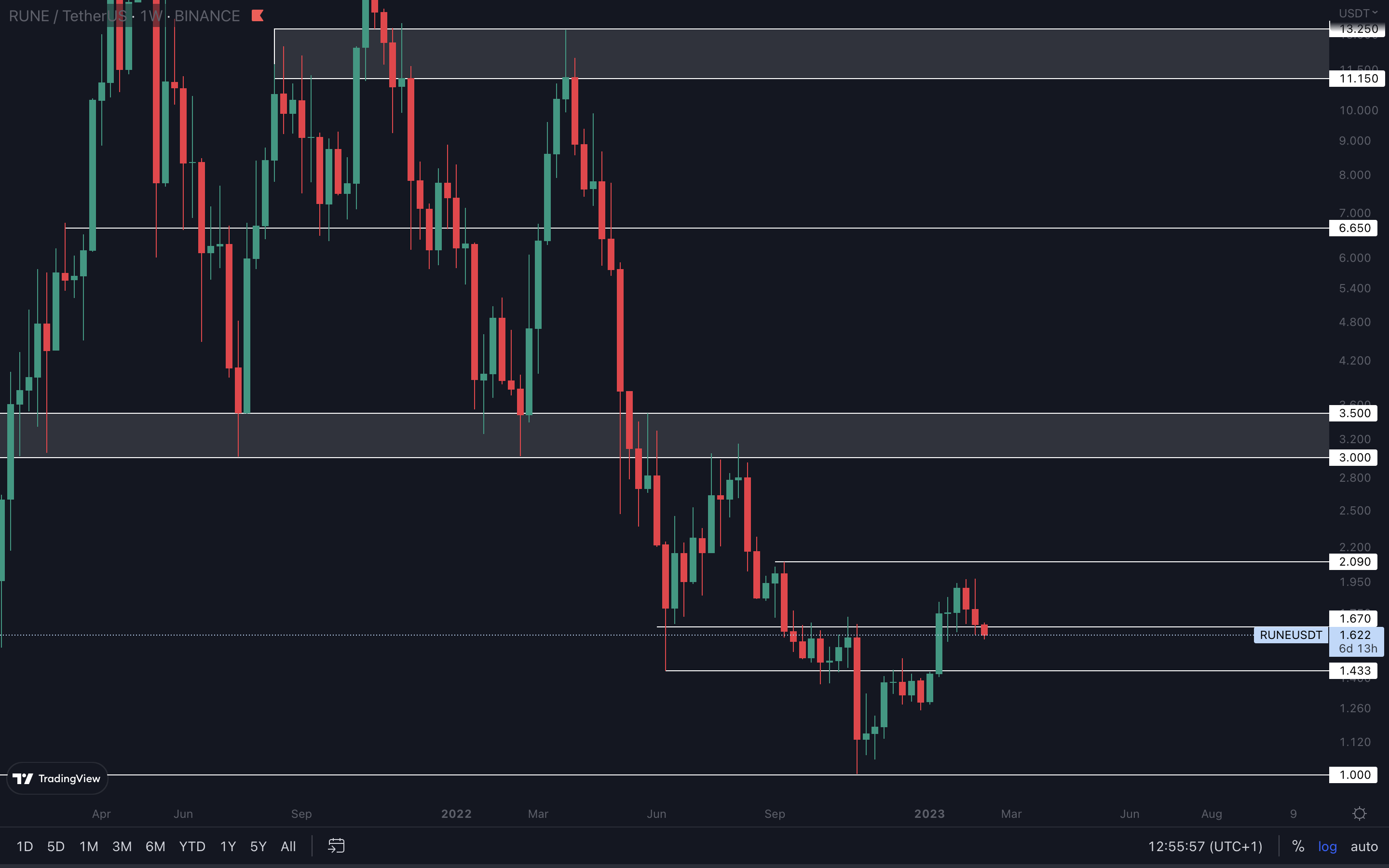

RUNE | THORChain

RUNE closed last week’s candle above support, but we’re now seeing it drop under this level. A weekly closure above $1.67 is required this week to avoid a drop to $1.43. This scenario is mostly influenced by Bitcoin’s price action, so make sure to track BTC simultaneously with RUNE.

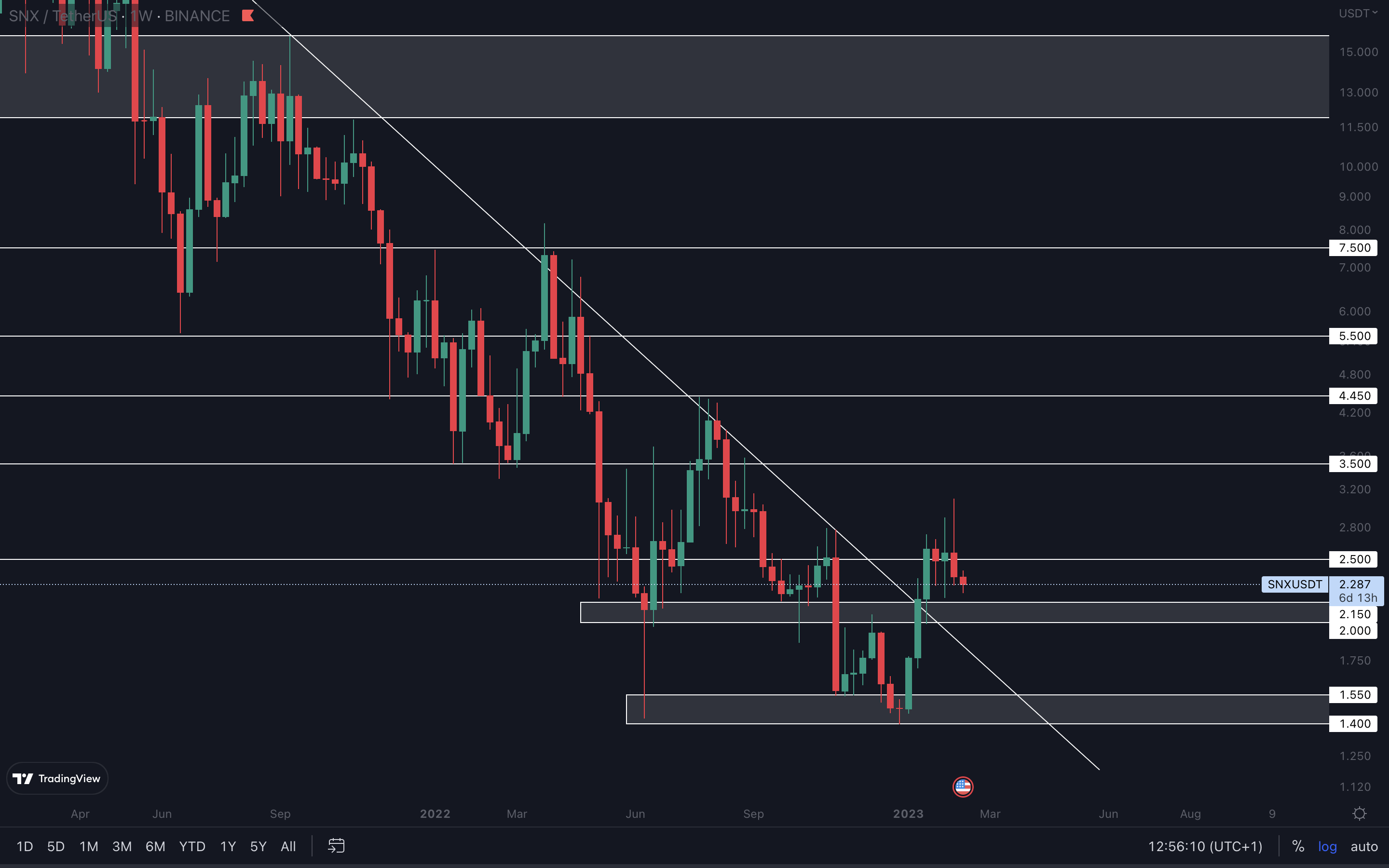

SNX | Synthetix

Another loss of $2.50, making the price action choppy and indecisive. This is not something we’d want to take advantage of because there’s nothing bullish here - yet. We’ll likely see SNX dropping to the $2 - $2.15 support area this week. As for the larger setup in play, we’ll need to see SNX reclaiming $2.50 and Bitcoin performing well simultaneously before we consider jumping on this.

dYdX | DYDX

DYDX barely closed above $2.50 last week, which puts the triple bottom a risk. For $4 and higher targets to remain on the cards, we’ll need to see DYDX close above $2.50 this week. A weekly closure under $2.50 would invalidate any upside for the time being. As far as we know, the odds here are equal, given that DYDX has performed well despite Bitcoin’s price action. For that reason, it might be best to wait for this week’s closure before jumping on this.

Cryptonary's Watchlist

DOT | Polkadot

As expected, DOT is back at $6. Where it goes next is n the hands of Bitcoin and tomorrow’s CPI figures. A weekly closure under $6 would result in DOT forming a weekly higher low anywhere between $6 and $4.25. We don’t believe DOT will reach $4.25 anytime soon. Instead, we might be looking at a new low that would push its price even higher in the rest of Q1 and Q2.

SYN | Synapse

SYN has seen a solid performance over the last few weeks, and we don’t see any signs of this stopping anytime soon. The asset is stuck between two levels, $1.50 and $1.10, and a break of either of these two will confirm its next direction. In the meantime, expect some ranging between $1.50 and $1.10. Keep in mind that SYN is also affected by Bitcoin’s price action, even if it has performed well despite BTC going down. A loss of support for BTC would most likely push SYN to $0.90 in the coming weeks.

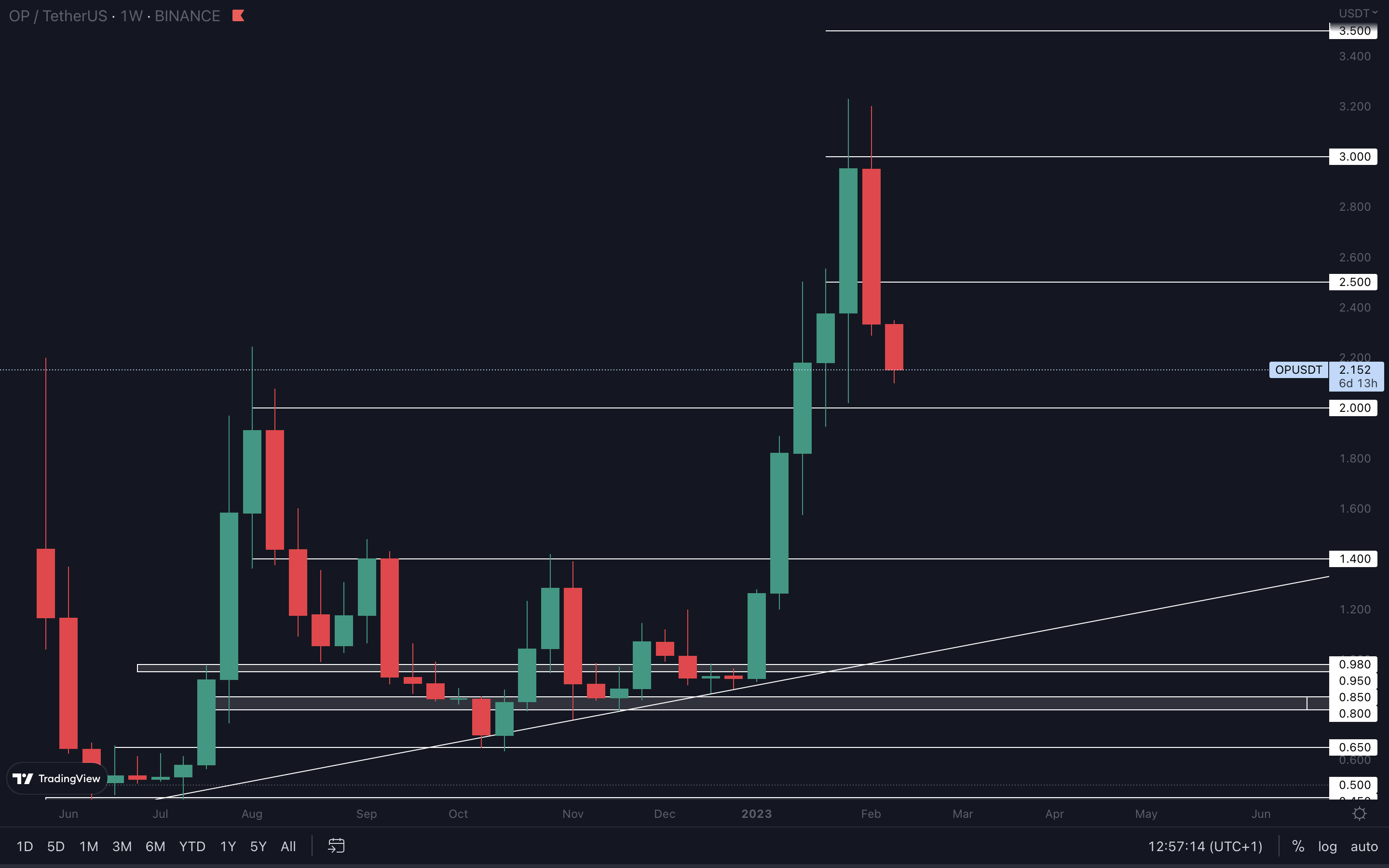

OP | Optimism

A bearish engulfing candle has formed on OP’s weekly timeframe. This confirms a move back to $2. If Bitcoin does lose its $21,450 support, we might see OP losing $2 and heading even lower.

LDO | Lido DAO

Last week, LDO closed as a bullish engulfing into resistance, not something we'd want to see when expecting higher prices. While we might be looking at some upside here, we need Bitcoin to perform well or consolidate for LDO to reach $3.10.

Last week, LDO closed as a bullish engulfing into resistance, not something we'd want to see when expecting higher prices. While we might be looking at some upside here, we need Bitcoin to perform well or consolidate for LDO to reach $3.10.

Bitcoin losing support would result in a much more aggressive descent for LDO, given that its bearish engulfing candle formed into resistance. Sellers could easily take over the price action.

HEGIC | Hegic

Not even 24 hours into the new week and HEGIC has risen by 14% and dropped back to its opening like nothing happened. The volatility here is beautiful but dangerous, easily influenced by Bitcoin’s price action. A loss of $21,450 for BTC would result in HEGIC coming down to retest $0.02725. On the other hand, if Bitcoin holds support, HEGIC could perform well and continue to rise rapidly toward $0.05.

ASTR | Astar

Here’s an even better contestant for the title of “Most volatile asset”. ASTR saw a ~+20% increase, which was invalidated completely after Bitcoin’s descent this morning. ASTR will perform based on Bitcoin’s trajectory. If $21,450 holds, we might see ASTR test $0.10 again in the coming week(s). However, if Bitcoin loses support and heads down, ASTR will see an aggressive descent toward $0.0550. This type of volatility is extremely dangerous and could be the easiest and fastest way for you to lose money. If you’re inexperienced, trading this type of price action shouldn’t even tempt you.

THOR | THORSwap

THOR holding $0.26 as support actually keeps $0.45 as a possibility in the coming weeks. Like the rest, THOR is influenced by external factors such as Bitcoin’s price action. A bad-performing BTC would most likely result in THOR losing $0.26 as support, which would put $0.20 on the cards.

We don’t view this as a solid opportunity right now.

MINA | Mina Protocol

MINA failed to close last week’s candle above the psychological and technical level of $1, increasing the odds of rejection. For MINA to continue higher, a weekly closure above $1 is necessary. This would put $1.60 as our next target for the asset. In case of rejection, MINA’s nearest support is $0.79.

STG | Stargate Finance

STG managed to close last week’s candle above resistance ($0.73), but we’re now seeing it drop under this level. For upside to continue, STG needs to close this week above $0.73. This would open the road for another $0.90 test shortly after. In the meantime, tracking Bitcoin is essential, as STG will also be influenced by its price action.

Cryptonary’s take

The Total Market Cap index is at support, the Altcoins Market Cap index has lost its previous support, and overall, everything points to indecision. We need to wait for tomorrow’s CPI figures for a better idea of where the market is going next. This announcement will most likely move prices. If the figures are negative, Bitcoin will lose its support, and the market-wide pullback will continue.

- Tracking altcoins simultaneously with BTC is your best play. This will help you understand where local bottoms may form and identify good entry points.

- Waiting for tomorrow’s CPI announcement is recommended. Prices will be volatile, and supports can be lost.

- Expect new higher lows to form in the coming weeks. They will be the foundation of a potential change in market structures.