Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Understanding the Current Market Environment

The market is presenting key opportunities as assets reach critical levels. Ethereum’s uptrend faces resistance at $2,700—breaking this could drive further gains. SUI and Aerodrome Finance are primed for short-term plays around psychological levels. Effective risk management is essential; adjust stops wisely to protect gains as we navigate this evolving landscape.Market context

We're currently holding a long-term Ethereum position, which has developed into a winning trade. It's a daily trend rather than an intraday move, which presents multiple opportunities to scale in and adjust our risk management accordingly. We’re looking at risk-free zones and areas of strength as the price action continues to unfold.Current trade position

We’re riding this uptrend with a clear swing high and lower high, followed by a breakout. It's critical to manage this trade effectively by reducing risk when possible. I tend to go risk-free as soon as possible, but the timing is essential—you don't want to do it too early and get shaken out of the position. Let’s break down why this matters.We’re approaching a major resistance level at $2,700. Historically, this price point has seen a lot of selling pressure, dating back to key resistance in January and August. Buyers push prices up, but if they hit exhaustion or shorts enter, it creates resistance. That’s exactly what we're facing now.

If Ethereum breaks above $2,700, we’ll shift our bias more bullishly, as that means sellers have been beaten. This could signal the start of stronger buying pressure at that level. Once we have a clean break with a retest and consolidation above this point, we can move our stop loss to break even, locking in the trade’s gains.

Playbook

Playbook

- Key level: $2,700 is the critical checkpoint. A clean break and retest here signal that sellers have stepped aside.

- Risk-free approach: Upon breaking $2,700 with conviction (multiple daily closes above), move the stop loss to entry to go risk-free.

- Next target: If we see daily closes above this level, we can aim for $2,900, potentially adding to the position.

Risk management

Don’t move your stop-loss to break even prematurely. Sellers are still strong at $2,700, so moving your stop right now could cause you to get stopped out unnecessarily. Once we see buyers take control, then it’s safe to reduce risk. Until then, maintain conviction in this trade.SUI – short-term play

Market context

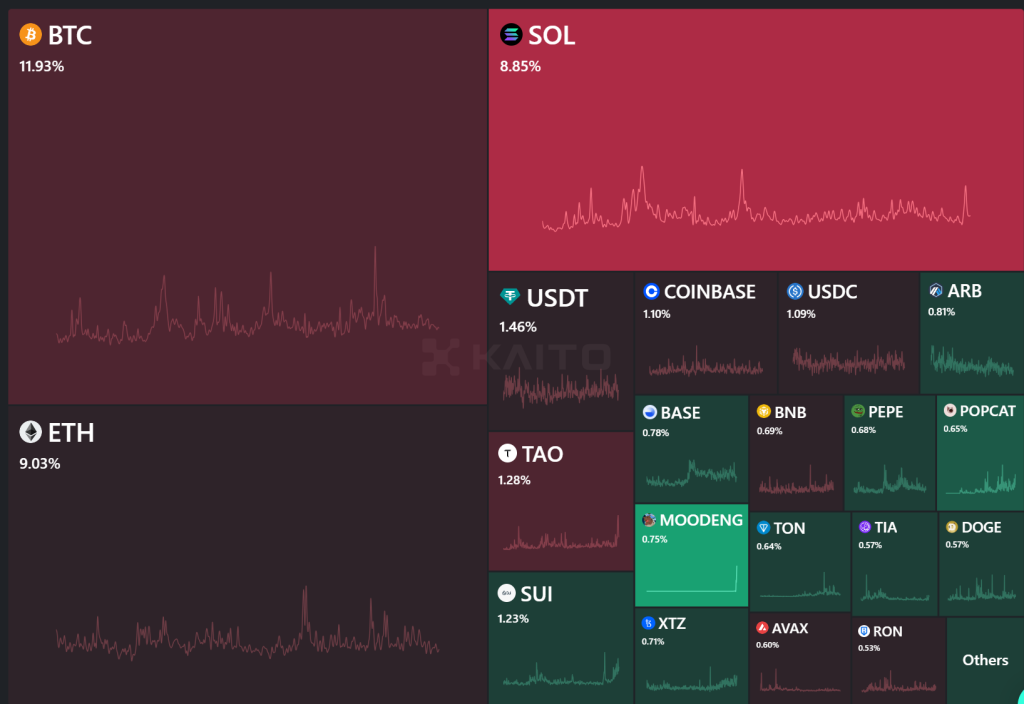

SUI has been on my radar for some time, dominating the mindshare in the past week, accounting for a solid 1.2% of the market. For an altcoin, this is significant and worth noting for a short-term momentum play.

We initially targeted the $0.75 level, and it's moved well since. Now, I'm adjusting the buy box to $1.13, which aligns with a key Fib level (61.8% to 70.5%) and psychological support at $1. It's showing strong momentum, and while I don't see this as a long-term hold, there is a clear opportunity for a short-term leverage play.

Playbook

Playbook

- Buy box: The new buy box sits around $1.13.

- Entry strategy: Small allocation with leverage (2x or 3x) for those looking to capitalize on this short-term momentum.

- Target: An 80-90% potential move to the upside.

Risk management

Leverage is optional here, but keep it small. You don't want to expose too much capital to a short-term trade like this.Aerodrome Finance – watching for reclaim

Market context

Aerodrome Finance has been a key player responsible for significant liquidity and volume on its network. Despite losing a trade here previously, I’m keeping a close eye on this asset, especially as it potentially forms an inverted head and shoulders pattern.We’ve broken a long-term trendline and retested it multiple times. If we reclaim the $1 mark with a solid move, there’s significant upside potential here.

Playbook

Playbook

- Breakout trade: Watch for a breakout and reclaim of the $1 mark.

- Potential move: Capturing a move from the current price to all-time highs could be highly rewarding, especially if we see volume return to the market.

Risk management

We will be able to strategize more clearly once we see demand shown at the $1 mark. The reason we have conviction that we will get further bids here is due to the psychological relationship participants have with key, significant round numbers like the $1 mark. This is why we saw so much trading and key bounces there earlier in the year.Market context

WIF is showing signs of slowing bearish momentum, forming a wedge pattern that could lead to a significant upside move. We’ve seen this type of wedge play out consistently in this cycle. It’s been a slow and steady grind, but the potential for a breakout is high.While I've entered a long position with 2x leverage into resistance (which I normally advise against), this is a calculated risk based on the slowing bearish momentum, wedge formation, and the wide stop in the form of liquidation levels below the $1 mark from my entry. I believe, given the current context, we have a higher chance of moving higher than dropping back down to my liquidation levels, hence the trade.

Playbook

- Wedge breakout: Keep a close eye on this wedge. If we break out of resistance with conviction, we could see a strong move higher.

- Entry strategy: I've entered early with 2x leverage. For those waiting, it's safer to wait for a confirmed breakout and retest before entering, especially if you have a tight stop loss and higher leverage allocated.

Risk management

This is a low-risk leverage trade with a stop loss below key levels, so exposure is limited. Once we see a breakout, I’ll adjust the stop loss to protect profits as usual.Cryptonary's take

There we have it—some volume back in the market and key assets finally moving. Patience pays. Here, we utilize different sentiment tools and technical analysis to identify the current attraction and how we can hop on board potential upside moves, which have a high chance of coming soon. This period of consolidation has been eye-opening, showing where real strengths and weaknesses lie in the market this cycle. Now, it's time to put this new knowledge to work and start getting positioned for action.Always manage your risk effectively, follow the price action, and stay sharp over the next 10 days as we monitor these assets closely.