Is this the end of BNB? | June 8th

This week has been nothing but crazy. You'd think the SEC taking on another major crypto exchange would send the market into a frenzy, but guess what? Prices are back to square one, just like a few days ago. Now, here's the million-dollar question: What does that tell us? Despite taking a major hit, investors are keeping their cool. They're betting on Binance to come out on top and they aren’t losing sleep over the market going down the drain like when FTX blew their cover (note: this doesn’t guarantee them winning in the end). We’re all about playing the odds here at Cryptonary, so we’ve come up with three different scenarios for this battle, and set targets for the market for all three.

TLDR 📃

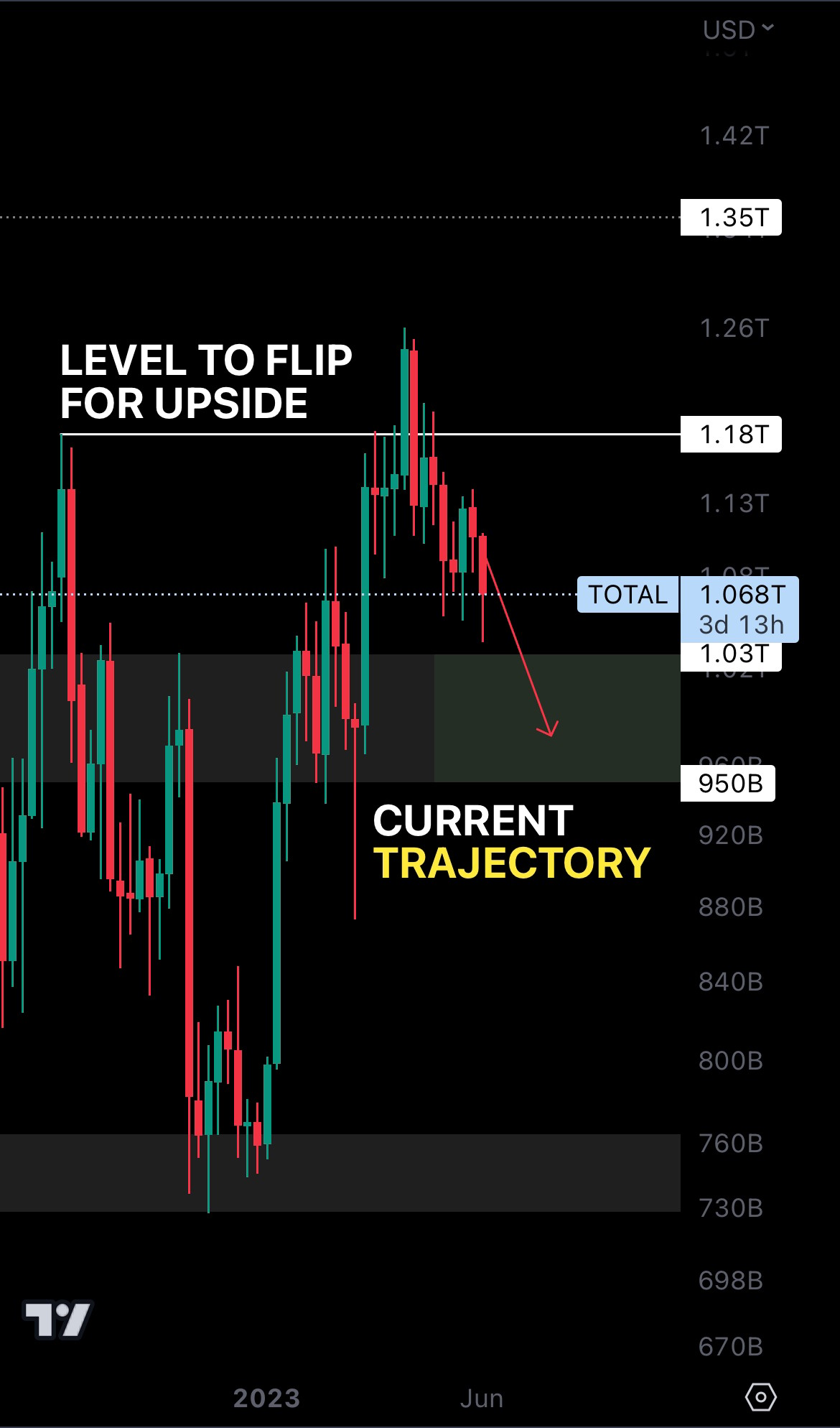

- The Binance vs SEC battle only fueled how much downside we might have left in the tank. Lower prices are very likely.

- There are three scenarios for the crypto market, all with different price targets. Buckle up, some might surprise you.

- BNB is now on our “bearish radar”. We view this token as dangerous for both investors and traders at this time, and for obvious reasons.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you understand our analysis very quickly. They are not signals and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Total Market Cap

The Total Market Cap (TOTAL) index represents the entire cryptocurrency market. We track this index to understand where the overall market is now and predict where it will go next.

Altcoins Market Cap

The Altcoins Market Cap (ALTS) index represents the entire valuation of the altcoins market: all coins other than BTC.

Bitcoin | BTC

Here’s what the 🔮 told us…

Bitcoin’s price is now directly linked to Binance vs SEC’s battle progression. To understand where we’re going, we’ll need to understand what the possibilities are. However, for a more in-depth look, here's our take on this matter.

Bitcoin’s price is now directly linked to Binance vs SEC’s battle progression. To understand where we’re going, we’ll need to understand what the possibilities are. However, for a more in-depth look, here's our take on this matter.

Best case (Conviction level of 40%)

Binance settles with the SEC, and Bitcoin bottoms out at ~$25,150.

Base case (Conviction level of 59%)

Binance’s US operations are halted - a hit for Binance, but only a stepback for crypto as a whole. In this case, Bitcoin bottoms out at ~$20,000.

Worst case (Conviction level of 1%)

CZ becomes a criminally-charged citizen, Binance risks bankruptcy and the crypto market is left in ruins. This will result in Bitcoin bottoming out at ~$15,000.

Ethereum | ETH

Cardano | ADA

Dogecoin | DOGE

Polygon | MATIC

Solana | SOL

TRON | TRX

Ripple | XRP

Litecoin | LTC

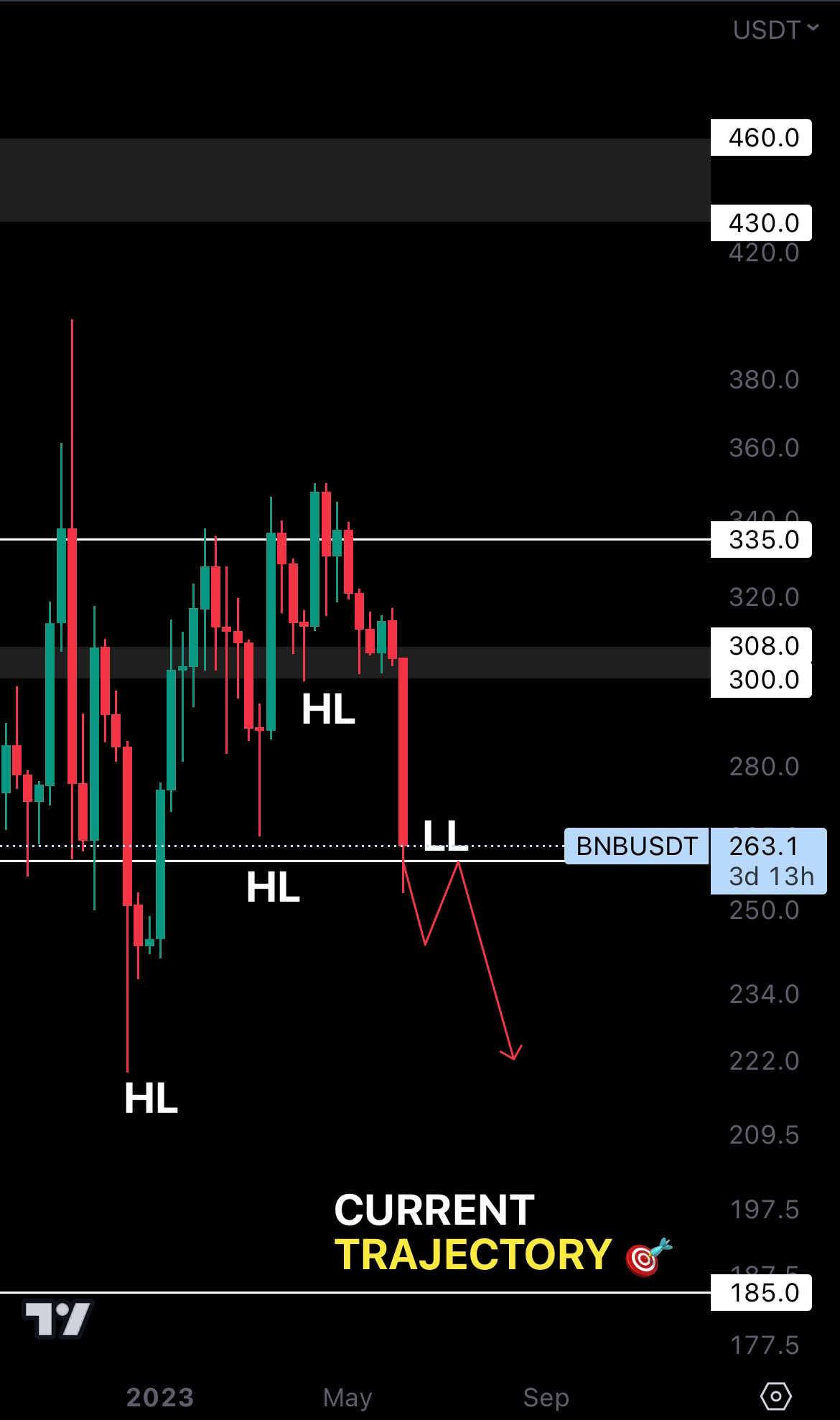

Binance | BNB

Is there a future for BNB?

That depends. Do we believe (and hope) that the battle ends with Binance on top? Absolutely. Should we ignore the possibility that Binance could teeter on the edge of bankruptcy if they do not win? Absolutely not. Our best bet right now is to protect our capital by staying away from BNB. Now, we don't want to rain on your parade, but there's a real possibility, albeit a slim 1% chance, of things going south. And hey, we'd rather dodge this bullet completely.

In the midst of a new lawsuit, this is not the time to get starry-eyed about potential gains. Instead, it looks like BNB is more likely to lose support at $260 and take a dip to $185, as both the bearish sentiment and the (now) bearish market structure point to this direction.

Cryptonary’s take 🧠

Such an event can shower the market with uncertainty. It's enough to make us question everything, right? Should we jump in and invest while the market is down? Should we go all-in or play it safe? Or maybe we should start selling bits and pieces, or even consider cashing out completely? All of that questioning will do nothing more than scramble your judgment. It'll just leave you second-guessing and doubting every move you make, wondering what you should be doing instead of actually doing something. Our take? Sit back, reduce your exposure, stay up-to-date with the Binance vs SEC battle by following Cryptonary, and wait to invest when the direction becomes clearer. Still, a long-term vision shouldn’t keep you from investing - bulls always triumph in the end 🐂.Action points 🎯

- As a Binance user, your priority should be moving your funds out of the exchange. Although we may believe that the battle will end with Binance on top, nothing is really certain in crypto.

- Short-term traders or investors should stay off the buys. More downside is coming, so why not wait?

- Interested in investing for the long run? The current price action shouldn’t stop you from accumulating.

- Got questions? Hit us up on Discord in the “🌎・general” or “🆓・alpha” channels. We’re happy to help.