Is this the end of the bull? | April 20th

The bulls might be dying. For weeks, we’ve been expecting Bitcoin to form a local top inside the $28,750 - $32,000 range. Why? Because it has to - in order to keep the trend healthy and sustainable. In this week’s report, we go over what can happen in the short term plus invalidations for those scenarios.

TLDR 📃

- The market is on edge: BTC dropping below $28,750 within the week will result in a market-wide crash. Flipping $32,000 into support puts it on track for $35,000 and above.

- ETH is on the way to lose $2,000 as support this week. The only thing that can save it and keep $2,500 on the line is a weekly closure above $2,000.

- If BTC loses support, altcoins will bleed a lot.

- The market is in limbo land, stay cautious and observant. Avoid making too many moves (i.e. flip-flopping long/short).

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

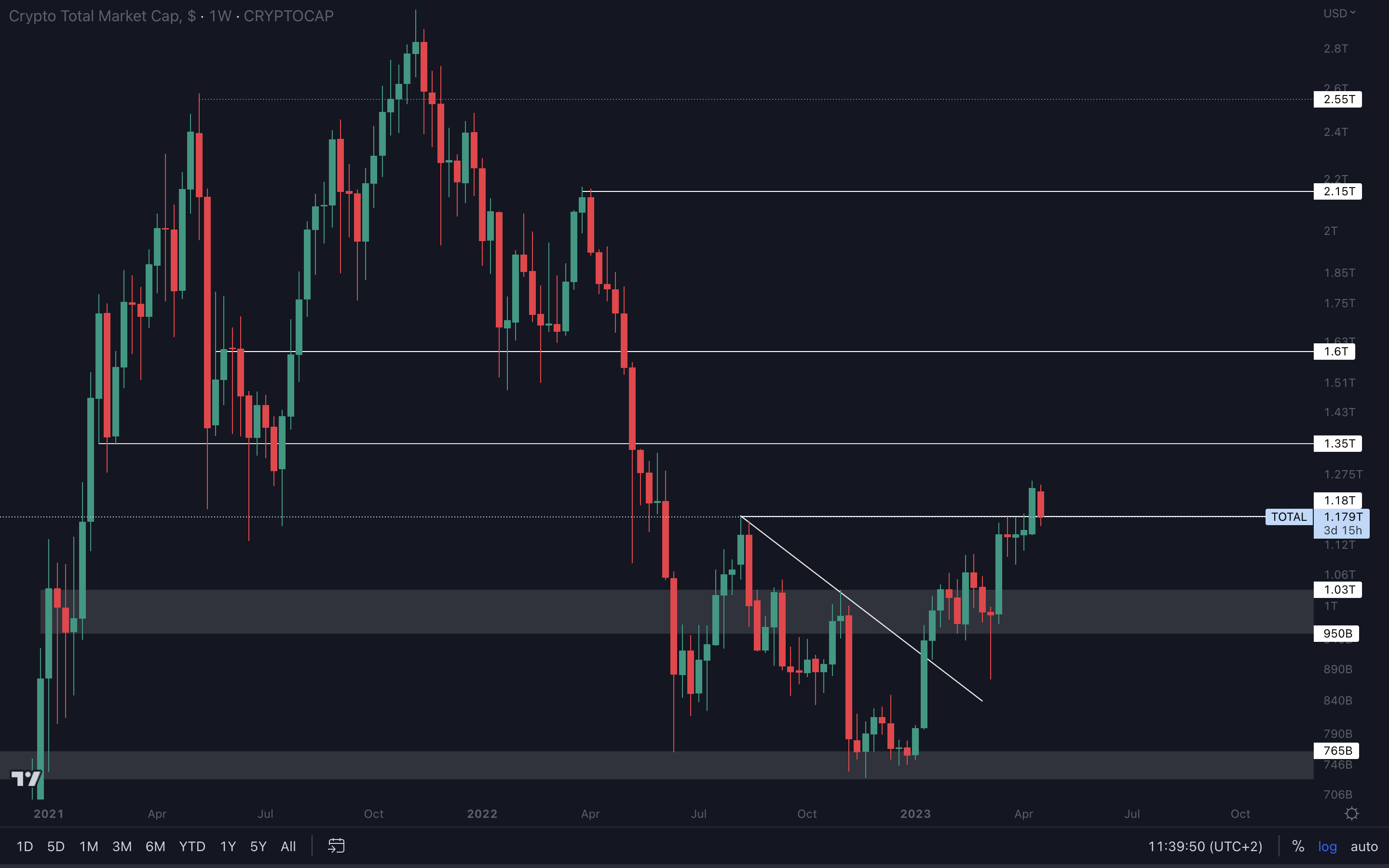

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will go next.

After breaking above $1.18T last week, total market cap is now retesting this level as support. A weekly closure under this level will invalidate any upside and confirm our expected outcome for the market - a pullback to $1.03T.

Holding $1.18T as support on the weekly timeframe keeps the door open for $1.35T. Fingers crossed!

After breaking above $1.18T last week, total market cap is now retesting this level as support. A weekly closure under this level will invalidate any upside and confirm our expected outcome for the market - a pullback to $1.03T.

Holding $1.18T as support on the weekly timeframe keeps the door open for $1.35T. Fingers crossed!

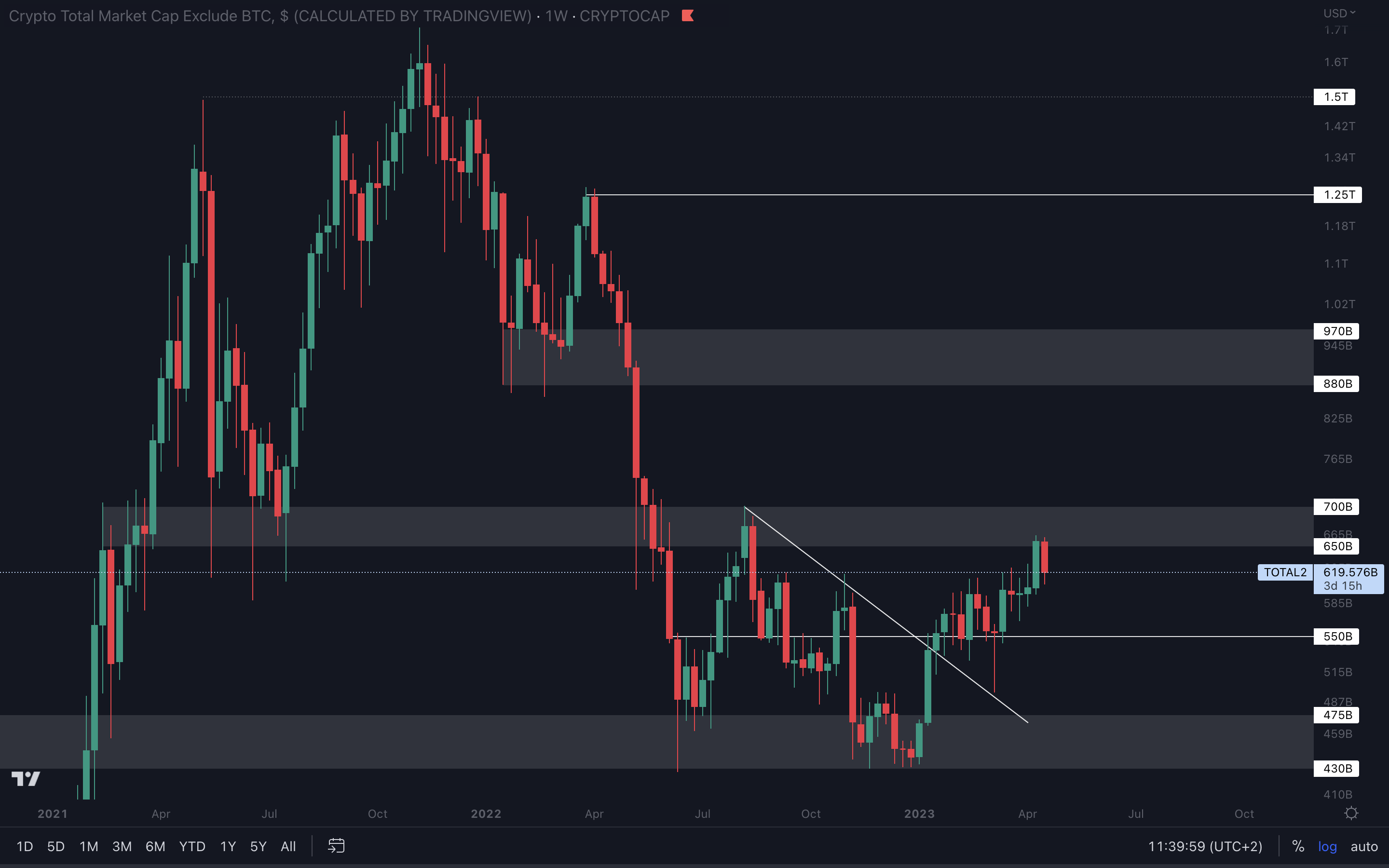

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market: all coins other than BTC.

Because of yesterday’s performance, the altcoins market cap has been rejected from resistance ($650B). The only thing we can do to predict how the altcoins market will perform is by looking at the Total Market Cap index. A good-performing TMC will help these alts in breaking resistance at $700B and going higher. In the meantime, a pullback is likely, and altcoins will drop aggressively if this happens. Keep your eyes peeled!

Bitcoin | BTC (Weekly)

Bitcoin had an aggressive week. Most of the selling pressure was caused by liquidations or traders getting stopped out, which is why we’ll give you a kind reminder: Do not trade if you’re inexperienced! Stick to investing only. Bitcoin is testing $28,750 as support. A weekly closure under this level will invalidate any upside and put the asset on track for $25,150. This will result in the altcoins market taking a significant hit, something which we’ve already seen in yesterday’s price action, with most alts dropping by 7% - 15%.

Holding $28,750 on the weekly timeframe keeps the door open for $32,000 and above. We are in limbo land, patience is key.

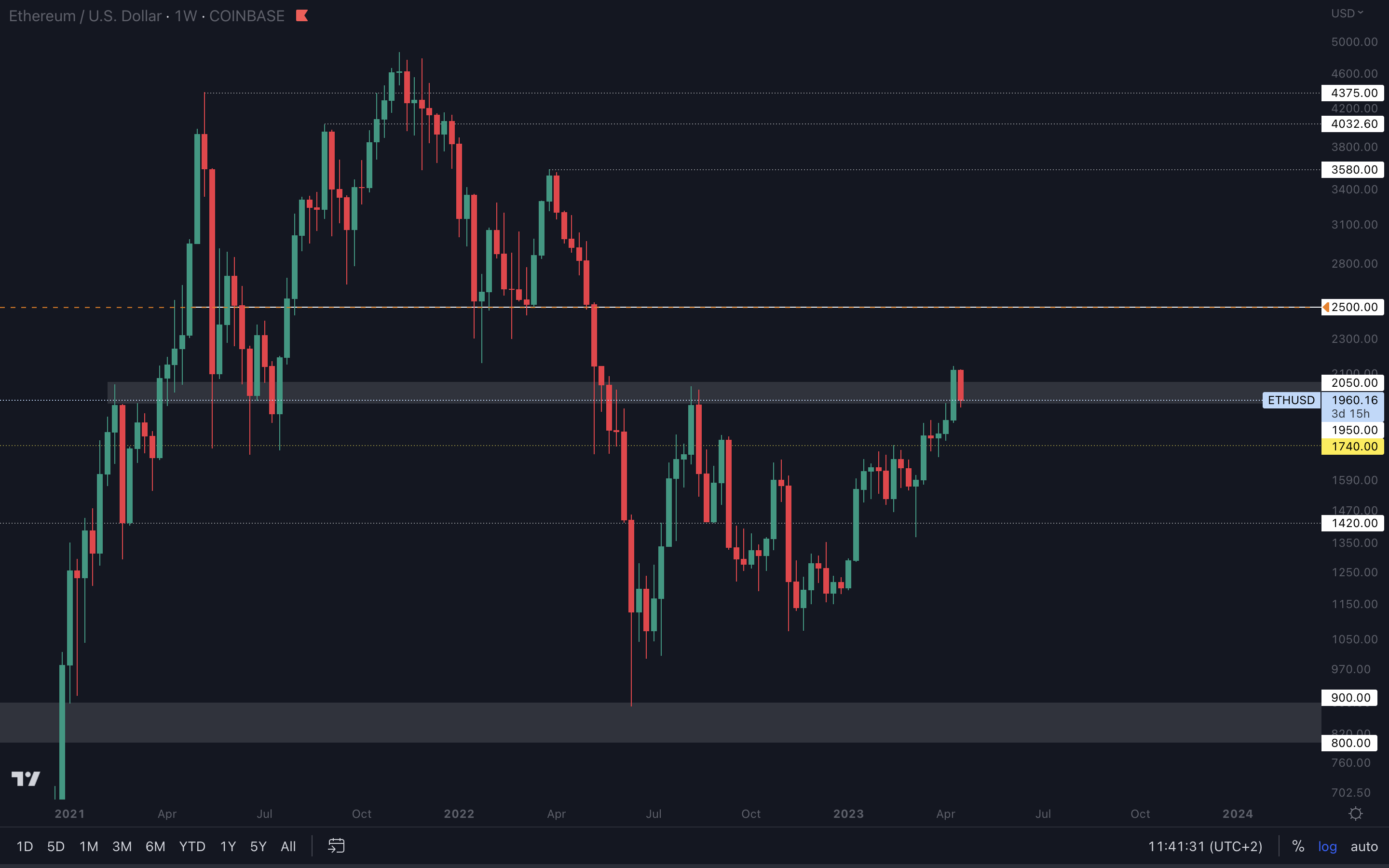

Ethereum | ETH (Weekly)

ETH is retesting the bottom of $2,050 - $1,950 region as support. This chart’s a little complicated. Let’s break it down:

Holding $1,950 as support on the weekly timeframe keeps the door open for $2,500. A weekly closure under this level will bring ETH back to $1,740 - and potentially lower.

This week’s closure is crucial for the market. Make sure you stay up to date in our Discord.

Binance | BNB (Weekly)

BNB finally broke above $335 last week. Unfortunately, it didn’t stay there long. Despite Bitcoin’s risk of heading down (and bringing the entire market with it), BNB is trading in a weekly market structure, and only a break of it will invalidate further upside. For this to occur, BNB will have to close a weekly candle under the small gray support area highlighted on the chart. On the brighter side, closing a weekly candle above $335 will put BNB on track for $430 - $460.

Ripple | XRP (Weekly)

After a solid performance a few weeks ago, XRP found resistance in the $0.50 - $0.54 region and has been ranging between these levels for the past weeks.

But there are some potential developments to watch:

- Bitcoin closing under $28,750

- Relative Strength Index (RSI) reaching a value of 70 on the weekly BTC chart

- XRP at resistance

Cardano | ADA (Weekly)

After last week’s performance, ADA marked a new weekly high, flipping the market structure from bearish to bullish. We highlighted this change using an arrow. For ADA to continue rising, $0.40 needs to hold on the weekly chart. If it doesn't, $0.30 will come very fast.

Dogecoin | DOGE (Daily)

After Elon Musk indulged in one of his free-time activities (changing Twitter’s logo to Doge) a couple weeks ago, the asset saw a high increase in volatility which continues to this day. Volatility is tempting, but it can make an asset very dangerous to play with. For that reason, we recommend avoiding DOGE even if you think it looks like an easy bet. It’s not. In confluence with the market, DOGE saw a significant decrease yesterday, but we can see that most of it is almost invalidated. This is a sign of demand, and we expect DOGE to reach $0.10 in the coming weeks if Bitcoin doesn’t lose $28,750 as support.

Polygon | MATIC (Daily)

We’ve highlighted a local supporting channel on MATIC’s daily timeframe. It’s apparent that this channel has been tested accurately multiple times in the past, so we’ll use this as our “guiding line” in the short-term. MATIC holding this channel as support keeps the door open for $1.30. A lower candle closure will push the asset down toward $0.76.

Solana | SOL (Weekly)

Last week SOL closed an almost full-bodied candle, suggesting high demand. Now the asset is back at support ($22) after yesterday’s market-wide drop. Upside to $30 can continue as long as SOL can hold $19 as support. That is the bottom of its current support area.

Polkadot | DOT (Weekly)

After DOT tested $7 as resistance, Bitcoin dropped - and that caused DOT to go lower as well. We’ve said this before - for upside to $8 - $9.65 and above to continue, DOT will have to close a weekly candle above $7. In the meantime, we should expect the asset to range between $6 and $7 until one of these levels is broken.

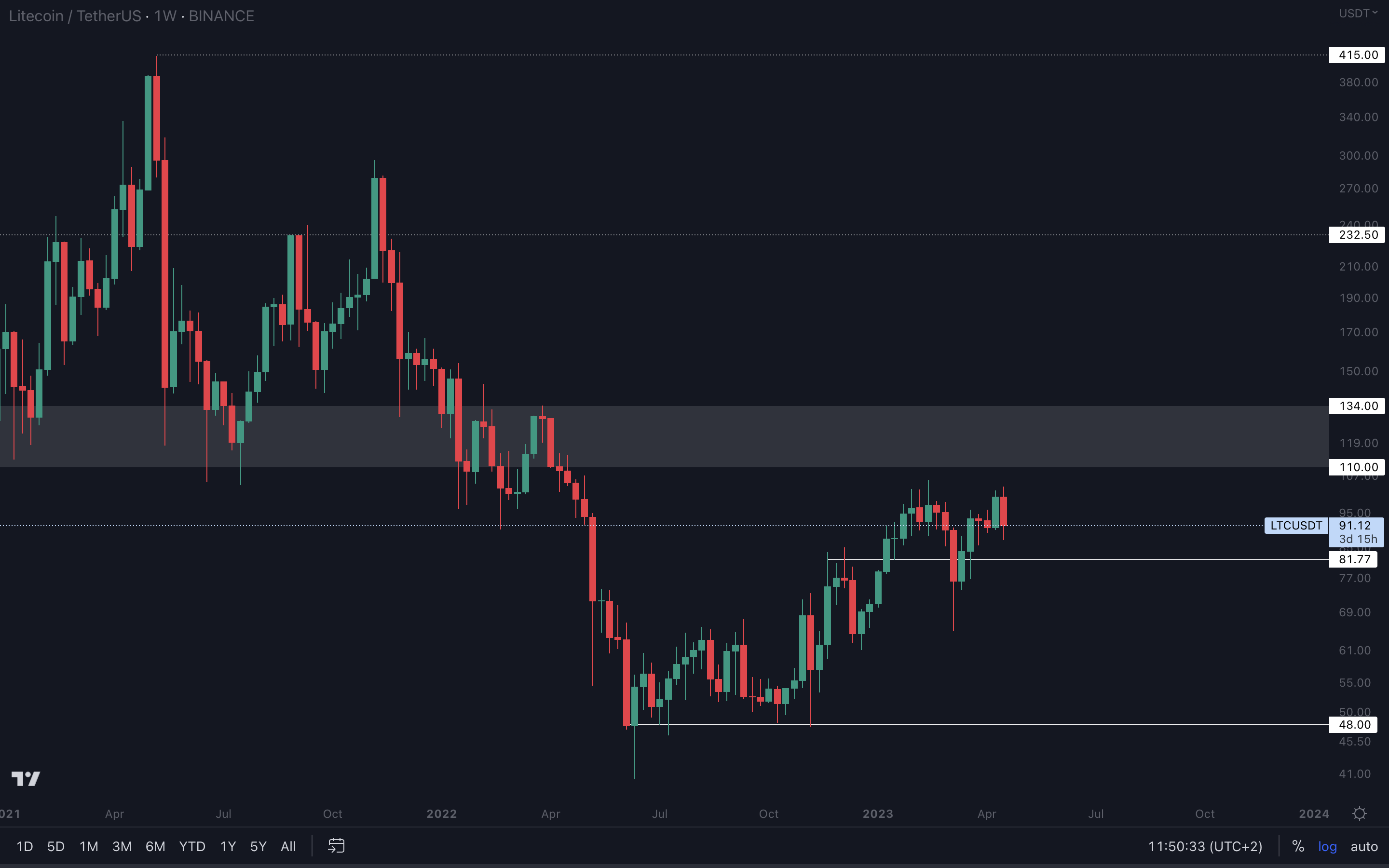

Litecoin | LTC (Weekly)

As long as $81.77 holds as support on the weekly timeframe, LTC can take a swing at $110 in the coming weeks. Bitcoin losing $28,750 as support and heading to $25,150 could result in a loss of the $81.77 support level for LTC, so caution is advised.

Cryptonary’s take 🧠

The market is on edge. Yesterday’s price action left us questioning whether the bulls have enough strength left to continue pumping the market. Our take?There are very high odds that we have seen a local top for the market. But we’re confident it will recover and go even higher in coming months.

All outcomes can be invalidated, and if Bitcoin flips $32,000 into support, that will invalidate any downside and the market could continue rising toward $35,000 and higher.

Action points 🎯

- We’re not as bullish as we were at the start of 2023. The market has more room to grow, but the risk/reward ratio has decreased since then.

- This week’s closures are very important, because most assets are in danger of losing support. Keep an eye out!