As always, macro governs all.

Below are the macro data points that will move the needle for crypto this week.

- Tuesday and Thursday: Earnings from big tech companies (Apple, Microsoft, Google, Amazon, Meta)

- Tuesday: JOLT's jobs data

- Wednesday: QRA from Yellen at the Treasury. This is super important – this is what sparked the rally on November 23

- Wednesday: Fed interest rate decision & Powell’s press conference

- Friday: Non-Farm Payrolls and Jobs data

This is a surprise. Jobs data would usually be the highlight of the week, but with a FED decision, a Powell Press Conference and a new QRA from Yellen at the Treasury, there are other "bigger" events this week.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Breaking down this week's jobs data

The jobs data is split into Tuesday and Friday.We have the JOLT's Job Opening on Tuesday, Non-Farm Payrolls, and the Unemployment Rate data on Friday.

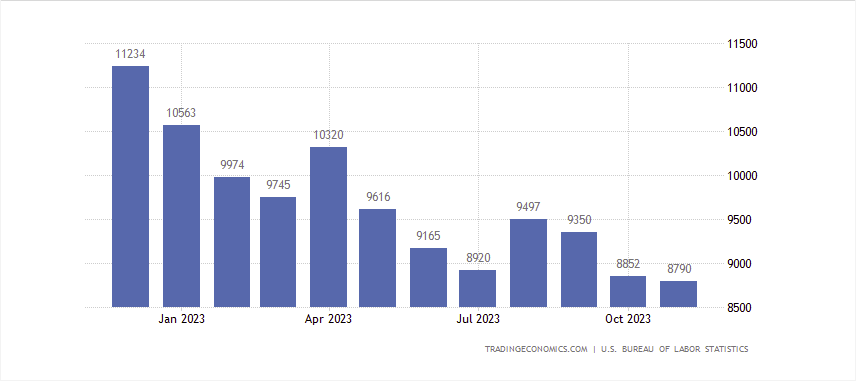

JOLT's Job Openings have been decreasing for four straight months while in a general downtrend over the past year.

The consensus is for 8.7m, slightly below the 8.79m from last month. If this print comes in at, close to, or above 8.7m, the market will likely take this positively as it'll show a labour market that is still more than holding up despite there being some early cracks beneath the surface.

A meaningful upside print will likely be taken positively by markets.

Friday's jobs data

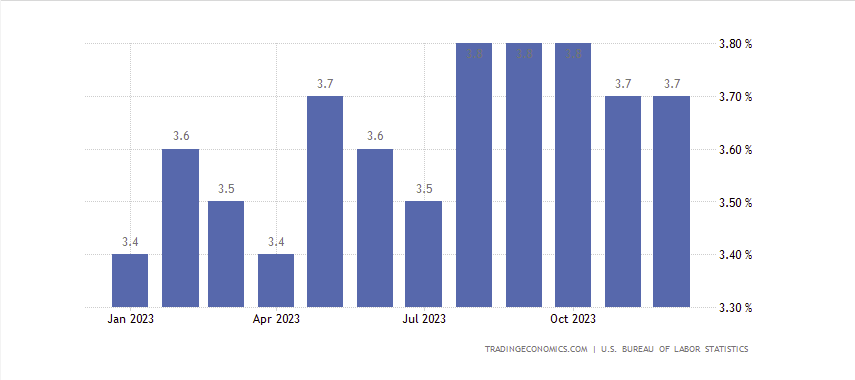

Non-Farm Payrolls and the Unemployment Rate.Non-Farm Payrolls data is expected to come in around 175k, less than the 216k last month. Alongside this, the Unemployment Rate is expected to come in at 3.8%, a 0.1% increase on last month’s print of 3.7%. If these numbers come in at or around consensus, then markets will likely take both positively as it indicates a labour market that, for now, is still holding up.

However, suppose we see Non-Farm Payrolls come in materially weaker (a lower number) or the Unemployment Rate came in at 3.9% or higher.

In that case, the market will likely not react too well to this as this would then look like the first major sign/data print that shows a labour market that may be beginning to turn.

Earnings from Big Tech companies

This is a section we'll keep relatively light.Q4 was the first quarter of 2023, where earnings analysts had estimated positive earnings from corporations. Therefore, there is a slightly higher expectation bar for earnings to beat for this earnings season.

In the majority, corporates have been beating earnings estimates with the stock price then reacting positively to the news. We will need to see if the Big Tech companies can do the same. If they can, and we think they can, then the S&P as a whole will likely react positively and move slightly higher over this week.

The big days this week for earnings are Tuesday and Thursday. Companies will report after the bell, i.e., after the stock market closes on those days.

Quarterly refunding announcement from the treasury

In the last QRA on November 1, 2023, the forward-guided issuance was less than expected. It meant fewer than expected Coupons and Bonds would be issued, and Bills (notes with maturities of less than 12 months) would get the majority of issuance. This caused demand for the longer duration Bonds to increase, pushing Yields lower, and risk assets took off.Less issuance and increasing Bill issuance meant the RRP would continue to be drained, which meant liquidity would stay net positive.

Hence, we've seen the rally in risk that we've seen over the prior few months. The market now expects that issuance of Coupons (notes with a maturity of between 1 and 10 years) will pick up, to offset the recent massive issuance in Bills.

Other than this, the markets will be watching the Fed for any forward guidance on QT and a taper of QT, along with any guidance on treasury buybacks. This is a form of QE. It would likely be light. But essentially, the first half of the year is more predictable with notes issuance.

We're watching out for any guidance on the taper of QT and potential treasury buyback programs that may be forward-guided for when the RRP is depleted.

Fed interest rate decision and Powell’s press conference

It's 99% likely the Fed keep the interest rate unchanged in Wednesday's meeting. However, the event to watch will be Powell's Press Conference and what forward guidance is given to a potential rate cut at the March meeting, along with any clues/mentions of tapering QT.For now, the Fed's interest rate cuts shouldn't be considered bullish dovish. They should be seen as the Fed doing its job to keep rates restrictive but less restrictive than they are currently. Real Rates are very restrictive as we speak. Inflation is at 3.4% but running at a three-month annualised rate of 1.8%.

So, with the Interest Rate at 5.5%, the Real Rate is at 2.1% if you take the Inflation rate of 3.4%. This is too restrictive and will likely cause damage to the economy if it remains. But, if the Fed can lower the Interest Rate by 0.5% by 2 x 25bps over two meetings in the first half of 2024, this would bring the Real Rate down to 1.6%, still restrictive, but not so restrictive that it's really squeezing the economy.

Even though these would be rate cuts, they would make the Real Rate less restrictive, not ease or boost the economy. The Fed are still in an inflation battle, and with Goods Inflation likely to significantly rear up in the coming months due to the shipping issues in the Red Sea, rates need to remain restrictive for now but less restrictive than they are currently. So, we should expect a couple of rate cuts to bring the restrictive rate down slightly but keep Real Rates restrictive so the Fed can continue down a diligent path in the inflation battle.

Regarding QT, it’s hard to know the Fed's plans here. But the markets will be watching this closely in this meeting to see if Powell forward guides the market on this.

The expectation is that the Fed will need to taper QT (reduce the amount of monthly balance sheet runoff) sometime in April or May following the draining of the RRP in late March - it looks likely that the RRP will have depleted to $0 come the end of the March.

Cryptonary's take

How is the crypto market likely to react to all these?

In terms of potential market-moving events this week, the top candidates are if the data (Jobs data) comes in much hotter or weaker than expected. Big Tech earnings also fall into this category.

But what will most likely move the markets is if there are significant messages in the forward guidance from Powell – particularly on the back of the QRA on Wednesday morning.

For example, if Powell indicates that the Fed is considering a March rate cut, and she also talks about a tapering of QT – that will be particularly bullish for risk assets.

An early taper to QT takes some pressure off the liquidity picture, with the RRP likely to deplete in the coming months.

If we get the above, we see crypto performing relatively well this week, although we still struggle to see BTC breaking above $43,200, let alone the $44,000 horizontal resistance.

Of course, we can be wrong on this, but we feel relatively confident about this.

If we see an upside, we feel that it'll come from the altcoins rather than BTC, but again, we don't see many major breakouts occurring.

We mostly see altcoins running higher into key horizontal levels, which will be the telling point for the market in the future.

Let's see. Either way, it is a huge week for crypto, and the macro markets will likely tell us the picture as we advance for the next few months.

Looking forward to digesting it all. Stay vigilant; we still have enough time to build positions going into the halving with many macro hiccups that could give us prime entries.

Let's go!