JUP and INJ test support amid pullback

As the market stabilizes after a significant pullback, Jupiter ($JUP) and Injective ($INJ) hold firm at key support levels. Let's explore how these assets are positioned for potential rebounds or further tests of support.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Jupiter:

Overview

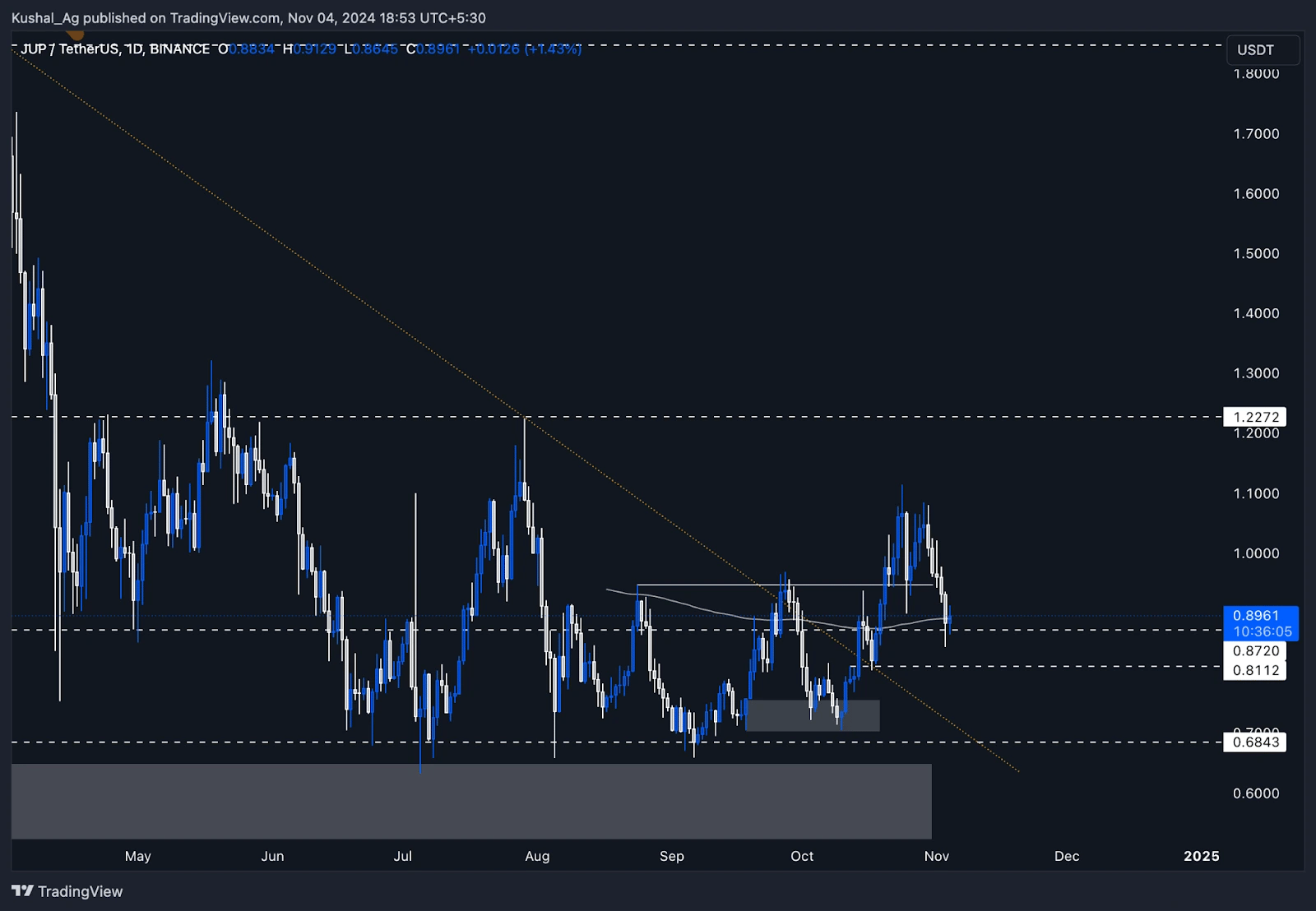

Jupiter ($JUP) has been consolidating alongside the wider market, which recently saw Bitcoin hit a high of $68k before retracing to $67.5k. This pullback affected many assets, including $JUP, which had been holding steady just above the $1 mark. However, as the market pulled back, $JUP dipped below the $1 level, challenging key support zones.Daily timeframe analysis

Currently, $JUP is trading around $0.891, aligning with its 200 EMA on the daily timeframe-a historically strong support level. This area is also bolstered by the previously identified support zone around $0.872, which has proven reliable in the past and continues to act as a solid cushion for $JUP. This confluence between the 200 EMA and the $0.872 level adds strength to this support zone, potentially positioning it as a base for the next move.After testing the $0.94 level as support, which unfortunately did not hold, $JUP found its footing in this lower support range. With the wider market stabilising, there's a chance for $JUP to regain momentum if it can maintain this support and bounce upward.

On the downside, if there's a further market pullback, $JUP may retest the $0.811 level as its next support zone. However, as long as the 200 EMA at $0.891 holds strong, this level is likely to serve as a crucial base.

Potential scenarios

- Bullish continuation: Should $JUP hold above the 200 EMA and $0.872 support, we could see a rebound, with the next key resistance at the $1.1 level. Breaking above this would mark a positive structural shift, opening the path for a continued rally.

- Downside risk: A sustained break below $0.872 could lead $JUP to retest the $0.811 level, especially if there's additional market pressure.

Cryptonary's take

With the current market sentiment favouring a potential recovery, $JUP's positioning at the 200 EMA is promising. The asset appears primed for a bounce if it can secure support here, making it an interesting watch for possible short- to medium-term gains. As always, monitoring the wider market's stability will be crucial to gauge $JUP's likelyInjective:

Overview

In trading assets like Injective, it's essential to consider the higher time frames to understand the asset's medium- to long-term potential. We last analysed $INJ on the 3D time frame when it was trading just above the $19 level. At that time, it was taking resistance from the 200 EMA on the 3D chart, an area that has proven pivotal.Since then, $INJ dipped back into its 3D demand zone, marked as a blue box on the chart, which ranges from $17.35 to $15.5. This deeper mitigation within the demand zone has shown a healthy reaction and solidified it as a strong support region.

3-day time frame analysis

- Demand zone reaction: After rejecting from the 200 EMA at approximately $19.57, $INJ retraced and entered the 3D demand zone (marked in blue), reaching as low as $16.14 before finding a strong buying interest. This deeper interaction with the demand zone reinforces it as a solid foundation, providing a healthy base for potential upward movement.

- Current positioning: $INJ is currently trading around the $17 level, indicating a positive reaction from the blue demand zone. The demand zone ($17.35 - $15.5) remains critical as a support region, and continued support here could set the stage for a pushback toward the $19.57 area.

- 200 EMA resistance: On the upside, the 200 EMA on the 3D time frame, sitting at $19.57, is the first major hurdle for $INJ. A break and consolidation above this EMA would be a significant positive indicator, potentially flipping it from resistance to support.

Potential scenarios

- Bullish scenario: Should $INJ continue to hold above the blue demand zone and make its way back toward the $19.57 level, a successful break above the 200 EMA could lead to a stronger upside move. In this case, we could see $INJ targeting higher resistance levels, aligning with a positive market structure.

- Bearish scenario: If the broader market remains weak and $INJ fails to maintain support within the blue zone, there's a possibility for a deeper pullback. However, the 3D demand zone is expected to hold a significant level for buyers.

Cryptonary's take

Injective's position within its 3D demand zone and proximity to the 200 EMA on this larger time frame makes it a key area to watch. If $INJ can establish support and reclaim the 200 EMA as a support level, it could provide a foundation for a robust move-up.Monitoring the asset's interaction with these levels, along with broader market conditions, will be essential for understanding $INJ's next phase. For now, Injective's structure on the 3D time frame continues to show potential for both strength and resilience in the mid-term.