Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview

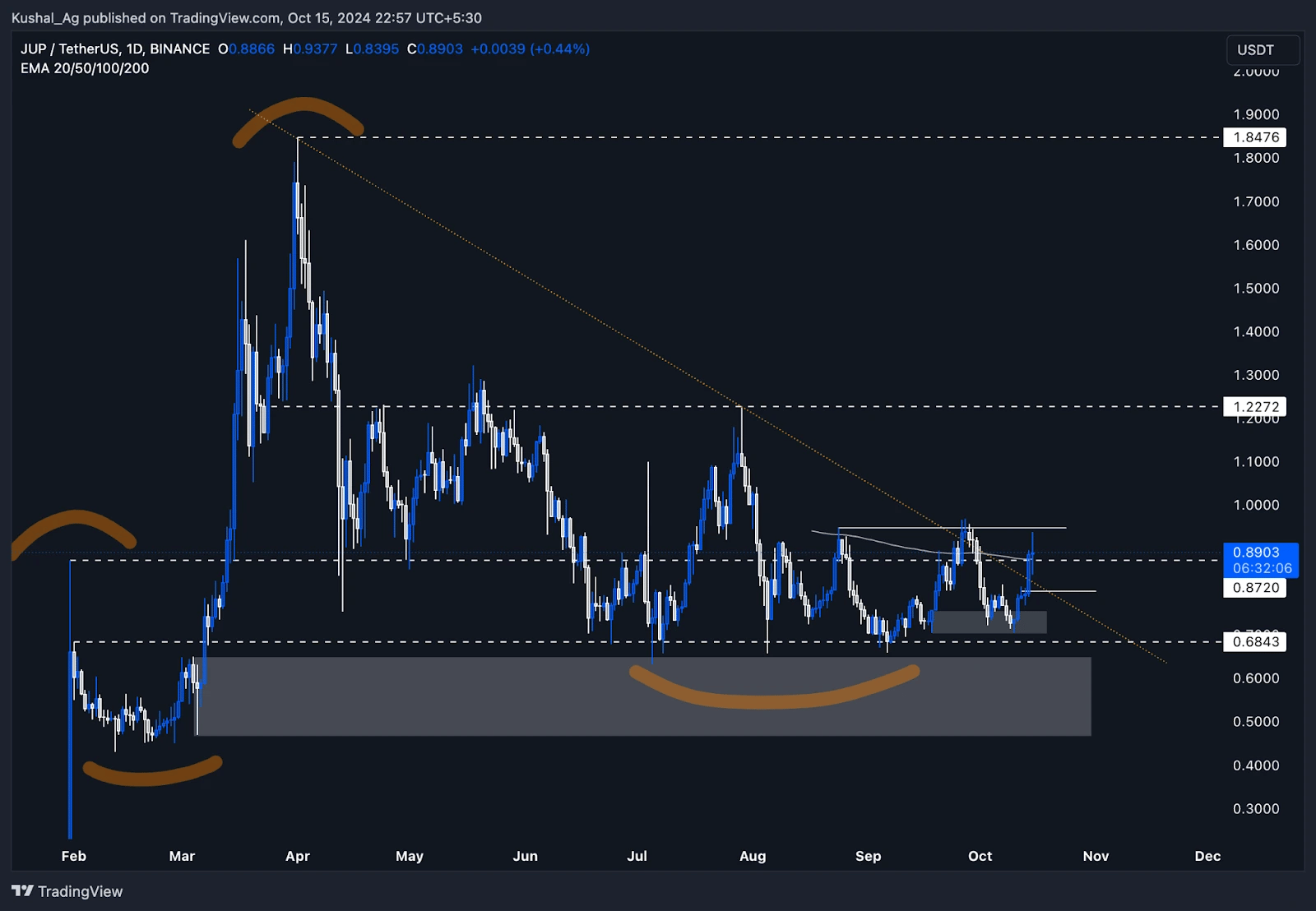

Jupiter ($JUP) has been showing some promising movements in the last two weeks, especially after our previous analysis earlier this month. The asset has been consolidating and forming key support and resistance levels on the daily time frame, indicating potential momentum for an upside move if critical resistances are broken.Daily chart analysis

At the time of our last analysis, Jupiter was pulling back into a demand zone between $0.75 and $0.70, which is a key area of support in the lower time frame. The price has reacted positively from this zone, confirming it as a strong support level.- Support zone: Jupiter took a strong bounce from this demand zone around October 4th and made another deeper test on October 10th, pushing into the lower part of the zone before reversing upwards.

- Price movement: After the second test, Jupiter saw a 25-30% bullish swing to the upside, indicating strong buying interest at these levels.

- Current levels: As of today, Jupiter is attempting to sustain above the $0.87 level, which is also where the 200 EMA lies on the daily chart. This level is crucial as maintaining price action above the 200 EMA would confirm strength and signal further bullish momentum.

- Jupiter is currently facing rejection around the $0.94 level, a key resistance area that has been marked previously.

- If Jupiter manages to break and hold above this $0.94 resistance, it could open the door for a rally toward $1.2 in the coming weeks.

- In case of a pullback, the $0.8 area represents a key retest level, aligning with the orange trendline. This zone would serve as a healthy retracement and accumulation point before another potential upward move.

Cryptonary's take

Jupiter is currently in a critical phase. The price has been reacting positively from strong demand zones, and now it's a matter of whether it can sustain above $0.87 and break the resistance at $0.94. If it manages to break through and consolidate above, we could see a significant move toward $1.2 and beyond in the medium term.However, traders should keep an eye on the 200 EMA and the $0.87 level. If the price fails to hold here, a pullback to $0.8 or even lower could be likely. Overall, Jupiter is looking strong but will need to confirm strength through key breakout levels to see further upside.