Kaspa and RUNE technical analysis: Can they break key resistance?

As Kaspa consolidates near $0.13 and RUNE tests $3.3, both assets are eyeing critical resistance levels. Let's dive into their technical analysis and explore the potential for breakout opportunities in the coming weeks.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

KASPA:

Market context

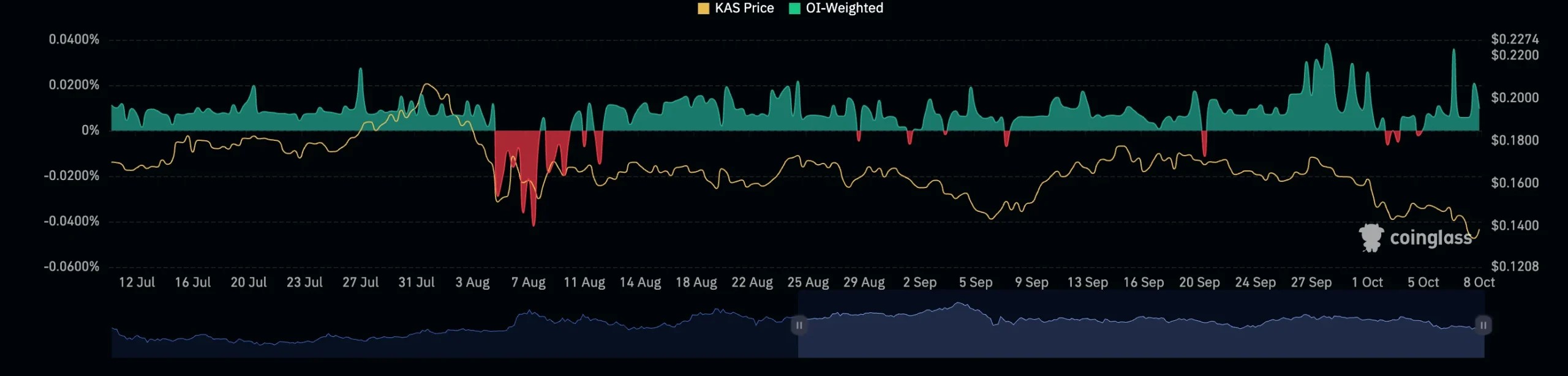

Kaspa has been one of the strongest assets this cycle in terms of structure, consistently respecting higher highs and higher lows. The 0.13 price point is the significant level in play, with the highs at 0.189 acting as resistance.We've seen consistent buying pressure around 0.13, where buyers have stepped in multiple times, making this a key area for accumulation. On the 6th of October and the 29th of September, spikes in open interest and funding rates led to some sell-offs.

Despite this, the positive funding rate during those periods indicated that buyers were still interested in accumulating Kaspa with leverage (risk on), which shows strong interest in the asset on the buy side. Now that the price is trading around 0.13 and the funding rate and open interest have reset to healthier levels, we could expect more bids to come in at this key level.

Historically, this level has shown strong buying activity, including a significant recovery on the 5th of August after a drastic sell-off, where Kaspa rebounded with a bullish candlestick that saw a 30% move. This is not an asset we're invested in, but its structure and price action make it one to watch, and with many requests on Kaspa, it's worth covering. The significant selling pressure at the 0.189 level suggests a key resistance zone that, if broken, could lead to significant upside.

Liquidation heat map

Over the last 3 months, there has been a significant build-up of short positions above the 0.18 level. This suggests that if Kaspa can break out above this price point, we could see a short squeeze, which would push the price higher. The 0.189 level is particularly key, as it has seen heavy selling pressure. If this level is cleared, it's likely we'll see a swift move upwards.

Weighted funding rate

Positive funding rate spikes on the 6th of October and 29th of September show that buyers were actively bidding on Kaspa with leverage. The current reset of the funding rate suggests a healthier state for fresh bids to come in.

Open interest

During the sell-offs, open interest spiked, showing significant activity from both buyers and sellers. Now, with open interest resetting, it's likely we'll see more buying pressure at the 0.13 level.

Playbook

Key levels

- Support: 0.13

- Resistance: 0.189

- Long-term target: 0.3 (with potential upside after 0.189)

Spot setup

Kaspa is currently range-bound between 0.13 and 0.189. Accumulating around 0.13 provides a solid opportunity, with the potential for a breakout above 0.189 to target 0.3. If Kaspa can reclaim 0.189 and break into price discovery, we will likely see a move to these levels when BTC begins to gain more traction towards November, especially considering the build-up of short positions above 0.18.Risk management

The key is to accumulate around 0.13. If this level fails, it's a signal to reassess. A breakout above 0.189 would provide the confirmation needed for a larger bullish move. Failure to break 0.189 could result in more sideways action or a retrace.Market sentiment

Kaspa has shown strong buying pressure at key levels, and with the funding rate and open interest resetting, this is a healthy zone for accumulation. The potential for a short squeeze to short term liquidation levels on the 48 hour above 0.15, combined with bullish market structure, makes this asset one to keep an eye on, even if we aren't currently positioned in it.

Cryptonary's take

Kaspa's price action is showing solid strength. With key levels at 0.13 and 0.189 in play, this is a strong accumulation zone. A breakout above 0.189 would signal a major shift, with the potential to target the highs and beyond. This is one to watch closely for the next move, as the asset is well-positioned for upside, provided it can break key resistance.RUNE:

Market context

RUNE is an asset we've been watching closely, especially after the live video session with Abro, where we analyzed the significance of head and shoulder patterns. What we noticed during the live is that both a head and shoulders and an inverted head and shoulders have formed on RUNE.Since the 20th of May, when RUNE sold off from $7, it has been in a bearish structure. We set a swing low into the $3.3 price point, a swing high around $5, and then another swing low down to $2.5, forming the head of the head and shoulders pattern. The right shoulder formed around the $3.3 price point, which was again well-respected.

From there, RUNE bounced up over 75%, reclaiming key psychological levels at $4.5 and $5. These price points have been significant in previous price action, as seen with the buying pressure back in early March and around April. The fact that we are reclaiming these levels suggests that RUNE may be poised for a sharp move back toward $7.2.

If we break through that level, the next key target will be the highs around $11. Based on what we've discussed in the live session, this head and shoulders pattern represents a potential reversal, offering a key opportunity for a move to the upside.

With bullish momentum expected to return to the markets in November, this could present a strong setup to take advantage of, especially as capital flows increase. RUNE remains part of our C-Pro Picks, as it has strong fundamental utility and a solid community backing it.

Playbook

Key levels

- Support: $3.3

- Resistance: $4.5, $5, $7.2

- Mid-term target: $11

Trading setup

The $3.3 level has proven to be a key zone for accumulation, with prices bouncing 75% from this region. As RUNE continues to reclaim levels, a move up to $7.2 becomes more likely. Accumulating within the $4.5 and $5 range would position you for potential upside if we break through $7.2, with the next target being the $11 region.Risk management

The main area to watch is the $3.3 support zone. If this level fails, we'll need to reassess the structure. However, holding above this zone, with a reclaim of $5, provides a clear path toward $7.2 and possibly $11. Any pullbacks into the $4.5-$5 range could present a buying opportunity.Market sentiment

With strong buying pressure seen around key levels and the potential for capital flow to increase in Q4, RUNE is well-positioned for a bullish reversal. This head and shoulders pattern, combined with the broader market sentiment, sets RUNE up for a potential move to $7.2 and beyond.