Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market context

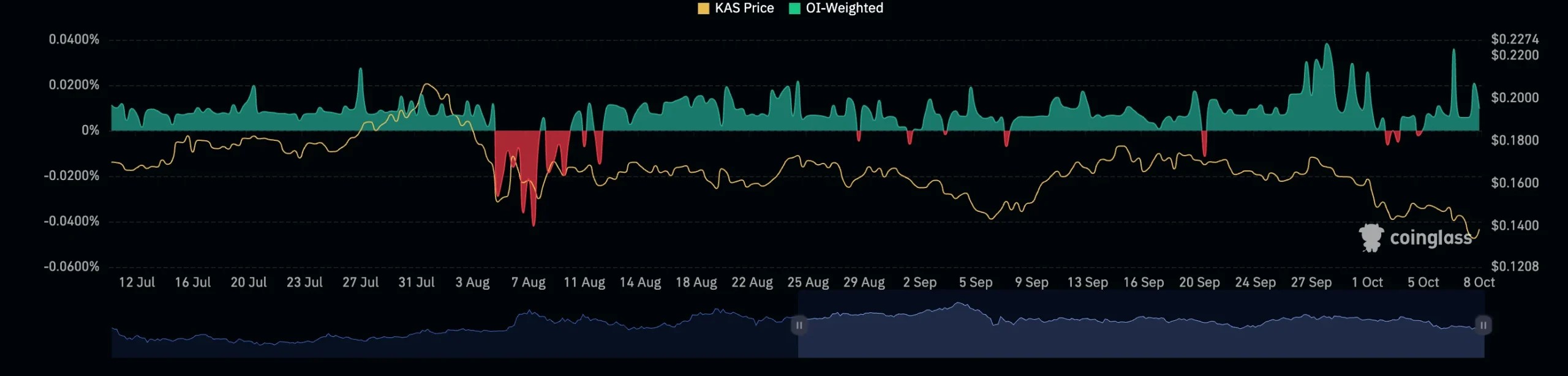

Kaspa has been one of the strongest assets this cycle in terms of structure, consistently respecting higher highs and higher lows. The 0.13 price point is the significant level in play, with the highs at 0.189 acting as resistance.We've seen consistent buying pressure around 0.13, where buyers have stepped in multiple times, making this a key area for accumulation. On the 6th of October and the 29th of September, spikes in open interest and funding rates led to some sell-offs.

Despite this, the positive funding rate during those periods indicated that buyers were still interested in accumulating Kaspa with leverage (risk on), which shows strong interest in the asset on the buy side. Now that the price is trading around 0.13 and the funding rate and open interest have reset to healthier levels, we could expect more bids to come in at this key level.

Historically, this level has shown strong buying activity, including a significant recovery on the 5th of August after a drastic sell-off, where Kaspa rebounded with a bullish candlestick that saw a 30% move. This is not an asset we're invested in, but its structure and price action make it one to watch, and with many requests on Kaspa, it's worth covering. The significant selling pressure at the 0.189 level suggests a key resistance zone that, if broken, could lead to significant upside.

Liquidation heat map

Over the last 3 months, there has been a significant build-up of short positions above the 0.18 level. This suggests that if Kaspa can break out above this price point, we could see a short squeeze, which would push the price higher. The 0.189 level is particularly key, as it has seen heavy selling pressure. If this level is cleared, it's likely we'll see a swift move upwards.

Weighted funding rate

Positive funding rate spikes on the 6th of October and 29th of September show that buyers were actively bidding on Kaspa with leverage. The current reset of the funding rate suggests a healthier state for fresh bids to come in.

Open interest

During the sell-offs, open interest spiked, showing significant activity from both buyers and sellers. Now, with open interest resetting, it's likely we'll see more buying pressure at the 0.13 level.

Playbook

Key levels

- Support: 0.13

- Resistance: 0.189

- Long-term target: 0.3 (with potential upside after 0.189)

Spot setup

Kaspa is currently range-bound between 0.13 and 0.189. Accumulating around 0.13 provides a solid opportunity, with the potential for a breakout above 0.189 to target 0.3. If Kaspa can reclaim 0.189 and break into price discovery, we will likely see a move to these levels when BTC begins to gain more traction towards November, especially considering the build-up of short positions above 0.18.Risk management

The key is to accumulate around 0.13. If this level fails, it's a signal to reassess. A breakout above 0.189 would provide the confirmation needed for a larger bullish move. Failure to break 0.189 could result in more sideways action or a retrace.Market sentiment

Kaspa has shown strong buying pressure at key levels, and with the funding rate and open interest resetting, this is a healthy zone for accumulation. The potential for a short squeeze to short term liquidation levels on the 48 hour above 0.15, combined with bullish market structure, makes this asset one to keep an eye on, even if we aren't currently positioned in it.