Technical Analysis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

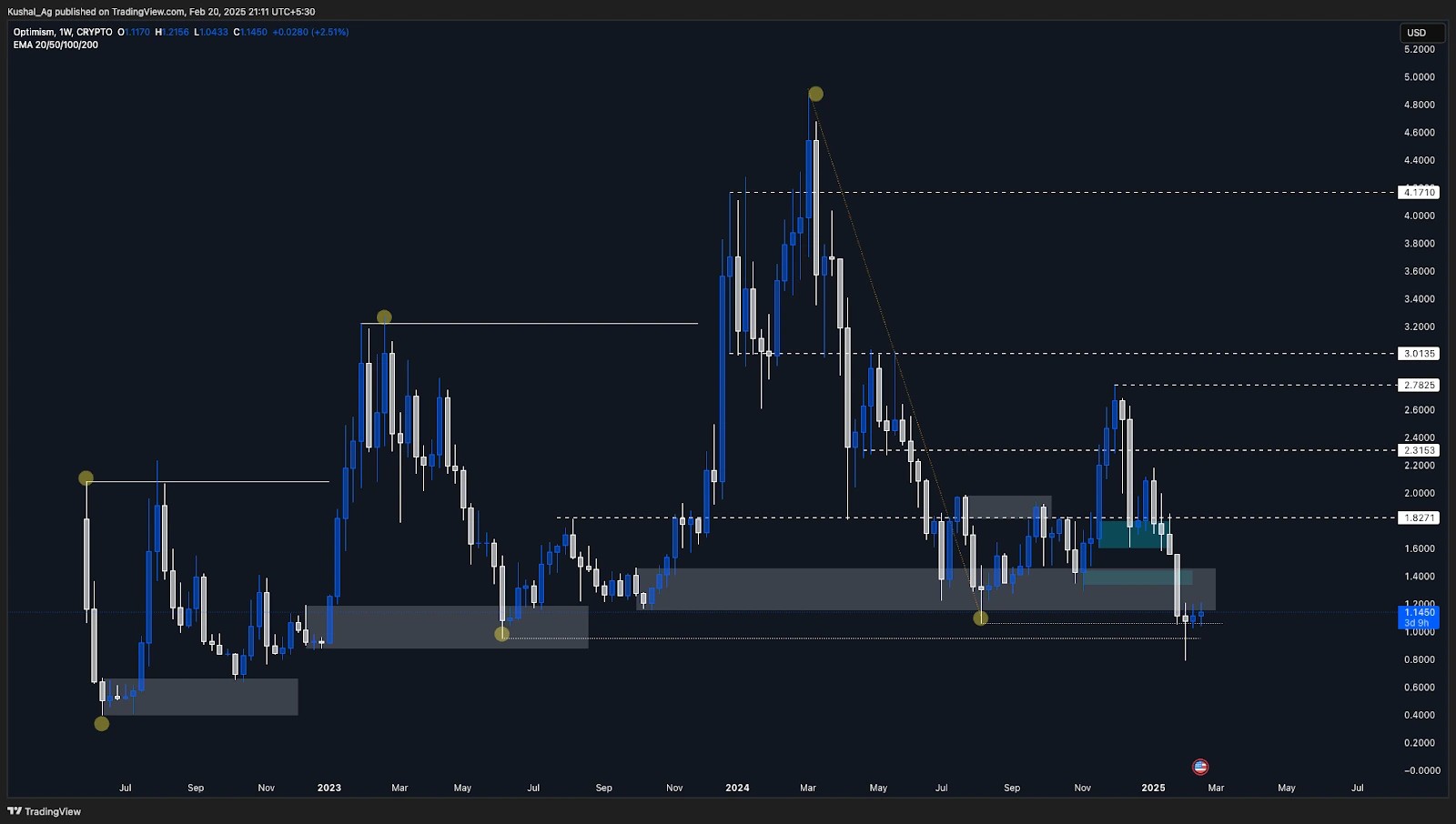

Optimism ($OP):

Overview

Optimism ($OP) has managed to hold above key structural lows, as indicated by the yellow dots and the extended dotted line, marking significant support levels around $1.06 on the weekly timeframe. This area has historically acted as a strong accumulation zone, and OP is currently trying to establish a base at this level.With the wider market still uncertain, OP's ability to consolidate above this region will determine its next major move.

Analysis & key levels

- Support levels:

- $1.06 → Key structural low, holding for now.

- $0.95 - $0.80 → The next major demand zone if the price fails to hold above $1.06.

- Resistance levels:

- $1.82 → First key upside resistance if OP starts grinding up.

- $2.31 → A major level to reclaim before any larger bullish trend shift.

Potential scenarios

- Bullish scenario:

- OP holds above $1.06 and slowly grinds up toward $1.82.

- This would indicate strength in accumulation, and if wider market conditions improve, we could see a push toward $2.31.

- Bearish scenario:

- If OP loses the $1.06 level, we could see further downside toward $0.95 - $0.80.

- This would indicate continued weakness, and OP might take longer to recover.

Cryptonary's take

OP has held key structural lows, but failing to maintain this range could lead to a deeper pullback. The $1.06 level is critical, and if it remains intact, OP could slowly grind toward $1.82 in the coming weeks.However, a break below $1.06 would suggest further downside risk, bringing $0.95 - $0.80 into play. Right now, waiting for confirmation is key, and watching how OP interacts with this support zone will determine the next move.

Chainlink ($LINK):

Overview

Chainlink ($LINK) has been chopping inside a range, moving between $19.20 resistance on the upside and $16.54 support on the downside. This consolidation phase has lasted for some time, with price action showing low volatility as LINK continues to hover inside this channel.Adding to the chop, the 200 EMA on the daily timeframe, currently positioned at $18.215, is aligning closely with the price at $17.90, further reinforcing this range-bound structure.

Analysis & key levels

- Support levels:

- $16.54 → Key support level, holding price inside the range.

- $12.51 → Larger support zone in case of a market-wide pullback.

- Resistance levels:

- $19.20 → First key resistance that needs to be reclaimed.

- $22.87 → The next major resistance if $19.20 is flipped.

Potential scenarios

- Bullish scenario:

- If $19.20 resistance is broken, we can expect a rally toward $22.87.

- This would indicate a shift in momentum, leading to higher prices potentially $27.2 in the medium term.

- Bearish scenario:

- If $16.54 fails to hold, we could see a deeper pullback toward $12.51.

- This would likely happen if Bitcoin and the broader market correct further.

Cryptonary's take

LINK is in consolidation mode, with choppy, range-bound movement between $16.54 and $19.20. A clear breakout above $19.20 would signal strength and a potential move toward $22.87, but until then, more sideways action is expected.On the downside, if support fails, we could see a drop toward $12.51, but that scenario depends largely on broader market conditions.