Market Direction

A break above the downtrend line of the wedge and the local resistance of $15.13 could see LINK shoot to $17.74.

TLDR

- Chainlink is bouncing between support at $13.34 and resistance at $15.13.

- It is stuck in a large pennant/wedge pattern that typically leads to a volatile breakout.

- Indicators like funding rates and RSI reset to neutral levels.

- Bitcoin price action will likely dictate Chainlink's next major move.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

LINK 4hr

Technical analysis

- LINK is ranging between the key support at $13.34 and $15.14.

- LINK is also in a wedge pattern that may have a more volatile move on a breakout.

- The RSI on all timeframes has reset substantially, with even the 3D timeframe out of overbought territory. However, the Weekly does remain overbought for now.

- A break of the key range will likely produce a volatile move. We will continue to assess price as it squeezes into the pinpoint.

Market mechanics

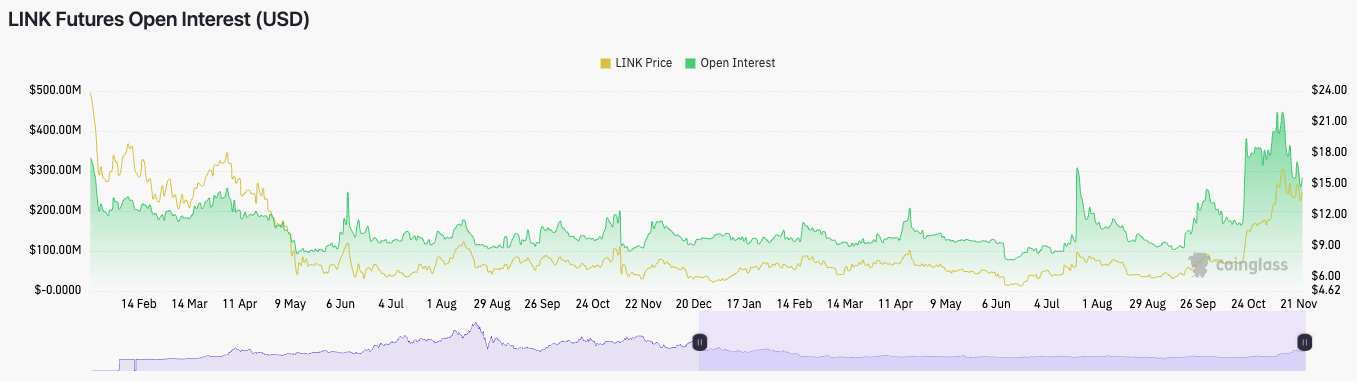

In terms of mechanics, it’s much improved and far less overheated than it was a week ago.- The Open Interest dropped from $447m a week ago to $284m today. This is now back to healthier levels and far less overheated than it has been. A lot of the excess leverage has been flushed out.

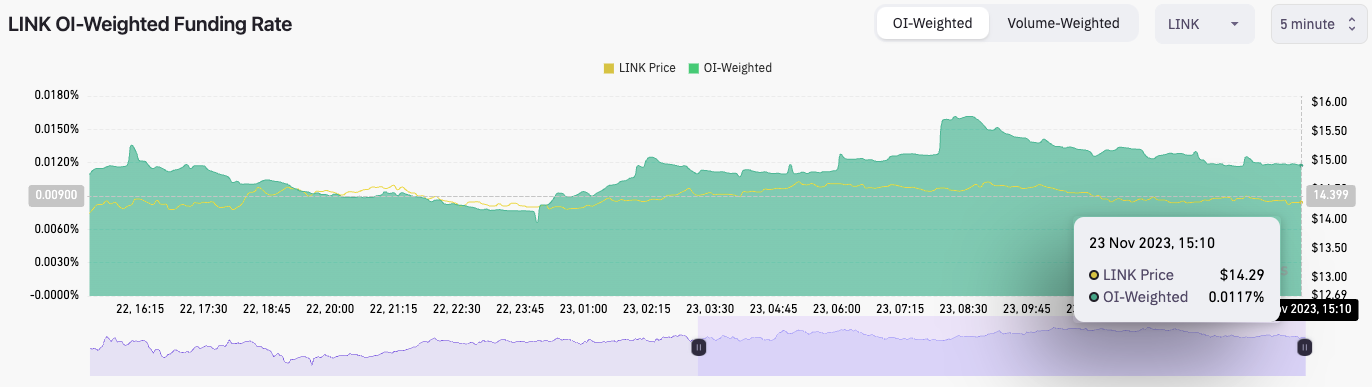

- The OI-Weighted Funding Rate has reset to neutral levels around the 0.012% mark, so there is a slight bias to be Long rather than Short, but overall, positioning is relatively even.

- The Long/Short Ratio is at 0.9589, indicating a bias among participants over the past 24 hours to go Short rather than Long. However, with the Funding Rate moving increasingly positive, we’re likely seeing bigger players Long here while more of retail is Short. However, this isn’t excessive here and may not play out volatilely.

Cryptonary’s take

The general market will likely be led by Bitcoin here, and LINK will likely remain range-bound until Bitcoin makes a meaningful move again.If Bitcoin can hold up, then LINK is set up to break to the upside of its wedge pattern and push onto $17.75.

If there is a pullback to the lower supports of $11.50, we would be DCA buys of LINK with a 12-18 month time horizon.