Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Rate cut decision

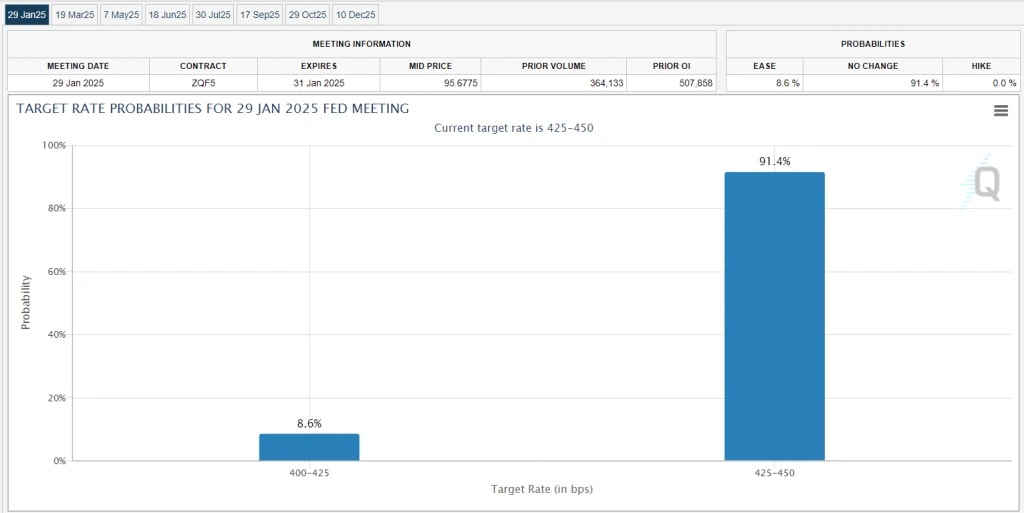

We got the 25bps Rate cut as we (and the market) expected. The interesting part here is the updated Summary of Economic Projections. The market has been pricing for two interest rate cuts for 2025. In the FED's last Summary of Economic Projections (back in September), the FED expected four interest rate cuts for 2025.In the newly released SEP (just released), the FED is expecting two interest rate cuts for 2025. This is a surprise; we thought they'd signal three cuts for 2025. However, fewer cuts are good also as it means growth is positive. As a result, the market is pricing no cuts in Jan 2025 as of now and looking for Powell's speech.

Post Powell speech

The market really doesn't like some of Powell's comments there. The market is now potentially considering just 1 or 2 more cuts, however, the bar to now cut rates further (or more than the markets expect) in 2025, is really low. We're seeing this as the FED looking to get ahead of potential inflationary policies from Trump.As hard as this is to watch (price action wise), this doesn't actually change a lot. The on-chain metrics aren't close to overheated levels, and we're moving into a really positive period with Trump coming in and changing the regulatory outlook around Crypto.

For now, we are still holding, and these drawdowns, particularly in the memes, are still typical. But, yes, we have absolutely got this wrong in terms of this kind of drawdown that we didn't expect. However, it doesn't change the long-term thesis. We're now seeing memes, and even some Majors, close to oversold territory. In our opinion, this certainly isn't the time to sell. We continue holding, despite how hard this is to watch.

We'll release a new report on Friday.

Peace!

Cryptonary, OUT!