Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

In this report:

- What Happened?

- Why This Matters?

- Powell's Potential Stance at Jackson Hole?

- Majors and Their Key Price Levels.

- Actionables and Cryptonary's Take.

What Happened?

On Wednesday, we had the release of the FED Minutes. Now note that the Minutes are from the last FED Meeting, which came just before the bad labour market data, so anything in these Minutes is going to be without the knowledge of the bad labour market data that came out just a few days after the FED Meeting.Let's cover some key points:

- Members suggested that they weren't prepared to cut in September (this is pre-negative labour market data, though).

- Several FED members noted concerns about how elevated asset valuations were.

Why This Matters?

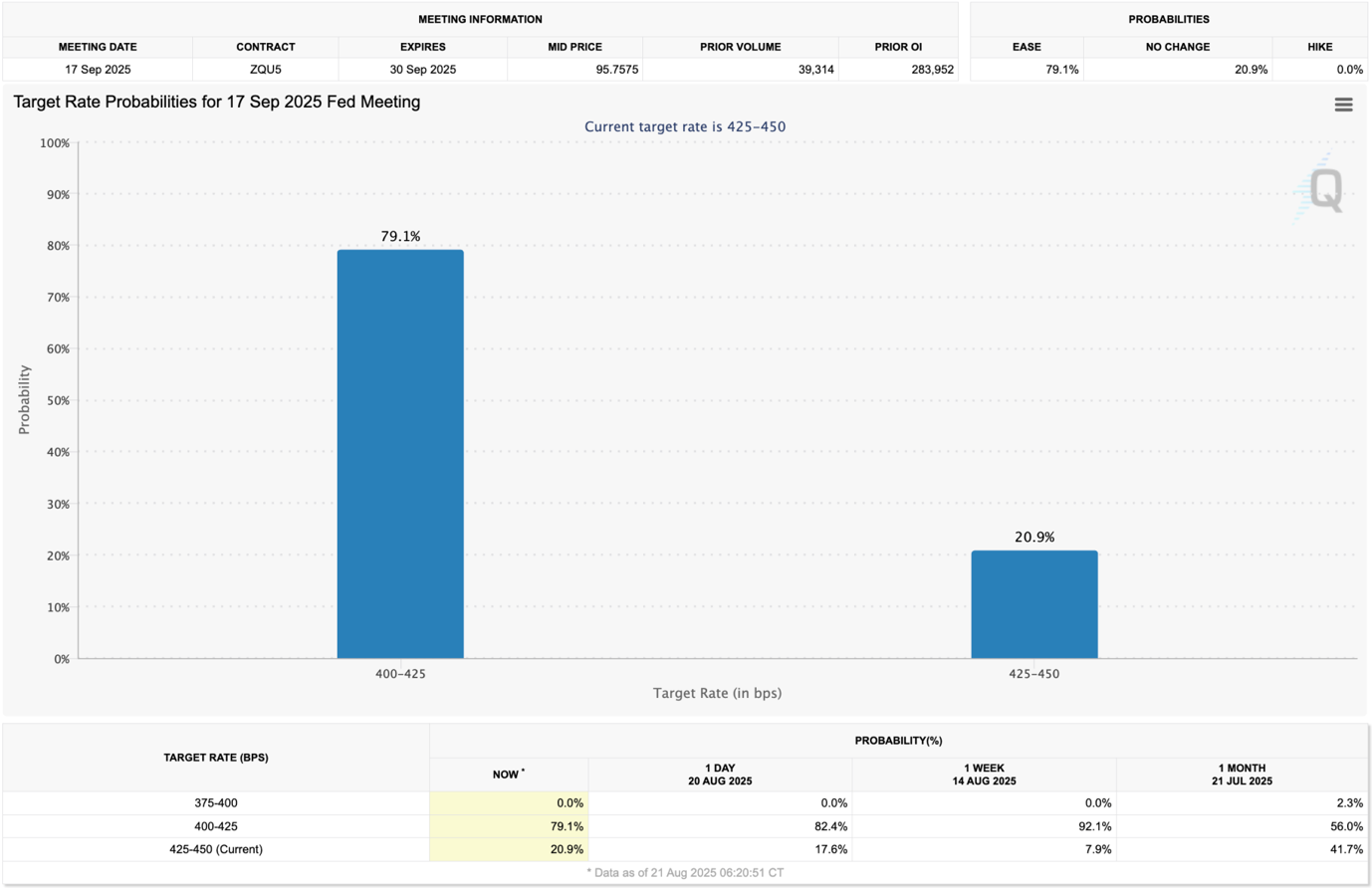

Risk assets are buoyant of the hopes that the FED will begin a new interest rate cutting cycle, so when we see news/data that suggests the odds of cuts are being dialled back, this hurts risk assets. As a result of the FED Minutes, the odds of a September interest rate cut have dialled back slightly, from 85% to 79%. So, for now, there is still a strong likelihood that we see a September rate cut.

Probabilities for a September Rate Cut

Powell's Potential Stance at Jackson Hole?

In the notes from the FED Minutes, we saw that members expect the inflationary effects of tariffs to take more time to pass through into the numbers, so Powell and the FED may be willing to remain on hold for another Meeting.But the weak labour market data we saw, was concerning, so this does mean we should still see a proactive Powell.

So, it's possible Powell might not commit to any outcome, and may remain data dependent. It's likely now that he will want to maintain optionality (to cut or not to cut), and therefore he'll suggest that he'll be reliant on seeing the inflation and labour market data in early September as to whether the FED should or shouldn't cut rates at the September Meeting.

The result of the above will likely be that we see the odds of a September rate cut come down from 79% and potentially closer to 50% (so a coin toss). Risk assets will likely pull back on this. But, we still expect the labour market data to weaken in early September, meaning that if we see the market pullback post-Powell's Jackson Hole speech (because of the odds of a September cut decreasing), then that's the dip we'll aggressively buy. So that would be post-Powell speech and into this weekend.

Majors and Their Key Levels:

Should we be right in seeing a dip post Powell speech, then the below levels are the levels we'd bid.- BTC: $108,000 - $112,000; long-term buys, we'd be relatively aggressive sub-$110k.

- ETH: $3,800 - $4,080; we'd want a deeper correction to buy for a move up to $5k.

- SOL: $144 - $165; lacking the narrative so again we'd need deeper to find it super attractive.

- HYPE: $32.80 - $40.00; we'd be less sensitive here and look to buy value territory with a long-term view.

- AURA: $0.116 - $0.145; in deep value territory, perfect downtrend pattern with bullish breakout bias.

BTC Chart

ETH Chart

SOL Chart

HYPE Chart

AURA Chart

Actionables and Cryptonary's Take:

To summarise, we expect Powell to not commit to too much at Jackson Hole and for him to maintain data dependence. This would likely see the odds of a September rate cut fall from 79%, to closer to 50%. However, we still expect the FED to cut in September, meaning we'd look to buy the dip aggressively should prices pull back following Powell's speech.In the meantime, we wouldn't look to sell Spot positions, as we're still proactive on the market (we're not selling into a new interest rate cutting environment), but we would look to be aggressive buyers of dips should we get our levels mentioned above.

Peace!

Cryptonary, OUT!