Market Update: Fed Signals Dovish Shift, BTC Lags as Gold Surges

Fed messaging turned more dovish this week, but Bitcoin trails equities and gold, stoking portfolio tension. Markets eye an October cut—can BTC catch up, or will gold keep absorbing flows? Here’s what you need to know now.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Fed outlook: Powell steady, Bowman and Miran dovish; October rate cut possible if labour market weakness persists.

- Upcoming data: Core PCE and Personal Spending due Friday; small uptick expected but markets likely unfazed.

- BTC vs. TradFi: Nasdaq and Russell 2000 continue higher on rate-cut bets; BTC lags as Gold rallies and absorbs flows.

- Leverage reset: Monday’s flush was modest; Open Interest still elevated, structure remains intact above key support.

- Cryptonary’s stance: Stay in Majors + select memes; hold some cash for dips; watch Fed tone and BTC’s key levels.

Topics covered:

- This Week's Fed Speak.

- This Week's Data.

- Gold, the Russell 2000 and BTC's Correlation.

- Crypto's Leverage Resetting?

- Cryptonary's Take.

This Week's Fed Speak:

This week, we've had a plethora of Fed speak, with more due to come over the course of the rest of the week. So far, the more notable speakers have been Powell, Miran and Bowman.Fed Chair Powell reiterated a similar tone to the one he gave at the 17th of September Fed Meeting. Powell mentioned that there is no risk-free path, and that the Fed are "well-positioned" to move going forward. Powell hinted that the Fed would be willing to lower rates at its October Meeting should the data corroborate that i.e., we continue to see that slowdown in the labour market data. Fed Governor Bowman struck a more dovish tone, where she emphasised the slowing labour market and that the "Fed needs to be decisive in fending off job market risks". This is a dovish statement that would suggest that Bowman is for cutting rates, and for cutting rates consecutively at the upcoming Meetings. The market is currently priced for a 94.1% chance that the Fed delivers an interest rate cut at October’s Meeting.

Miran was also dovish of course, where he said that the Fed was misreading how tight it has set monetary policy and its effect on the jobs market. Miran advocated that the Fed should be slashing rates by 100-200bps. We see a 100-200bps of cuts happening in 2025 as close to a 0% chance of happening.

The market didn't react too much to the Fed speak so far, as Powell (the one the market really listens to) didn't stray too far from the rhetoric he gave at the last Fed Meeting just last week.

This Week's Data:

This week's macro data that's worth paying attention to is Core PCE and Personal Income and Spending, which all fall on Friday.The consensus is for both Core PCE and PCE to come in slightly higher at 3.0% (an uptick from 2.9%) and 2.8% (an uptick from 2.6%). Assuming that there isn't a further upside surprise in these data points, then the market should take them in their stride.

Personal Income and Spending are both expected to come in positively but ticking down from last month's prints of 0.4% and 0.5%, to 0.3% each. We'd expect the market to take these prints positively.

Gold, the Russell 2000, and BTC's Correlation:

We noted in our last Market Update (last week) that Gold and the TradFi Indexes, particularly the Nasdaq and the Russell 2000 broke out to new highs, whilst BTC lagged, and that this was an interesting divergence as you'd expect BTC to perform similarly to the Nasdaq and the Russell 2000. We're unfortunately continuing to see that divergence remain.Both the Russell 2000 and the Nasdaq have continued their moves higher, despite stalling in the last few days.

Nasdaq 1D Chart:

Perhaps the biggest explainer of this is Gold. As we have covered in prior reports, when Gold moves higher, BTC tends to stall or pull back, and when Gold stalls or pulls back, BTC tends to outperform to the upside.

We did see Gold have a significant move higher between August 22nd and September 9th. Gold was then range-bound between September 9th and September 19th. Note, that is when BTC broke out of the $112k level and moved up to $117k. On September 19th, Gold broke out from its consolidation pattern, and since September 19th, BTC has pulled back from $117k to $112k.

Gold 1D Chart:

Gold consolidating between September 9th and 19th, allowing BTC to have its time in the sun, only for it to all be reversed as Gold broke out on the 19th for more upside.

BTC 1D Chart:

BTC has pulled back from $117k to $112k as Gold has broken out to the upside from its consolidation pattern.

Gold may be taking some of the flows that Bitcoin would have had, although Gold has a strong narrative currently with the global de-risking from Treasuries and rebalancing into Gold, whilst BTC isn't exactly "undervalued" here.

In terms of identifying "undervalued", we'd be looking at BTC's on-chain metrics or a flush out in positioning.

Crypto's Leverage Resetting?

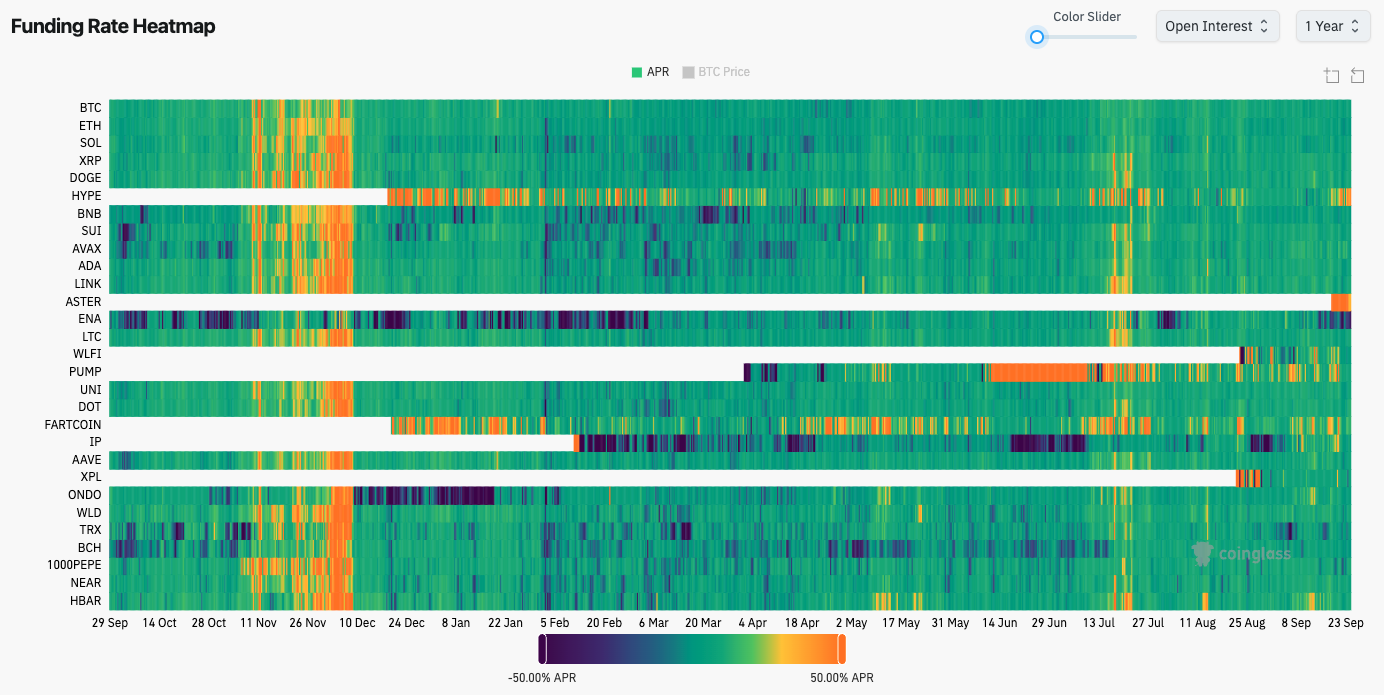

On Monday, we saw a leverage flush out, initially driven by Bitcoin being driven down by a large Spot seller. However, if we look back at it, Funding Rates weren't elevated, and Open Interest (the amount of leverage in the system) has hold a small pullback, but Monday's "flush out" doesn't reflect an absolute resetting in positioning. Open Interest remains elevated, and Funding Rates remained contained throughout.Funding Rate Heatmap:

The Funding Rate Heatmap shows that the Majors had relatively contained Funding Rates (soft green), whereas if we look back to November/December 2024, Funding Rates were much more frothy (yellow and orange).

Total Open Interest (in USD value):

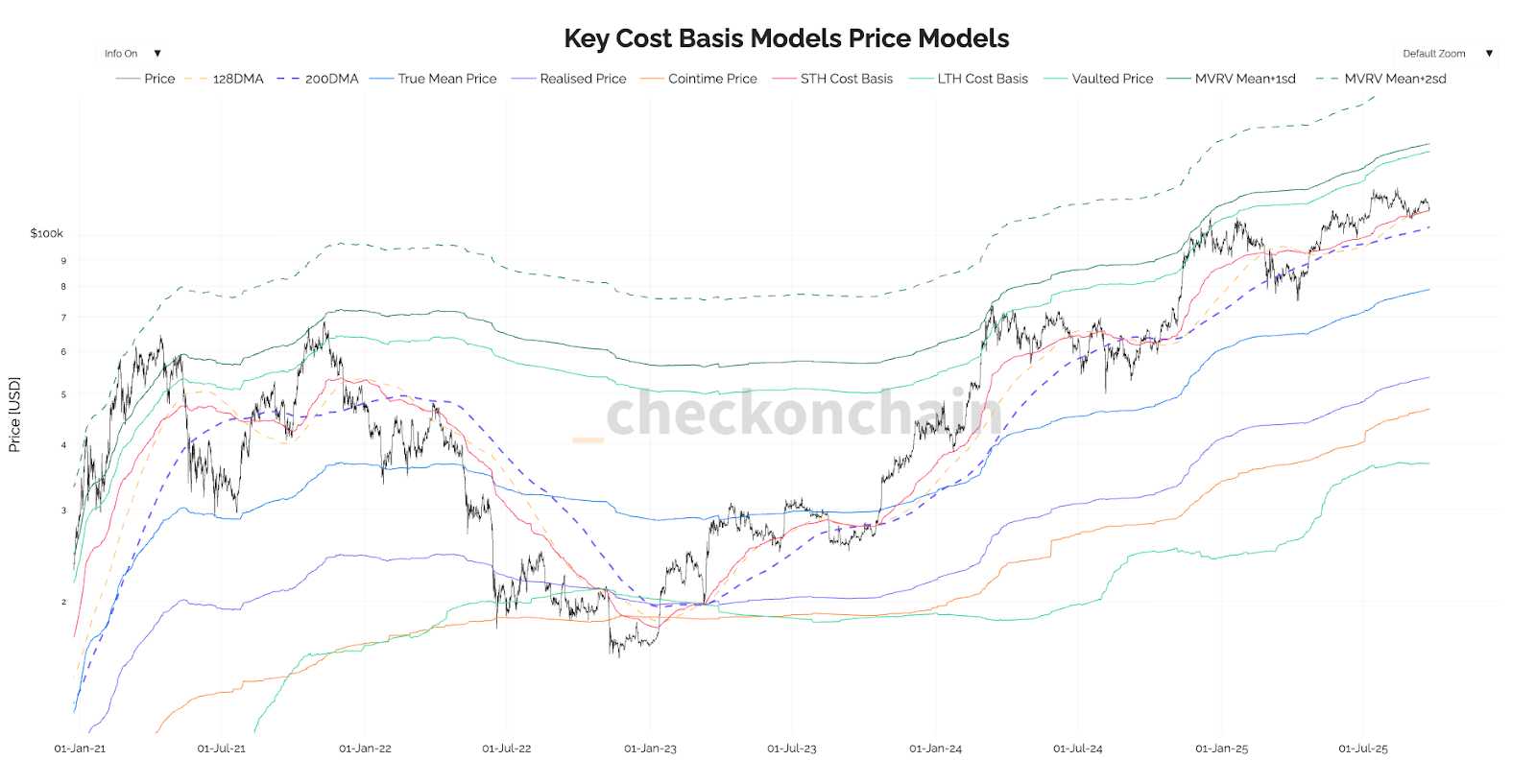

If we then look at this from a simple on-chain perspective, we can see that price hasn't even broken below the first line of defence for the bulls, which is the Short-Term Holder Cost Basis (Realised Price) at $111,400. Price still sits on top of that level, the $110k-$112k technical support, along with the 200DMA at $103,800.

Key Cost Basis Models:

Cryptonary's Take:

For now, the structure remains bullish, despite the lagging performance that has seemingly really shaken confidence. Prior signals that have worked with great accuracy are seemingly not working as well. The outperformance in Crypto is currently lying in the Majors and then in the new hot "pocket" or "sector". Just in the last two weeks, we've seen this transition from Pump.Fun to Aster, with HyperLiquid being punished as a result. However, we do still advocate for not chasing the new “hot sector”, and to remain mostly positioned in Majors.Ultimately, the above aids our view that we should remain positioned in Majors and select memes, and that having a well-diversified portfolio (positioned in lots of different alts) will likely only hinder your portfolio performance.

We remain open to the view that prices can pull back further, and therefore it's handy to have some allocation to cash should that scenario occur; however, we'll continue to monitor price action to see if BTC can hold its key levels. Should it not be able to, then we would look to more drastically lighten our positioning. If we were to see more hawkish Fed speak that might suggest that an October rate cut is unlikely, that would also lead us to de-risk some of our size, as that is what can potentially derail what is currently a supportive macro-outlook.

For now, we remain calm in our positioning as we expect prices to be substantially higher in 1-2 months. We’ve begun to investigate hedging strategies for members to utilise should they want to, and we’re working on a piece that’ll outline these, which we hope to release next week.

Peace!