Market Pulse: Fed Surprise Cools Markets, BTC Tests Lower Range

The Fed’s unexpected hawkish pivot and mixed Big Tech earnings have injected fresh tension into markets. With the December cut now in doubt and BTC slipping, volatility is back. Here’s what we expect in the coming months...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Yesterday's Fed Meeting:

Let's highlight a few of the main highlights from yesterday's Fed Meeting before we dive into the details of it.- The Fed cut by 25bps as the market expected and was priced for.

- There were two dissents, one from Miran for 50bps, and one from Schmid for no cut.

- Announced the end of quantitative tightening (QT) for December 1st.

- Powell pushed back on the December cut: "far from a foregone conclusion".

Alongside this, the Fed announced that quantitative tightening would come to an end by December 1st, and Powell mentioned that the Fed would be able to add to their balance sheet in the future, if they deemed it necessary. This is positive for risk assets going into next year.

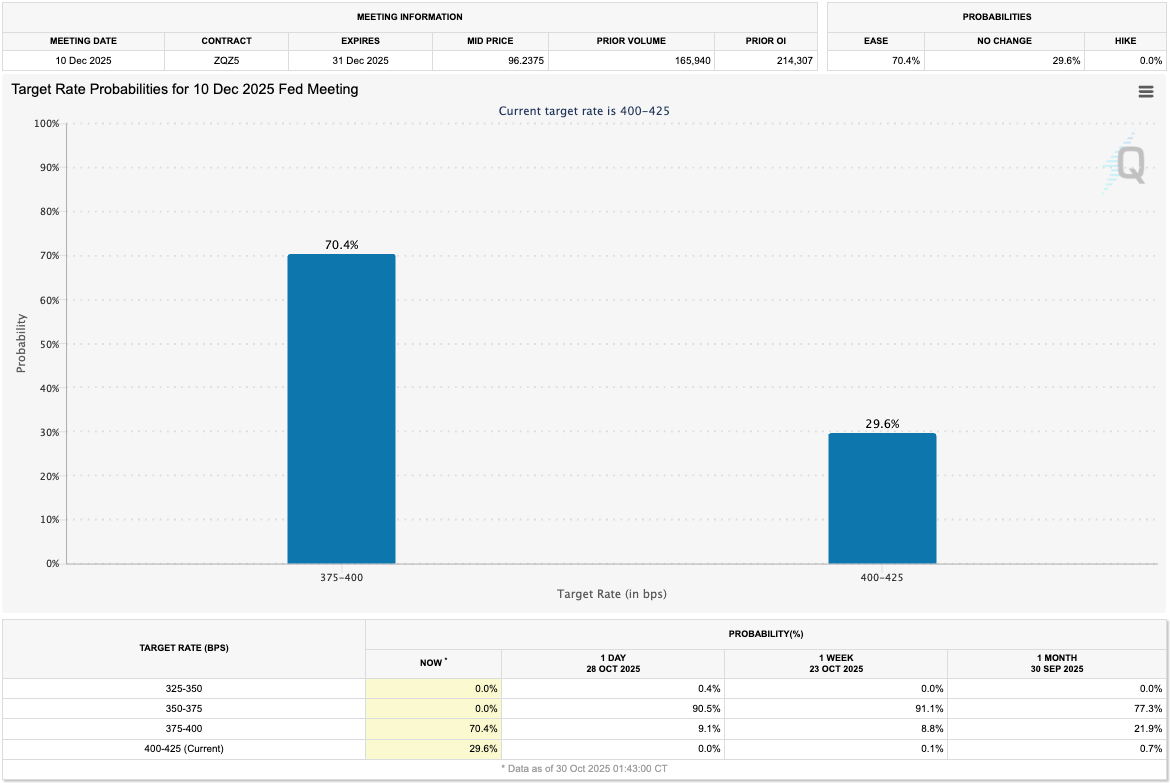

Most of the above was expected and therefore priced by the market going into the rate decision, hence there was a muted market reaction in response to these elements. What really moved the market was when Powell threw a December cut into doubt, "a cut in December is far from a foregone conclusion". Before Powell spoke, markets priced a December cut at a 94% likelihood, however, following Powell's comments, the odds dropped to 70% for a December cut.

Target Rate Probabilities for Dec 10th Meeting:

There's clearly dissent amongst the committee, and this is likely to continue, especially when there's such a lack of clarity around the data, or lack of data, due to the government shutdown.One theory we're open to is that Powell is providing a pushback to cutting rates in December to put pressure on Trump in the negotiations to get the government reopened again, and he can use the lack of data as an excuse to “slow down” (the rate cuts). Powell is a Democrat, and the Democrats need some negotiating power (in the negotiations to reopen the government), and Powell opting not to cut rates might be that negotiating leverage that the Democrats need.

Should we see a deal done that enables the government to reopen, then we'd be looking for the tone out of the Fed to become more dovish again. If so, this would confirm our above thesis.

Earnings Out Of Big Tech:

Yesterday, Meta, Google and Microsoft all reported Earnings, which came in strong with beats on revenues. However, all the companies are guided towards increased capital expenditure into AI, which, as a result, threatens margins going forward. Alongside this, the forward guidance/outlook wasn't as rosy as the market would have hoped.This resulted in $META pulling back by 8%, and $MSFT down 3%. However, $GOOGL moved up by 5%. Overall, this was a mixed set of results, and the market will be looking for better future guidance going forward.

Markets will now turn to Apple and Amazon reporting today.

Market's Reaction:

The notable moves following yesterday's events were that the S&P and Nasdaq were mostly unchanged, but the Russell pulled back, whilst the US2Y Yield moved up 12bps. This is the market pricing in a reduced likelihood of an interest rate cut at the December 10th Fed Meeting.

US2Y Yield up 12bps yesterday:

BTC fell below the $112,600 a few hours before the Meeting, with price then wicking into the $108k's as Powell delivered more hawkish remarks than the market expected.

BTC 1D Timeframe:

Cryptonary's Take:

Undoubtedly, the takeaway from yesterday is that Powell was more hawkish than we, and many market participants expected. Powell's commentary threw a December cut into doubt, although it still remains as a 70.4% chance that the Fed cuts in December.Following Powell's comments yesterday, this might result in a reduced willingness amongst participants to take increased risk over the coming 1-2 weeks as we wait for the US government to reopen and begin receiving the economic data. Therefore, it's likely that Majors are still in chop mode, and we're open to the idea that BTC revisits the lower bound of the range - this is between $101k-$104k - with price even potentially deviating into the late $90k's.

Over the medium term, not much has changed. We're still in a rate-cutting cycle; it may just be that the pace of rate cuts is slowed, which in our view isn't an issue. Remember, in 6 months, Powell is going to be replaced, and likely replaced with a very dovish candidate, as this is what Trump wants.

Therefore, should Majors revisit the lower end of their range, we'd be buyers at those price levels.

Those areas look like:

- BTC: $98k-$104k

- ETH: $3,400-$3,600

- SOL: $165-$180

- HYPE: $39-$42

- AURA: $0.07 (solid holder base now, would be surprised to see it go back below $0.06).

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms