Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Good morning all.

We wake up today to a very red market, let's break it down and see what's happened.

Open Interest Flush Out:

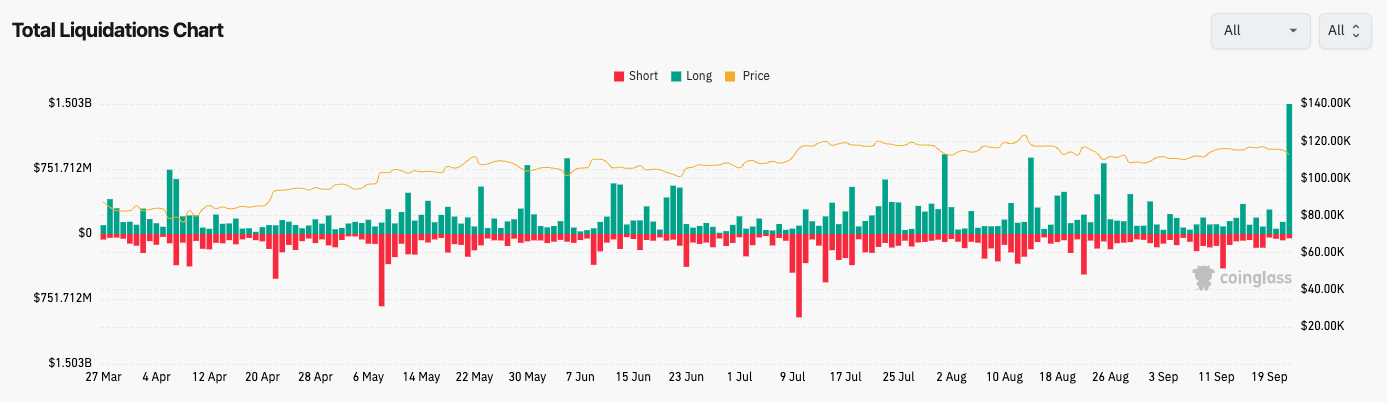

In the early hours of this morning, we saw a large BTC seller on Binance which forced the price lower and resulted in an altcoin puke out. This caused a cascade in the leverage market with over $1.5b in Long liquidations, and a meaningful pullback in Open Interest – the amount of built up leverage in $ terms. Considering Open Interest was elevated, this flush out is likely healthy in terms of resetting the market.

Long Liquidations:

Over $1.5b in Long Liquidations - the largest in over 9 months.

Key Levels?

It's important now to assess price action in the coming days following this liquidation event. We'd now be looking for Bitcoin to find support at the $112k level with buyers stepping back in. And for TOTAL3, we've seen a pull back from the highs, although price is now retesting the old highs of $1.08t - potentially as new support.

Both BTC and TOTAL3 are at key levels here and hence we'll be closely watching how they respond over the coming days.

TOTAL3 1D Chart:

Cryptonary's Take:

Overall, this is a leverage flush out that was catalysed by a big seller of BTC on Binance, which has then resulted in the largest $ liquidation event in more than 9 months. This has meant prices have reset drastically, although this is coming off the back of a large run higher in prices, so there is the argument that this is a healthy resetting.

We're now closely watching BTC and TOTAL3 which are both at key supports. $112k for BTC and $1.08t for TOTAL3. A convincing break and close below these levels, and we would potentially look to re-evaluate some positions i.e., recent JUP Long for example. But the likelihood is that this won't change our key positioning; Long Spot Majors (BTC, ETH, SOL and HYPE), and Long select memes (AURA).

Let's see how the US market opens today, and what price action we're given in the coming days.