Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What happened?

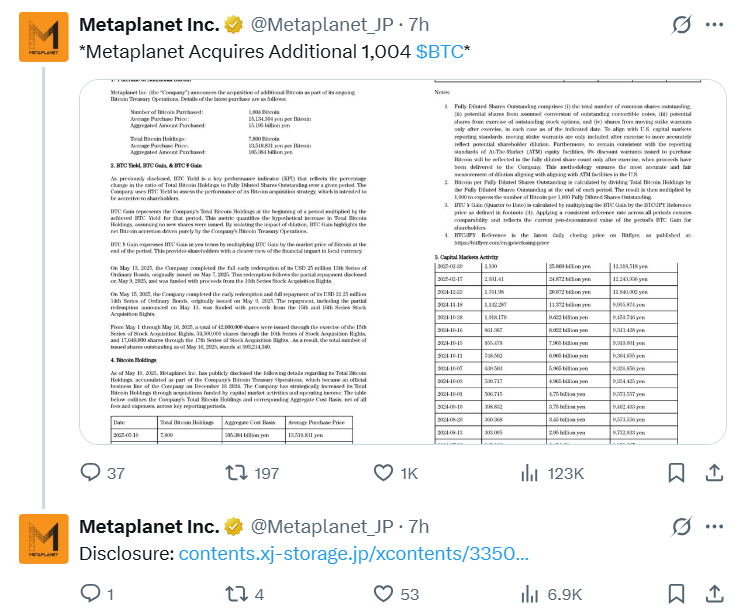

Metaplanet, dubbed Asia’s “MicroStrategy,” purchased 1,004 BTC at $104,183 each, overtaking El Salvador’s holdings to become the tenth-largest corporate Bitcoin holder globally with 7,800 BTC.

What's next

But what signal did Metaplanet just send to the rest of Asia's corporate giants—and why might this be a turning point for BTC adoption?Metaplanet’s strategy: A Bitcoin-First blueprint

Metaplanet’s aggressive Bitcoin accumulation is rooted in its “Bitcoin First, Bitcoin Only” strategy, launched in April 2024. The firm aims to hold 10,000 BTC by year-end 2025 and 21,000 BTC by 2026, treating Bitcoin as a core treasury asset to hedge against fiat devaluation and inflation. To fund this vision, Metaplanet has raised ¥35 billion ($244M) through zero-coupon bonds and stock offerings since early 2024, including a $21.25m bond issuance in May.

Cryptonary’s take

The demand for BTC coming from Metaplanet isn’t big yet. However, it is good to see other corporate entities, aside from Michael Saylor, accumulating BTC while shorting fiat. Microstrategy started small before sizing up on their BTC bets. Now, we have another corporate entity from Japan doing exactly the same. The race to accumulate as much BTC as possible is heating up, and likely, we will have more entities joining the party as we go.

Supply of BTC is getting squeezed right now, almost 26.7k BTC bought by spot ETFs in May so far, while we had only 7.2k BTC produced by miners. However, many indicators have been in overbought territory, and we had 6 green weeks straight. So, from a technical point of view, not a great time to start FOMOing. However, if we were to see a significant pullback, slow allocation via DCA or VA strategies into quality assets like BTC isn’t gonna hurt mid-to-long term.

Peace!

Cryptonary, out!