Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What happened?

- The crypto market has been buzzing with activity lately, fueled by a wave of big developments

- First, Bitcoin perma-bull Michael Saylor, Executive Chairman of Strategy, has been on a buying spree, snapping up 13,390 Bitcoins last week alone. This brings Strategy's total holdings to 555,450 BTC, valued at over $58 billion, representing approximately 2.6% of Bitcoin's total circulating supply. Saylor's relentless accumulation, funded through convertible bonds and equity offerings, continues to signal unshakable confidence in Bitcoin as a premier treasury asset.

- On the global stage, the recent US-China trade deal has added rocket fuel to market optimism. After just two days of talks in Geneva, both nations agreed to temporarily slash tariffs, easing trade tensions and sparking hopes of smoother economic flows. While the deal didn't directly push Bitcoin significantly higher as of now, it has bolstered broader market confidence.

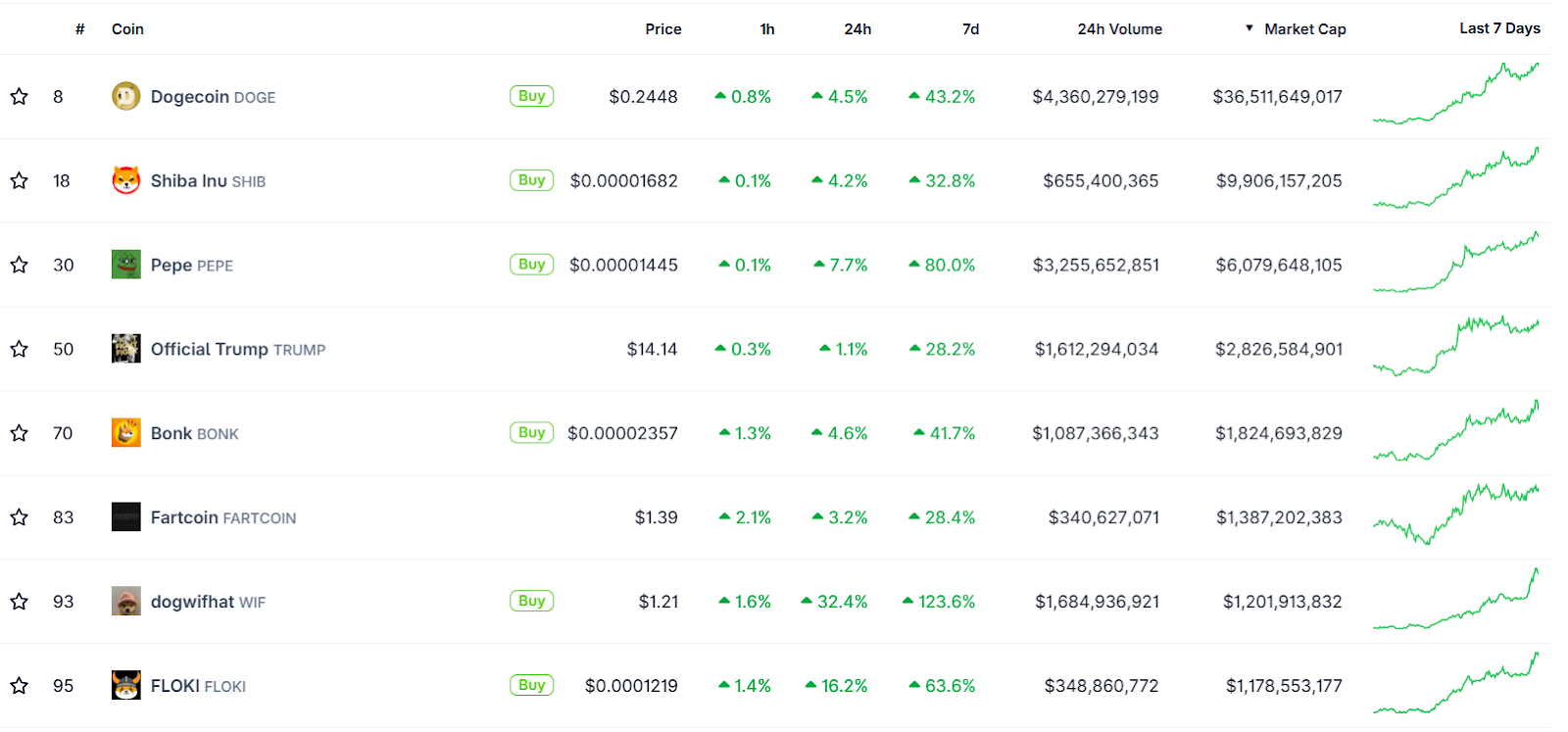

- These positive catalysts have increased investors' appetite for risk, pushing capital toward the far end of the risk curve. Memecoins have been the biggest beneficiaries, posting jaw-dropping rallies over the last few weeks, indicating a risk-on environment among traders and investors.

Cryptonary's take

The market is gaining momentum, and we can’t ignore the strength of the price action or the growing demand for Bitcoin from ETFs and corporations. The rest of the market is catching up with BTC—funding rates are rising, and meme coins are pumping. The unwinding of the trade war marks a significant macro shift. That said, the best entries are still most likely to come on pullbacks.

If the BTC breaks above all-time highs and goes into strong price discovery, there will likely be a lot of money-making opportunities across the board. If BTC sees a significant pullback, that is the time to start accumulation on good assets. Total crypto market cap and memecoin sector are still way down from their highs if we zoom out. Therefore, we still have time to get positioned and catch outperformers of the next leg up.

See you later in a stream!Peace!