Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Expected data

- Non-Farm Payrolls: Consensus 70k-78k

- Unemployment Rate: Consensus 4.3%

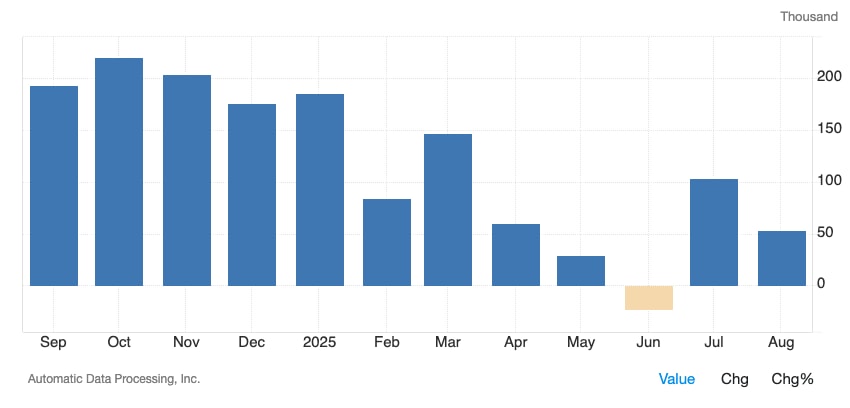

Today, we just had the release of the ADP Employment number. Now, ADP has shown declining job growth for the last 4 months (although July's number did rebound). The ADP numbers were previously brushed off because the BLS (the official numbers) were coming in much higher. However, we've recently seen much lower revisions, indicating that ADP were likely right all along.

The ADP numbers just came in at 54k, suggesting that hiring is at a relatively low level in the US and the labour market is contracting. This aids the argument for FED cuts.

ADP Employment Change:

Why The Labour Market Data Matters:

Markets are expecting a new Interest Rate cutting cycle due to a weakening labour market. The market will want to see the slowdown in jobs continue for that rate cutting cycle to materialise. What could trouble risk assets in the short-term is if the labour market really deteriorates at a rapid rate i.e., the economy moving into a recession. Or, if the labour market makes a significant rebound. A rebound would likely result in Interest Rate cuts being paired back, and this would hurt risk assets in the short-term.Scenarios:

- Hot Print (4.2% Unemployment and Payrolls greater than 130k): front-end Yields and the Dollar Index would move up slightly. Risk assets and Crypto would likely pull back. BTC would potentially retest $108k.

- Inline (4.3% Unemployment and Payrolls in the 70k-90k range): Yields would remain flat to slightly down. Risk assets would likely continue their consolidation/grind higher.

- Soft Print (4.4% Unemployment and Payrolls less than 50k): Yields and the Dollar would come down, particularly Yields (as they'd begin pricing in rising odds of a recession), and risk assets (and Crypto) would likely remain range-bound. The reason being would be that a really soft print might suggest increased odds of a recession.

Plan:

Going into the release, we remain positioned as we expect the numbers to come in inline.Should the numbers come in hot, we'd hold our positions. Perhaps the biggest risk would be if the Payrolls print came in negatively. A negative print would signal a "falling off the cliff" labour market, and that would likely hurt risk assets in the short-term. Medium term, it would be positive as it would bring the FED to the table quicker, and we'd likely see increased stimulus. However, a negative print, isn't our base case.

Bottom Line:

The chances are that we see a print between 50k-100k, and markets would likely take this in their stride. The risk is that we see a majorly hot print (although this wouldn't worry us) or a majorly soft print (negative payrolls). A negative print would likely worry markets, but again, this isn't what we're expecting to see tomorrow.We remain positioned for a cut in September, and therefore we maintain our Crypto positions as we expect a new rate cutting cycle as the FED tries to get ahead of a weakening labour market.

Our base case is that a new cutting cycle will see Crypto perform well in Q4 2025 and Q1 2026 - we're positioned for that.

We'll cover the numbers immediately on release.

Stay tuned!