Market Pulse: Trump Escalates Trade War, Crypto Faces Record Liquidations

BTC lost critical support as Trump amped up China tensions, triggering crypto's one of the largest liquidation event in history. Is the bull case dead, or just delayed? Here’s how we’re thinking about the aftermath and what could come next.

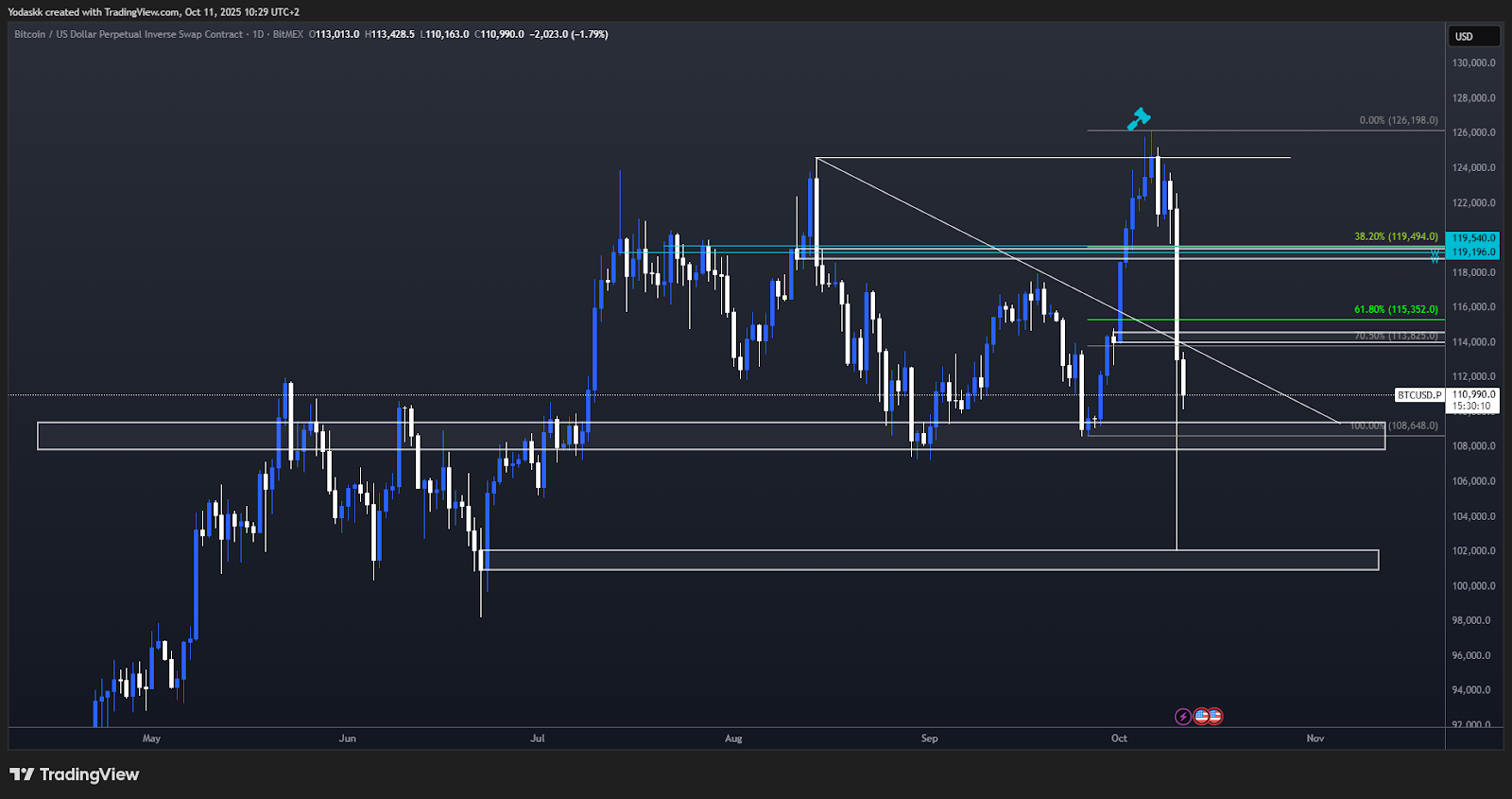

BTC shattered all supports one after the other yesterday, invalidating the short-term bullish scenario.

Yesterday, Trump sharply escalated tensions with China by hinting at new trade restrictions and tariffs, sparking fears of another trade war. For markets, that means a potential short-term risk-off move: equities saw deep pullbacks as investors price in higher uncertainty and slower global growth.

Crypto had its largest liquidation event ever following US markets close.

Would any diplomatic cooling quickly reverse that dip, just like previous Trump-driven flare-ups, or are the damage done too big? Let’s dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Invalidation of Short-Term Bullish Thesis

We recently put out our reasoning for why we might see re-accumulating above $119k before trying for new highs again. This has now been invalidated with the BTC price breakdown below both closest supports at $119k and $114k.The analysis was based on the positive macro-outlook and the increase in M2/ liquidity. Yesterday’s event was a Black Swan.

Trump’s sudden escalation with China, with threats of new tariffs and trade restrictions is being viewed as a potential black swan because it was largely unexpected by markets that had priced in easing global tensions. Such a move risks disrupting global supply chains, reigniting inflation, and forcing central banks to delay rate cuts. This combination of higher inflation and slower growth could shock both traditional and crypto markets, creating a liquidity squeeze similar to 2018’s trade war period.

This was a low-probability but high-impact event that could temporarily derail the bullish macro narrative.

BTC reacted quickly to the news and broke multiple supports one after the other. Once $114k gave way, bids vanished. Price flushed to $102k before bouncing back to $113k. That invalidates the short-term bullish thesis we laid out.

Altcoins were hit much harder, with most down 60 to 80 percent in a single 15-minute candle. To put it in perspective, XRP was more volatile last night than during the COVID crash.

Liquidations yesterday went as high as $19.2 BILLIONS. EVERY long, regardless of its leverage, even at 2X, got liquidated. We will probably make a follow-up on this liquidation event once more information will be available next week.

Cryptonary's Take:

We’ll be watching next week’s price action closely, along with any new statements from Trump or China. There is a real possibility that this sell-off could reverse quickly if Trump shifts his tone and signals a resolution. That could trigger a sharp V-shaped recovery. If tensions continue, however, expect the market to take several weeks or even months to regain upward momentum and reach new highs. We'll be monitoring and updating in real time.Possible Scenarios include:

- Base formation: The bottom is already in, and BTC and majors consolidates before moving higher.

- One more flush: The market trades near the lows and breaks down one more time before forming a true bottom. Stay safe.