Market uncertainty weighs on AERO and DOT outlook

As AERO hovers near critical support and DOT continues its prolonged decline, altcoins remain under pressure. Will key reclaims spark a turnaround, or is patience still the best play? Let’s dive into the latest market developments.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

AERO:

AERO remains within a large range, failing to break into new all-time highs during its last run. The previous high at $2.3, set in April, once again acted as resistance, preventing further upside momentum. Now, price action suggests a move back toward $0.60, which has historically been a strong support level. This floor has been held multiple times—on July 4th, August 5th, and September 4th—reinforcing its significance as a key structural level.$1.00 stands out as the primary pivot for AERO. This level is critical in determining whether the asset transitions into a bullish phase or remains in range-bound conditions. As it stands, no immediate action should be taken. If AERO revisits $0.60, it becomes an area of interest, but confirmation is required before engaging in any accumulation.

The alternative scenario is a reclaim of the $1.00 mark, which would signal renewed strength and open the door for a move towards liquidity zones between $2.2 and $2.3. Until either of these conditions materializes, the best approach is patience. Sitting on the sidelines remains the optimal strategy, waiting for either a high-conviction accumulation opportunity or a confirmed reclaim of key levels.

Playbook

If the price reaches the $0.60 level, it presents an accumulation opportunity, but only with confirmation of demand. This level has historically been a strong support, so any signs of a bounce or a reclaim could indicate an optimal entry. Without confirmation, further downside risk remains.The second scenario is a reclaim of $1.00, which would shift sentiment toward bullish momentum. In that case, AERO becomes a swing trade candidate, with targets set at the next liquidity zones between $2.2 and $2.3. Until one of these conditions is met, the best approach is to remain patient and avoid unnecessary risk.

Cryptonary’s take

AERO has held up relatively well compared to many other assets in this market cycle, maintaining a structured range instead of breaking down significantly. This resilience makes it an asset worth monitoring closely. However, there is no immediate action to take—either AERO needs to revisit and confirm demand at $0.60, or it needs to reclaim $1.00 to signal a bullish continuation.Right now, patience is key. There’s no reason to force trades in a range-bound asset without confirmation. If either of the outlined conditions materializes, AERO becomes a high-probability trade setup. Until then, the best move is to sit on the sidelines and wait for a clear signal.

DOT:

Market context

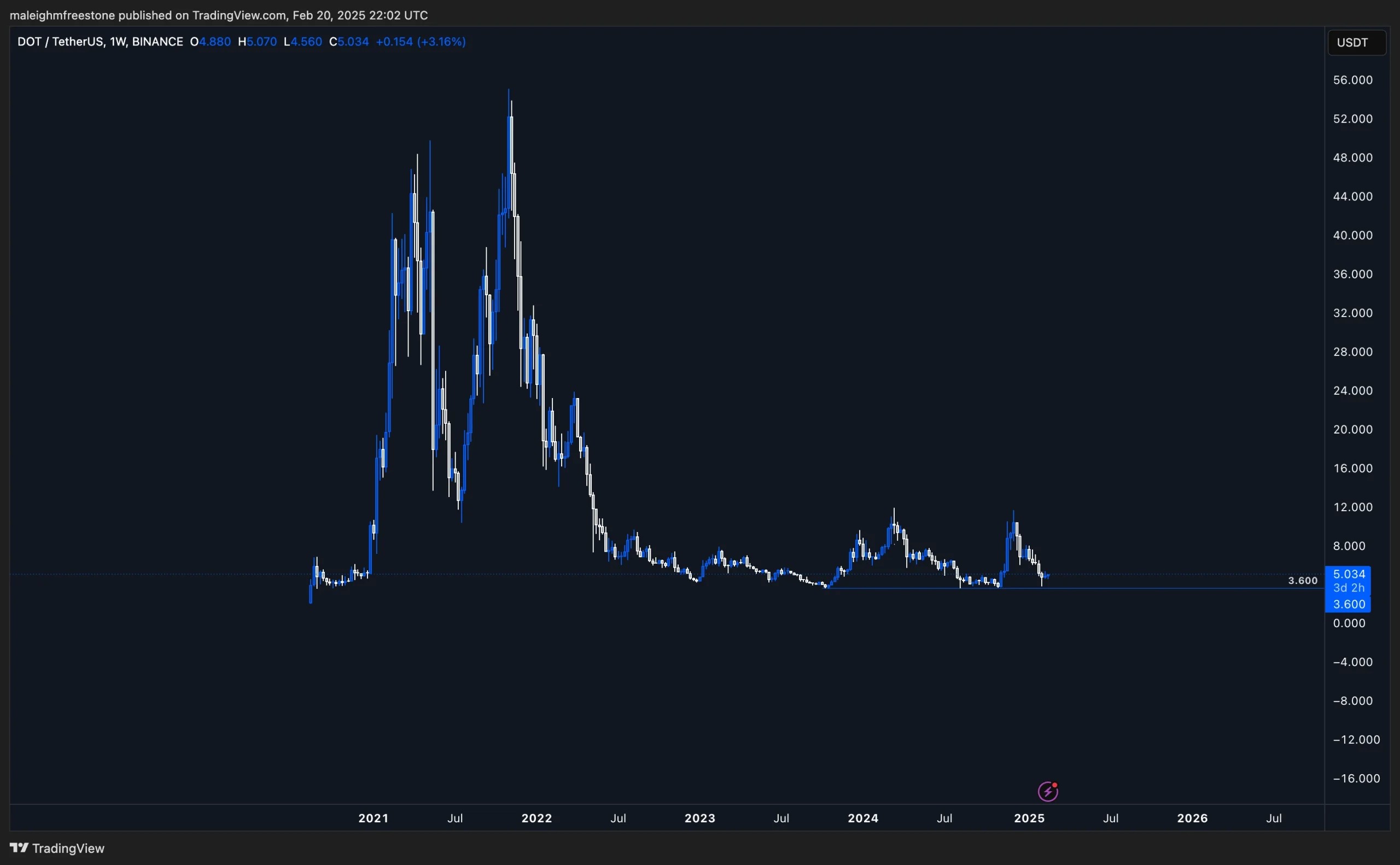

Polkadot is currently trading near its all-time lows, reflecting one of the most significant drawdowns among major altcoins. Once valued at over 1,000% higher than its current price, DOT has experienced a 90% decline, a clear indication of the broader weakness in the altcoin market.The fact that DOT recently stabbed into its lows on February 3rd and is now hovering around the $3.60 level further reinforces its unattractiveness from an opportunity-cost perspective. While some buying interest has historically occurred around these levels, the overall sentiment and structure remain weak. This level is more indicative of capital flight from speculative assets rather than a genuine accumulation zone.

More broadly, DOT’s severe underperformance is a reflection of the current state of altcoins—liquidity is constrained, and capital is concentrated in stronger narratives, leaving many previous cycle leaders struggling to reclaim any meaningful ground.

Playbook

No action should be taken at this stage. While $3.60 has acted as a floor in previous cycles, the overall weakness in structure and market participation suggests that any potential upside is highly limited. The opportunity cost of holding DOT compared to stronger, higher-momentum assets is too high.Until a meaningful shift in market structure occurs—whether through macro-level liquidity improvement or significant trend reversals—there is no valid reason to engage in this asset. This remains a swap token at best, not a high-probability trade setup.

Cryptonary’s take

DOT’s current price action is a clear reflection of the broader altcoin market’s struggles. The fact that a once-dominant asset is now trading at cycle lows with no meaningful recovery highlights the extent to which liquidity has drained from the sector.This is not just an isolated case—many alts are showing similar signs of prolonged weakness, with capital cycling into stronger narratives and assets that offer real upside potential. While some assets will eventually recover, others may not, and DOT’s structural decline puts it in a vulnerable category.

Right now, altcoins are still in a de-risking phase, and DOT’s price action is evidence of that. Until the market signals a broader shift back into risk-taking behaviour, sitting on the sidelines remains the best approach. The focus should be on identifying assets with strong structural support, momentum, and positioning in dominant narratives, rather than trying to catch speculative bounces in assets with little evidence of sustained demand.