Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Bitcoin’s 33% pullback has pushed price into value territory, with $52k-$58k identified as deep value based on multiple on-chain and cost-basis metrics.

- Large ETF outflows and Long-Term Holder selling suggest capitulation is underway, but historical precedents imply bottoms usually form over time.

- Regime shift from risk-off trading to progressive accumulation, focusing primarily on BTC and selective altcoins.

Topics covered:

- Assessing This Crypto Pullback.

- Our Approach.

- Cryptonary's Take.

Assessing This Crypto Pullback:

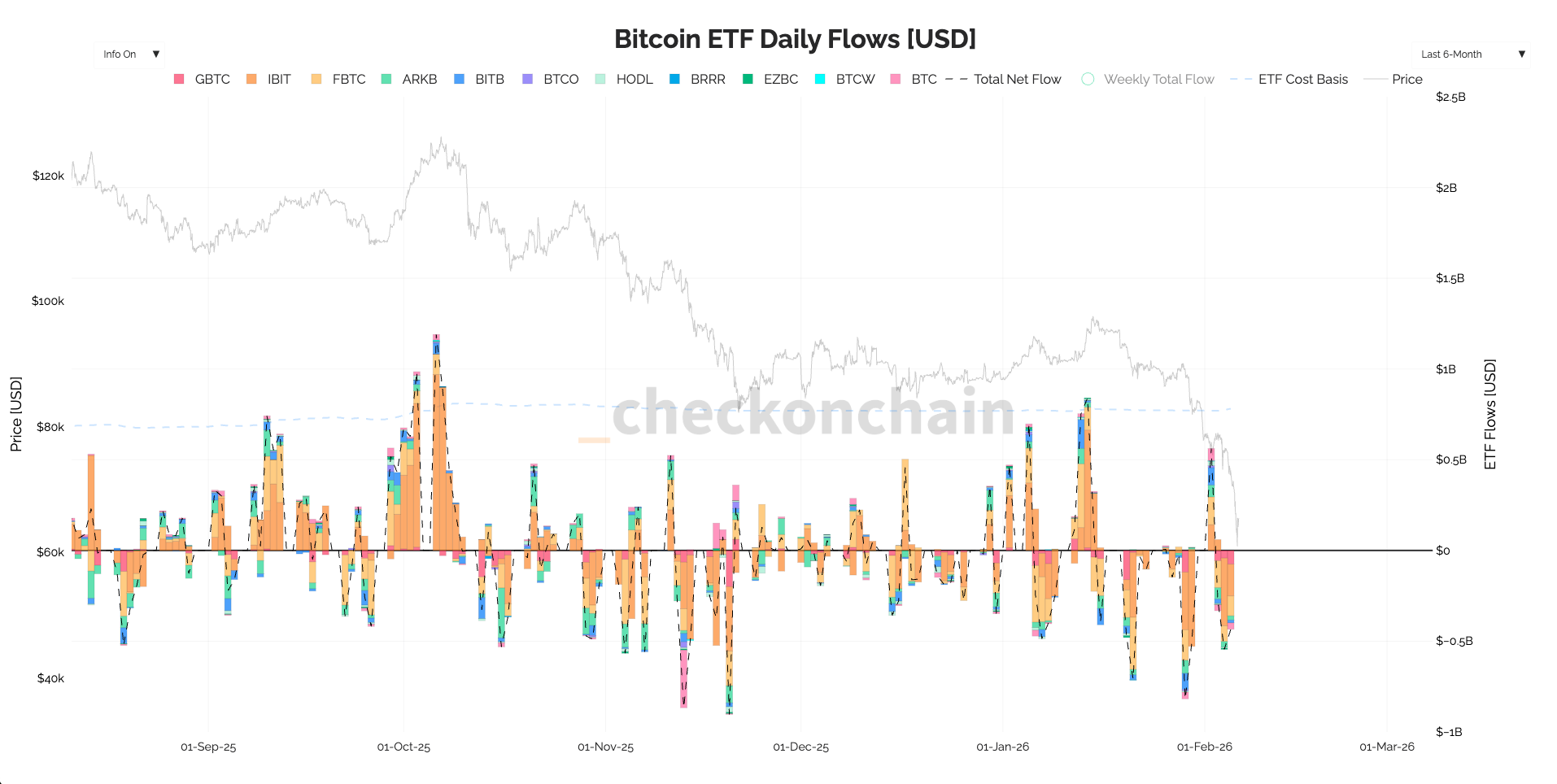

Bitcoin's pullback has been driven by large sellers, who aggressively increased their selling in the last 2 days. We can see this in the large ETF outflows, and Long-Term Holder selling spiking (lower, showing distribution). ETF Flows showing significant outflows - selling:

ETF Flows showing significant outflows - selling:

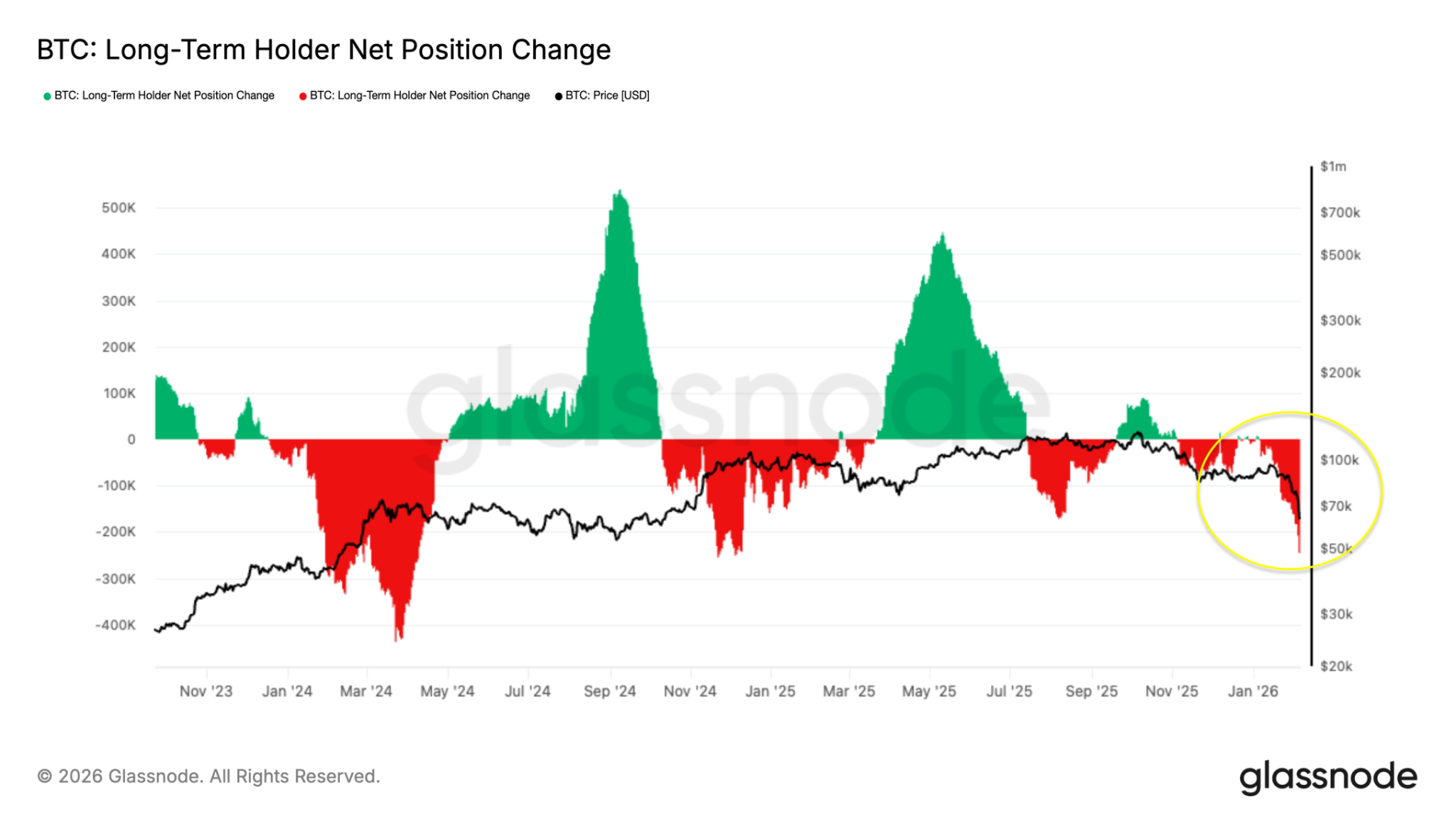

Long-Term Holder Net Position Change - showing large selling (large downside spike):

Long-Term Holder Net Position Change - showing large selling (large downside spike):

This move down has resulted in traders booking losses (large realised losses), whilst it has plunged 'Long-Term Holders' into large unrealised losses.

Net Realised Profit/Loss - shows large losses being taken, that are similar to the large realised losses taken in 2022, the last bear market:

Net Realised Profit/Loss - shows large losses being taken, that are similar to the large realised losses taken in 2022, the last bear market:

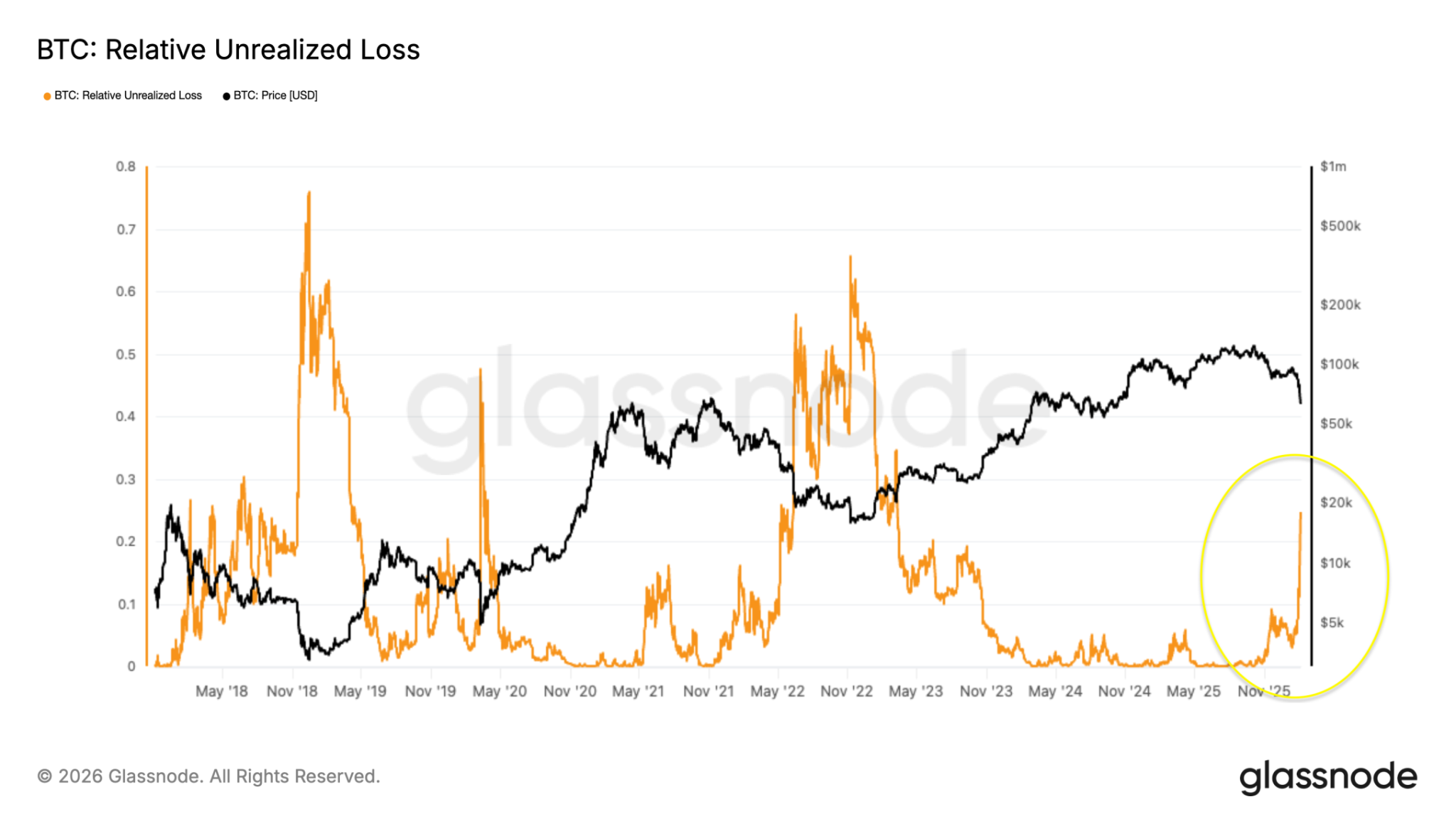

Relative Unrealised Loss:

Relative Unrealised Loss:

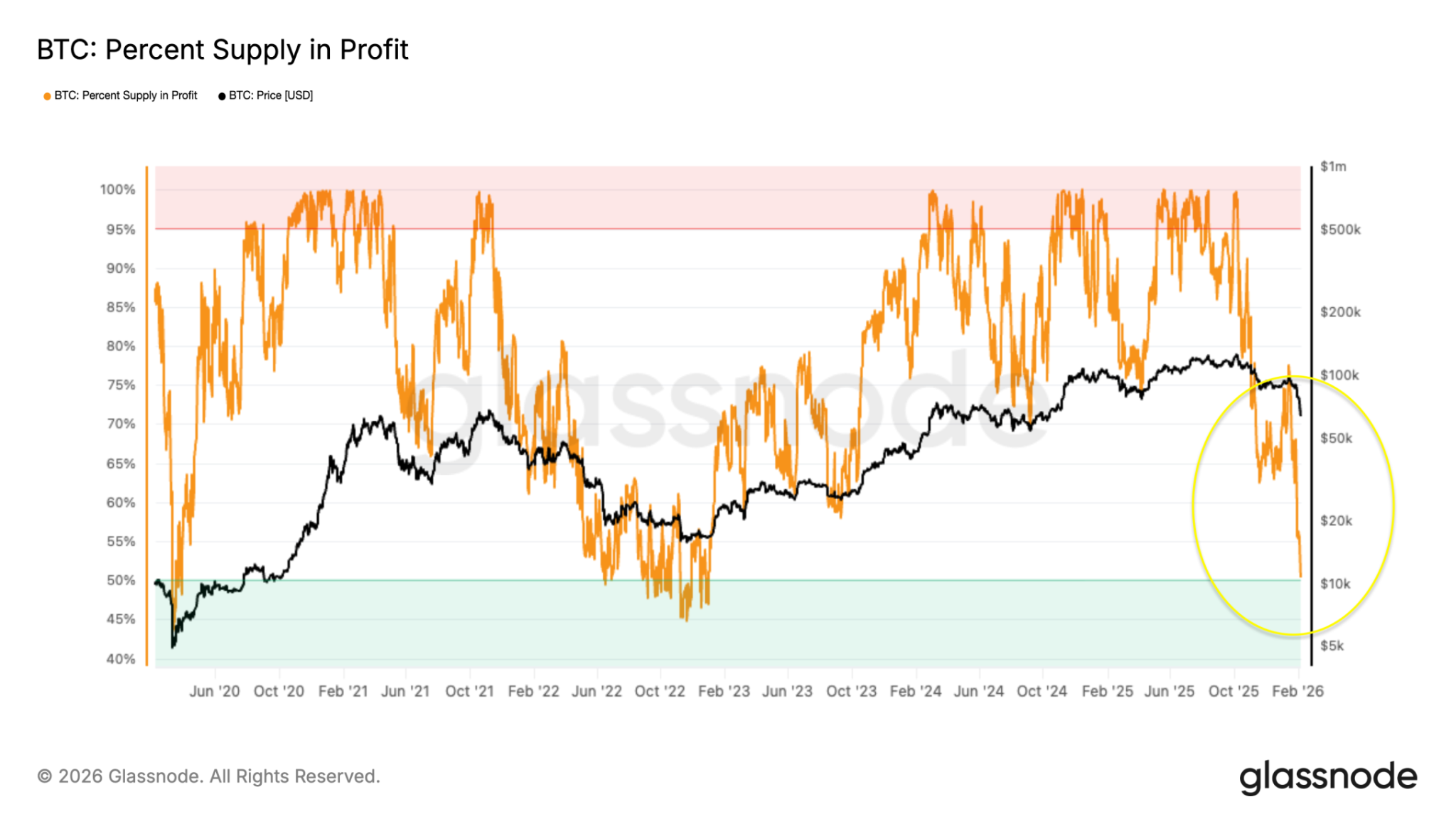

Whilst we've seen the unrealised losses significantly spike up, it does not yet compare to the large unrealised losses that we've seen in prior bears: 2018/2019, and 2022. Although, the percent of supply (of BTC) that's in profit has dropped close to prior bear market levels.

The big question now will be: are we going to see the typically hawkish Warsh or is this a different Kevin Warsh that's going to shake up the Fed and look to cut rates aggressively in line with what the Trump administration wants? We expect we'll see a more dovish Warsh as it's highly unlikely that President Trump would appoint someone that's outright hawkish.

Percent of Supply that's in Profit:

Percent of Supply that's in Profit:

So, do these losses represent that enough carnage and capitulation has been had, and that these price levels are now an attractive area to step in and buy?

Let's look at it from a pricing model's perspective.

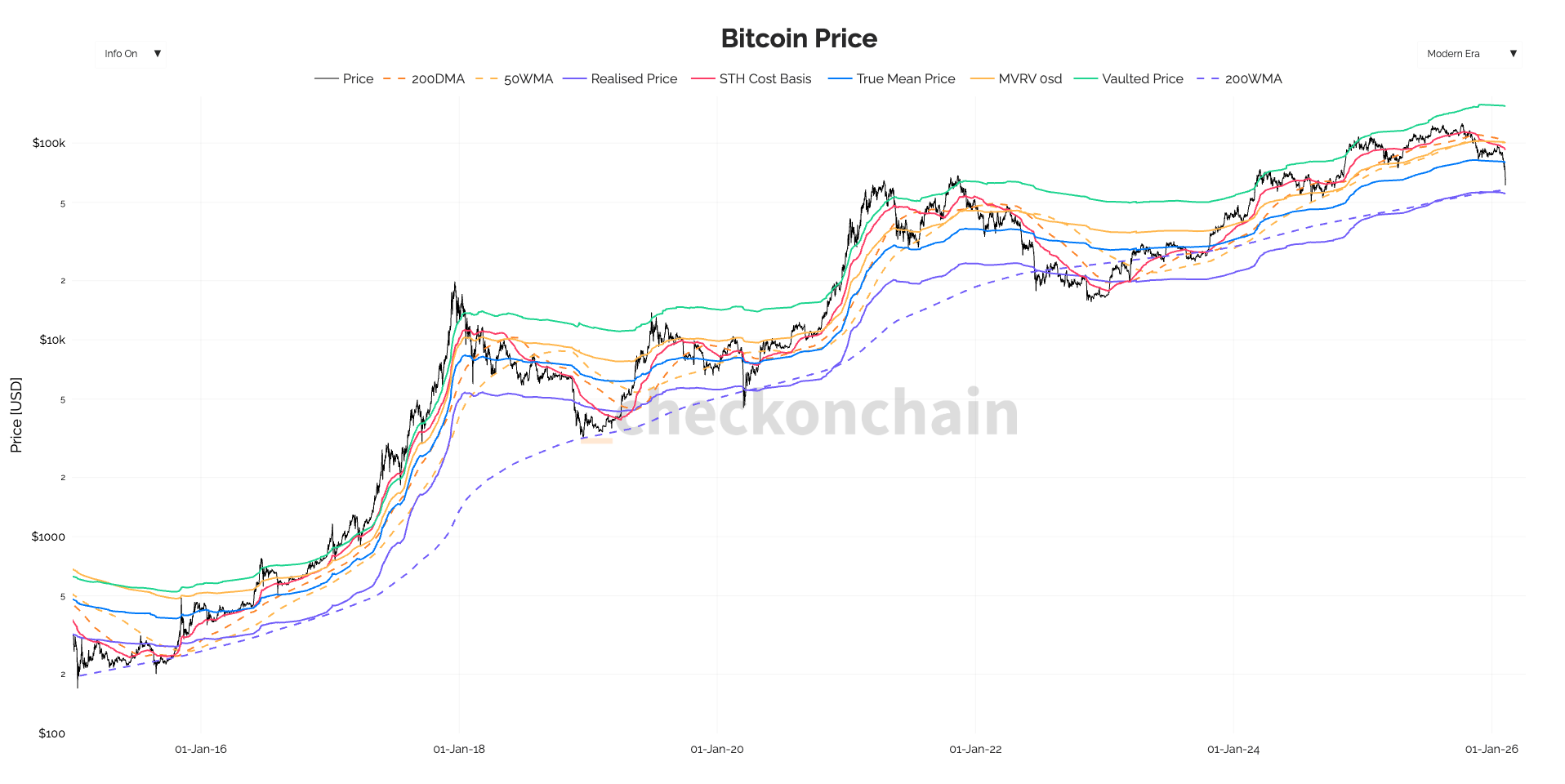

If we look at one of the simplest Cost Basis Models, we can see that Bitcoin has broken below its 'True Market Mean' price at $81k, and essentially fallen close to the 200WMA at $58k, and the Realised Price at $55k.

Bitcoin Price Key Costs Basis Levels:

Bitcoin Price Key Costs Basis Levels:

These levels have historically been a battleground for price that has either marked a bear market bottom for price, or has been close to a bottom for price. Either way, price touching into this zone (between $55k-$58k) is deep value territory for Bitcoin.

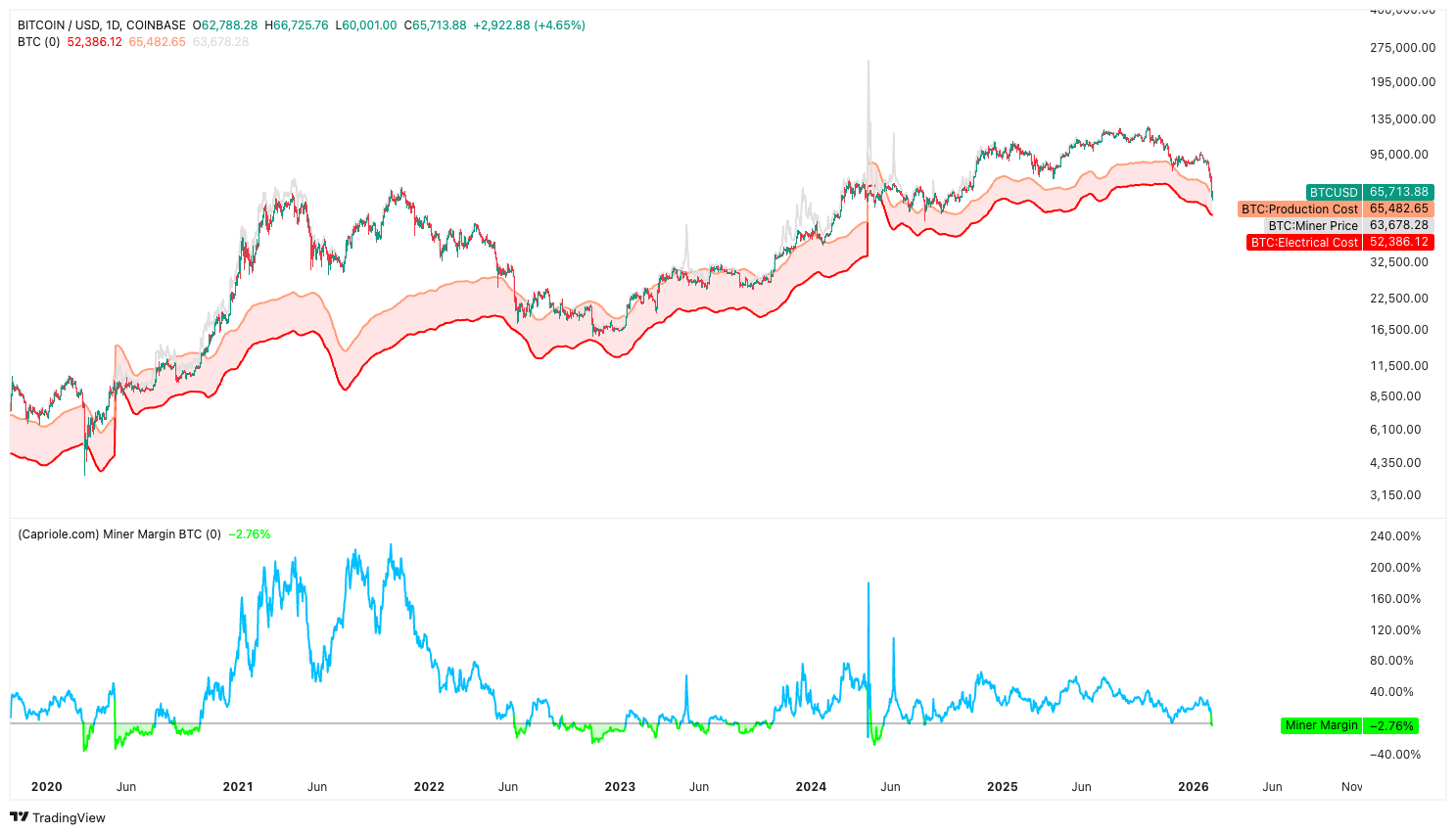

This mid-$50ks level also coincides with Bitcoin’s Electrical cost, this is at $52k. This is essentially the cost for efficient miners to mine 1 Bitcoin. Historically, the Production Cost, currently at $65k, represents a value area to buy Bitcoin. The Electrical Cost (at $52k) on the other hand, was last touched during the Covid crash of March 2020. The Electrical Cost represents deep value territory, and it represents a historically compelling entry point should price reach it.

Bitcoins Production and Electrical Cost Levels: Credit: Capriole

We're beginning to define a range for buys here. Value territory is in the $58k to mid-$60ks, with deep value territory between $50k-$58k - the Electrical Cost at $52k, up to the 200WMA at $58k, with Realised price sat neatly in the middle at $55k.Our Approach:

Firstly, let's outline the regime we've been in, and the new one we believe we're moving into.We've been risk off since Bitcoin was trading at $111k back in early-November, with a significant overweighting to cash. We've taken trading opportunities along the way, with recent ones being:

- Longing BTC from $89k to $97k (profitable).

- Longing SOL from $125 to $139 (profitable).

- Longing BTC from $75k to higher (stopped out for a loss at $72k).

Our view now is that the regime is still tricky, but it can change in Q2 as we believe the market is underpricing the number of Fed rate cuts this year. Therefore, we'd look to buy ahead of this, and accumulate BTC into value areas.

And Bitcoin has now pulled back to value areas, and should it have another leg lower, it would represent deep value territory. Therefore our focus shifts from an overweight to cash with the view of taking trading opportunities to progressively allocate our cash to Bitcoin and some select altcoins. Buying now, and continuously over the coming weeks, with a view to then sell into Q4 this year.

In terms of accumulating select altcoins, that's up to the individual as to what percent weighting of their portfolio that they want. For today, we'll focus on how we'd accumulate BTC. Should you want a 70% weighting to BTC, then in the below, we'll suggest at what prices we'd allocate that 70% cash.

We've determined that the core range that matches key on-chain levels is between $52k and $58k. But, even at today's price of $65k, this price does represent value. Therefore, we'd accumulate as follows:

- Allocate 30% between $59k-$63k (ladder orders).

- Allocate 50% between $50k-$58k (ladder orders).

- Retain 20% in cash as a buffer, to be deployed if price breaks below $50k or if the macro conditions deteriorate further.

So, just because price is extremely oversold now, doesn't mean the low is in. It's possible that $60k is the low, but from prior experience and examples, bottoms take time to form. Therefore, our approach is to layer orders that hopefully fill between $50k and $63k, as a bottoming process happens. We'll continue to assess this going forward, and this may be a moving target (in terms of the buying), but for now, we see $52k-$58k as reflecting deep value, and therefore that's going to be our target zone to accumulate at.

BTC Weekly Timeframe Bullish Divergences:

BTC Weekly Timeframe Bullish Divergences:

Our thinking is that this past week's move down for price is something similar to the move down in June 2022 (highlighted in the above chart). We don't expect a rapid rebound, although a relief rally could see a retest of $70k-$74k. However, with bottoming processes usually taking time, we expect price to move lower into the $52k-$58k zone over the coming weeks.

Our reason for this is that there are still upcoming headwinds for price, whether that be labour market weakness that sees equities pull back (as the Fed is potentially behind the curve), or equities pulling back due to CapEx concerns, or geopolitical concerns between the US and Iran. This still reflects a risk-off environment in the short-term. But, we choose to accumulate Bitcoin in deep value territory well, precisely because it's in deep value territory. We also expect the risk-off environment to last just a few more months. In our view the Fed is underpriced to cut rates more than what the market expects. The market is looking for 2 cuts this year, we're expecting 3 as a minimum, maybe 4. Therefore, we choose to get positioned again in BTC in the deep value territory with a risk-on environment returning by the end of Q2, and that gives fuel to BTC to move substantially higher in the second half of the year.

Cryptonary's Take:

Bitcoin's decline to $66k places price in value territory, with the $52k-$58k zone representing deep value backed by the 200WMA, Realised price, and the Electrical Cost convergence.

Our strategy: laddered accumulation between $50k and $63k, with 20% held in reserve as cash. Today marks a regime shift - from risk-off to structure accumulation into defined buy zones.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms