Market Update: Broader Bottoming Process Expected

We’ve likely seen the panic low; now comes the patience phase. Bitcoin’s move off $60k has eased immediate downside pressure, but the conditions for a sustained bull move are not yet in place. This is a market caught between relief and reality, and the coming data will decide which side wins in the near term.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Bitcoin has rebounded from $60k to the $68k-$71k range, but we view this as a relief rally within a broader bottoming process.

- Key data this week: delayed Payrolls and Unemployment (Wednesday) and Inflation (Friday) both could shift rate cut expectations forward from June to April.

- Current setup mirrors mid-2022: price capitulation largely complete, but time capitulation has not yet occurred. We expect a rounding bottom over the coming months, not a V-shaped reversal.

- Key risks: US-Iran escalation and a potential Yen carry trade unwind should Dollar/Yen break 160.

- Strategy unchanged: laddered bids between $50k-$63k with 80%, and 20% remaining in cash on the sidelines for now.

Topics covered:

- This Week's Data.

- Current Market Stance?

- Potential Risks in the Short-Term?

- Cryptonary's Take.

This Week's Data:

This week, there are two key economic data releases: labour market data (Wednesday) and inflation data (Friday). This labour market data is the delayed Payrolls and Unemployment Rate data that was due out last Friday, but wasn't released due to the government shutdown - which has now reopened.For context, last week we did get some labour market data: Job Openings, Challenger Job Cuts and ADP Employment Change.

Job Openings saw a large decrease from 6.9m, with a consensus of 7.2, but coming in at 6.5m. The number of open job advertisements is falling. Meanwhile, Challenger Job Cuts came in at 108k, well above the prior month's 35k number. And ADP Employment Change came in at 22k, well below the 48k consensus number. All of this points to a weakening labour market, which is what Governor Chris Waller pointed to in his dissent (for a rate cut) at the late-January Fed meeting.

The consensus this Wednesday is for a 70k Payrolls print, with the Unemployment Rate expected to remain unchanged at 4.4%. Should we see these numbers, they would signal a still-resilient labour market, and rate cuts would remain pushed out to mid-year. However, should we see weaker numbers, then risk assets could see some upside, assuming the weakness in the jobs numbers isn't too weak. Essentially, the market wants data that supports more rate cuts and sooner, but it doesn't want to see the labour market deteriorate too much, otherwise that would be recessionary and risk assets would sell off more materially.

Inflation on the other hand (to be released on Friday), is expected to show declines in both the Core measure and the Headline number. The forecast is for a 2.5% Core YoY print, and a 2.4% YoY Headline print. Markets would celebrate this should we see it, as it would mean that inflation is trending down towards the Fed's 2.0% mandated target and they can focus on the weakening labour market. This would result in more rate cuts and for the first to likely be sooner than June.

Currently, the next rate cut is priced to happen at the June meeting, with March showing an 84% chance of a continued pause, and late-April showing a 67% chance of a pause. In our view, we expect these odds to decrease by the end of this week once both the labour market and inflation data numbers are out i.e., we may see a shift for the first cut to become priced to happen in April rather than June.

Current Market Stance?

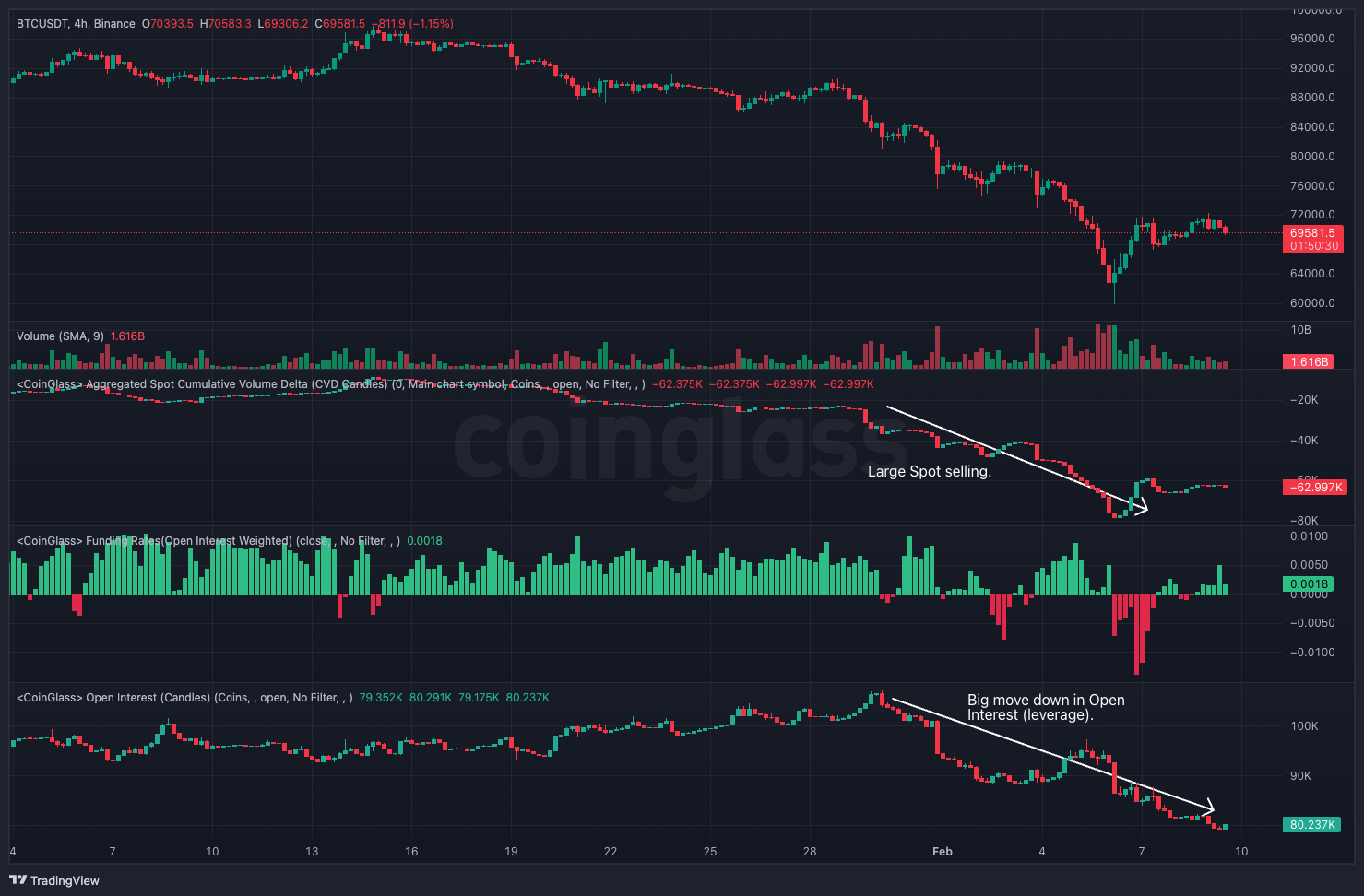

Last week, the Bitcoin market saw large Spot selling drive price down, we can see this in the Spot Cumulative Volume Delta (below chart). The breakdown from $75k to $60k also saw a significant flushing out of Open Interest (leverage), with Funding Rates now just fluctuating near neutral.Bitcoin Mechanics 4hr Chart:

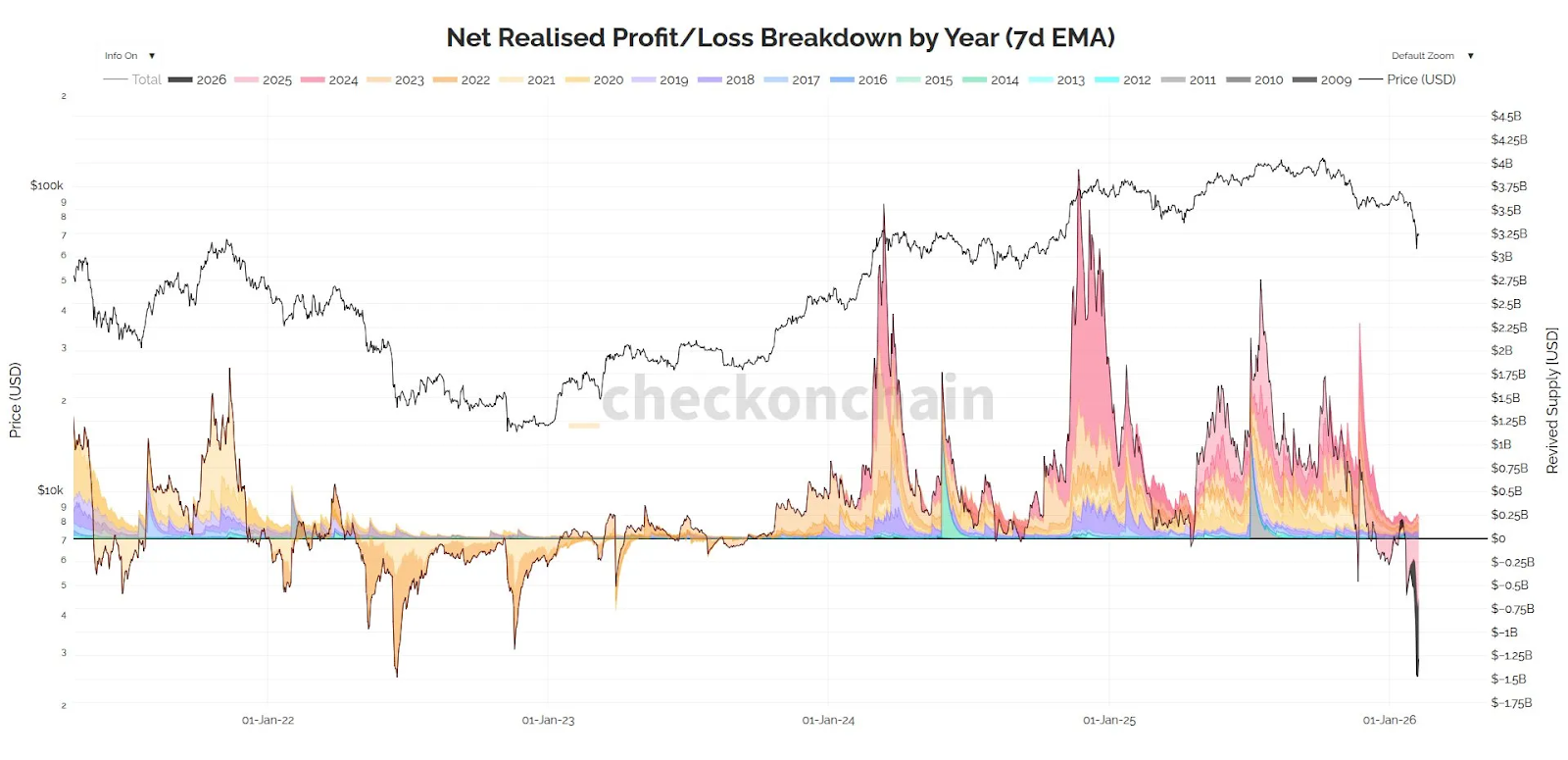

Alongside this, massive realised losses were taken, with losses similar to that of June 2022 when BTC collapsed by 44% in a short period of time.

Net Realised Losses hitting similar levels to June 2022:

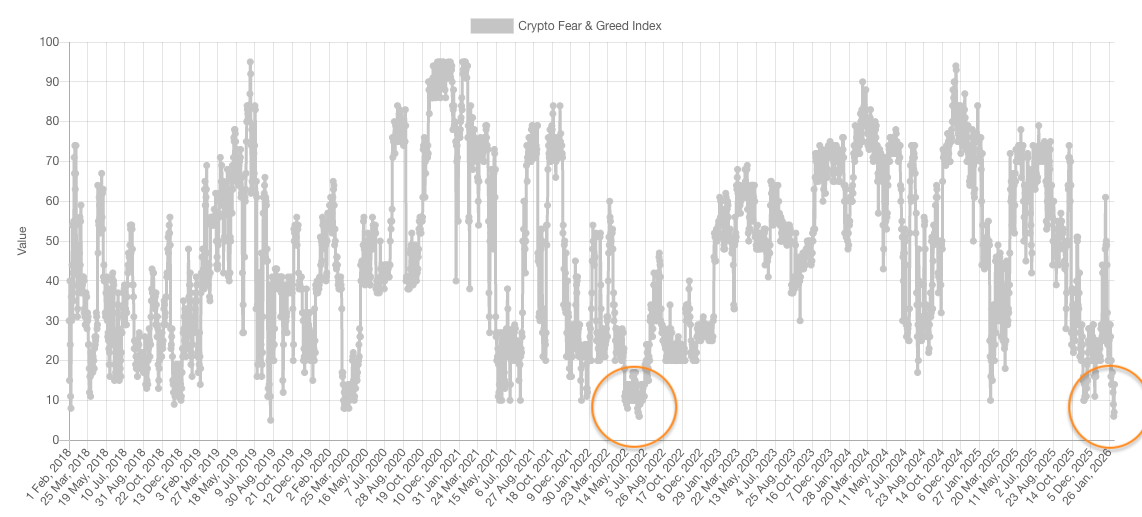

Whilst the Fear & Greed index plunged to lows not seen since... mid-2022. Note, mid-2022 was 222 days into a 366 day bear market.

Fear & Greed Index at new lows:

In our view, we believe today's market is in a similar position to June 2022:

- We've seen a more than 50% drawdown from price all-time highs.

- The bulk of the price drawdown appears complete, but time capitulation has not yet occurred.

- Bottoms are a process, and we expect a 'rounding' bottom formation rather than a 'V-reversal'; this is not a Covid-style scenario where a rapid liquidity injection produces a V-shaped reversal.

- The 3D RSI has probably bottomed, but bottoms take time, so we expect that price hasn't yet bottomed, but a new price low won't generate a new RSI low = bullish divergence.

- Retail participation has declined significantly.

Ultimately, it seems that enough capitulation was had that $60k was a local low, and therefore we may see a potential relief rally in the short-term. Although arguably, a fair chunk of that has already happened in the rebound from $60k to $71k.

But, when we look at the underlying drivers of price, it remains our base case that BTC visits the $50k-$60k zone - there are too many key cost basis levels there, and for now, there isn't sufficient reason for institutional buyers to meaningfully step in before $50k-$60k is retested. However, this may take 1-3 more months to play out, and we expect price to be range-bound between $60k-$78k in the meantime.

Potential Risks in the Short-Term?

Over the coming weeks, there are several potential risks that we're watching:1. Potential escalating tensions between Iran and the US. Should Oil breakout to the upside, that would potentially precede a meaningful escalation. Should a strike happen, it's likely risk assets would drastically pull back.

2. Dollar/Yen breaking above 160 due to increasing fiscal deficits. This may result in a 'Yen carry trade' unwind, which has negatively impacted risk assets in the past. We don't expect this to be hugely impactful as a lot of leverage has been taken out of this trade already.

Cryptonary's Take:

Bitcoin has bounced from $60k to $71k, with price now resting at $68k. However, we see this as a relief rally that may go higher, or stall it in the low $70ks, but we're not betting on substantial upside here and we prefer to remain on the sidelines.Our strategy: we maintain that the market is in a risk-off environment, but that prices have come down close to deep value areas. Therefore, we're layering bids between $50k to $63k with 80% of our cash, with a view to accumulating for the long-term.

Peace!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms