Market Update: BTC Relief Rally Faces Resistance

Markets are moving fast, and every data release seems to shift the narrative. Weak labour prints, soft flows, and muted spot demand are shaping this week’s tone, just days before the Fed’s December meeting. In this report, we break down what’s really driving price, how flows are evolving, and what it means for Bitcoin in the weeks ahead.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC Price at time of publishing: $91,300.

TLDR:

- Labour market cooling: Weak ADP and rising layoffs signal deterioration despite low Jobless Claims.

- Rate cuts ahead: December cut priced in; odds of a January cut have risen.

- BTC rally lacks strength: Move from $80k→$94k shows weak Spot demand and continued LTH selling.

- Flows not supportive: ETF inflows muted; LTH selling and soft Spot bid limit upside.

- Outlook: BTC likely range-bound, with risk of retesting $80k; attractive buy zone $75k–$82k; 2026 still viewed positively.

Topics covered:

- This Week's Data.

- Mechanics and Flows.

- Cryptonary's Take.

This Week's Data:

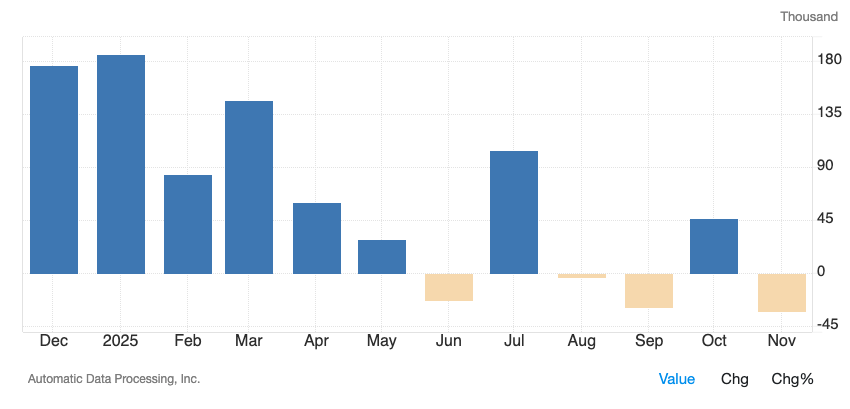

In the last two days, we've had ADP and Challenger jobs data out. ADP Employment Change (released on Wednesday) came in at -32k, far worse than the consensus +10k. Alongside this, Challenger Job Cuts came in at 71k (71k jobs cut). The Challenger survey Year-on-Year showed more layoffs and fewer hires.ADP Employment Change:

However, Jobless Claims (the number of people claiming for unemployment benefits) moved down to 191k, the lowest figure since late 2022. But, Jobless Claims measures how many people claimed this week, so it's a very zoomed in and narrow metric. Layoffs are usually "the last shoe to drop", and when we look at the other metrics, they suggest that the labour market has materially cooled down and is now weakening. You'd expect layoffs to come as a result of this, but this should result in more interest rate cuts i.e., the Fed is potentially behind the curve.

Jobless Claims:

COMMENT: In terms of rate cuts’ pricing, these job figures didn't change much for the December 10th Meeting. It is still widely expected that the Fed will cut rates in 5 days. However, we did see an improvement in the odds for a January cut. Whilst still unlikely, the odds for a January rate cut have increased from 21.3% on November 29th to 25.1% today.

Target Rate Probabilities for 28 January 2026 Fed Meeting:

Note: we have PCE, Personal Income, and Personal Spending data out later today. But it's September's data, and therefore relatively outdated and unlikely to move markets, so we're not giving it too much weight in our overall analysis.

Mechanics and Flows:

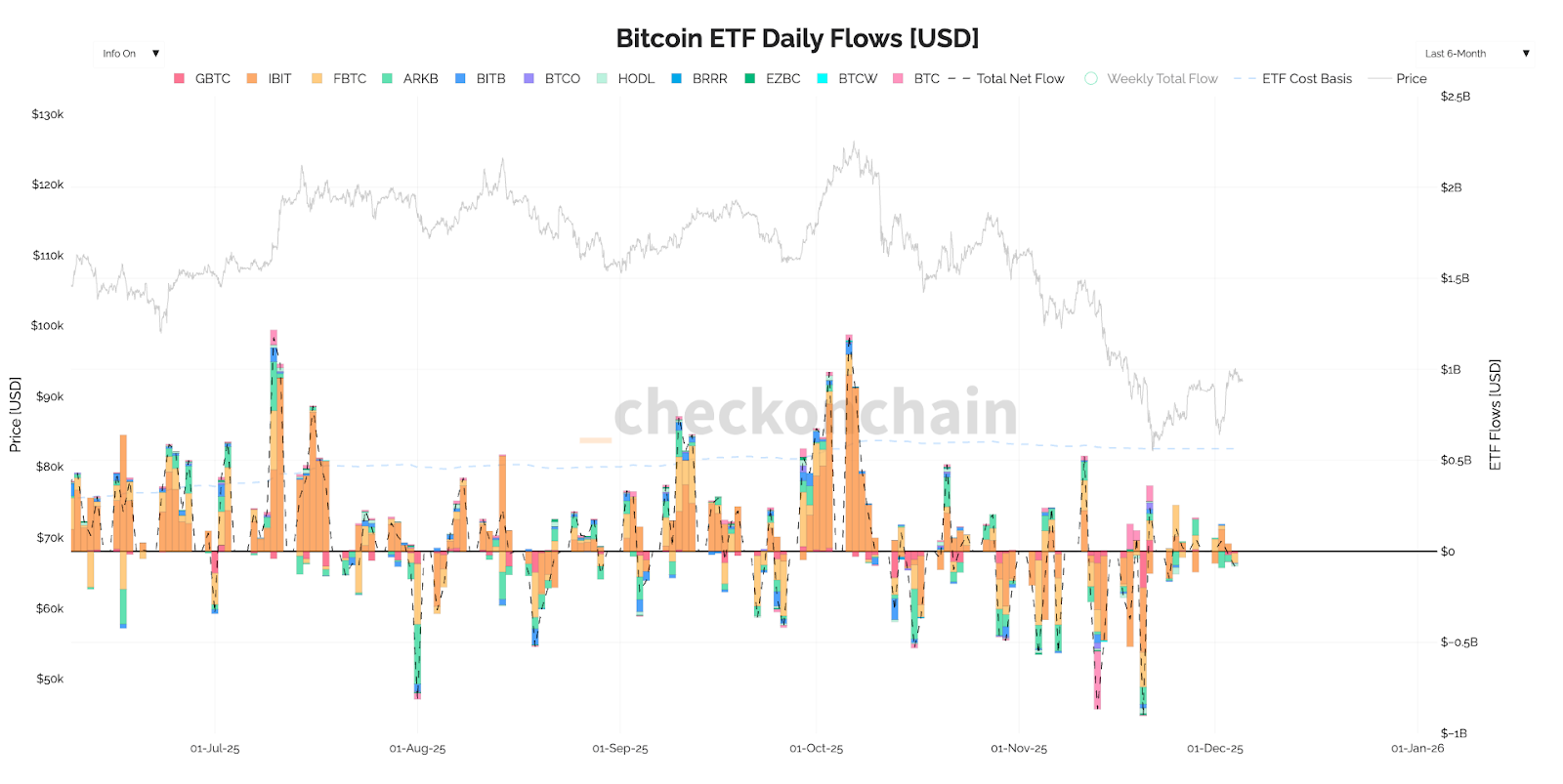

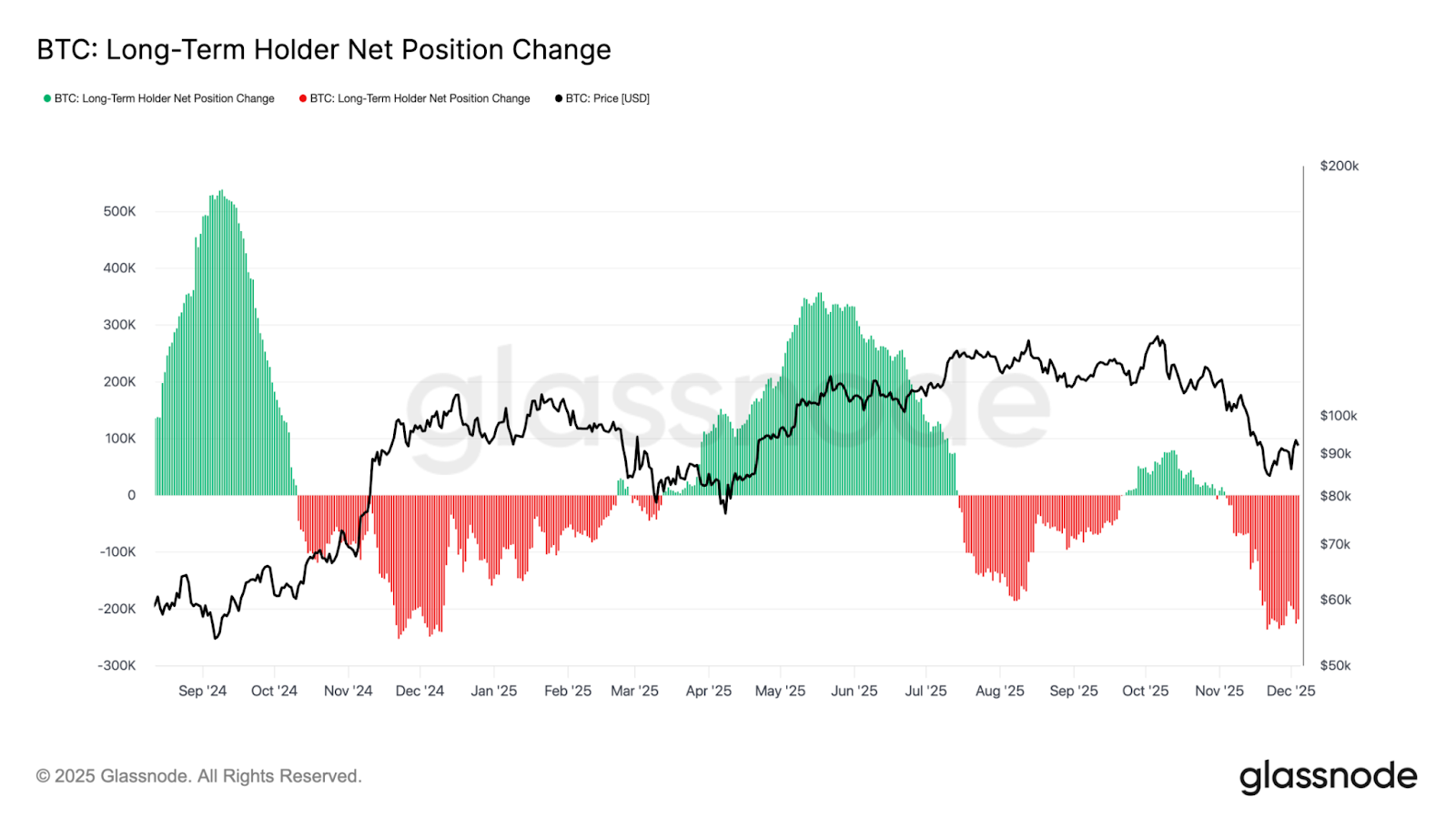

In the last 3 weeks, we've seen price breakdown from the mid-$90k's, and quickly wick into $80k before bouncing into the $93k-$94k.Initially, we saw a puke out in the ETFs (huge outflows), whilst Long-Term Holders continued to sell. This is what drove the move into $80k. The large ETF outflows have mostly stopped, and we're now in a more neutral period (some small inflow days, some small outflow days). This is positive. However, the Long-Term Holders aren't yet showing any signs of easing up on their sells, having now sold down their supply for the last 4 weeks.

ETF Flows:

Long-Term Holder Net Position Change:

For the price to make a meaningful turnaround, Long-Term Holders selling will need to ease, and the ETFs will need to become meaningful buyers again (large inflows).

Going back to the initial breakdown that drove price into $80k, we saw price bottom with a large volume candle - shown on the chart with the green circle.

BTC 1D Chart - Large Volume Candle:

We can also see a similar effect on the MSTR (MicroStrategy) chart.

MSTR 1D Chart - Large Volume Candle:

The large volume candle indicates a capitulatory move that was then ultimately bought up, marking the local bottom.

Since price has bounced from $80k to $93k-$94k, but it's not been driven by significant Spot volume, and we can see this with the Spot CVD having remained flat. Before, it was declining considerably, which is what contributed to the price moving down to $80k. Therefore, we have to question the health of this rally and whether it's sustainable. And from the metrics we're tracking, it doesn't look to be.

Spot CVD is the Spot Cumulative Volume Delta. This measures the net difference between buying and selling volume at the ask (aggressive buys) vs bid (aggressive sells) in the Spot market.

BTC Spot CVD:

Alongside this, if we then look to the Options market, we can see that traders aren't betting on meaningful upside here. More $100k Calls have been sold rather than bought. This suggests the upside conviction (using the $100k mark for BTC) amongst traders is limited.

Calls Sold vs Calls Bought for BTC @ $100k Strike Price:

In summary, from looking at the mechanics and the flows, the move up from $80k to $94k looks like a relief rally.

For this to change, we'd need to see the following:

- ETF inflows improve

- Long-Term Holders ease off on their selling, and ideally begin accumulating again

- The spot bid in the market to picking up again.

Cryptonary's Take:

This week's data shows a continued weakening in the labour market despite some individual data points suggesting that mass layoffs aren't imminent. But a deteriorating labour market likely results in layoffs down the line, and the Fed will need to meet this with more interest rate cuts in an attempt to stimulate growth and therefore hiring.Fed speak suggests that there might be fewer cuts in the next 2-3 months, but the deteriorating data suggests that there might be more cuts (than what the market is expecting) in Q2, and into year-end 2026. This would be a positive tailwind for risk assets and therefore Crypto.

In terms of BTC's price action, we can see that the aggressive selling that resulted in BTC wicking into $80k has eased off on some metrics, like the ETFs. However, Long-Term Holders are still offloading size whilst there isn't a large Spot bid to offset this. And with our expectation that the Fed delivers a hawkish cut next week (the cut part is already mostly priced), we don't see a catalyst in the immediate term that would take BTC north of $100k. This is also reflected in the Options data that we've highlighted above, with more $100k Calls being sold, rather than bought.

For now, the move up in BTC from $80k to $94k looks like a relief rally, and we believe that $94k was the local top. And until the flows and underlying mechanics of the move improve, the greater likelihood is that price is range-bound in the short-term (capped at $94k), with the range lows ($80k) likely to be retested, and potentially even before year-end.

We remain of the view that 2026 will be a positive year, mid-term election years usually are. Therefore, should we see a move back down to $80k, and even below (we do expect this), then we'd be buyers of assets at those levels. For BTC, that looks like $75k-$82k.

We expect this to happen in the next 1-2 months, and we expect to be buyers there going into late Q1, with a bull market top going into the mid-term elections - Q3 2026 top.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms