Market Update: BTC Surges on Spot Buying, Local Top Near?

A sharp move higher has put $100k back on the table, but not without resistance and risk. In today’s update, we cut through the noise to assess the strength of the rally and where the price may pause next. Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- BTC surged from $90k to $97k, led by Spot buying and strong ETF inflows rather than leverage.

- Market conditions have improved, with ETFs buying and Long-Term Holder selling easing, but not yet flipping to strong accumulation.

- Heavy resistance sits between $98k and $105k, making near-term consolidation or a local top possible.

- Upside toward $105k-$108k depends on continued ETF inflows, a positive Coinbase Premium, and LTH accumulation.

- Geopolitical risk remains, with oil prices the key external signal to watch.

Topics covered:

- Mechanics Behind The Move Higher.

- Potential Risks To The Rally Outside of Crypto.

- Cryptonary's Take.

- Mechanics Behind The Move Higher:

We'll start with the mechanics before we dive into the key on-chain levels.

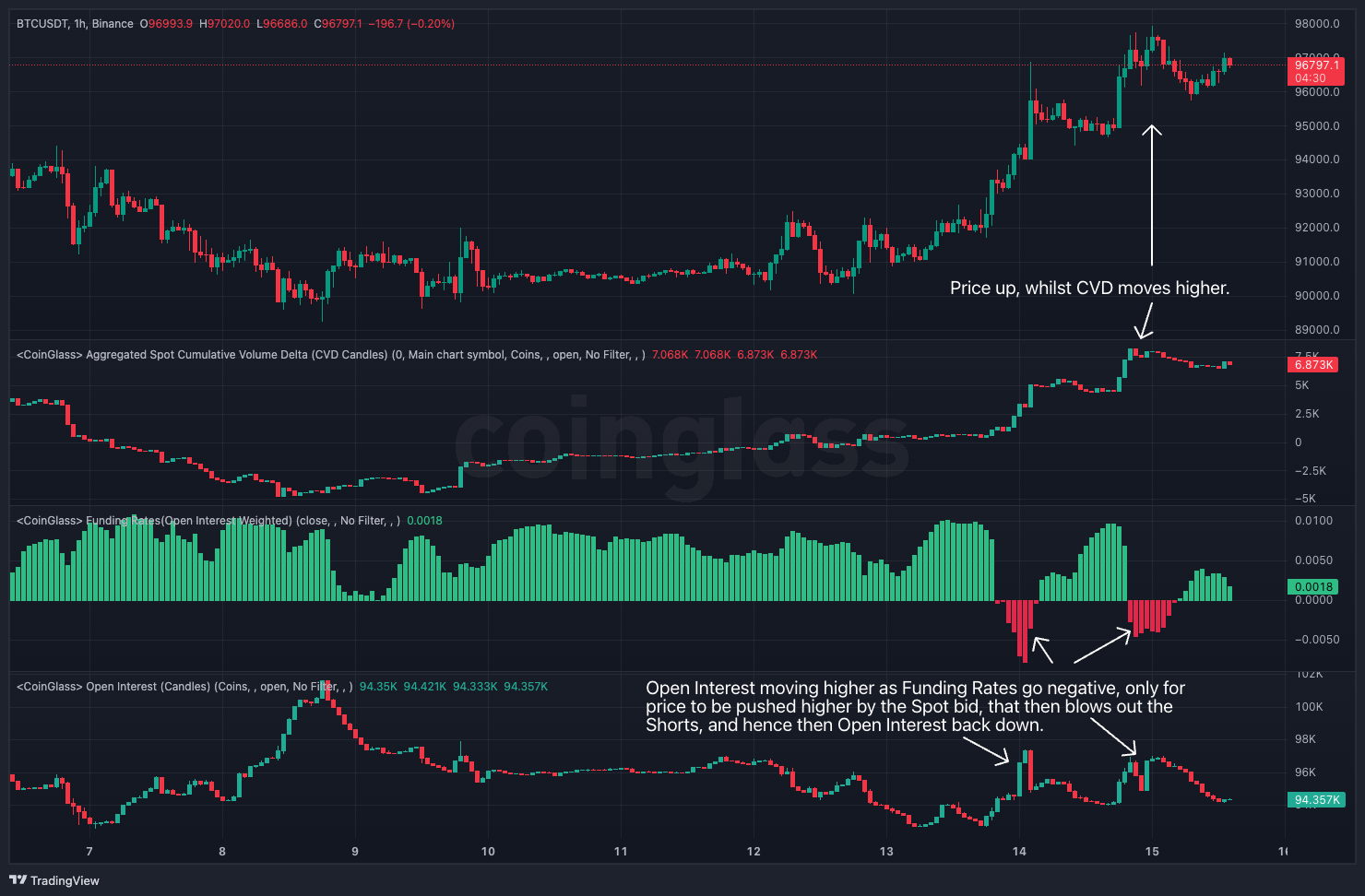

When looking at mechanics, we're trying to gauge if price is being driven by Spot (usually a healthier sign of continuation) or leverage. If price is moving higher, and in the most recent case it was, then we're looking for that price rally to have been driven by Spot buying rather than leverage Longs. If price moves higher off the back of strong Spot buying, that is usually a healthier rally, as it isn't 'unwound' so easily as leverage Longs can be.In this recent move up from $90k to $97k, we can see that we have the following:

- Rapidly increasing CVD (cumulative volume delta), meaning there is strong Spot buying.Open Interest increasing, but alongside Funding Rates going down, i.e., as price moves up, Shorts are piling in, only for the Spot bid to push price up, and for the Shorts to get taken out.

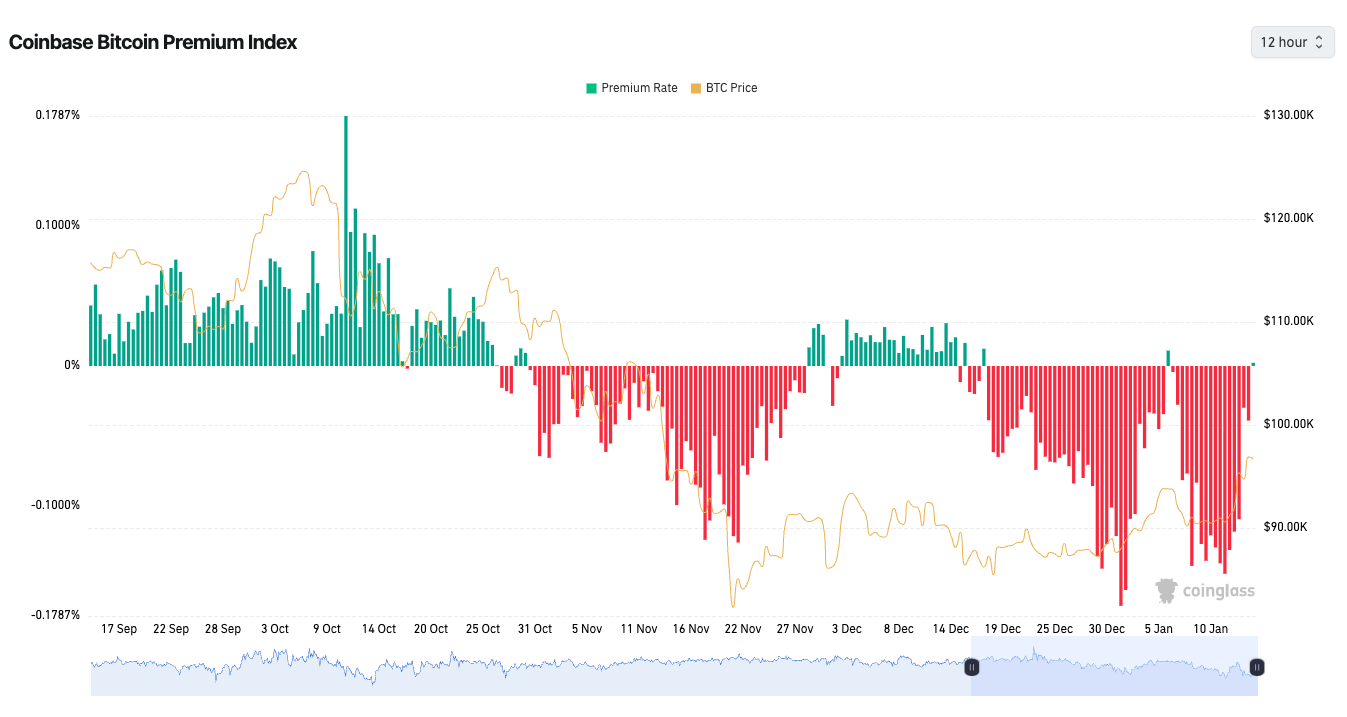

- Coinbase Premium is moving from deeply negative to slightly positive. It's not necessarily how positive the Premium is, but the direction in which the Premium is moving. In this case, from deeply negative to positive, indicating stronger levels of Spot buying on US exchanges (Coinbase), usually positive for price action.

BTC Price, CVD, Funding Rate and Open Interest:

Below, we can see that the Coinbase Premium went from deeply negative to positive, indicating that the price of BTC is trading at a premium on Coinbase (in the US) over non-US exchanges. This has historically been supportive of higher prices.

Coinbase Premium turning positive:

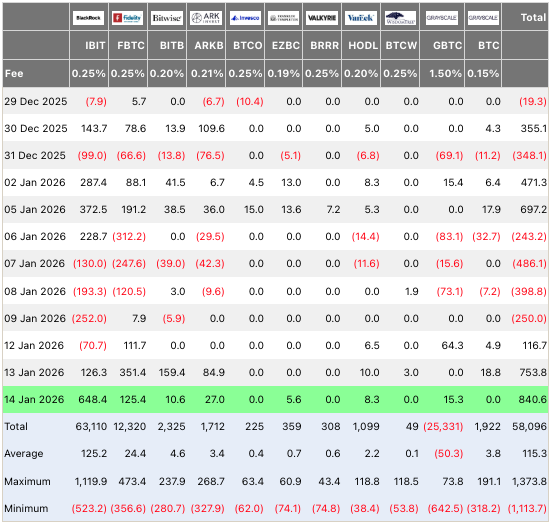

We can see the strong Spot bid behind BTC over recent days in the ETFs. In just the last two days (Jan 13th and 14th), the Bitcoin ETFs saw a net inflow of nearly $1.6b, with $648m coming from Blackrock's IBIT just yesterday (Jan 14th). This has been a key driver of BTC pushing from $90k to $97k.

For net flows, look at the far right column on the below chart.

BTC ETF Flows in USD:

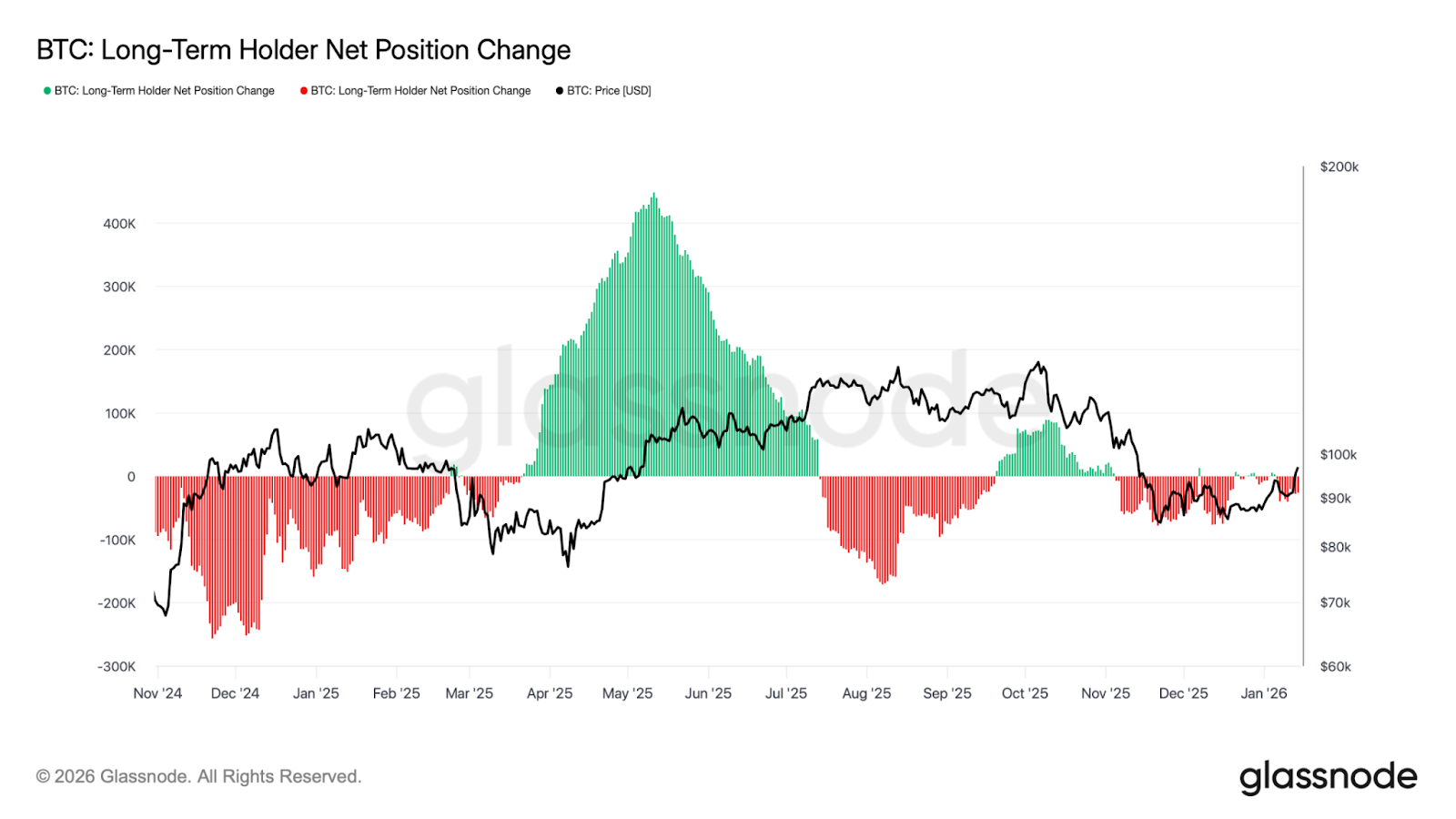

These strong net inflows have also been matched by Long-Term Holders dramatically easing up on their selling, and even going into 'accumulation' rather than 'distribution' mode. However, as price has moved into the $97k area, we're seeing Long-Term Holders begin distributing (selling) their coins again, although not in huge size, and so far it has been comfortably absorbed by the ETF's buying.

Long-Term Holder Net Position Change:

Overall, the above is a far more positive and constructive backdrop for price to push higher, and, as we've seen these metrics go from strong bearishness to easing up, that's been one of the key drivers as to why we've become bullish in recent weeks - even though the metrics weren't outright bullish, the key takeaway for us was that peak bearishness was likely over and behind us. As a result, this has enabled us to identify Long trades and reap the upside of those.

Potential Resistances?

We've had a move from $90k to $97k for BTC in a relatively short period. We'll now look to the upside at key price levels that can be a resistance for the price, and therefore potentially cap this rally.

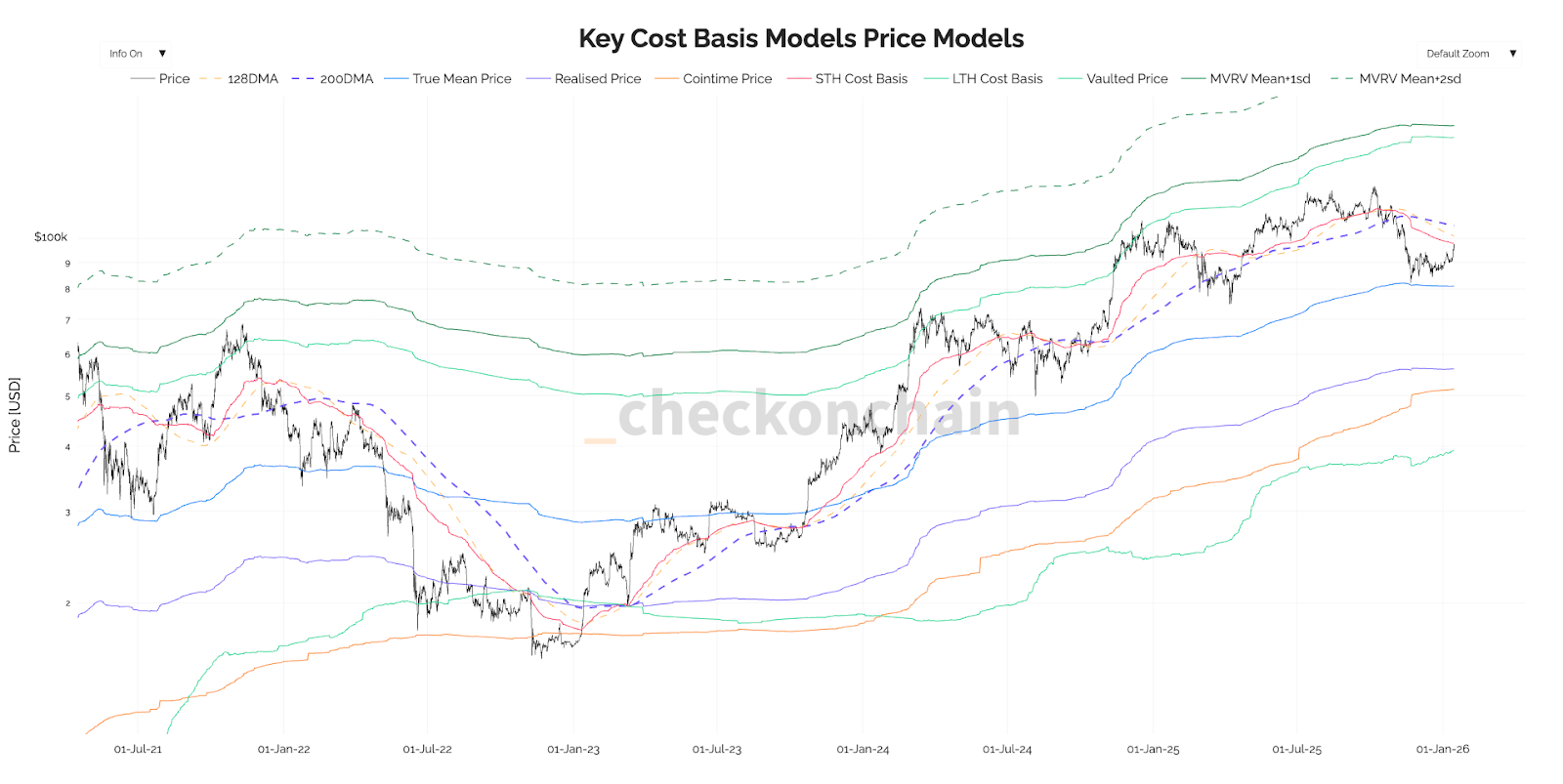

In the chart below, we can see that BTC has now moved up and into the Short-Term Holder Cost Basis of $98,000. This level just in itself can be enough of a resistance for price in the immediate term, particularly after we've seen a move up from $90k to $97k in a short period of time. And, beyond this (the STH Cost Basis of $98,000), we have the 128-day moving average (at $101,200) and the 200-day moving average (at $106,000).

Key Cost Basis Price Models:

If we then look at BTC from a technical viewpoint, we can see that the price has broken out above the key resistance zone between $94,000 and $95,000, with the price now consolidating above this zone. The next technical resistance zone is between $99,300 and $101,600.

BTC 1D Chart:

So, the metrics have improved, and we've seen a strong Spot bid which has driven BTC from the mid-$80k's into $97k. However, there are a plethora of resistances (be it on-chain or technical levels) between $98k and $105k. Therefore, it's possible that BTC may have locally topped here, or is close to locally topping here.

However...

The metrics have improved significantly:- Long-Term Holders aren't selling down their coins in substantial size anymore, and we've even seen brief periods of accumulation over the last week.

- The ETFs have become large net buyers of BTC again.

- We've seen huge distribution (of coins) over the last few months with the market far less 'top-heavy' than it was in September/October time.

Concluding Thoughts:

With this being said, it's possible that price can continue higher here. But for us to be more convinced of that, we'd need to see the metrics improve further (more ETF buying, LTH accumulation rather than distribution, positive Coinbase Premium, etc.) and for the price to consolidate between $96k and $99k. Should we see this, then we'd be more convinced of a further move up to $105k.But, for now, BTC may be locally topping or beginning to consolidate here. Either way, it may be prudent for the traders to lock-in some of the gains from the BTC Long from $90k.

Potential Risks To The Rally Outside of Crypto:

Whilst we're looking underneath the hood at the on-chain and mechanics of this rally in Crypto to determine its sustainability, we also have an eye on events outside of Crypto that may stall this move higher, and/or even result in a more meaningful pullback for price.There is always a plethora of things going on that could be a 'risk' to this current rally, be it a hiccup in the recent Crypto bill that Coinbase withdrew support for or the Yen devaluation (which is helping risk assets currently) that may lead to the Bank of Japan intervening to protect their currency (which could result in risk assets pulling back). However, in our view, we see the most significant risk currently being the tension between the US (rather the Trump administration) and the protests in Iran against the Islamic Republic regime, in an attempt to overthrow the regime.

It looked like the US were about to imminently strike Iran, however, it's been said that President Trump called off the strikes “at the last minute” as advisors couldn't promise a decisive regime-toppling blow. President Trump has since stated that there are "no plans to attack", and tensions have now eased.

This was reflected in the price of Oil, where the price spiked to $62 before pulling back today to $59, down 4.66% on the day.

Crude Oil Futures 1D Chart:

For now, this risk may be behind us, but for how long that remains is questionable. The tell for us will be Oil. Should we see Crude Oil move higher into the mid-$60's, that would indicate to us that a US strike on Iran may be more imminent again. Should we see this, that would lead us to tilt more aggressively risk-off - assuming we're holding Spot positions/have some Longs running.

Right now, we believe we're beyond this risk, but we're watching it closely as a significant strike on Iran (from the US) would likely result in a major pullback for risk assets.

Cryptonary's Take:

We highlighted a few weeks ago that we had seen an improvement in some of the key metrics we track that might have suggested that peak selling was behind us. During this period, BTC stabilised in the mid-$80k's, and following a continued improvement in the said metrics, we went Long BTC from $90k - having played SOL before that from $125 to $140.BTC has now rebounded from the low $80k's, and it's just a few per cent away from the major psychological $100k level. Despite the metrics we track improving significantly, they're not yet very accommodating. For instance:

- The Coinbase Premium was deeply negative, and now it's close to flat, but it isn't significantly positive.

- The ETFs have had large inflows, but it's just for a few days, and we have had huge outflow days in the last few weeks, also.

- Long-Term Holders have eased up on their distribution, i.e., they're selling far fewer coins today than they were 6 weeks ago. But, they're still not buyers.

Should we see price consolidate for 1-2 weeks between $94k and $98k, and the metrics improve to become accommodative:

- Coinbase Premium go positive,

- ETFs continue to see large inflow days,

- Long-Term holders begin accumulating with size, rather than distributing, then we'd look to position Long again for another move up, with a potential target for BTC of $105k-$108k.

It's possible we've seen the meat of this move higher for BTC, but should we see the metrics become accommodative and BTC consolidate between $94k and $98k, then we'd look to re-position Long again for a move into $105k-$108k.

Ultimately, this is a very tricky market, and it's a traders’ market. This favours more active management rather than a more passive approach.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms