Market Update: Crypto Relief Rally Continues

Markets have kicked off the year with speed and intent. In this update, we break down what’s driving price action, what actually matters going forward, and how we’re positioning as the market tests whether this move has legs...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Friday’s jobs data is the key focus; as long as employment stays positive and unemployment ≤4.6%, markets should hold up, with dips likely bought.

- The macro environment remains supportive, even if labour data softens modestly.

- Trump’s Venezuela move signals a tougher stance geopolitically; short-term oil risk, longer-term inflation relief.

- Crypto shows healthier positioning: leverage reset, selling pressure easing, base forming.

- BTC is likely in a relief rally, with major resistance at ~$95k–$106k; reclaiming these levels would strengthen the bull case.

Topics covered:

- This Week's Data.

- Trump Takes Venezuela.

- Sustained, or Relief Rally?

- Cryptonary's Take.

This Week's Data:

We have a number of economic data points this week with the major one coming on Friday - Payrolls and Unemployment Rate.But, preceding Friday, we have ISM Manufacturing today, and ADP Employment Change, ISM Services and JOLT's Job Openings on Wednesday. ISM Manufacturing is expected to come in at 48, whilst Services is expected to come in as previous at 52. JOLT's is expected to come in unchanged at 7.7m, whilst ADP Employment Change is forecasted to be 45k. We don't expect these data points to really move the market; we'll watch them to help us in our formulation of the overall picture, but we don't expect these data points to materially move the market.

This week's potentially market moving data will be Friday's Unemployment Rate and Payrolls figures. Forecasts are for a low amount of jobs added (45k), and for the Unemployment Rate to remain unchanged at 4.6%.

For now, the market is in a 'Goldilocks' environment, so as long as the numbers show a positive jobs number and the Unemployment Rate at 4.6% or lower, then the market can take this print in its stride. But, should we see softer numbers (negative Payrolls and higher Unemployment), then the market could pull back slightly on this.

Our View?

We're expecting the market to hold firm even if the Unemployment numbers are weak. Should they be weak, then a small pullback is possible, but we expect it to be bought and for the market to continue higher.

Trump Takes Venezuela:

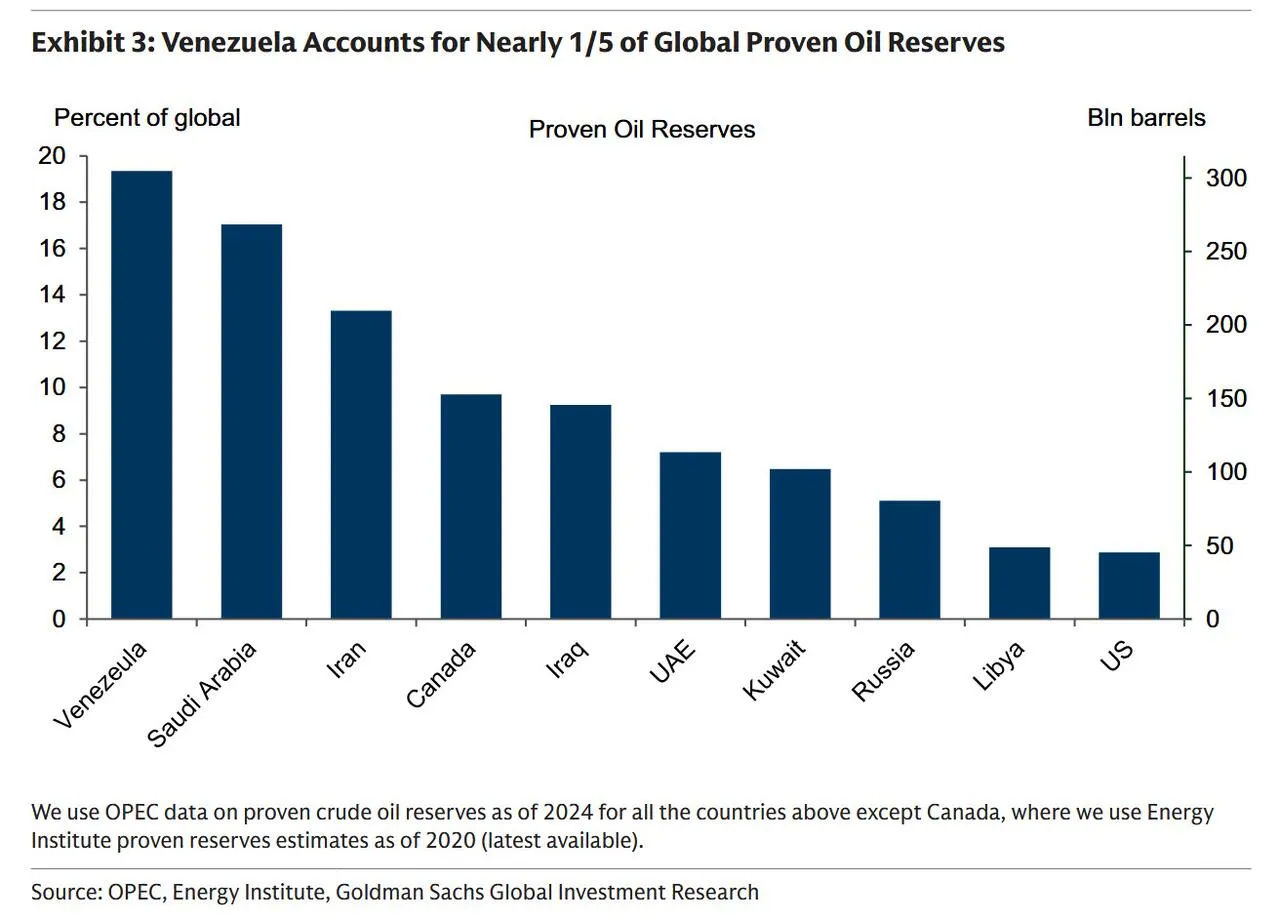

President Trump began this weekend by sending an elite military unit to Venezuela to capture and extract Nicolas Maduro, who was the acting President of Venezuela. Maduro was considered a dictator, who led an authoritarian government characterised by electoral fraud, human rights abuses, corruption and poor economic performance.Following Maduro's capture/arrest, President Trump stated that "the US will run the country until a safe transition". This gives the Trump administration access to one of the world's biggest oil reserves, with Venezuelan oil reserves accounting for nearly 1/5th of global proven reserves.

Venezuelan Oil Accounts for Nearly 1/5th of Global Proven Oil Reserves:

President Trump said "we're going to have our very large United States oil companies go in, spend billions and fix the badly broken infrastructure, and start making money". Trump mentioned that this money would be for the Venezuelans and the US. But more importantly, it gives the US control over the world's biggest oil reserve. However, due to the poor infrastructure in Venezuela, it'll take time for output to increase. Venezuela only produces 0.9m barrels per day, despite producing nearly 3.0m barrels in the early 2000's - this is due to the lack of investment in recent years and the deteriorating infrastructure.

In the immediate term, the price of Crude is likely to move up slightly, due to disruptions to exports (in Venezuela), but long-term, increased supply likely means lower oil prices - assuming the Saudis don't pull back on production due to the lower prices. This aids the Trump administration's efforts in bringing down inflation.

Despite the relatively muted market reaction, what this does tell us is this: Trump is not bluffing - TACO (Trump Always Chickens Out) no more. And with mid-term elections coming up in November, we expect that Trump will follow a hardline approach, and do what he can to win them, meaning a potential 'juicing' of markets can come this year.

Sustained, or Relief Rally?

We'll keep this section to headline metrics and charts, but we'll essentially look at it from a mechanics, on-chain and technicals perspective.Starting with the mechanics: Open Interest is up, and Funding Rates are positive, meaning that we've seen some leverage go back on but Funding Rates are contained so there isn't excessive bullishness currently. This is a healthy leverage market. Alongside this, the Spot Cumulative Volume Delta has stopped down trending, and it's now put in a bottom and tilting upwards.

BTC Open Interest and Funding Rates:

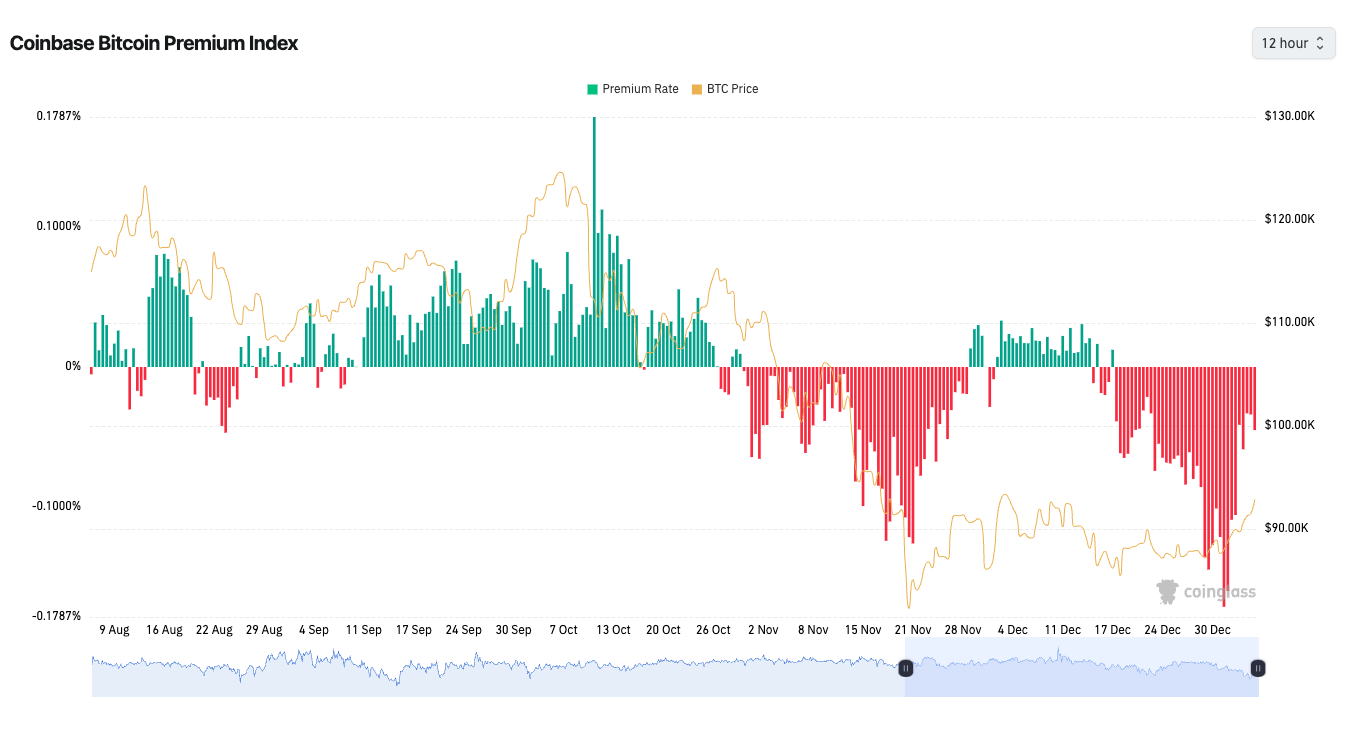

We also mentioned last week that we had an eye on the Coinbase Premium, how negative it was and that it was potentially closing back towards 0/positive. In the last week, we've seen that develop, and although the Premium is still negative, it's far less negative than last week - a closing of the Premium i.e., more buying in the US than we've seen in recent weeks.

BTC Coinbase Premium Index:

For a continued bullish development to happen, we'd want to see the Premium become less negative and move back to 0, and hopefully become positive (green bars). We'll continue to monitor this over the coming week.

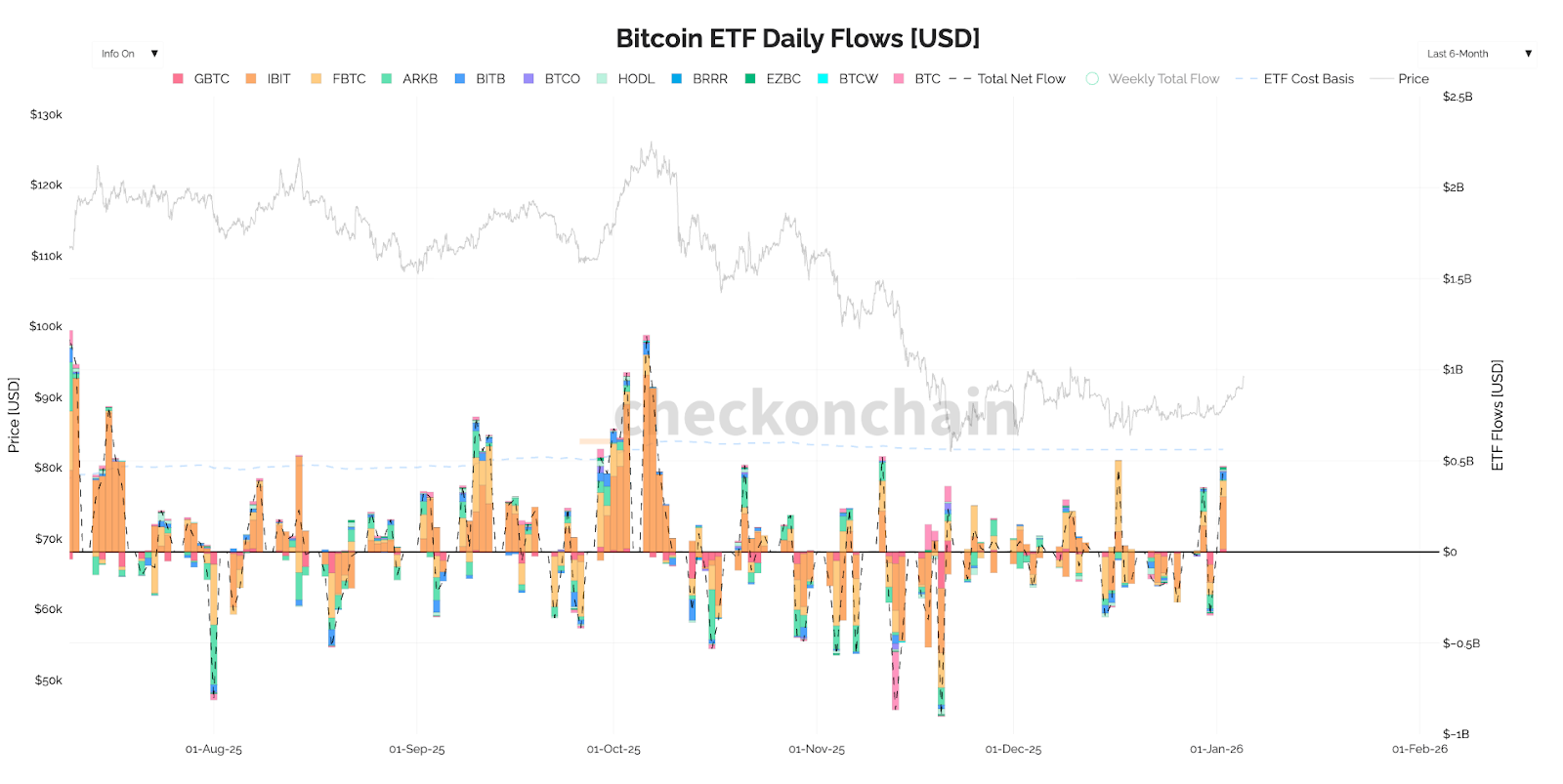

If we now look at the flows, the ETF flows are still somewhat mixed, but we're beginning to see a few more large inflow days. For price to push higher, and break above key resistance levels (which we'll outline further down in this report), we'll need to see more net inflow days, and preferably sizable inflows.

BTC ETF Flows:

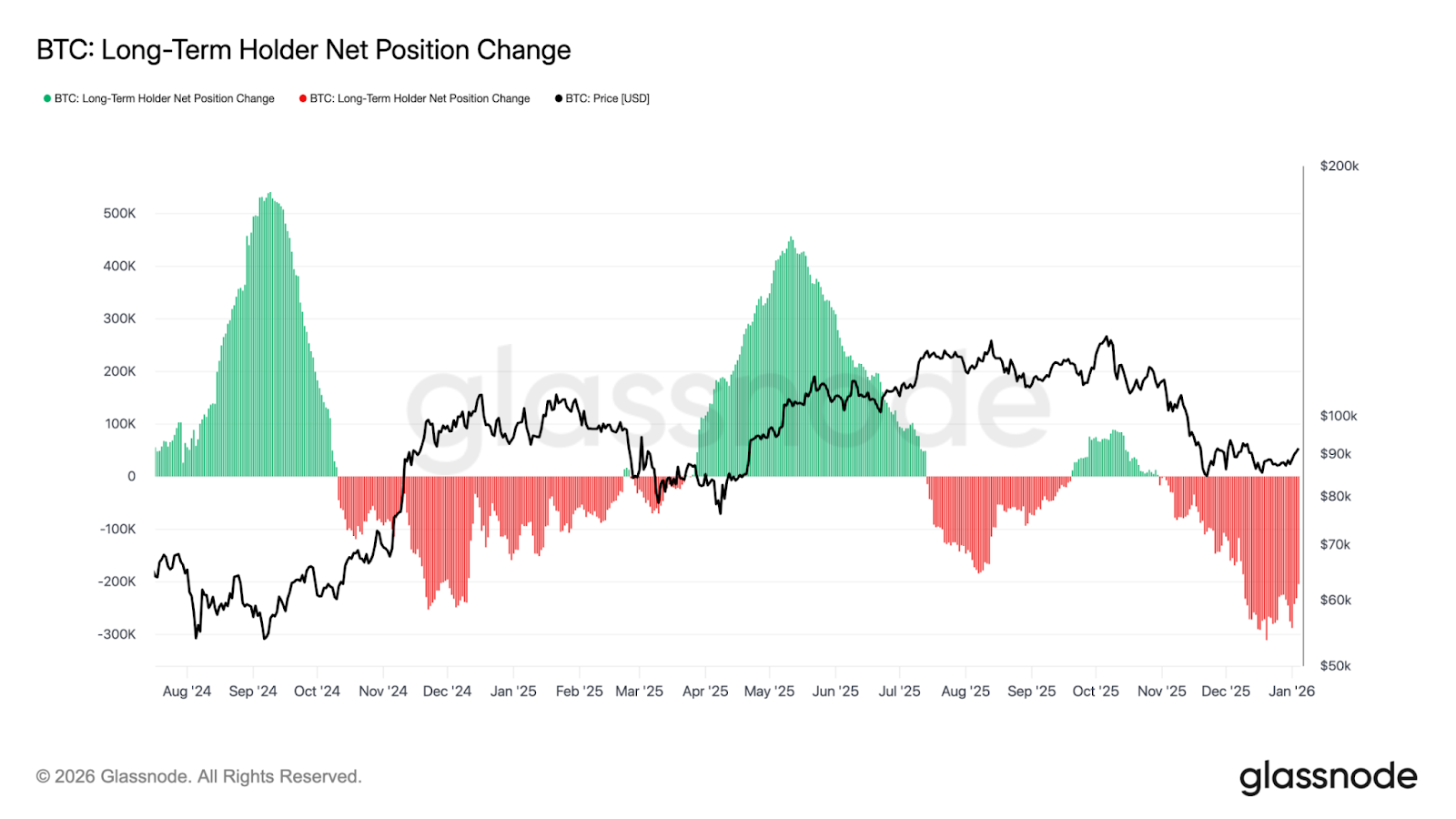

Unfortunately, we do have Long-Term Holders still selling down their holdings, however the amount of coins they're selling down is decreasing slightly.

Long-Term Holder Net Position Change:

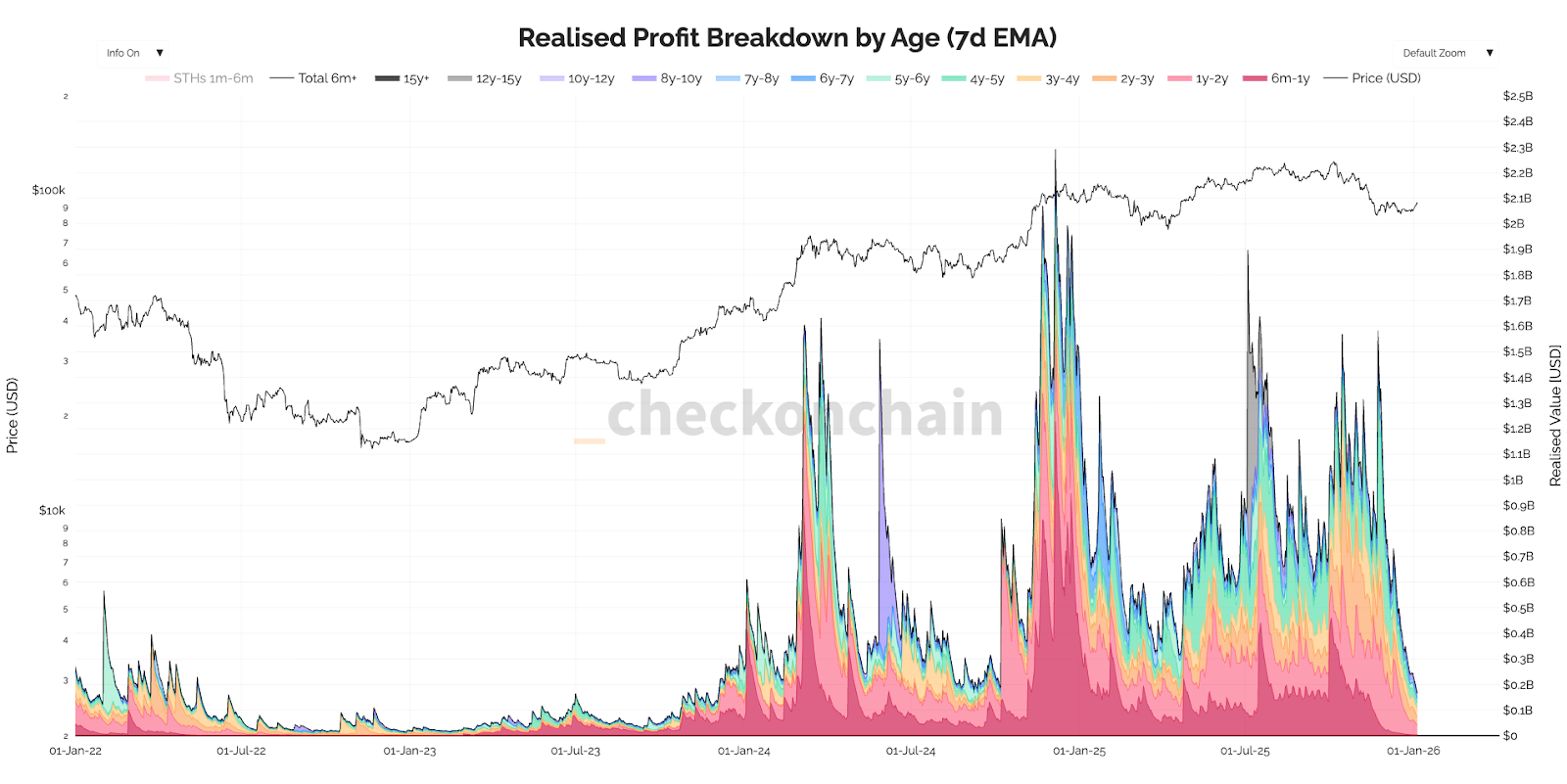

But, a significant positive we can take is the following: Long-Term Holder Profit Taking is slowing drastically. Historically, a collapsing Realised Profit chart has resulted in a hammering out of a bottom formation. This can still take time, but this metric collapsing essentially means that less and less profit is being realised from Long-Term Holders. They're either done selling the coins they wanted to sell, or they're just unwilling to sell at certain price levels i.e., the mid-$80k's. Again, this can take more time to play out, but there's no doubt that it's a bullish development.

Realised Profit Breakdown by Age:

To summarise:

- leverage was flushed in October and November, and we've now had a substantial reset in positioning.

- the flows are more neutral, although not yet net buying.

- Long-Term Holders are less willing to sell coins at these levels (mid-$80k's), and it's likely that the most aggressive form of selling is behind us.

BTC Breakout?

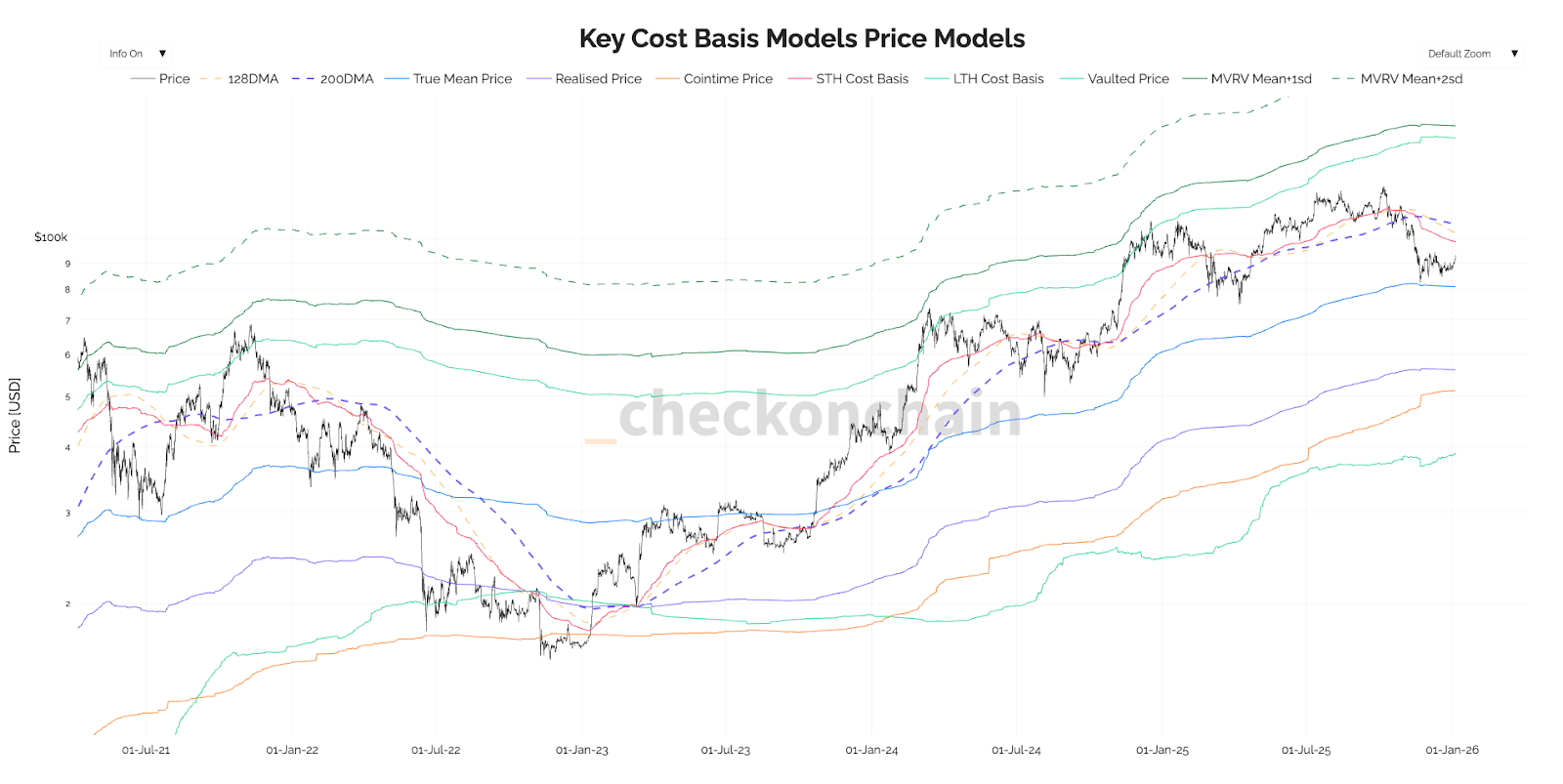

Looking at the above chart, and downtrend line breakout aside, we have horizontal resistances at $95,400 and $101,600. If we turn to key on-chain cost levels, we have the Short-Term Holder Cost Basis at $98,800 and the 200d Moving Average at $106,600. So even though price is currently breaking out, there are many resistances overhead between $95k and $106k, with the strongest levels coming between $98k and $106k.

Key Cost Basis Price Models:

Ultimately, the environment and foundations are there for a relief rally in the immediate term. Therefore, we expect price to move higher in the near-term and for price to stall between $98k-$106k.

Should we see price reclaim these key overhead resistances, and the flows, and on-chain indicators all improve, then it's possible that this is more than just a relief rally. But for the time being, until proven otherwise, we're positioned, but we're of the view that this is a relief rally, so we will look to sell Spot bags into these resistances, with the view to accumulating lower. However, we're more than open to changing our view should key levels be reclaimed, and the flows and metrics tell us to.

Cryptonary's Take:

We're focused this week on the labour market data, and whether this rally in Crypto can sustain. Should we see favourable economic data (the labour market holding up), this can aid risk assets. For Crypto, we're also paying close attention to the flows data: we'd like to see this continue to improve i.e., more ETF inflows, a closing of the Coinbase Premium, and Long-Term Holders to ease their selling. Should we get all this, and we expect we can, then BTC can keep grinding higher.For now, we're positioned, and positioned Long having given out a trade, the SOL buy, in last week's update at $125 (currently up 8.3%).

We're now closely assessing whether this rally can be sustained or whether it'll be a relief rally. Our view is that it's probably a relief rally, but should we see key price levels reclaimed (outlined in the section above - $95k-$106k), and the metrics improve alongside this, then we're open to changing our view, and therefore holding our Spot positions for longer.

On a side note, we're also paying close attention to the Trump administration and what happens to Maduro although we don't expect it to have any immediate impact on markets for now.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms