Market Update: Fed Cuts Rates, Markets Struggle Despite Dovish Signals

The Fed eased, Powell sounded dovish, and liquidity support is coming. But markets still faded. That mismatch matters more than you think. In this update, we break down why the rally stalled and what to expect next. Let's go!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Fed cut rates as expected and announced $40B/month in liquidity purchases - stabilizing markets, not stimulating them.

- Powell leaned more dovish, highlighting labour-market softness and reduced inflation concerns.

- Markets, especially Crypto, couldn’t hold gains despite the dovish setup, showing lingering weakness.

- ETF inflows improved but are outweighed by long-term holder selling, leading to weak, low-volume rallies.

- Base case: equities chop; BTC retests low $80k’s, ETH $2,800, SOL $110 unless flows and accumulation turn meaningfully positive.

Topics covered:

- Breaking Down Yesterday's FOMC.

- Dovish Tilt From Powell?

- Price Action.

- Cryptonary's Take.

Breaking Down Yesterday's FOMC:

Going into yesterday's FOMC, the market was priced for a "hawkish cut". We could see this in the backing up of the US2Y Bond Yield, which had increased from 3.49% to 3.62% over the last trading week. This was the Bond market telling us that they were expecting a hawkish cut.US2Y Bond Yield increasing going into yesterday's FOMC:

As expected, the rate cut was delivered, with the median Dot (in the Dot Plot) showing 1 more rate cut in 2026. This wasn't particularly dovish or hawkish, as it was largely what the market expected.

However, the Fed announced $40b/month of "reserve management purchases" in order to increase bank reserves. The reason for this, is that the Fed took QT (quantitative tightening) too far i.e., they drew down their balance sheet to a too low level, and therefore "reserve management purchases" are now needed to increase bank reserves again. When banking reserves drop to a too low level, banks aren't willing to take more risk, and that includes in the repo markets. Less liquidity in repo markets (repo markets is where hedge funds and prime brokers go to finance their leveraged positions) causes the borrowing rate to spike, which in turn causes further liquidity issues.

The Fed beginning to buy $40b of T-Bills helps to "plug" this liquidity gap in money markets/repo markets, with these purchases coming as early as this Friday. This was a dovish development, but it also highlights the growing concern over the "ampleness" of reserves and therefore the overall level of liquidity in the system.

The T-Bill purchases aren't about easing and stimulating risk assets - but rather about preventing money market dysfunction.

Now, this isn't QE, as it isn't directly taking duration out of the market. However, the Fed did say that they may buy up to 3-Year Treasury Notes, so this would be duration. The question will be how much buying is done in the 3-Year, rather than in say T-Bills.

It is expected that "reserve management purchases" will last a few months and that it's solely to increase liquidity in money markets rather than to be outright stimulative. But, one could argue that this is the first step towards larger scale balance sheet growth i.e., QE. But for now, it's not that, and it's just to increase bank reserves back to an appropriate level of ampleness.

Dovish Tilt From Powell?

Following the rate decision, the updated Dot Plot and announcement of T-Bill purchases, Powell stepped up to the podium. Here are some of his most notable comments:- "we think job gains have been overstated by 60k per month in recent months".

- "we think there's a negative 20k in payrolls jobs per month".

- "we have made progress this year in non-tariff related inflation".

- "if no new tariff announcements, inflation from goods should peak in Q1".

- "we're now in the high end of the range for neutral".

- "the Fed well positioned to determine the extent of more moves".

- "reserve management purchases may remain elevated for a few months to alleviate money market pressures. Thereafter, we expect purchases to decline".

So what's the takeaway from Powell's comments?

Perhaps the biggest takeaway from Powell was that he was more dovish than expected. He leant into the labour market weakness, "we think there's a negative 20k in payrolls per month", whilst he was more dismissive of long-term inflation, "we've made progress this year in non-tariff related inflation". This would suggest that Powell is more focused on the labour market than inflation, and with the median Dot (on the Dot Plot) showing 1 rate cut for next year, perhaps the market is now underpricing the number of cuts that could come in 2026, particularly with the likelihood of an "uberdove" becoming the new Chair in May 2026.To us, it seems that Powell is the dove, and other members on the committee are the hawks. For instance, there were 2 hawkish dissents (from Goolsbee and Schmid) and there were 4 "soft dissents" (soft dissents are non-voting members). Pair this with a total of 7 officials projecting zero cuts for 2026, there was plenty of dissent here for Powell to toe the hawkish line, but he didn't, he remained relatively neutral, and even arguably skewed dovish, considering he didn't outright reject a January rate cut.

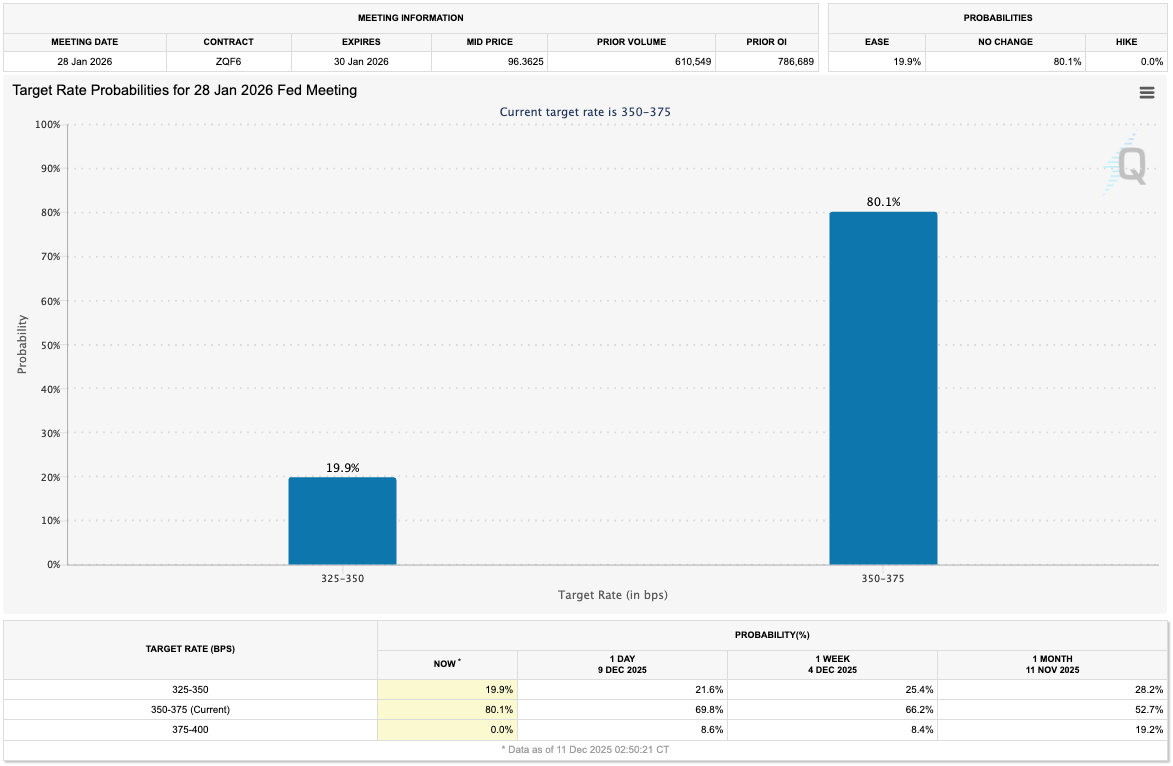

Despite this, the odds of a January rate cut decreased down to 19.9% - down from 25.4% a week ago.

Target Rate Probabilities for 28th January 2026 Fed Meeting:

And the reason we say that perhaps Powell is the dove, is that he said that the Fed is now "within a range of plausible estimates of neutral, and this leaves us well positioned to determine the extent and timing of additional adjustments". He also said, "we're now in the high end of the range for neutral".

In our view, this is Powell leaving the door open for a January rate cut. The level of dissent that he's dealing with inside the Fed is what suggests a January pause. But, Powell himself putting the Fed at the "high end of neutral", could mean there's another cut to come here in the near-term.

For now, it's not our base case that we get a January cut, and we'd only get one should we see next Tuesday's data (Non Farms and Unemployment Rate) come in very weak, which we're not expecting to show that outright weakness just yet.

Our current base case is that the Fed are on pause now, and it's possible they deliver another cut in March, but it'll be dependent on the labour market more materially deteriorating.

Fed Meeting Summary:

Going into the event, the markets were pricing in a hawkish cut. They got the cut, and they got the 2 hawkish dissents (it could have easily been more than 2 dissents) but not a hawkish Powell. Back at the October Meeting, a more hawkish Powell fairly reflected the differentiating views on the Fed, yet in this Meeting he took a more dovish line, despite more hawkish dissents (including "soft dissents").We expect that a January rate cut is still possible, but it'll need the labour market to materially weaken in the meantime, which we don't expect. Therefore our view, is that the Fed is on hold for now and we expect more cuts to come once Powell is replaced.

Lastly, on the "reserve management purchases", this is positive for liquidity, but it is targeted at preventing dysfunction in money markets rather than making conditions accommodative. Risk assets will likely need more than this, and perhaps they'll get it, but we don't think that'll happen until Powell is replaced.

Price Action:

A less hawkish than expected Powell saw both the Dollar (DXY - Dollar Index) and the US2Y Yield come down.DXY 1D Chart:

US2Y Yield:

Whilst the S&P moved up, and the Russell 2000 outperformed to the upside, although arguably somewhat Short-squeeze driven.

S&P 1D Chart:

Russell 2000 1D Chart:

The Nasdaq however, was relatively unchanged on the day despite its pullback being bid back up.

Nasdaq 1D Chart:

For the most part, the Indexes were able to climb higher off an unexpectedly more dovish Powell. However, with the Fed Funds rate now more in line with the US2Y Yield (following 175bps of cuts over the last 15 months), the rate is now much closer to neutral and we might now be in an "extended pause" period until more data comes in over the coming months.

Therefore, without an immediate catalyst, Crypto will likely continue to lull over the coming weeks. We expect the catalysts to come in early 2026: Big Beautiful Bill fiscal stimulus, and maybe more down the line - Trump "stimmy" cheques. But in the immediate term, Crypto is lacking a major catalyst that can really push prices higher.

In recent updates, we've covered key on-chain metrics which continue to show that BTC's price resides below crucial on-chain cost basis, and in order for price to make a meaningful attempt higher to challenge these cost basis levels, we'd need to see the flows improve.

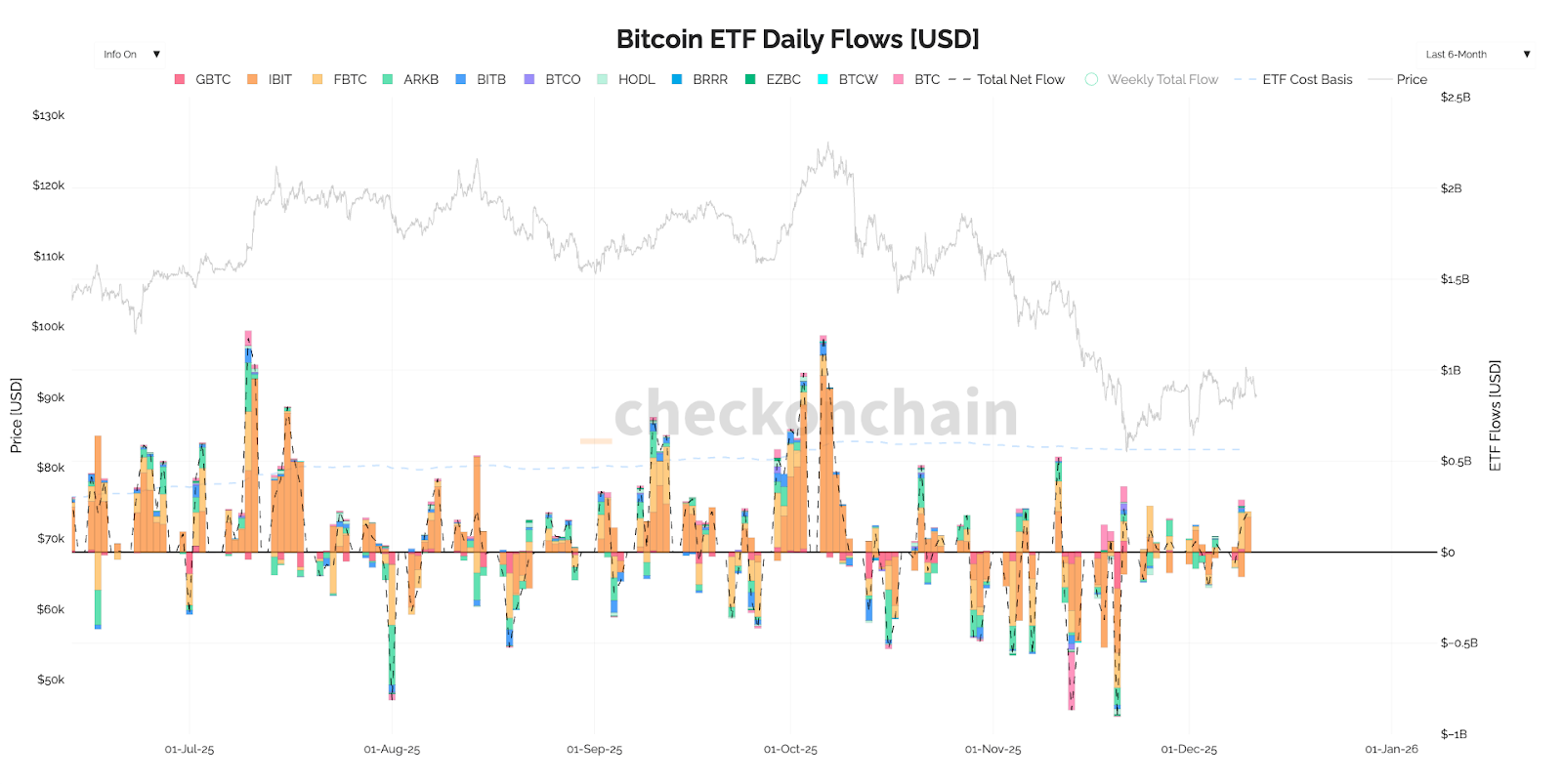

Surprisingly, the ETF flows have improved, but only over the last few days. We need to see these inflows sustained and for them to ideally, increase.

ETF Flows:

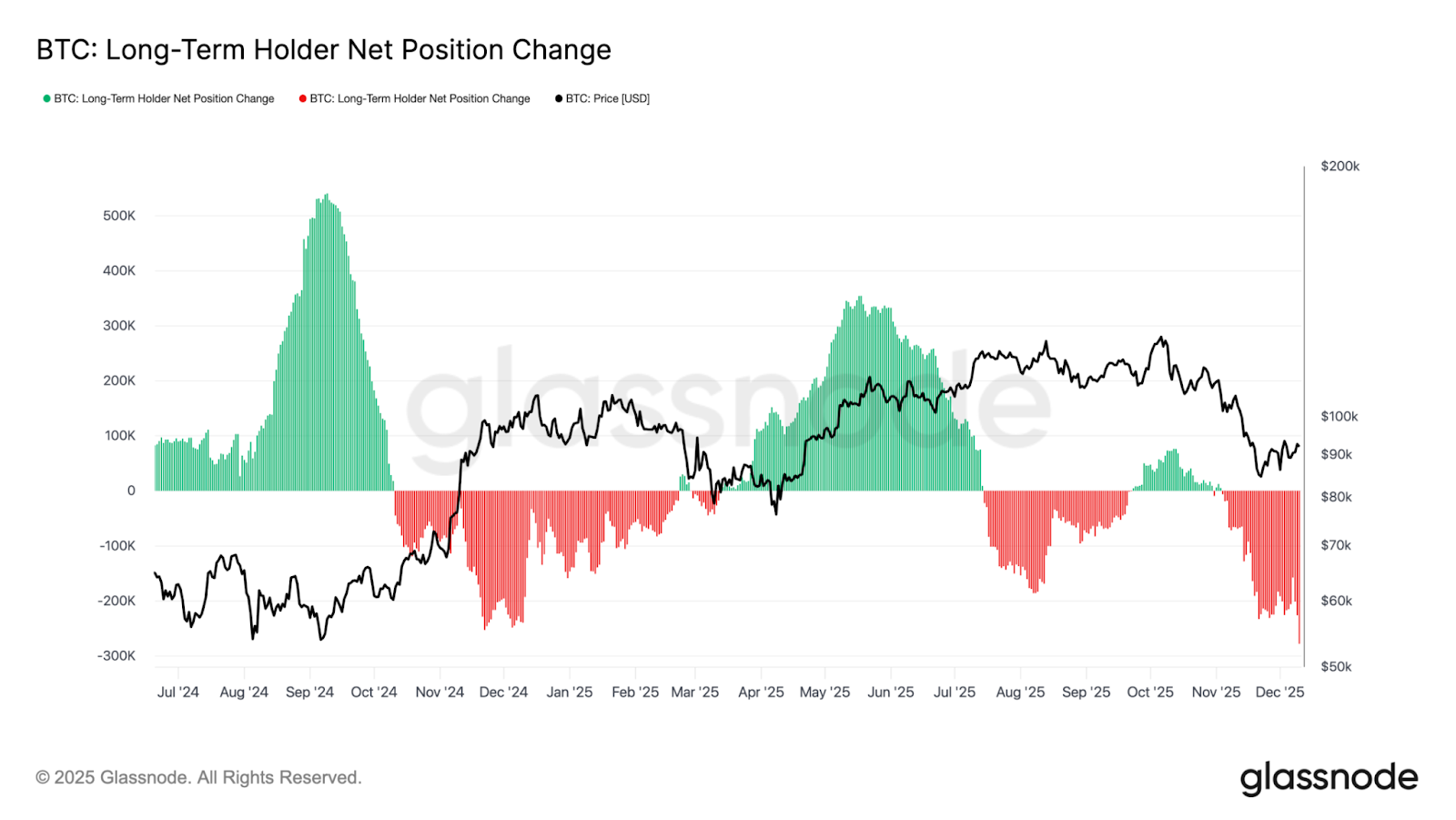

However, the Long-Term Holders continue to sell down their supply, and in increasing size. The behaviour of the market currently is that rallies are being sold into.

Long-Term Holder Net Position Change:

If we then look at the Crypto Majors (BTC, ETH and SOL), we can see that BTC is in a bear flag, ETH has invalidated its bear flag (positive) and SOL continues to languish below its key horizontal resistance of $144, having rejected into that level a number of times now.

Note: all are seeing decreasing volumes as prices have increased. This is usually not a good setup that would more than likely result in a move to the downside.

BTC 1D Chart:

ETH 1D Chart:

SOL 1D Chart:

Ultimately, other than ETH, we look at these rallies and think they're relatively weak.

We have decreasing volumes and small ETF inflows which are being more than offset by Long-Term Holders continuing to sell down in increasing size. It now also looks likely that the Fed will be "on pause" whilst the "reserve management purchases" that are beginning on Friday, are enough to halt repo rates from spiking, preventing dysfunction in money, but not enough that it stimulates risk assets.

Alongside this, yesterday we got a dovish Powell (despite many hawkish dissents) and the market couldn't sustain a rally off the back of it. Going into yesterday's FOMC, if you had asked the bulls how they'd have liked the Meeting to go, it went about as well as it could have for them, and yet, price couldn't sustain the rally.

For us, this is more cause for concern in the immediate term. And for the bulls, we expect "choppy price action" at best.

Our Base Case for Price Action:

Our base case for price action over the coming weeks is the following:

- Equities chop/pull back a few percent.

- US2Y Yields remain close to 3.50%.

- BTC retests the low $80k's as a minimum target.

- ETH retests $2,800 as a minimum target.

- SOL prints into the $110 level.

Cryptonary's Take:

Yesterday, Chair Powell and the Fed delivered a 25bps rate cut, whilst announcing "reserve management purchases" to help stabilise money markets. Powell came in more dovish than the market expected, despite there being a number of hawkish dissents in the committee.Markets rallied off the back of a less hawkish than expected Powell, however those gains haven't been sustained, particularly in Crypto, with BTC now fighting at the $90k level again. To us, this is a concern, particularly as Powell came in as dovish as he could have been given the number of dissents in the committee. Bulls had everything they needed to push price higher, yet it couldn't sustain.

Our base case for the coming weeks remains as before: we expect BTC to retest its lows. And until the underlying indicators and metrics change, only at a retest of the lows ($80k) would we become buyers of BTC again. For now, we remain patient and we'll choose to remain on the sideline.

Should we see ETF flows drastically improve and Long-Term Holders accumulate rather than continuing to sell down their supply, then this would invalidate our thesis. But until then, our view remains the same...

Lower - $80k!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms